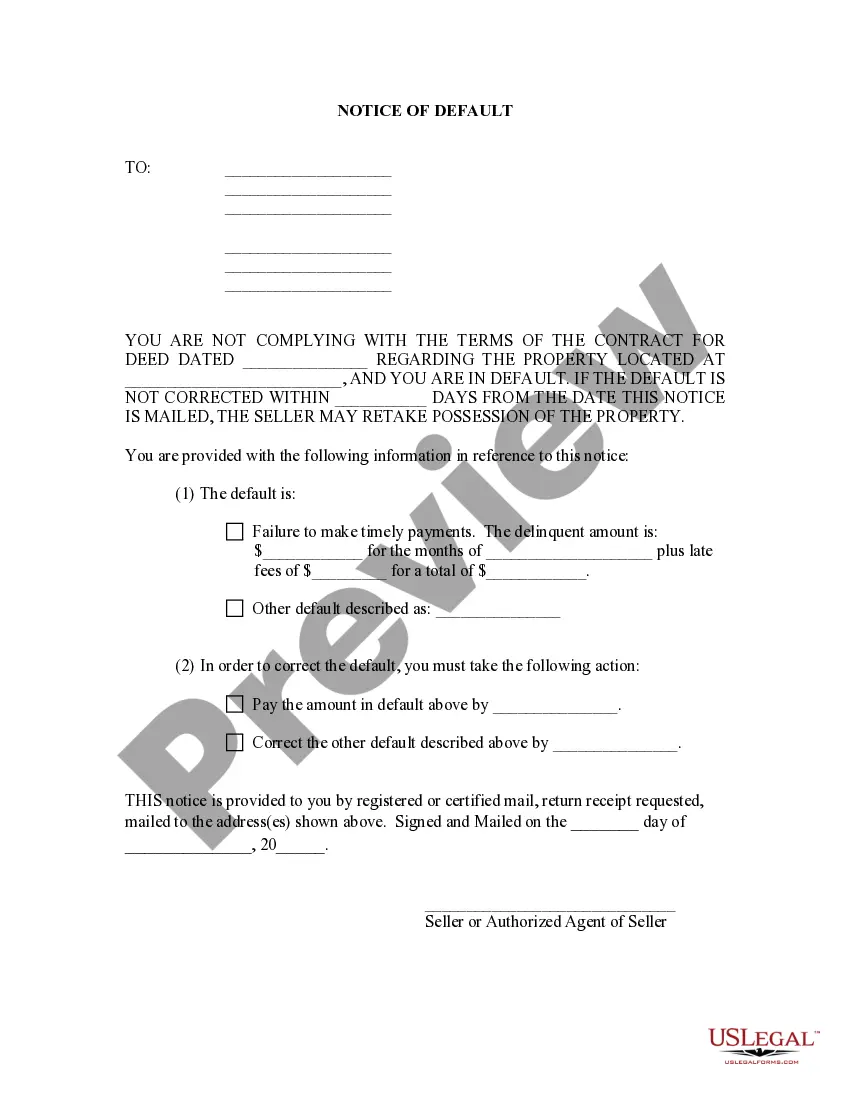

This is a general notice of default that can be used by the Seller to notify the Purchaser of being in default. This form allows the Seller to notify the Purchaser of the reason why the contract for deed is in default, the performance required to cure the default, and the Seller's planned remedy in case the Purchaser does not cure.

A General Notice of Default for Contract for Deed in Sunnyvale, California is a legal document issued by the lender or holder of a contract for deed to notify the buyer that they have breached the terms of the agreement. This notice serves as a warning that if the default is not cured within a specified period of time, the lender may initiate foreclosure proceedings and take possession of the property. In Sunnyvale, California, there are two main types of General Notice of Default for Contract for Deed: 1. Non-Payment Default: This type of default occurs when the buyer fails to make the agreed-upon payments under the terms of the contract for deed. The lender will issue a notice stating the specific amount past due, including the principal, interest, and any late fees. The notice will also provide a deadline by which the buyer must bring the payments current to avoid further action. 2. Breach of Contract Default: This type of default arises when the buyer violates any other terms and conditions specified in the contract for deed. This can include failure to maintain the property, unauthorized alterations, unpaid property taxes, or failure to obtain proper insurance coverage. The General Notice of Default will outline the specific breach and provide a deadline for the buyer to rectify the situation. It's important to note that the process for handling General Notices of Default for Contract for Deed may vary depending on the specific terms and conditions of the agreement. Buyers should always consult with an attorney to understand their rights and options when facing a default. In Sunnyvale, California, homeowners who receive a General Notice of Default for Contract for Deed should consider the following steps: 1. Review the Notice: Carefully read the notice to understand the specific reasons for the default and the required actions to cure it. 2. Consult an Attorney: Seek legal advice from a qualified attorney who specializes in real estate law and contract for deed agreements. 3. Assess Options: Explore possible solutions, such as renegotiating the terms, seeking refinancing, or restructuring the agreement with the lender. 4. Communicate with the Lender: Contact the lender to discuss possible resolutions and demonstrate the willingness to rectify the default. 5. Cure the Default: Take necessary actions to cure the default within the specified timeframe, which may involve making outstanding payments, rectifying property defects, or resolving other breaches. 6. Document Everything: Keep detailed records of all communications, payments, and actions taken to resolve the default. 7. Seek Mediation: In case of disputes or difficulties in resolving the default, consider engaging in mediation to reach a mutually agreeable solution. 8. Monitor the Situation: Stay updated on the status of the default and proactively respond to any further correspondence from the lender or holder of the contract for deed. Facing a General Notice of Default for Contract for Deed can be a complex and financially stressful situation. It's crucial for buyers to understand their rights and seek professional guidance throughout the process to protect their interests and potentially avoid foreclosure.A General Notice of Default for Contract for Deed in Sunnyvale, California is a legal document issued by the lender or holder of a contract for deed to notify the buyer that they have breached the terms of the agreement. This notice serves as a warning that if the default is not cured within a specified period of time, the lender may initiate foreclosure proceedings and take possession of the property. In Sunnyvale, California, there are two main types of General Notice of Default for Contract for Deed: 1. Non-Payment Default: This type of default occurs when the buyer fails to make the agreed-upon payments under the terms of the contract for deed. The lender will issue a notice stating the specific amount past due, including the principal, interest, and any late fees. The notice will also provide a deadline by which the buyer must bring the payments current to avoid further action. 2. Breach of Contract Default: This type of default arises when the buyer violates any other terms and conditions specified in the contract for deed. This can include failure to maintain the property, unauthorized alterations, unpaid property taxes, or failure to obtain proper insurance coverage. The General Notice of Default will outline the specific breach and provide a deadline for the buyer to rectify the situation. It's important to note that the process for handling General Notices of Default for Contract for Deed may vary depending on the specific terms and conditions of the agreement. Buyers should always consult with an attorney to understand their rights and options when facing a default. In Sunnyvale, California, homeowners who receive a General Notice of Default for Contract for Deed should consider the following steps: 1. Review the Notice: Carefully read the notice to understand the specific reasons for the default and the required actions to cure it. 2. Consult an Attorney: Seek legal advice from a qualified attorney who specializes in real estate law and contract for deed agreements. 3. Assess Options: Explore possible solutions, such as renegotiating the terms, seeking refinancing, or restructuring the agreement with the lender. 4. Communicate with the Lender: Contact the lender to discuss possible resolutions and demonstrate the willingness to rectify the default. 5. Cure the Default: Take necessary actions to cure the default within the specified timeframe, which may involve making outstanding payments, rectifying property defects, or resolving other breaches. 6. Document Everything: Keep detailed records of all communications, payments, and actions taken to resolve the default. 7. Seek Mediation: In case of disputes or difficulties in resolving the default, consider engaging in mediation to reach a mutually agreeable solution. 8. Monitor the Situation: Stay updated on the status of the default and proactively respond to any further correspondence from the lender or holder of the contract for deed. Facing a General Notice of Default for Contract for Deed can be a complex and financially stressful situation. It's crucial for buyers to understand their rights and seek professional guidance throughout the process to protect their interests and potentially avoid foreclosure.