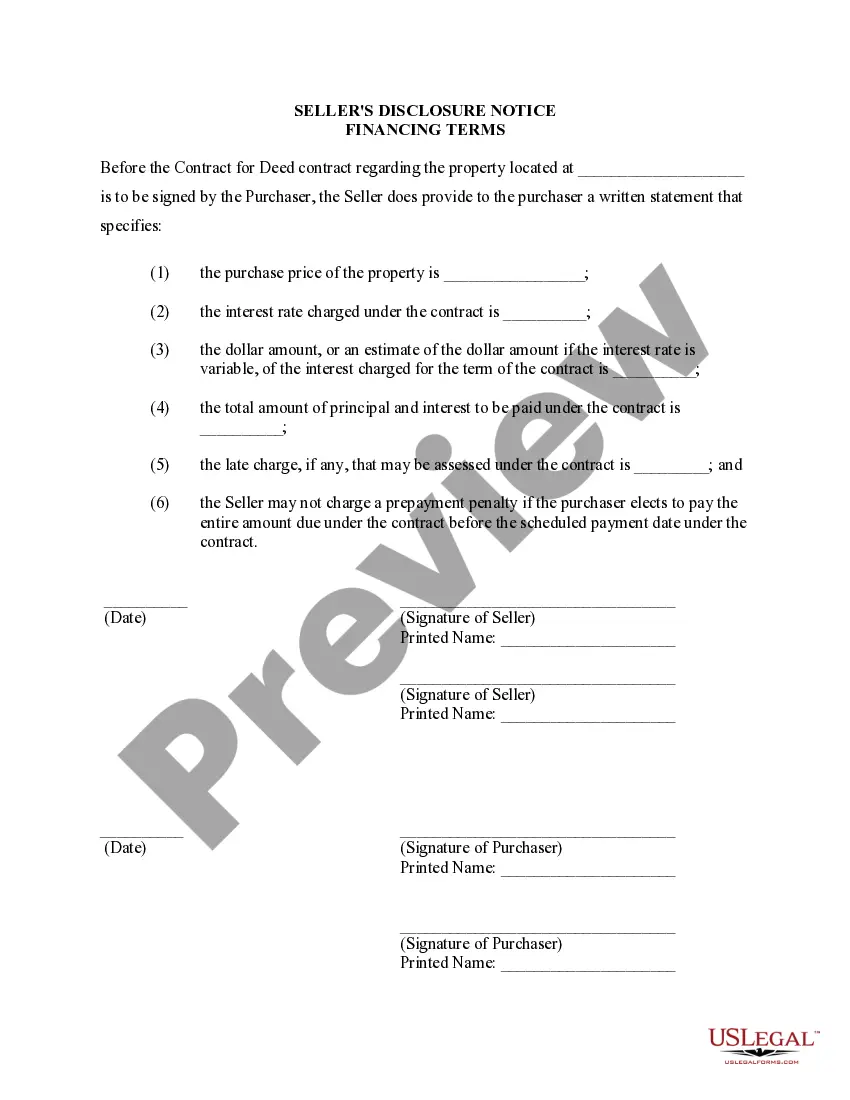

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

In Escondido, California, a Seller's Disclosure of Financing Terms for Residential Property is an essential document in connection with a Contract or Agreement for Deed, commonly known as a Land Contract. This disclosure provides crucial information to prospective buyers regarding the financing options and terms associated with purchasing the residential property. The Escondido California Seller's Disclosure of Financing Terms for Residential Property ensures transparency and allows buyers to make informed decisions. The disclosure highlights specific details related to the financing arrangement, including interest rates, payment schedules, down payment requirements, and any additional fees or charges applicable to the transaction. Different types of Escondido California Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed may include the following: 1. Fixed-Rate Financing Disclosure: This disclosure outlines the terms for a traditional fixed-rate mortgage, where the interest rate remains unchanged throughout the loan term. It includes information regarding the length of the loan, monthly payment amounts, and any prepayment penalties or restrictions. 2. Adjustable-Rate Financing Disclosure: This disclosure applies when the interest rate on the loan may fluctuate over time. It includes details about the initial rate, adjustment periods, rate caps, and how the interest rate is determined (e.g., based on an index). 3. Balloon Payment Disclosure: In some cases, the seller may offer financing with a balloon payment, where the majority of the principal is due at the end of the loan term. This disclosure explains the terms of the balloon payment, including the amount, due date, and any available options for refinancing or extending the loan. 4. Seller Financing Disclosure: This disclosure pertains to situations where the seller provides financing directly to the buyer, eliminating the need for a third-party lender. It contains information about the interest rate, repayment schedule, and any seller-specific terms and conditions. 5. Assumable Loan Disclosure: If the existing mortgage on the property is assumable, this disclosure provides details regarding the assumption process, requirements, and potential liabilities for the buyer. The Escondido California Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed aims to protect both buyers and sellers by ensuring all financing terms are clearly communicated and understood. Prior to entering into any agreement, it is essential for buyers to review and understand the disclosed financing terms, and for sellers to provide accurate and complete information.In Escondido, California, a Seller's Disclosure of Financing Terms for Residential Property is an essential document in connection with a Contract or Agreement for Deed, commonly known as a Land Contract. This disclosure provides crucial information to prospective buyers regarding the financing options and terms associated with purchasing the residential property. The Escondido California Seller's Disclosure of Financing Terms for Residential Property ensures transparency and allows buyers to make informed decisions. The disclosure highlights specific details related to the financing arrangement, including interest rates, payment schedules, down payment requirements, and any additional fees or charges applicable to the transaction. Different types of Escondido California Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed may include the following: 1. Fixed-Rate Financing Disclosure: This disclosure outlines the terms for a traditional fixed-rate mortgage, where the interest rate remains unchanged throughout the loan term. It includes information regarding the length of the loan, monthly payment amounts, and any prepayment penalties or restrictions. 2. Adjustable-Rate Financing Disclosure: This disclosure applies when the interest rate on the loan may fluctuate over time. It includes details about the initial rate, adjustment periods, rate caps, and how the interest rate is determined (e.g., based on an index). 3. Balloon Payment Disclosure: In some cases, the seller may offer financing with a balloon payment, where the majority of the principal is due at the end of the loan term. This disclosure explains the terms of the balloon payment, including the amount, due date, and any available options for refinancing or extending the loan. 4. Seller Financing Disclosure: This disclosure pertains to situations where the seller provides financing directly to the buyer, eliminating the need for a third-party lender. It contains information about the interest rate, repayment schedule, and any seller-specific terms and conditions. 5. Assumable Loan Disclosure: If the existing mortgage on the property is assumable, this disclosure provides details regarding the assumption process, requirements, and potential liabilities for the buyer. The Escondido California Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed aims to protect both buyers and sellers by ensuring all financing terms are clearly communicated and understood. Prior to entering into any agreement, it is essential for buyers to review and understand the disclosed financing terms, and for sellers to provide accurate and complete information.