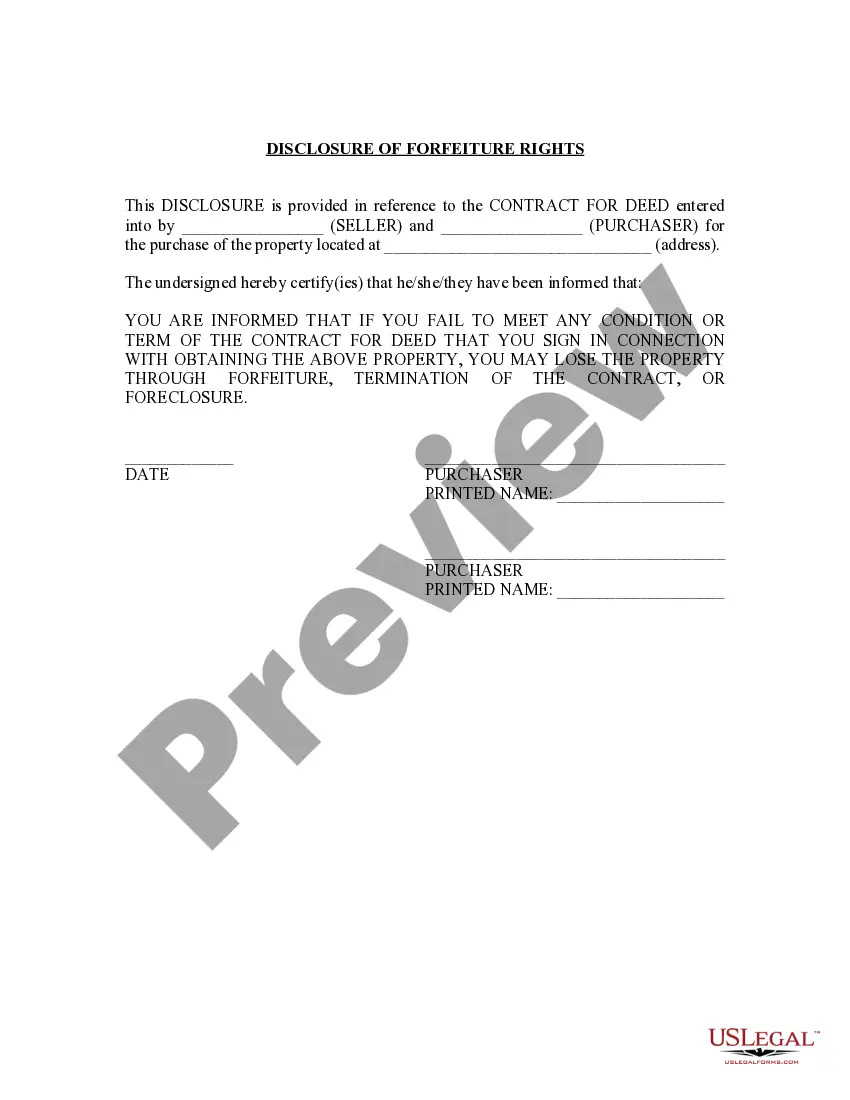

This Disclosure Notice of Forfeiture Rights form is provided by the Seller to the Purchaser at the time of the contract signing. Mandatory use of this form is rarely required; however, this form provides the Purchaser with a good understanding of forfeiture and how he or she can be affected by it in the event of a default. Should the courts become involved, the use of this form will help the Seller show that the Purchaser understood his side of the bargain and may help the Purchaser pursue the remedy of forfeiture if challenged by the Purchaser.

The Norwalk California Seller's Disclosure of Forfeiture Rights for Contract for Deed is a crucial document designed to protect both the seller and buyer involved in a real estate transaction. It outlines the forfeiture rights associated with a Contract for Deed agreement in Norwalk, California, ensuring that both parties are aware of their rights and obligations. In Norwalk, California, the Seller's Disclosure of Forfeiture Rights for Contract for Deed holds vital information for buyers and sellers entering into a Contract for Deed agreement. This document provides transparency and legal clarity regarding the potential consequences and rights pertaining to forfeiture in the event of non-payment or breach of contract. Within the Norwalk California Seller's Disclosure of Forfeiture Rights for Contract for Deed, important key terms and concepts are explained to ensure a smooth and fair understanding between the parties involved. These may include: 1. Forfeiture Rights: This section outlines the specific rights and remedies available to the seller in the event of default by the buyer, such as eviction or retaining all payments made by the buyer. 2. Payment Terms: It is important to disclose the terms of payment and define any penalties or consequences for missed or late payments. This ensures that both parties have a clear understanding of their obligations and the risks associated with non-compliance. 3. Maintenance and Repairs: This section may outline the responsibilities of the buyer and seller concerning property maintenance, repairs, and improvements during the term of the Contract for Deed. Addressing these obligations in advance helps prevent disputes later on. 4. Default and Remedies: This disclosure explains the consequences the buyer may face if they fail to comply with the terms of the agreement. It may cover aspects such as the process of reclaiming the property, loss of equity, and potential legal action the seller can take. Different types of Norwalk California Seller's Disclosure of Forfeiture Rights for Contract for Deed might be distinguished by variations in their clauses, terms, and conditions. Some examples may include: 1. Short-Term Contract for Deed: This type of Seller's Disclosure caters to agreements with a shorter duration, usually spanning a few months to a couple of years, with specific forfeiture rights relating to non-payment or failure to fulfill obligations during the specified period. 2. Long-Term Contract for Deed: This Seller's Disclosure would apply to agreements with a longer duration, typically spanning several years, where the forfeiture rights and remedies may differ based on the length of the contract, cumulative payments made, or other specified conditions. 3. Residential Property Contract for Deed: This type of Seller's Disclosure focuses on the unique aspects and considerations of residential properties, addressing issues relevant to homeownership, such as upkeep, usage restrictions, and possible default scenarios. 4. Commercial Property Contract for Deed: This Seller's Disclosure is specific to commercial properties, covering topics such as lease terms, maintenance responsibilities, insurance requirements, and potential forfeiture rights for non-compliance. It is important to consult with a qualified real estate attorney or legal professional to ensure that the Norwalk California Seller's Disclosure of Forfeiture Rights for Contract for Deed appropriately reflects the intentions of both the seller and buyer and complies with the specific regulations and laws in Norwalk, California.The Norwalk California Seller's Disclosure of Forfeiture Rights for Contract for Deed is a crucial document designed to protect both the seller and buyer involved in a real estate transaction. It outlines the forfeiture rights associated with a Contract for Deed agreement in Norwalk, California, ensuring that both parties are aware of their rights and obligations. In Norwalk, California, the Seller's Disclosure of Forfeiture Rights for Contract for Deed holds vital information for buyers and sellers entering into a Contract for Deed agreement. This document provides transparency and legal clarity regarding the potential consequences and rights pertaining to forfeiture in the event of non-payment or breach of contract. Within the Norwalk California Seller's Disclosure of Forfeiture Rights for Contract for Deed, important key terms and concepts are explained to ensure a smooth and fair understanding between the parties involved. These may include: 1. Forfeiture Rights: This section outlines the specific rights and remedies available to the seller in the event of default by the buyer, such as eviction or retaining all payments made by the buyer. 2. Payment Terms: It is important to disclose the terms of payment and define any penalties or consequences for missed or late payments. This ensures that both parties have a clear understanding of their obligations and the risks associated with non-compliance. 3. Maintenance and Repairs: This section may outline the responsibilities of the buyer and seller concerning property maintenance, repairs, and improvements during the term of the Contract for Deed. Addressing these obligations in advance helps prevent disputes later on. 4. Default and Remedies: This disclosure explains the consequences the buyer may face if they fail to comply with the terms of the agreement. It may cover aspects such as the process of reclaiming the property, loss of equity, and potential legal action the seller can take. Different types of Norwalk California Seller's Disclosure of Forfeiture Rights for Contract for Deed might be distinguished by variations in their clauses, terms, and conditions. Some examples may include: 1. Short-Term Contract for Deed: This type of Seller's Disclosure caters to agreements with a shorter duration, usually spanning a few months to a couple of years, with specific forfeiture rights relating to non-payment or failure to fulfill obligations during the specified period. 2. Long-Term Contract for Deed: This Seller's Disclosure would apply to agreements with a longer duration, typically spanning several years, where the forfeiture rights and remedies may differ based on the length of the contract, cumulative payments made, or other specified conditions. 3. Residential Property Contract for Deed: This type of Seller's Disclosure focuses on the unique aspects and considerations of residential properties, addressing issues relevant to homeownership, such as upkeep, usage restrictions, and possible default scenarios. 4. Commercial Property Contract for Deed: This Seller's Disclosure is specific to commercial properties, covering topics such as lease terms, maintenance responsibilities, insurance requirements, and potential forfeiture rights for non-compliance. It is important to consult with a qualified real estate attorney or legal professional to ensure that the Norwalk California Seller's Disclosure of Forfeiture Rights for Contract for Deed appropriately reflects the intentions of both the seller and buyer and complies with the specific regulations and laws in Norwalk, California.