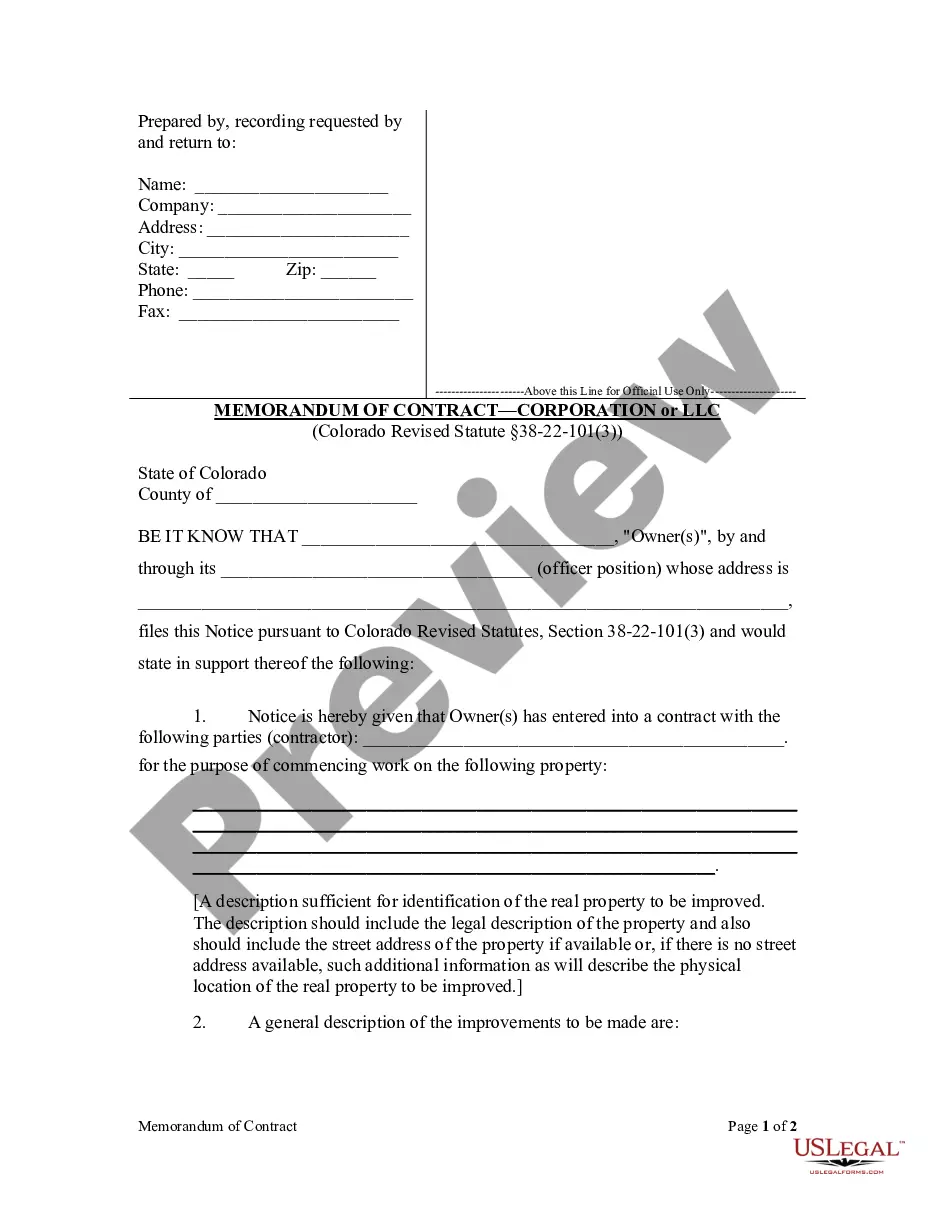

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

Irvine California Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Irvine California Notice Of Default For Past Due Payments In Connection With Contract For Deed?

If you are in pursuit of an applicable form template, it’s challenging to discover a more user-friendly location than the US Legal Forms site – likely the most extensive compilations on the web.

With this collection, you can discover a vast array of templates for business and personal objectives categorized by types and states, or keywords.

Utilizing our sophisticated search functionality, obtaining the most current Irvine California Notice of Default for Outstanding Payments related to Contract for Deed is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Select the file format and save it to your device. Make changes. Fill in, alter, print, and sign the received Irvine California Notice of Default for Outstanding Payments related to Contract for Deed.

- Moreover, the validity of each document is confirmed by a team of experienced attorneys who routinely assess the templates on our site and update them in line with the latest state and county requirements.

- If you are already familiar with our platform and possess an account, all you need to do to access the Irvine California Notice of Default for Outstanding Payments concerning Contract for Deed is to Log In/">Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the steps outlined below.

- Ensure you have selected the template you require. Review its description and utilize the Preview feature to examine its content. If it does not fulfill your needs, employ the Search bar at the top of the page to find the suitable record.

- Confirm your choice. Select the Buy now button. Subsequently, choose your preferred payment plan and enter your details to set up an account.

Form popularity

FAQ

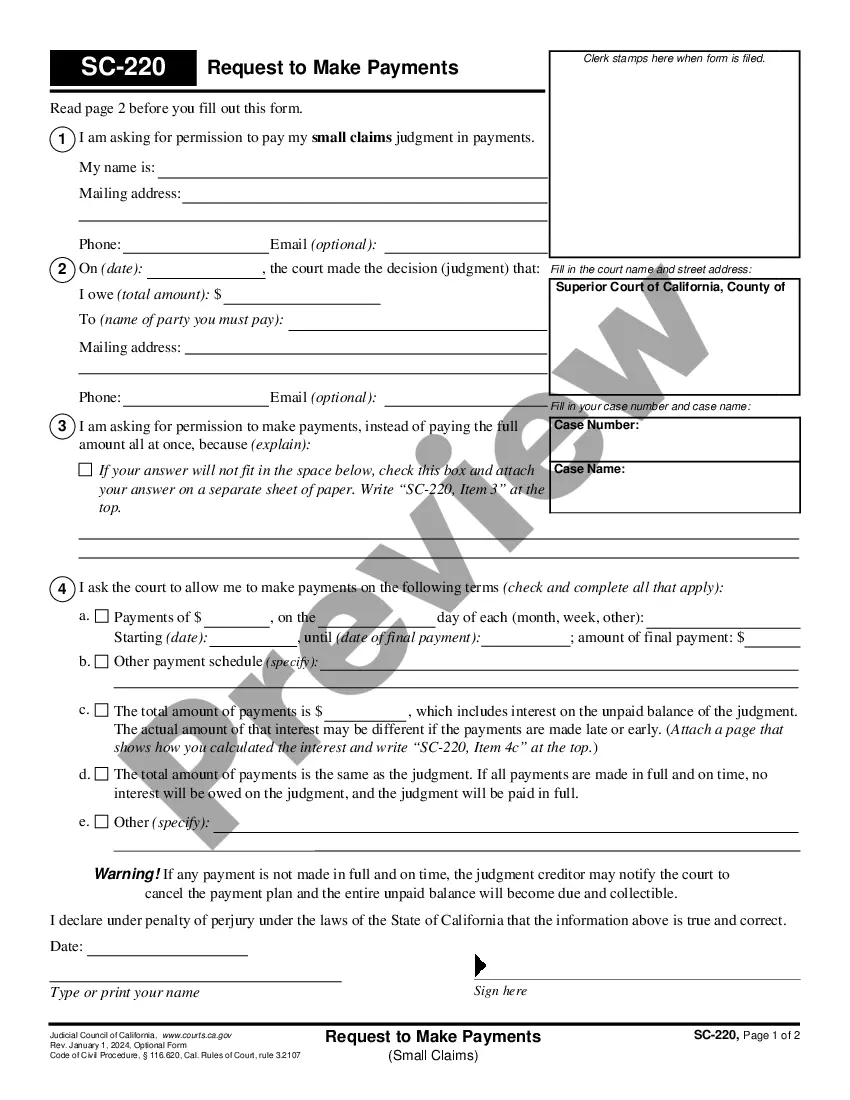

Notice of Default The date of the notice. The names of the lender and borrower. The date of the promissory note itself. The full amount of the promissory note (that is, the total amount that was borrowed) The number of installment payments that have been missed.

After you've received a Notice of Default, you have 3 months in which to attempt to get your loan current. As mentioned above, that means paying all back payments, interest, fees, property taxes, and insurance. After 3 months, the bank can officially set a date for the auction of your home.

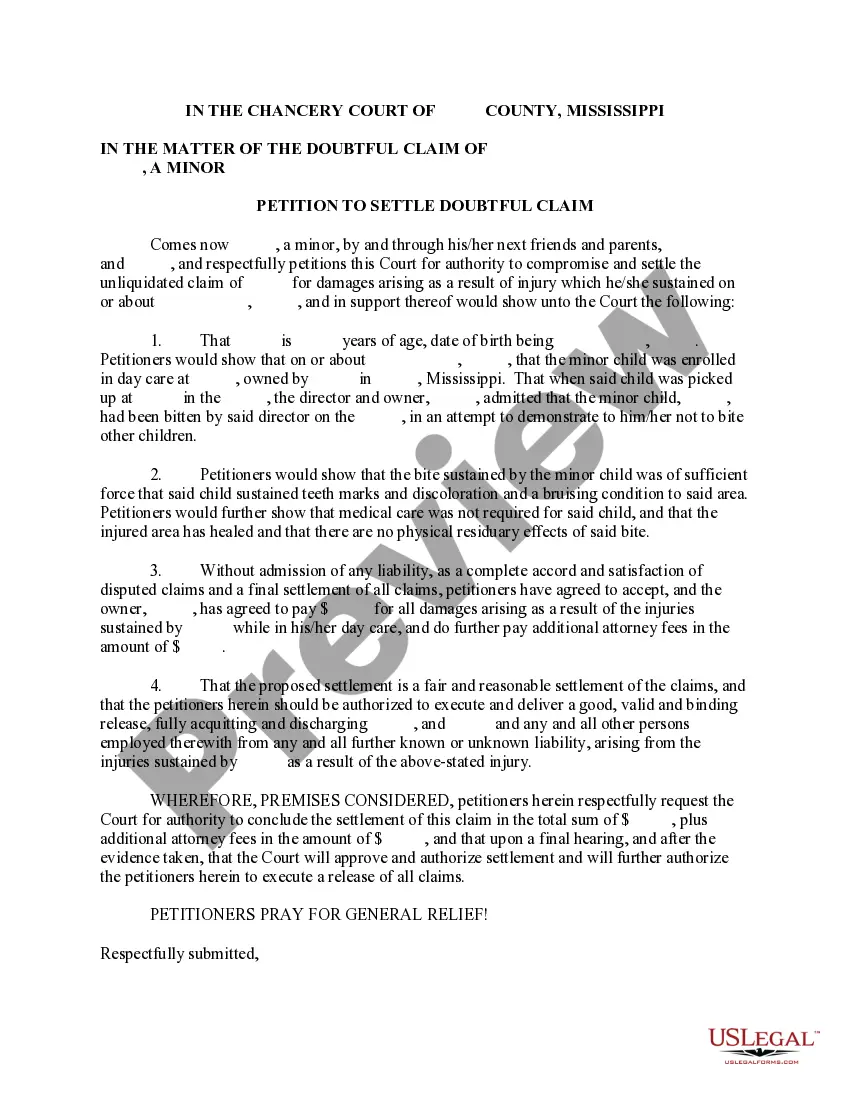

Technically speaking, a notice of default is not a foreclosure. Instead, it serves as notice that you are behind in your payments and that your property may be sold as a result of foreclosure if you don't act soon.

In CA a Notice of Default does not expire. The Notice of Default would be active until a Notice of Rescission or a Reconveyance is recorded on the loan in question.

Your lender is required to give you notice within 10 days of filing a Notice of Default in California. When you receive a Notice of Default in California, the formal foreclosure process has begun.

In the context of mortgage foreclosure, a notice of default is a formal notice that a lender filed with courts to notify the borrower who has failed to make payments that the lender intends to conduct a sale foreclosure.

It notifies a borrower that their delinquent mortgage payments have breached the limit as outlined in their mortgage loan contract. Lenders outline the number of delinquent payments allowed in a mortgage contract before default action is taken.

There are three popular ways to find a notice of default. Legal newspaper. Buy or subscribe to a legal newspaper in your county.County recorder's office.Legal property descriptions.Tax assessor's office.Online pre-foreclosure website.Online commercial pre-foreclosure service.

A notice of default is a statement sent by one contract party to notify another that the latter was in default by failing to fulfil the terms of an agreement and a legal action would follow if the latter continue to default.

The lender sends you a copy of this notice by certified mail within 10 business days of recording it. You then have 90 days from the date that the Notice of Default is recorded to ?cure? (fix, usually by paying what is owed) the default.