This Buyer's Home Inspection Checklist form is used by the Buyer when initially viewing a home to purchase in California. It provides a comprehensive list of items to check or to ask the Seller prior to making an offer on a home. This is an all-inclusive form and not all items may be applicable to the property being viewed.

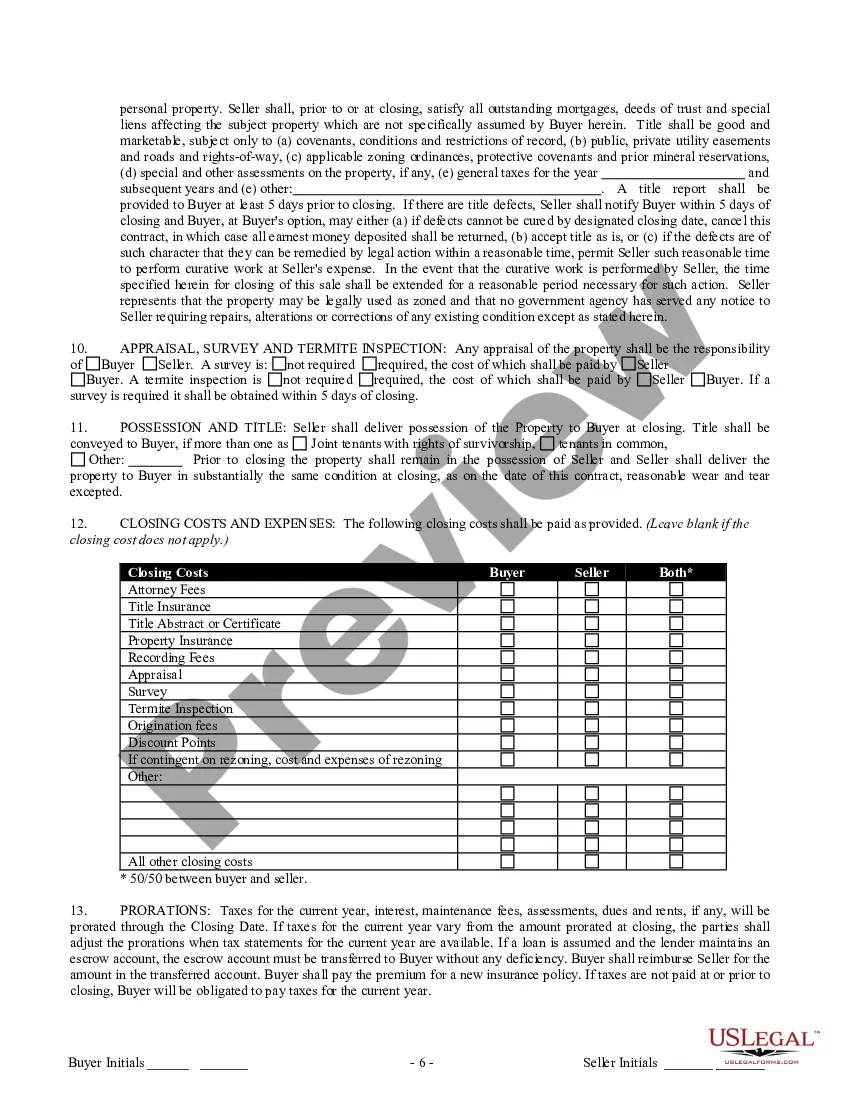

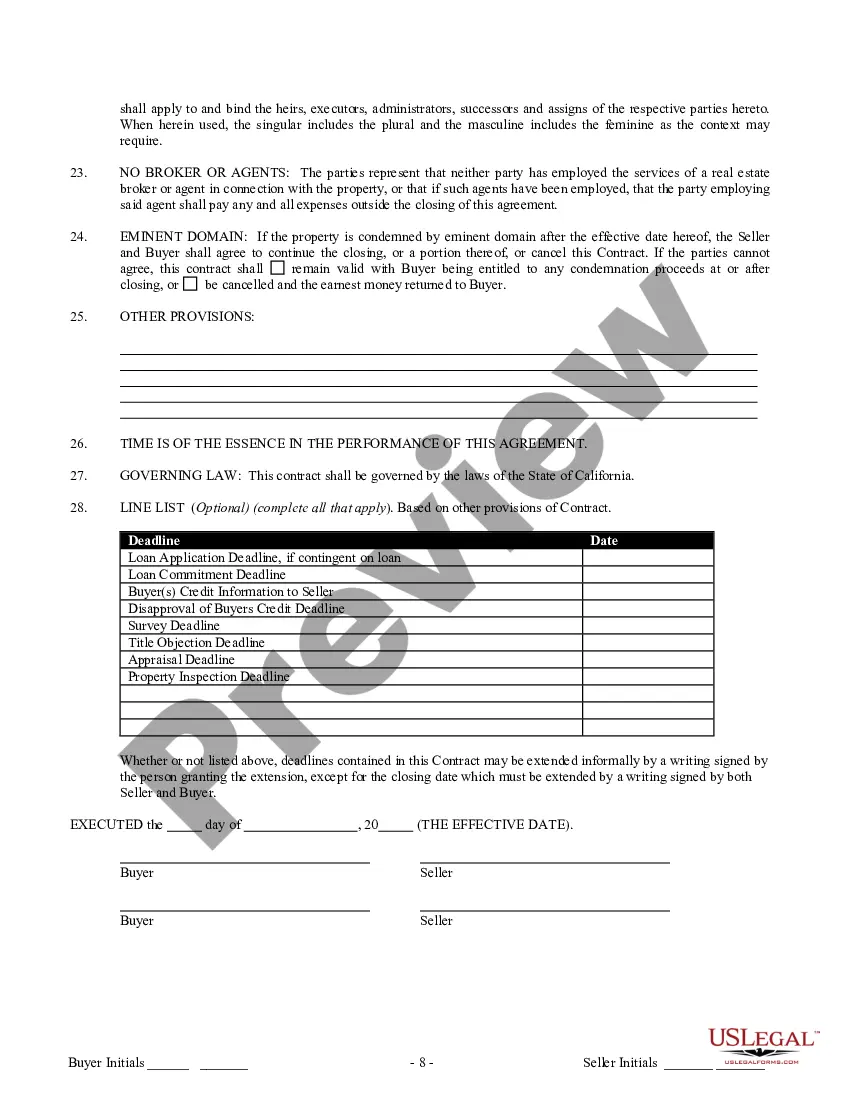

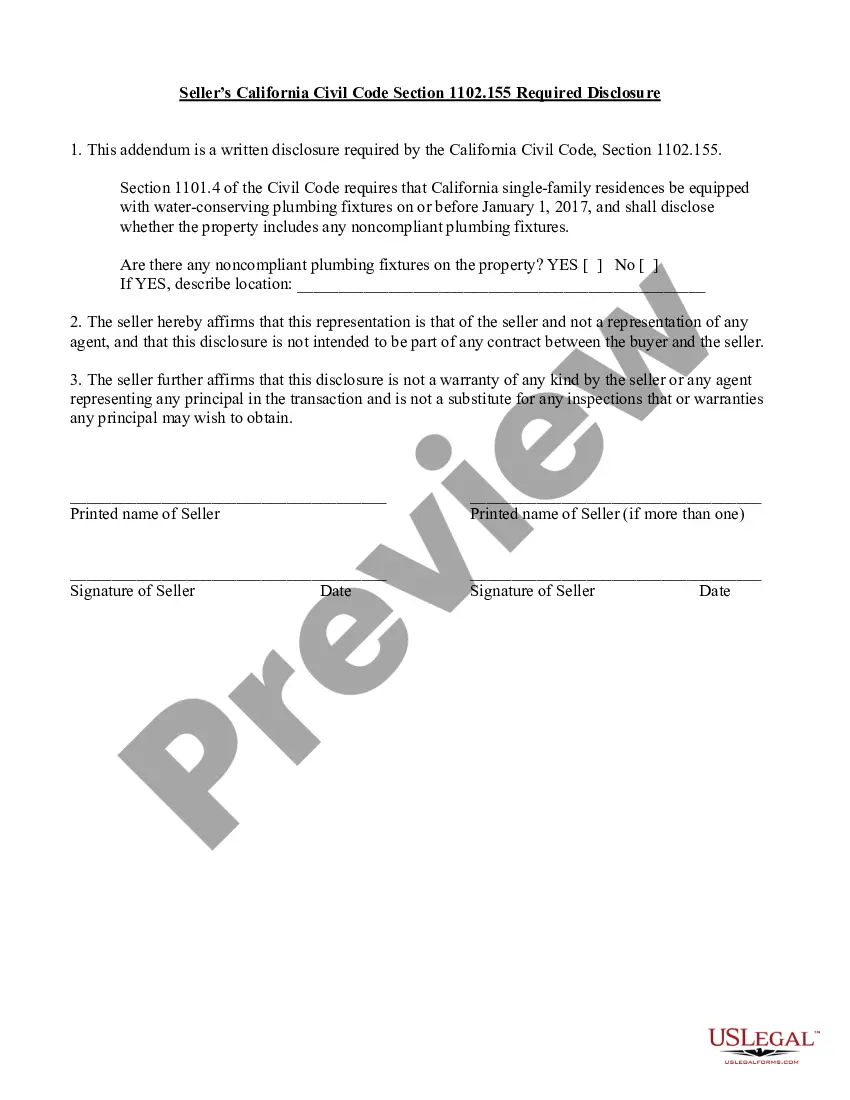

The San Jose California Residential Purchase Agreement for Sale by Owner is a legal document that outlines the terms and conditions of a real estate transaction between a homeowner selling their property and a potential buyer, without the involvement of a real estate agent or broker. This agreement serves as a binding contract and covers various aspects of the sale, providing both parties with a clear understanding of their rights and responsibilities. Key elements of the San Jose California Residential Purchase Agreement for Sale by Owner include: 1. Description of the Property: This section provides a detailed description of the property being sold, including its address, legal description, boundaries, and any additional features or fixtures included in the sale. 2. Purchase Price and Financing Terms: The agreement specifies the purchase price agreed upon by both parties, the desired method of payment, and any provisions for financing, such as the buyer obtaining a mortgage or the seller providing financing. 3. Contingencies: Contingencies protect the buyer's interests and may include provisions for inspections, property appraisals, securing financing, or the sale of the buyer's current property. If these conditions are not met within the specified timeframe, the agreement may be terminated. 4. Disclosures: Sellers are required to provide certain disclosures regarding the property's condition, any known defects, and any potential hazards. These disclosures ensure that the buyer is fully informed about the property's condition before completing the purchase. 5. Earnest Money Deposit: This section outlines the amount of earnest money the buyer is required to deposit as a sign of good faith to proceed with the sale. It also specifies how the deposit will be handled in the event of cancellation or completion of the sale. 6. Closing Date and Costs: The agreement includes provisions for the closing date, the location of the closing, and who is responsible for various closing costs, such as title insurance, escrow fees, and transfer taxes. 7. Default and Dispute Resolution: The agreement outlines the consequences of default by either party, including potential financial penalties or the right to pursue legal remedies. It may also include provisions for mediation or arbitration to resolve any disputes that may arise during the transaction. Different types of San Jose California Residential Purchase Agreements for Sale by Owner may vary in terms of their additional clauses or specific language used, but the fundamental elements mentioned above generally remain the same. It is always advisable for both the seller and buyer to seek legal advice or consultation to ensure the agreement complies with the state's real estate laws and adequately protects their interests.