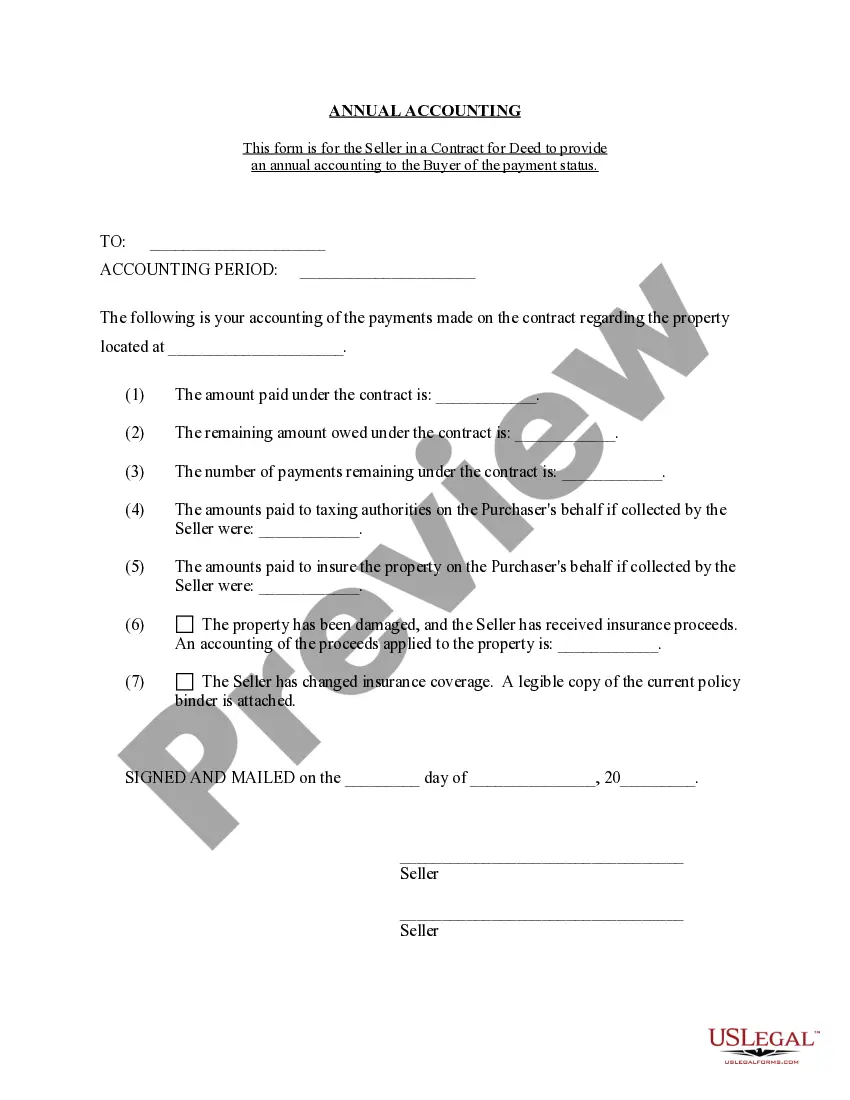

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Vista California Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out California Contract For Deed Seller's Annual Accounting Statement?

If you’ve previously made use of our service, sign in to your account and retrieve the Vista California Contract for Deed Seller's Annual Accounting Statement on your device by clicking the Download button. Ensure your subscription is current. If it isn’t, renew it according to your payment arrangement.

If this is your initial encounter with our service, follow these straightforward steps to acquire your file.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to use it again. Utilize the US Legal Forms service to easily find and save any template for your personal or business requirements!

- Verify that you’ve found a suitable document. Browse through the description and utilize the Preview option, if available, to confirm it satisfies your requirements. If it doesn’t suit you, use the Search tab above to find the correct one.

- Procure the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and make a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Vista California Contract for Deed Seller's Annual Accounting Statement. Select the file format for your document and save it onto your device.

- Finish your sample. Print it out or use professional online editors to complete it and sign it digitally.

Form popularity

FAQ

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

Contract for deed is a contract for the sale of land which provides that the buyer will acquire possession of the land immediately and pay the purchase price in installments over a period of time, but the seller will retain legal title until all payments are made.

A contract for deed, also known as a land contract or installment sale, is a type of seller financing that lasts from three to five years. It allows the property's title to stay with the seller until the total sale price is paid. A typical way to end the contract is with a balloon payment.

Disadvantages of Common Law Contracts Contracts cost time and money to write. Whether they're drafted by a lawyer or reviewed by one, or even if they are written by an HR professional, contracts require a good deal of energy and are not an inexpensive undertaking.

Pros and Cons of a Contract for Deed Pro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.