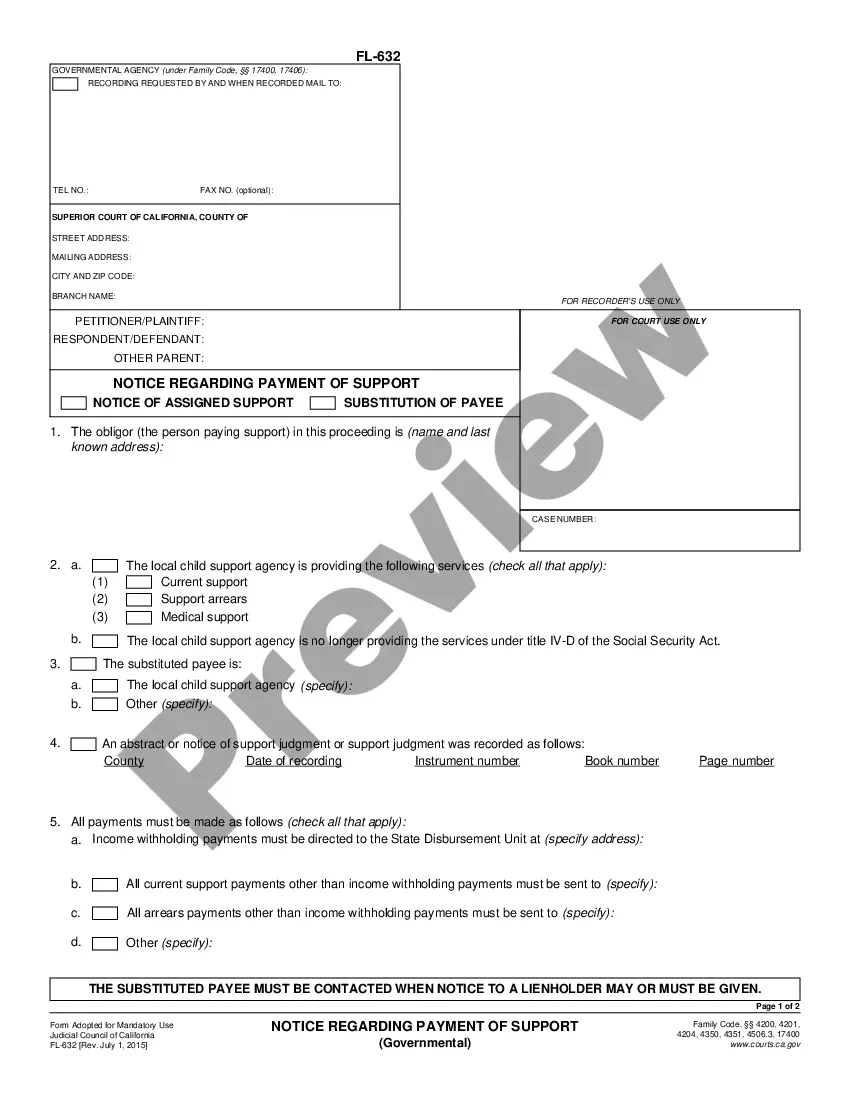

This is a general notice of default that can be used by the Seller to notify the Purchaser of being in default. This form allows the Seller to notify the Purchaser of the reason why the contract for deed is in default, the performance required to cure the default, and the Seller's planned remedy in case the Purchaser does not cure.

Vista California General Notice of Default for Contract for Deed

Description

How to fill out California General Notice Of Default For Contract For Deed?

Irrespective of social or professional standing, finalizing legal documents is an unfortunate obligation in today's business landscape.

Frequently, it’s nearly impossible for someone lacking any legal experience to create this type of paperwork from scratch, primarily because of the complicated jargon and legal nuances involved.

This is where US Legal Forms can come to the rescue.

Ensure the form you have selected is tailored to your region since the laws of one state or area do not apply to another.

Review the document and check a brief summary (if provided) of the scenarios where the paper can be utilized.

- Our service offers an extensive catalog with over 85,000 ready-to-use state-specific documents suitable for nearly any legal circumstance.

- US Legal Forms is also a valuable resource for associates or legal advisors who wish to enhance their efficiency using our DIY documents.

- Whether you need the Vista California General Notice of Default for Contract for Deed or any other relevant document for your state or region, US Legal Forms has it all available.

- Here’s how you can quickly acquire the Vista California General Notice of Default for Contract for Deed through our trustworthy service.

- If you are a returning customer, you can simply Log In to your account to download the required form.

- However, if you’re new to our platform, please follow these steps before obtaining the Vista California General Notice of Default for Contract for Deed.

Form popularity

FAQ

In California, you generally have a maximum of two years from the date of default to file for a default judgment. However, specific case circumstances, such as the nature of the contract and the type of property, may lead to different timelines. It is essential to be familiar with the regulations concerning the Vista California General Notice of Default for Contract for Deed to ensure you comply. Consulting legal resources or platforms like uslegalforms can provide clarity and support in this process.

To issue a default notice, first, ensure you have the correct details from the contract for deed. Create a written document that outlines the default, including the payment amounts and dates, in a readable format. In the case of a Vista California General Notice of Default for Contract for Deed, deliver this notice through certified mail or personal delivery to ensure receipt. Using a legal forms platform like uslegalforms can simplify this process by providing templates and guidance specific to your state's requirements.

An example of a default notice would be a letter stating, "Your payment due in January was not received, which constitutes a default under the terms of your contract for deed." In the context of a Vista California General Notice of Default for Contract for Deed, the notice should reference the specific contract, mention the missed payment date, and outline the consequences of non-payment. Providing clear information helps prevent further misunderstandings and enables the borrower to take corrective action.

To find properties with a notice of default, check the local county recorder's office or property listings online. Many real estate websites also keep track of properties facing default status. You can easily search for properties in Vista, California, by looking for recent Vista California General Notice of Default for Contract for Deed filings in your area.

When writing a notice of default letter, include the property owner's name, property address, and a clear statement of the default. Specify the amount due and provide a deadline for payment or action. You may want to leverage resources from US Legal Forms to ensure your document aligns with the requirements of a Vista California General Notice of Default for Contract for Deed.

A notice of default typically includes the property owner's name, the property address, and the details of the outstanding mortgage or contract payment. It will also state the amount owed and the deadline to remedy the situation. If you're interested in legal documents related to a Vista California General Notice of Default for Contract for Deed, platforms like US Legal Forms can provide templates to assist you.

Yes, a notice of default is a public record. This means anyone can access this information through the county recorder's office or online property records. It is important to stay informed about properties in your area with a Vista California General Notice of Default for Contract for Deed, especially if you are considering purchasing real estate.

To determine if a property is in default, you can start by checking public records at your local county recorder's office. Additionally, online databases often provide valuable information regarding the status of properties in Vista, California. Look for any filed Vista California General Notice of Default for Contract for Deed, as these documents indicate that a property has entered the default stage.

To issue a notice of default, you must deliver the document to the buyer in accordance with California laws. The notice needs to be served either personally or via certified mail, ensuring the buyer receives the Vista California General Notice of Default for Contract for Deed. Furthermore, it is important to keep documentation of the delivery method and date. Utilizing platforms like US Legal Forms can simplify this process, providing templates and guidance for proper issuance.

Writing a notice of default requires clarity and adherence to legal standards. Start with a clear title stating 'Notice of Default' and include essential details such as the parties involved, the default amount, and the specific terms of the contract for deed referenced in the Vista California General Notice of Default for Contract for Deed. It’s crucial to specify the time frame the buyer has to rectify the default before further action is taken. Consider consulting with a legal professional or using resources like US Legal Forms to ensure compliance with state laws.