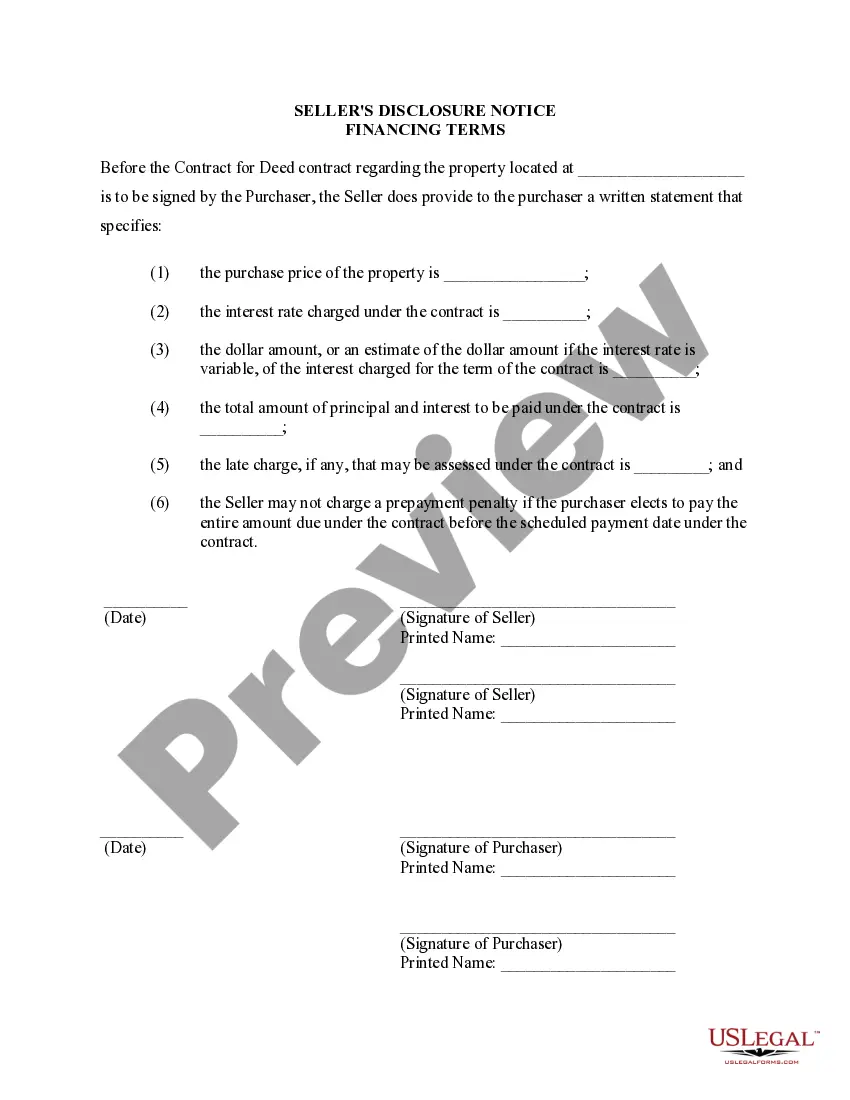

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Long Beach California Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is a crucial document that outlines the terms and conditions related to financing a residential property transaction in Long Beach, California. This disclosure is designed to provide buyers with essential information about the financing arrangements when purchasing a property through a Contract or Agreement for Deed, also known as a Land Contract. The Long Beach California Seller's Disclosure of Financing Terms for Residential Property covers various elements that buyers need to be aware of before entering into a financing agreement. Here are the key details and relevant keywords related to this disclosure: 1. Purchase Price: The disclosure will specify the agreed-upon purchase price of the residential property, including any required down payment. 2. Interest Rate: It outlines the interest rate that applies to the financing arrangement, which significantly impacts the overall cost of purchasing the property. 3. Loan Duration: The disclosure indicates the length of the loan term or the total number of months or years required to repay the loan amount. 4. Monthly Payments: It outlines the amount of monthly payments, inclusive of principal and interest, that the buyer must make throughout the agreed loan duration. 5. Default Remedies: The disclosure highlights the potential consequences or remedies for defaulting on the financing terms, such as foreclosure or contract termination. 6. Late Payment Charges: It specifies any additional charges or penalties imposed for late payments and how they are calculated. 7. Property Taxes and Insurance: The disclosure may mention the responsibility of the buyer to pay property taxes, homeowner's insurance, and any other related expenses. 8. Prepayment Penalties: It states whether any penalties apply if the buyer intends to repay the loan earlier than the agreed-upon loan term. 9. Maintenance Obligations: This section may highlight the buyer's obligation to maintain the property, including repairs and upkeep. 10. Arbitration or Dispute Resolution: Some agreements may include provisions related to resolving disputes through arbitration rather than traditional courtroom litigation. Different types or variations of Long Beach California Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed include: 1. Standard Disclosure: This covers the essential financing terms as outlined above, ensuring transparency between the seller and the buyer. 2. Customized Disclosure: In some cases, sellers or buyers may negotiate additional financing terms tailored to their specific needs. A customized disclosure would outline these unique terms. 3. Additional Local Requirements: Long Beach, California may have specific additional disclosure requirements that deal with local laws, regulations, or unique regional conditions. These requirements may vary, and it's crucial to consult with a local real estate professional or attorney to ensure compliance. It's important for both buyers and sellers to carefully review and understand the Long Beach California Seller's Disclosure of Financing Terms for Residential Property. Consulting with a real estate attorney or professional can provide further guidance and ensure compliance with the applicable legal requirements.Long Beach California Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is a crucial document that outlines the terms and conditions related to financing a residential property transaction in Long Beach, California. This disclosure is designed to provide buyers with essential information about the financing arrangements when purchasing a property through a Contract or Agreement for Deed, also known as a Land Contract. The Long Beach California Seller's Disclosure of Financing Terms for Residential Property covers various elements that buyers need to be aware of before entering into a financing agreement. Here are the key details and relevant keywords related to this disclosure: 1. Purchase Price: The disclosure will specify the agreed-upon purchase price of the residential property, including any required down payment. 2. Interest Rate: It outlines the interest rate that applies to the financing arrangement, which significantly impacts the overall cost of purchasing the property. 3. Loan Duration: The disclosure indicates the length of the loan term or the total number of months or years required to repay the loan amount. 4. Monthly Payments: It outlines the amount of monthly payments, inclusive of principal and interest, that the buyer must make throughout the agreed loan duration. 5. Default Remedies: The disclosure highlights the potential consequences or remedies for defaulting on the financing terms, such as foreclosure or contract termination. 6. Late Payment Charges: It specifies any additional charges or penalties imposed for late payments and how they are calculated. 7. Property Taxes and Insurance: The disclosure may mention the responsibility of the buyer to pay property taxes, homeowner's insurance, and any other related expenses. 8. Prepayment Penalties: It states whether any penalties apply if the buyer intends to repay the loan earlier than the agreed-upon loan term. 9. Maintenance Obligations: This section may highlight the buyer's obligation to maintain the property, including repairs and upkeep. 10. Arbitration or Dispute Resolution: Some agreements may include provisions related to resolving disputes through arbitration rather than traditional courtroom litigation. Different types or variations of Long Beach California Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed include: 1. Standard Disclosure: This covers the essential financing terms as outlined above, ensuring transparency between the seller and the buyer. 2. Customized Disclosure: In some cases, sellers or buyers may negotiate additional financing terms tailored to their specific needs. A customized disclosure would outline these unique terms. 3. Additional Local Requirements: Long Beach, California may have specific additional disclosure requirements that deal with local laws, regulations, or unique regional conditions. These requirements may vary, and it's crucial to consult with a local real estate professional or attorney to ensure compliance. It's important for both buyers and sellers to carefully review and understand the Long Beach California Seller's Disclosure of Financing Terms for Residential Property. Consulting with a real estate attorney or professional can provide further guidance and ensure compliance with the applicable legal requirements.