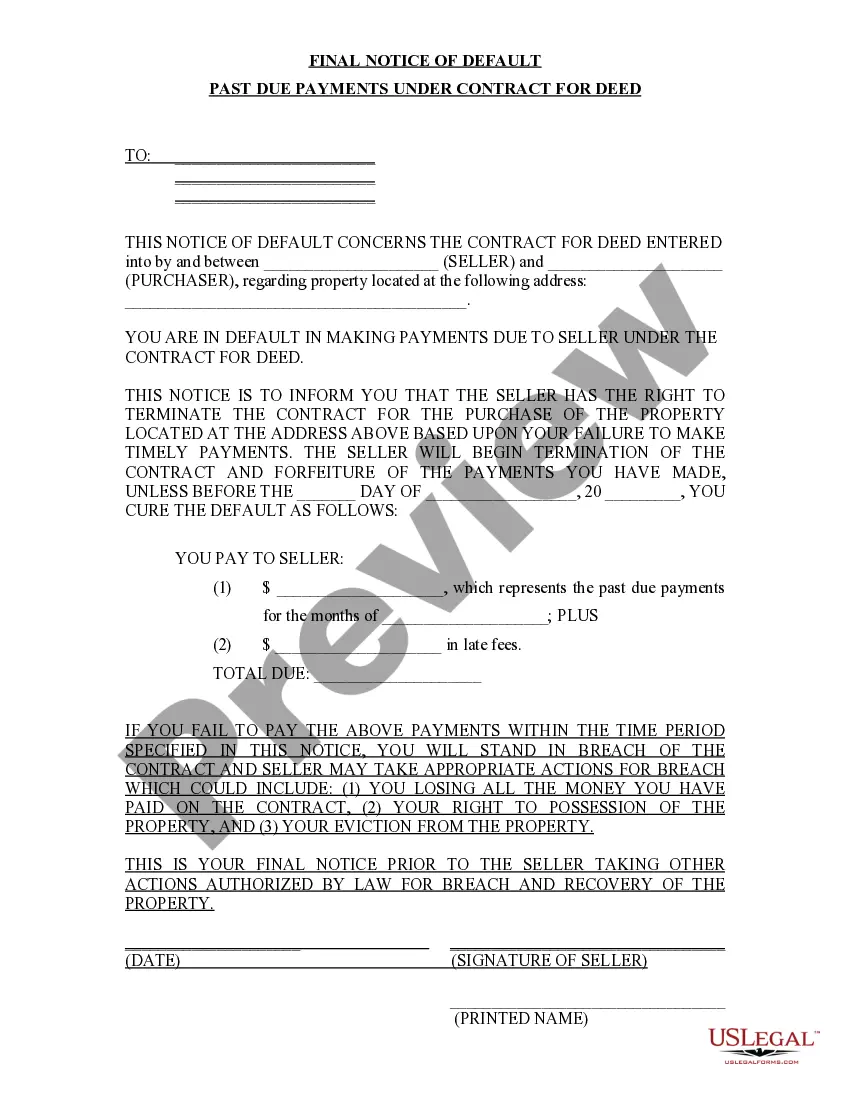

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Title: Understanding El Monte California Final Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: El Monte California, final notice of default, past due payments, Contract for Deed Introduction: As a resident of El Monte, California, it is crucial to have a comprehensive understanding of legal processes such as the Final Notice of Default for Past Due Payments in connection with a Contract for Deed. This document acts as a significant indicator of monetary obligations and potential consequences for failing to meet payment deadlines. In this article, we will examine and explain the different types of Final Notice of Default that may apply in El Monte, California. 1. El Monte California Final Notice of Default for Past Due Payments in Connection with Contract for Deed: This notice is issued to notify the buyer of a property under Contract for Deed that their payment(s) are past due, breaching the terms of the agreement. It serves as a final warning before further legal action is taken. 2. Specific Types of El Monte California Final Notice of Default: a. First Notice of Default (NOD): The First NOD is the initial formal notice sent by the lender or seller, usually after the buyer has missed multiple payments. It outlines the amount due and provides a grace period for the buyer to remedy the situation within a specified timeframe. b. Second Notice of Default: If the buyer fails to rectify the default within the provided grace period, the lender or seller may issue a Second Notice of Default. This notice reiterates the consequences of non-payment and may include additional penalties. c. Final Notice of Default: If the buyer continues to neglect their payment obligations, a Final Notice of Default is sent by the lender or seller. This notice acts as a final warning, informing the buyer of the imminent loss of their property rights unless immediate payment is made. 3. Consequences of Default: Failure to resolve the default after receiving a Final Notice of Default may lead to further legal actions, including foreclosure proceedings. The lender or seller has the right to initiate a foreclosure sale, potentially resulting in the loss of the buyer's property. 4. Seeking Professional Assistance: If you have received a Final Notice of Default, it is advised to consult with a qualified attorney experienced in real estate law, specifically regarding Contract for Deed matters. They can guide you through the process, assess your options, and help negotiate a resolution or explore alternatives to foreclosure. Conclusion: Being aware of the various types of El Monte California Final Notice of Default for Past Due Payments in connection with a Contract for Deed is crucial for anyone facing financial difficulties. Adhering to the terms of the agreement and promptly addressing any payment deficits can help prevent the potential loss of property and safeguard your legal rights. Seeking professional assistance is highly recommended navigating the complexities associated with this legal process.Title: Understanding El Monte California Final Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: El Monte California, final notice of default, past due payments, Contract for Deed Introduction: As a resident of El Monte, California, it is crucial to have a comprehensive understanding of legal processes such as the Final Notice of Default for Past Due Payments in connection with a Contract for Deed. This document acts as a significant indicator of monetary obligations and potential consequences for failing to meet payment deadlines. In this article, we will examine and explain the different types of Final Notice of Default that may apply in El Monte, California. 1. El Monte California Final Notice of Default for Past Due Payments in Connection with Contract for Deed: This notice is issued to notify the buyer of a property under Contract for Deed that their payment(s) are past due, breaching the terms of the agreement. It serves as a final warning before further legal action is taken. 2. Specific Types of El Monte California Final Notice of Default: a. First Notice of Default (NOD): The First NOD is the initial formal notice sent by the lender or seller, usually after the buyer has missed multiple payments. It outlines the amount due and provides a grace period for the buyer to remedy the situation within a specified timeframe. b. Second Notice of Default: If the buyer fails to rectify the default within the provided grace period, the lender or seller may issue a Second Notice of Default. This notice reiterates the consequences of non-payment and may include additional penalties. c. Final Notice of Default: If the buyer continues to neglect their payment obligations, a Final Notice of Default is sent by the lender or seller. This notice acts as a final warning, informing the buyer of the imminent loss of their property rights unless immediate payment is made. 3. Consequences of Default: Failure to resolve the default after receiving a Final Notice of Default may lead to further legal actions, including foreclosure proceedings. The lender or seller has the right to initiate a foreclosure sale, potentially resulting in the loss of the buyer's property. 4. Seeking Professional Assistance: If you have received a Final Notice of Default, it is advised to consult with a qualified attorney experienced in real estate law, specifically regarding Contract for Deed matters. They can guide you through the process, assess your options, and help negotiate a resolution or explore alternatives to foreclosure. Conclusion: Being aware of the various types of El Monte California Final Notice of Default for Past Due Payments in connection with a Contract for Deed is crucial for anyone facing financial difficulties. Adhering to the terms of the agreement and promptly addressing any payment deficits can help prevent the potential loss of property and safeguard your legal rights. Seeking professional assistance is highly recommended navigating the complexities associated with this legal process.