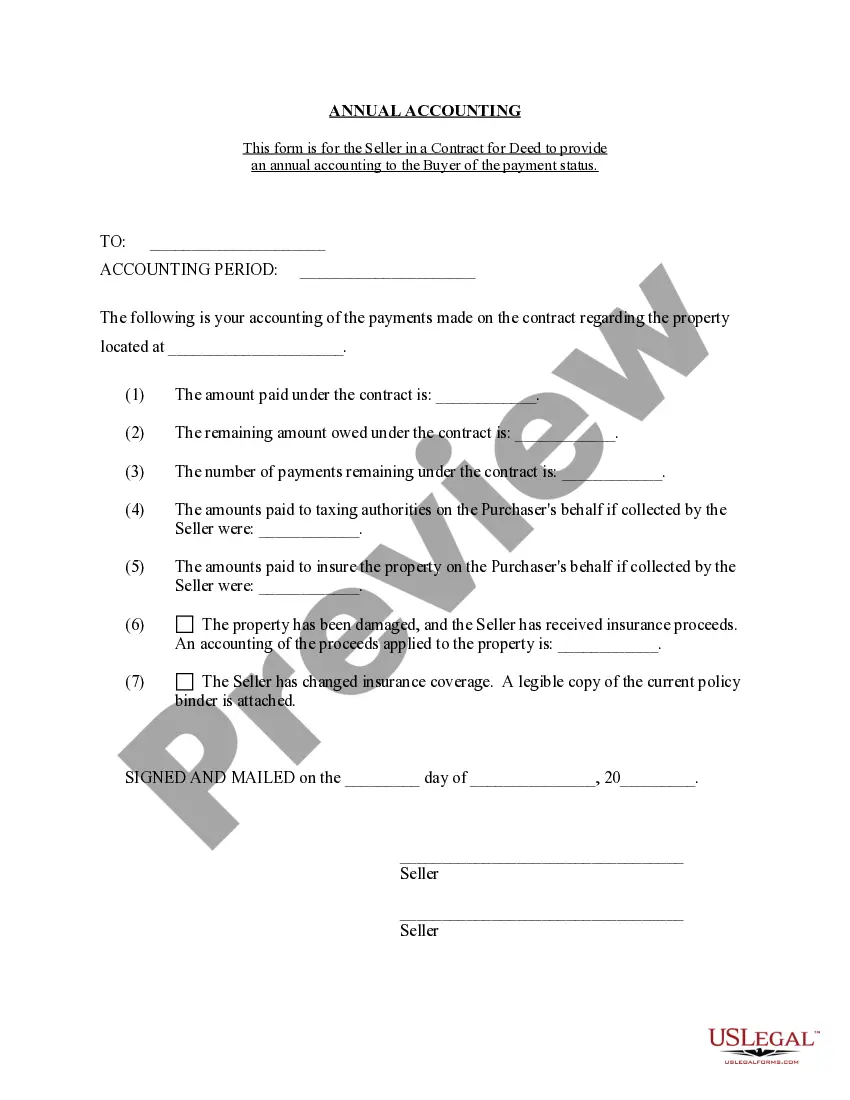

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Sacramento California Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document that provides a detailed overview of the seller's financial transactions and obligations related to the contract for deed agreement. This statement serves to maintain transparency and accountability between the parties involved in the contract for deed, ensuring that both the buyer and seller are aware of the financial status and any adjustments that may be necessary. Keywords: Sacramento California, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, obligations, transparency, accountability, buyer, seller, adjustments. Different types of Sacramento California Contract for Deed Seller's Annual Accounting Statements may include: 1. General Contract for Deed Seller's Annual Accounting Statement: This type of statement is the standard variation and covers all essential financial aspects related to the contract for deed agreement in Sacramento, California. It includes details about the principal amount, interest payments, taxes, insurance premiums, and any other relevant financial obligations of the seller. 2. Adjusted Seller's Annual Accounting Statement: In some cases, adjustments might be required during the course of the contract for deed agreement due to changes in interest rates, property taxes, or insurance premiums. This variation of the accounting statement provides a comprehensive overview of the adjustments made to the initial statement, calculating the updated financial obligations of the seller. 3. Late Payment Penalty Seller's Annual Accounting Statement: If the buyer fails to make timely payments, a late payment penalty may be imposed. This type of accounting statement focuses on outlining the penalties incurred by the buyer due to late payments, providing transparency regarding the added financial burden. 4. Early Payment Seller's Annual Accounting Statement: In the event that the buyer chooses to pay off the contract for deed before its scheduled maturity date, an early payment statement becomes relevant. This accounting statement details the financial obligations of the seller and any adjustments, such as prepayment penalties or interest rate reductions, as a result of the early payment. 5. Escrow Seller's Annual Accounting Statement: In cases where an escrow account is established, a specific accounting statement is required. This statement focuses on tracking the funds held in escrow, detailing the deposits, withdrawals, interest earned, and any other transactions related to the escrow account. Remember, the variations mentioned above are just examples, and the actual types of accounting statements may differ based on the specific terms and conditions outlined in the Sacramento California Contract for Deed.The Sacramento California Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document that provides a detailed overview of the seller's financial transactions and obligations related to the contract for deed agreement. This statement serves to maintain transparency and accountability between the parties involved in the contract for deed, ensuring that both the buyer and seller are aware of the financial status and any adjustments that may be necessary. Keywords: Sacramento California, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, obligations, transparency, accountability, buyer, seller, adjustments. Different types of Sacramento California Contract for Deed Seller's Annual Accounting Statements may include: 1. General Contract for Deed Seller's Annual Accounting Statement: This type of statement is the standard variation and covers all essential financial aspects related to the contract for deed agreement in Sacramento, California. It includes details about the principal amount, interest payments, taxes, insurance premiums, and any other relevant financial obligations of the seller. 2. Adjusted Seller's Annual Accounting Statement: In some cases, adjustments might be required during the course of the contract for deed agreement due to changes in interest rates, property taxes, or insurance premiums. This variation of the accounting statement provides a comprehensive overview of the adjustments made to the initial statement, calculating the updated financial obligations of the seller. 3. Late Payment Penalty Seller's Annual Accounting Statement: If the buyer fails to make timely payments, a late payment penalty may be imposed. This type of accounting statement focuses on outlining the penalties incurred by the buyer due to late payments, providing transparency regarding the added financial burden. 4. Early Payment Seller's Annual Accounting Statement: In the event that the buyer chooses to pay off the contract for deed before its scheduled maturity date, an early payment statement becomes relevant. This accounting statement details the financial obligations of the seller and any adjustments, such as prepayment penalties or interest rate reductions, as a result of the early payment. 5. Escrow Seller's Annual Accounting Statement: In cases where an escrow account is established, a specific accounting statement is required. This statement focuses on tracking the funds held in escrow, detailing the deposits, withdrawals, interest earned, and any other transactions related to the escrow account. Remember, the variations mentioned above are just examples, and the actual types of accounting statements may differ based on the specific terms and conditions outlined in the Sacramento California Contract for Deed.