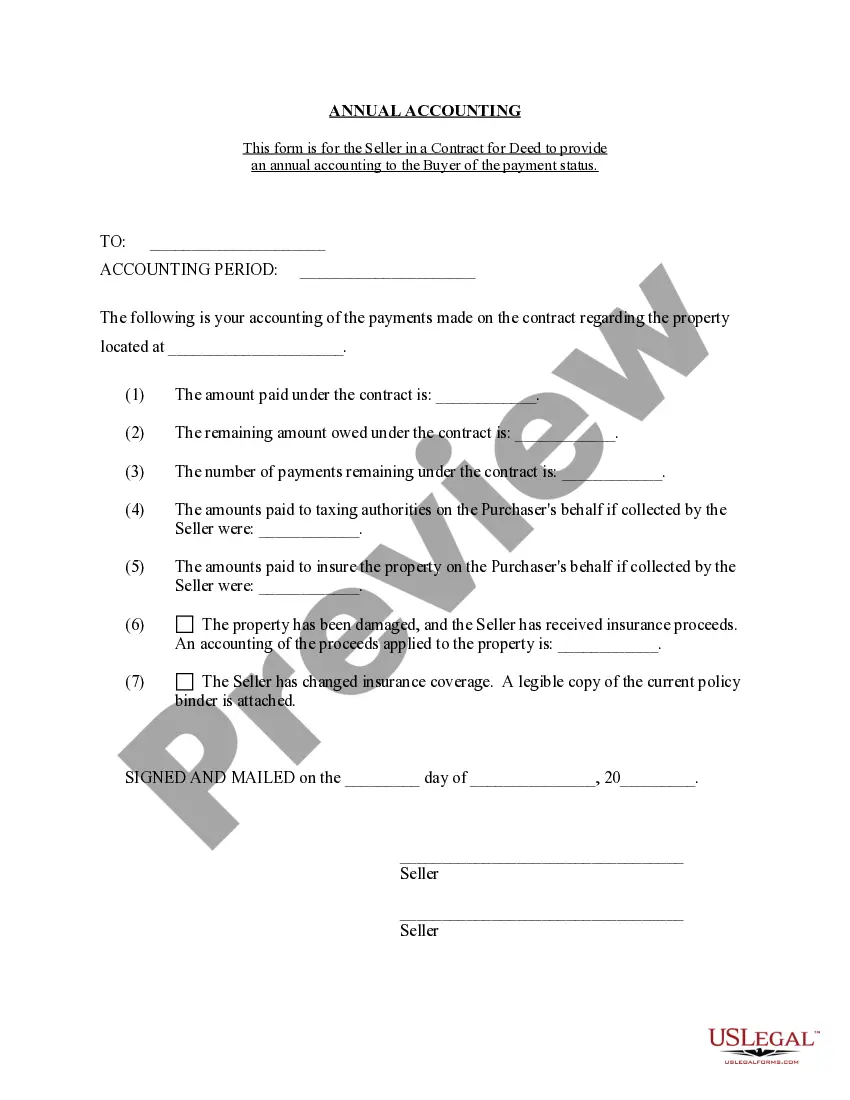

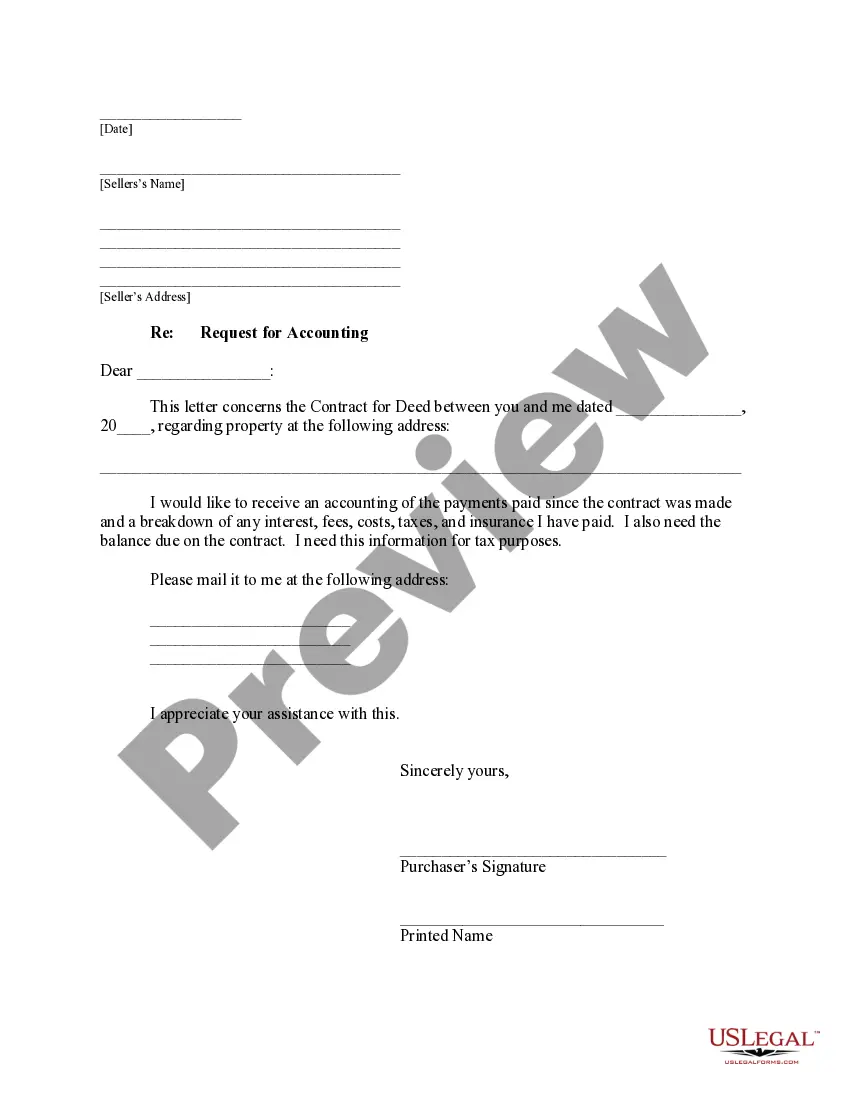

This is a Purchaser's Request of Accounting Statement from Seller. It is a request in writing to receive an accounting of the payments paid since the contract was made and a breakdown of any interest, fees, costs, taxes and insurance paid. It is also a request for the balance due on the contract.

Clovis California Buyer's Request for Accounting from Seller under Contract for Deed When entering into a Contract for Deed agreement in Clovis, California, buyers may have the right to request an accounting of the property's financials from the seller. This request for accounting allows the buyer to thoroughly review the property's income, expenses, and other financial aspects before finalizing the transaction. By obtaining this information, buyers can make informed decisions and ensure the property's financial stability meets their requirements. Keywords: Clovis California, buyer's request, accounting, seller, contract for deed. Types of Clovis California Buyer's Request for Accounting from Seller under Contract for Deed: 1. Property Income Accounting: This type of request focuses on the property's income-related details, including rental income, lease agreements, utility payments, and any other sources of revenue generated by the property. Reviewing this information helps buyers assess the property's income potential and evaluate its profitability. 2. Expense Accounting: Buyers may request a detailed breakdown of the property's expenses, such as property taxes, insurance costs, repairs and maintenance, management fees, and any other financial obligations associated with the property. Analyzing these expenses helps buyers understand the ongoing financial commitments related to the property and ensure it aligns with their budget. 3. Repair and Maintenance History: This request delves into the property's repair and maintenance records, outlining past repairs, renovations, and associated costs. Understanding the property's maintenance history allows buyers to gauge the property's condition, anticipate future costs, and make informed decisions regarding its upkeep. 4. Financial Statements: Buyers may also request comprehensive financial statements from the seller, including balance sheets, income statements, and cash flow statements. These statements provide an overview of the property's financial position, revenue, and expenses, enabling buyers to evaluate its overall financial health and potential. 5. Tax Assessment and Liabilities: This type of request involves gathering information about the property's tax assessment history and any outstanding tax liabilities. By understanding the property's tax situation, buyers can assess its compliance with tax obligations and potential financial risks. In conclusion, obtaining a Clovis California Buyer's Request for Accounting from Seller under Contract for Deed allows buyers to review and assess important financial aspects of a property. By analyzing income, expenses, repair history, financial statements, and tax assessments, buyers can make informed decisions and ensure the property meets their financial requirements.Clovis California Buyer's Request for Accounting from Seller under Contract for Deed When entering into a Contract for Deed agreement in Clovis, California, buyers may have the right to request an accounting of the property's financials from the seller. This request for accounting allows the buyer to thoroughly review the property's income, expenses, and other financial aspects before finalizing the transaction. By obtaining this information, buyers can make informed decisions and ensure the property's financial stability meets their requirements. Keywords: Clovis California, buyer's request, accounting, seller, contract for deed. Types of Clovis California Buyer's Request for Accounting from Seller under Contract for Deed: 1. Property Income Accounting: This type of request focuses on the property's income-related details, including rental income, lease agreements, utility payments, and any other sources of revenue generated by the property. Reviewing this information helps buyers assess the property's income potential and evaluate its profitability. 2. Expense Accounting: Buyers may request a detailed breakdown of the property's expenses, such as property taxes, insurance costs, repairs and maintenance, management fees, and any other financial obligations associated with the property. Analyzing these expenses helps buyers understand the ongoing financial commitments related to the property and ensure it aligns with their budget. 3. Repair and Maintenance History: This request delves into the property's repair and maintenance records, outlining past repairs, renovations, and associated costs. Understanding the property's maintenance history allows buyers to gauge the property's condition, anticipate future costs, and make informed decisions regarding its upkeep. 4. Financial Statements: Buyers may also request comprehensive financial statements from the seller, including balance sheets, income statements, and cash flow statements. These statements provide an overview of the property's financial position, revenue, and expenses, enabling buyers to evaluate its overall financial health and potential. 5. Tax Assessment and Liabilities: This type of request involves gathering information about the property's tax assessment history and any outstanding tax liabilities. By understanding the property's tax situation, buyers can assess its compliance with tax obligations and potential financial risks. In conclusion, obtaining a Clovis California Buyer's Request for Accounting from Seller under Contract for Deed allows buyers to review and assess important financial aspects of a property. By analyzing income, expenses, repair history, financial statements, and tax assessments, buyers can make informed decisions and ensure the property meets their financial requirements.