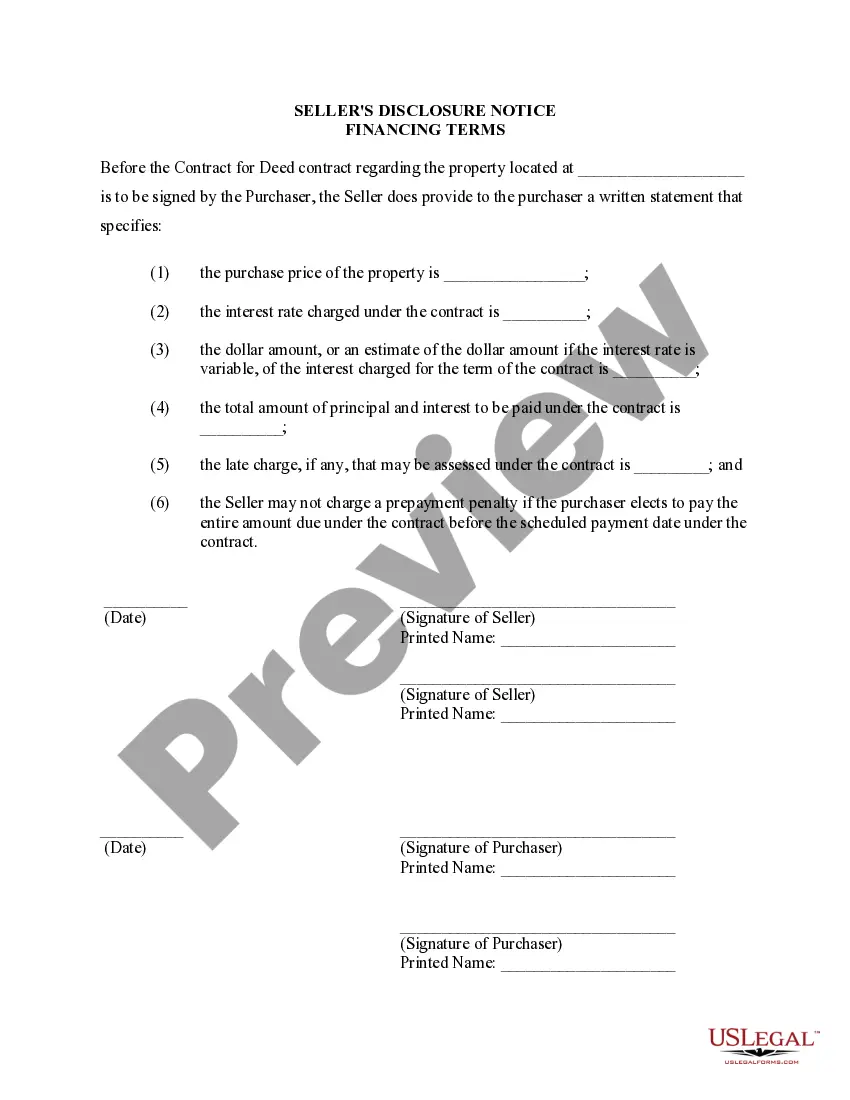

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Orange California Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a legal document that outlines the terms and conditions of the financing arrangement between the seller and the buyer for the purchase of residential property. This disclosure is an essential component of the contractual agreement and provides information regarding the financial aspects of the transaction. The Orange California Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed encompasses various key elements, including interest rates, payment schedules, and any specific conditions or contingencies related to the financing arrangement. By disclosing these details, the document ensures transparency and helps both parties understand their obligations and rights during the term of the contract. In addition to the general Seller's Disclosure of Financing Terms for Residential Property, there might be different types of disclosures that specifically pertain to Orange California. These could include: 1. Orange California Interest Rate Disclosure: This disclosure highlights the interest rate applicable to the purchase financing and provides the buyer with clear information about the cost of borrowing for the property. 2. Orange California Payment Schedule Disclosure: This type of disclosure outlines the agreed-upon payment schedule between the buyer and the seller, including the frequency of payments (e.g., monthly, bi-monthly), the due dates, and any grace periods or penalties associated with late payments. 3. Orange California Contingency Disclosure: This disclosure specifies any contingencies that must be met before finalizing the land contract, such as property inspections, loan approvals, or satisfaction of any legal or regulatory requirements. 4. Orange California Default and Remedies Disclosure: This disclosure explains the consequences and remedies available to both parties in the event of a default or breach of the terms outlined in the land contract. It may include details about penalties, fees, or the right to seek legal action. 5. Orange California Property Insurance Disclosure: This disclosure highlights the buyer's responsibility to obtain appropriate property insurance coverage and provides information on any specific insurance requirements mandated by Orange County or California state laws. 6. Orange California Prepayment Penalty Disclosure: If applicable, this disclosure outlines any prepayment penalties that might be charged if the buyer decides to pay off the land contract before its scheduled maturity date. These different variations of the Orange California Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed aim to address specific aspects of the financing arrangement and ensure that the buyer is well-informed about the financial implications of their purchase. It is crucial for both parties to carefully review and understand each disclosure before entering into any land contract or agreement for deed to protect their interests and rights.Orange California Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a legal document that outlines the terms and conditions of the financing arrangement between the seller and the buyer for the purchase of residential property. This disclosure is an essential component of the contractual agreement and provides information regarding the financial aspects of the transaction. The Orange California Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed encompasses various key elements, including interest rates, payment schedules, and any specific conditions or contingencies related to the financing arrangement. By disclosing these details, the document ensures transparency and helps both parties understand their obligations and rights during the term of the contract. In addition to the general Seller's Disclosure of Financing Terms for Residential Property, there might be different types of disclosures that specifically pertain to Orange California. These could include: 1. Orange California Interest Rate Disclosure: This disclosure highlights the interest rate applicable to the purchase financing and provides the buyer with clear information about the cost of borrowing for the property. 2. Orange California Payment Schedule Disclosure: This type of disclosure outlines the agreed-upon payment schedule between the buyer and the seller, including the frequency of payments (e.g., monthly, bi-monthly), the due dates, and any grace periods or penalties associated with late payments. 3. Orange California Contingency Disclosure: This disclosure specifies any contingencies that must be met before finalizing the land contract, such as property inspections, loan approvals, or satisfaction of any legal or regulatory requirements. 4. Orange California Default and Remedies Disclosure: This disclosure explains the consequences and remedies available to both parties in the event of a default or breach of the terms outlined in the land contract. It may include details about penalties, fees, or the right to seek legal action. 5. Orange California Property Insurance Disclosure: This disclosure highlights the buyer's responsibility to obtain appropriate property insurance coverage and provides information on any specific insurance requirements mandated by Orange County or California state laws. 6. Orange California Prepayment Penalty Disclosure: If applicable, this disclosure outlines any prepayment penalties that might be charged if the buyer decides to pay off the land contract before its scheduled maturity date. These different variations of the Orange California Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed aim to address specific aspects of the financing arrangement and ensure that the buyer is well-informed about the financial implications of their purchase. It is crucial for both parties to carefully review and understand each disclosure before entering into any land contract or agreement for deed to protect their interests and rights.