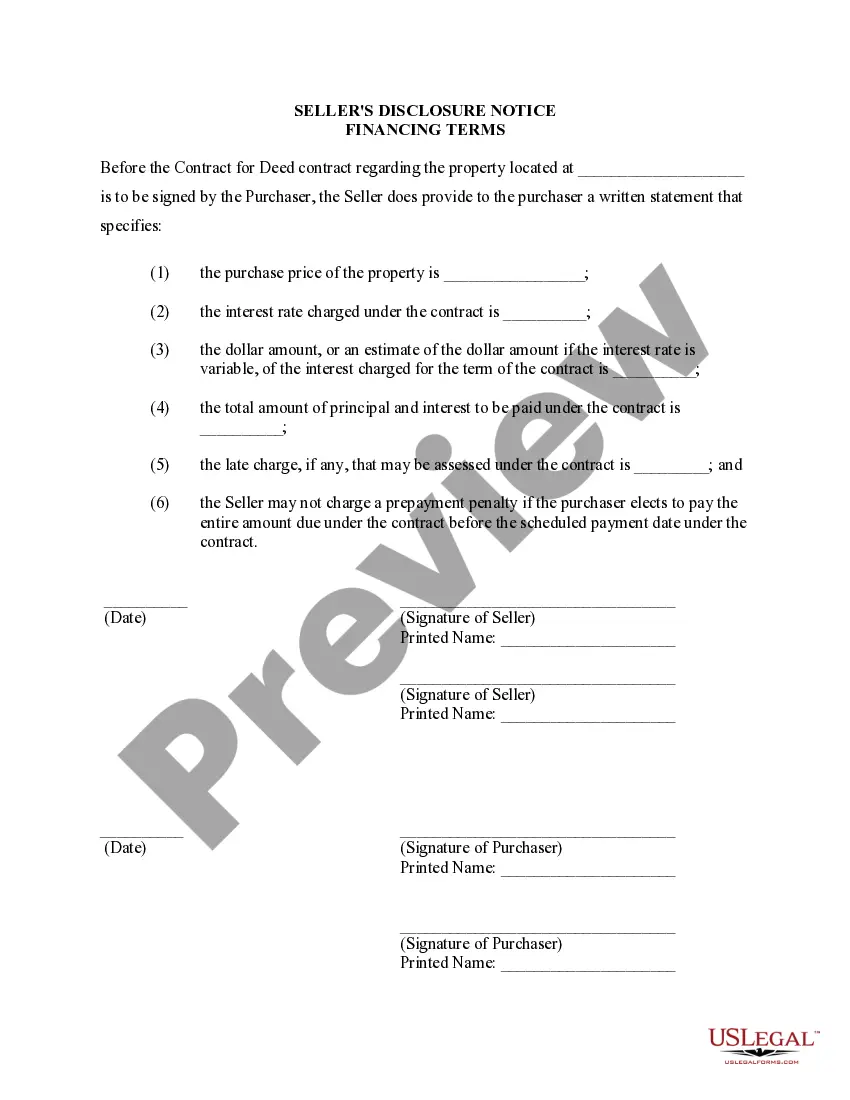

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Rialto California Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an important document that outlines the specific financial terms agreed upon between the seller and buyer in a residential property transaction. This disclosure aims to ensure transparency and protect the rights of both parties involved. Here are the different types of Rialto California Seller's Disclosures of Financing Terms for Residential Property in connection with Contract or Agreement for Deed: 1. Down Payment Amount: This clause specifies the exact amount of money the buyer must pay upfront as a down payment towards the purchase of the residential property. This typically represents a percentage of the total property value. 2. Installment Payments: The Installment Payments clause outlines the frequency and the specific amount of money the buyer must pay the seller, usually on a monthly basis, until the full purchase price is paid off. This may include the principal amount and any agreed-upon interest charges. 3. Interest Rate: This clause defines the interest rate that will apply to the remaining balance owed by the buyer. It is crucial to specify whether the interest rate is fixed or adjustable and provide its exact value. 4. Payment Schedule: The Payment Schedule section describes the due dates and the frequency at which the installment payments are expected. This may include information on late payment penalties, grace periods, and acceptable methods of payment. 5. Length of Financing Term: This clause outlines the overall duration of the financing term. In an Agreement for Deed or Land Contract, this period is usually shorter than traditional mortgage terms and can range from a few months to several years. 6. Balloon Payment: The Balloon Payment clause specifies if there is a large, final payment due at the end of the financing term. This final payment is typically higher than the regular installment payments and may represent the remaining balance of the purchase price. 7. Default and Remedies: This section outlines the consequences if either party fails to meet their respective obligations under the financing terms. It may include information about default penalties, termination of the contract, and any legal actions that can be taken in case of non-compliance. 8. Closing Costs: The Closing Costs clause details who are responsible for paying various expenses associated with the sales transaction, such as title searches, document preparation fees, escrow fees, and recording fees. 9. Property Condition and Inspections: While not directly related to financing terms, it is common for sellers to disclose the property's condition and any known defects. This is to ensure that the buyer is fully aware of the property's condition before entering into the financing agreement. It is important for both sellers and buyers to carefully review and understand the Rialto California Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed. It is recommended to seek legal advice and clarification if needed, to ensure a smooth and transparent transaction.Rialto California Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an important document that outlines the specific financial terms agreed upon between the seller and buyer in a residential property transaction. This disclosure aims to ensure transparency and protect the rights of both parties involved. Here are the different types of Rialto California Seller's Disclosures of Financing Terms for Residential Property in connection with Contract or Agreement for Deed: 1. Down Payment Amount: This clause specifies the exact amount of money the buyer must pay upfront as a down payment towards the purchase of the residential property. This typically represents a percentage of the total property value. 2. Installment Payments: The Installment Payments clause outlines the frequency and the specific amount of money the buyer must pay the seller, usually on a monthly basis, until the full purchase price is paid off. This may include the principal amount and any agreed-upon interest charges. 3. Interest Rate: This clause defines the interest rate that will apply to the remaining balance owed by the buyer. It is crucial to specify whether the interest rate is fixed or adjustable and provide its exact value. 4. Payment Schedule: The Payment Schedule section describes the due dates and the frequency at which the installment payments are expected. This may include information on late payment penalties, grace periods, and acceptable methods of payment. 5. Length of Financing Term: This clause outlines the overall duration of the financing term. In an Agreement for Deed or Land Contract, this period is usually shorter than traditional mortgage terms and can range from a few months to several years. 6. Balloon Payment: The Balloon Payment clause specifies if there is a large, final payment due at the end of the financing term. This final payment is typically higher than the regular installment payments and may represent the remaining balance of the purchase price. 7. Default and Remedies: This section outlines the consequences if either party fails to meet their respective obligations under the financing terms. It may include information about default penalties, termination of the contract, and any legal actions that can be taken in case of non-compliance. 8. Closing Costs: The Closing Costs clause details who are responsible for paying various expenses associated with the sales transaction, such as title searches, document preparation fees, escrow fees, and recording fees. 9. Property Condition and Inspections: While not directly related to financing terms, it is common for sellers to disclose the property's condition and any known defects. This is to ensure that the buyer is fully aware of the property's condition before entering into the financing agreement. It is important for both sellers and buyers to carefully review and understand the Rialto California Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed. It is recommended to seek legal advice and clarification if needed, to ensure a smooth and transparent transaction.