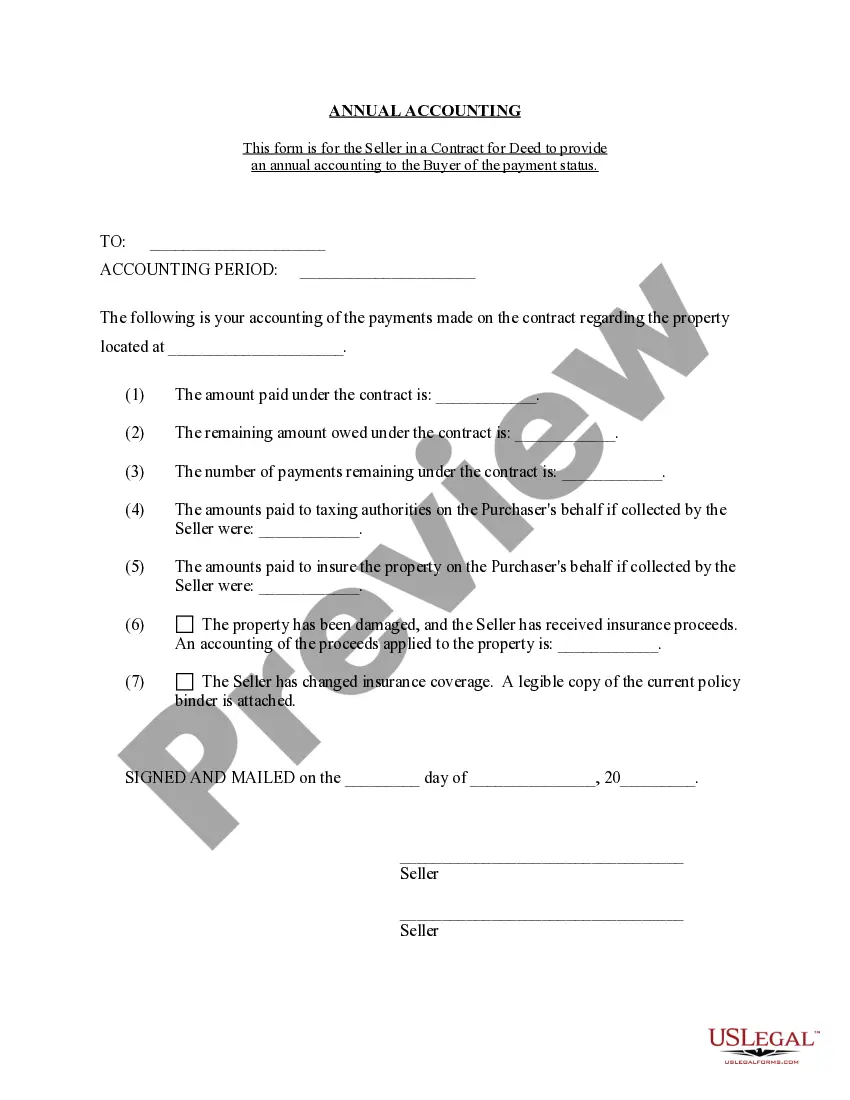

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Thousand Oaks California Contract for Deed Seller's Annual Accounting Statement is a crucial document designed to provide a comprehensive financial summary for individuals or entities engaged in contract-for-deed transactions in Thousand Oaks, California. This statement serves as an essential tool for sellers to track and report financial information related to the contract-for-deed agreements they have entered into. The Thousand Oaks California Contract for Deed Seller's Annual Accounting Statement outlines key financial aspects, ensuring transparency and accountability between the seller and the buyer. This statement includes pertinent information such as the total amount received as down payment, the principal amount paid by the buyer, interest collected throughout the year, any applicable late fees, and credits or adjustments made during the accounting period. Additionally, various types of Thousand Oaks California Contract for Deed Seller's Annual Accounting Statements may exist, depending on the specific terms agreed upon in the contract-for-deed agreement. These may include: 1. Basic Annual Accounting Statement: This type of statement offers a fundamental overview of the financial transactions associated with the contract-for-deed arrangement, highlighting the principal payments, interest earned, and any adjustments made during the year. 2. Comprehensive Annual Accounting Statement: A more detailed version of the statement, incorporating additional information such as the buyer's payment history, escrow account balances, and any taxes or insurance payments disbursed by the seller on behalf of the buyer. 3. Late Payment Accounting Statement: This specialized statement is issued when a buyer fails to make timely payments in accordance with the contract-for-deed agreement. It clearly outlines the overdue amount, any late fees imposed, and any additional actions taken by the seller to rectify the situation. Thousand Oaks California Contract for Deed Seller's Annual Accounting Statements play a vital role in establishing transparency and maintaining accurate financial records. These statements not only ensure compliance with legal and financial regulations but also foster a healthy business relationship between the seller and the buyer, promoting trust and accountability throughout the contract-for-deed term.Thousand Oaks California Contract for Deed Seller's Annual Accounting Statement is a crucial document designed to provide a comprehensive financial summary for individuals or entities engaged in contract-for-deed transactions in Thousand Oaks, California. This statement serves as an essential tool for sellers to track and report financial information related to the contract-for-deed agreements they have entered into. The Thousand Oaks California Contract for Deed Seller's Annual Accounting Statement outlines key financial aspects, ensuring transparency and accountability between the seller and the buyer. This statement includes pertinent information such as the total amount received as down payment, the principal amount paid by the buyer, interest collected throughout the year, any applicable late fees, and credits or adjustments made during the accounting period. Additionally, various types of Thousand Oaks California Contract for Deed Seller's Annual Accounting Statements may exist, depending on the specific terms agreed upon in the contract-for-deed agreement. These may include: 1. Basic Annual Accounting Statement: This type of statement offers a fundamental overview of the financial transactions associated with the contract-for-deed arrangement, highlighting the principal payments, interest earned, and any adjustments made during the year. 2. Comprehensive Annual Accounting Statement: A more detailed version of the statement, incorporating additional information such as the buyer's payment history, escrow account balances, and any taxes or insurance payments disbursed by the seller on behalf of the buyer. 3. Late Payment Accounting Statement: This specialized statement is issued when a buyer fails to make timely payments in accordance with the contract-for-deed agreement. It clearly outlines the overdue amount, any late fees imposed, and any additional actions taken by the seller to rectify the situation. Thousand Oaks California Contract for Deed Seller's Annual Accounting Statements play a vital role in establishing transparency and maintaining accurate financial records. These statements not only ensure compliance with legal and financial regulations but also foster a healthy business relationship between the seller and the buyer, promoting trust and accountability throughout the contract-for-deed term.