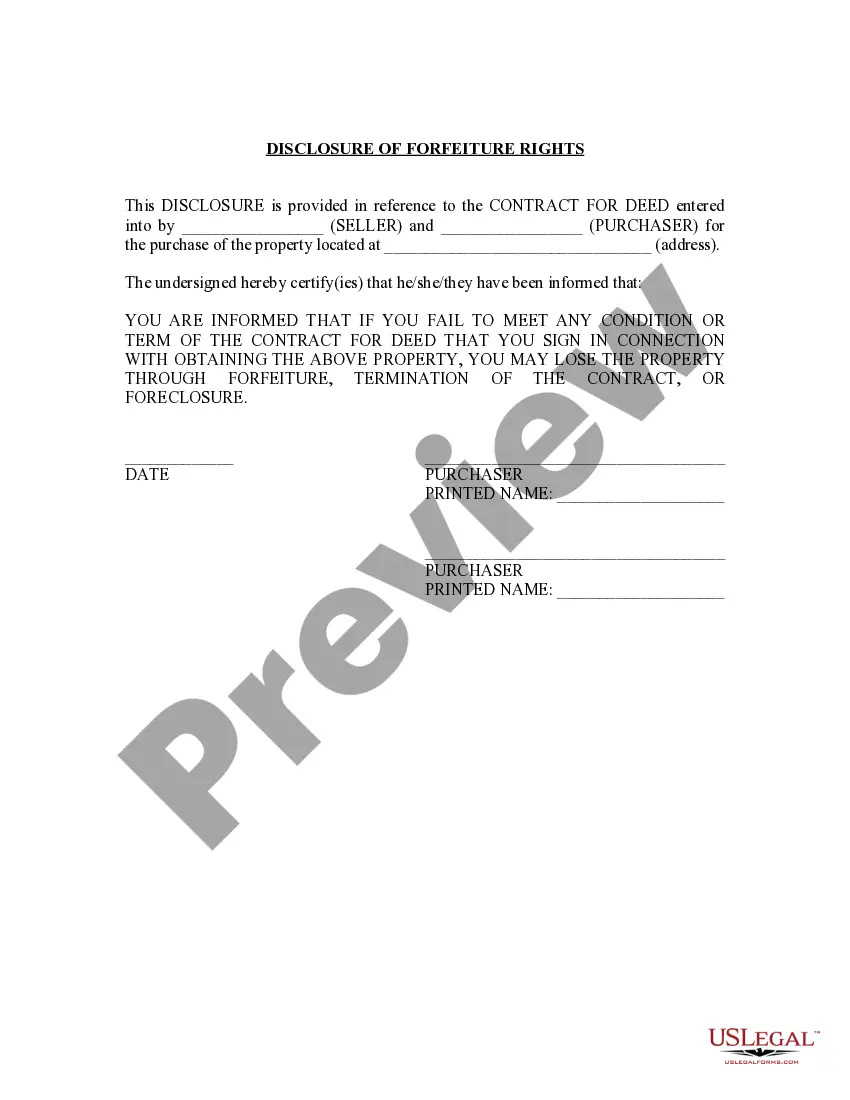

This Disclosure Notice of Forfeiture Rights form is provided by the Seller to the Purchaser at the time of the contract signing. Mandatory use of this form is rarely required; however, this form provides the Purchaser with a good understanding of forfeiture and how he or she can be affected by it in the event of a default. Should the courts become involved, the use of this form will help the Seller show that the Purchaser understood his side of the bargain and may help the Purchaser pursue the remedy of forfeiture if challenged by the Purchaser.

El Monte California Seller's Disclosure of Forfeiture Rights for Contract for Deed is a legally binding document used in the real estate industry. It serves as a disclosure statement provided by the seller to the buyer, outlining the forfeiture rights associated with a contract for deed agreement. A contract for deed is a type of financing arrangement where the seller acts as the lender and the buyer agrees to make installment payments directly to the seller over an agreed-upon period. The buyer does not receive the title to the property until the full payment is made. The Seller's Disclosure of Forfeiture Rights addresses the potential consequences if the buyer fails to make the required payments or defaults on the agreement. Within El Monte, California, there are several variations of the Seller's Disclosure of Forfeiture Rights that sellers might utilize. These variations are often tailored to specific circumstances or situations, and may include: 1. Standard Seller's Disclosure of Forfeiture Rights: This is the most common type of disclosure, which outlines the standard forfeiture rights the seller has in case of default by the buyer. It usually includes the process for terminating the contract, the timeline for forfeiture, and the conditions under which the seller can seize the property. 2. Extended Seller's Disclosure of Forfeiture Rights: This type of disclosure provides additional rights and options for the seller in case of default. It may include provisions such as the right to retain all payments made by the buyer, the right to pursue legal action for damages, or the right to repossess any improvements made to the property. 3. Limited Seller's Disclosure of Forfeiture Rights: This disclosure type limits the forfeiture rights of the seller to specific circumstances. It may outline certain conditions under which the seller cannot proceed with forfeiture and may include protections for the buyer, such as allowing a grace period for missed payments or the option to cure the default. When drafting a Seller's Disclosure of Forfeiture Rights for a Contract for Deed in El Monte, California, some essential keywords to include are property, contract for deed, forfeiture, default, termination, installment payments, title, seizure, rights, damages, legal action, improvements, grace period, and cure default. It is crucial for both sellers and buyers to thoroughly understand the contents of the Seller's Disclosure of Forfeiture Rights before entering into a contract for deed agreement. Seeking legal advice and conducting thorough due diligence can help ensure all parties are aware of their rights and obligations under such agreements.El Monte California Seller's Disclosure of Forfeiture Rights for Contract for Deed is a legally binding document used in the real estate industry. It serves as a disclosure statement provided by the seller to the buyer, outlining the forfeiture rights associated with a contract for deed agreement. A contract for deed is a type of financing arrangement where the seller acts as the lender and the buyer agrees to make installment payments directly to the seller over an agreed-upon period. The buyer does not receive the title to the property until the full payment is made. The Seller's Disclosure of Forfeiture Rights addresses the potential consequences if the buyer fails to make the required payments or defaults on the agreement. Within El Monte, California, there are several variations of the Seller's Disclosure of Forfeiture Rights that sellers might utilize. These variations are often tailored to specific circumstances or situations, and may include: 1. Standard Seller's Disclosure of Forfeiture Rights: This is the most common type of disclosure, which outlines the standard forfeiture rights the seller has in case of default by the buyer. It usually includes the process for terminating the contract, the timeline for forfeiture, and the conditions under which the seller can seize the property. 2. Extended Seller's Disclosure of Forfeiture Rights: This type of disclosure provides additional rights and options for the seller in case of default. It may include provisions such as the right to retain all payments made by the buyer, the right to pursue legal action for damages, or the right to repossess any improvements made to the property. 3. Limited Seller's Disclosure of Forfeiture Rights: This disclosure type limits the forfeiture rights of the seller to specific circumstances. It may outline certain conditions under which the seller cannot proceed with forfeiture and may include protections for the buyer, such as allowing a grace period for missed payments or the option to cure the default. When drafting a Seller's Disclosure of Forfeiture Rights for a Contract for Deed in El Monte, California, some essential keywords to include are property, contract for deed, forfeiture, default, termination, installment payments, title, seizure, rights, damages, legal action, improvements, grace period, and cure default. It is crucial for both sellers and buyers to thoroughly understand the contents of the Seller's Disclosure of Forfeiture Rights before entering into a contract for deed agreement. Seeking legal advice and conducting thorough due diligence can help ensure all parties are aware of their rights and obligations under such agreements.