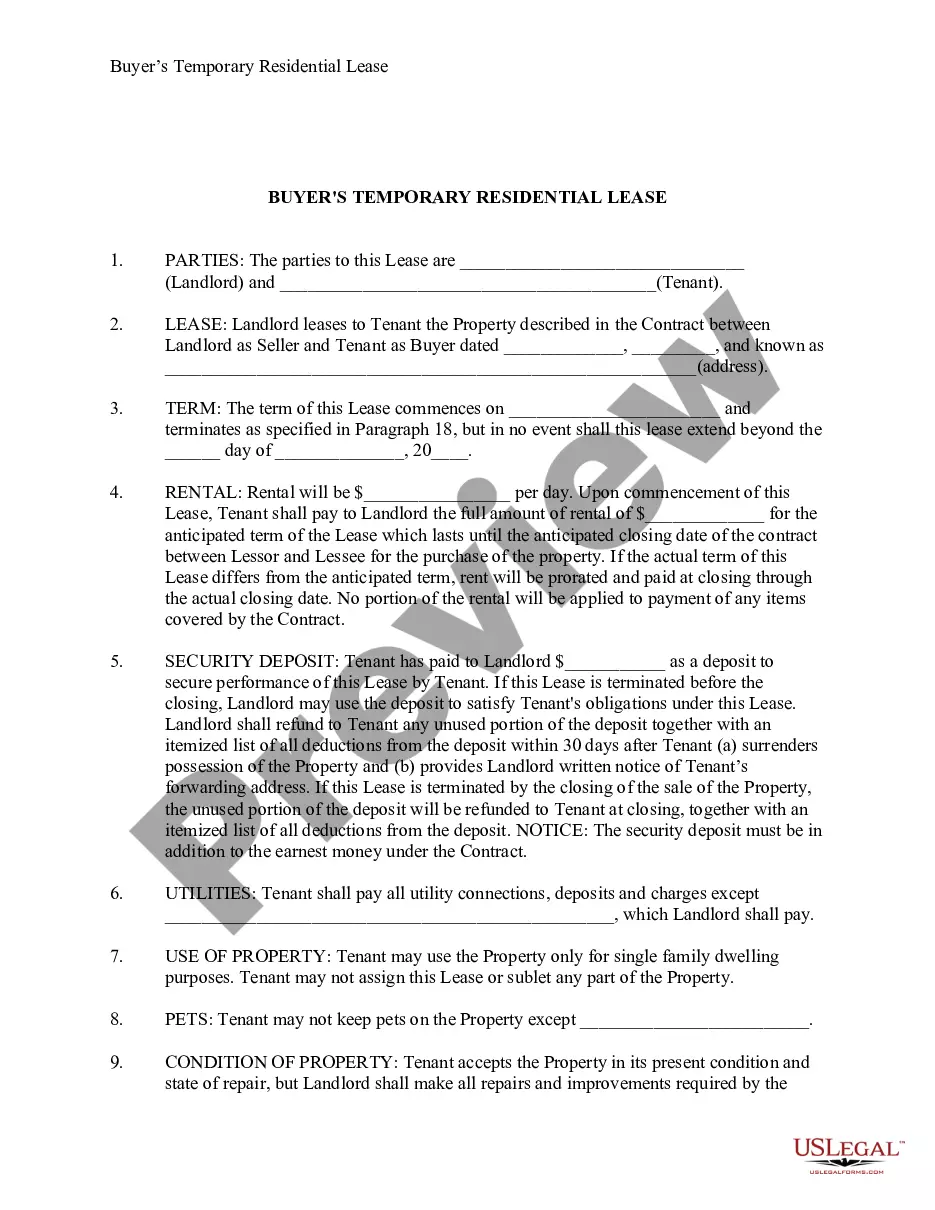

This Option to Purchase Addendum to Residential and Lease Agreement is entered into by and between the lessor and the lessee. The lessor agrees not to offer the residence for sale to anyone during the term of the lease, and to give the lessee (tenant) the option to purchase the residence at any time prior to the expiration of the lease, provided the lessee gives notice of intent to purchase in accordance with the provisions of the Addendum. At that point, a separate contract of sale will be executed and the sale will proceed as any sale would.

Please note: This Addendum form is NOT a lease agreement. You will need a separate Residential Lease Agreement. The Addendum would be attached to that Agreement

San Diego California Option to Purchase Addendum to Residential Lease — Lease or Rent to Own: The San Diego California Option to Purchase Addendum to Residential Lease — Lease or Rent to Own is a legally binding agreement that allows tenants to have the option to purchase the property they are currently leasing. This addendum provides a unique opportunity for individuals who wish to transition from being renters to homeowners. The San Diego California Option to Purchase Addendum to Residential Lease — Lease or Rent to Own offers several advantages to both landlords and tenants. For landlords, it ensures a stable cash flow from the lease payments while potentially securing a future buyer for their property. On the other hand, tenants benefit from having the opportunity to try out living in the property before committing to a full purchase. There are two main types of San Diego California Option to Purchase Addendum to Residential Lease — Lease or Rent to Own: 1. Lease with Option to Purchase: In this type of agreement, the tenant has the right to purchase the property during or at the end of the lease period. During the lease term, the tenant pays rent and an additional fee that is credited towards the future purchase price. This option allows the tenant to save up for a down payment and improve their credit score before officially buying the property. 2. Lease-Purchase Agreement: Unlike the Lease with Option to Purchase, the lease-purchase agreement requires the tenant to purchase the property at the end of the lease term. The tenant and landlord agree on a purchase price at the beginning of the lease agreement. The tenant pays rent during the lease term with a portion of the payment going towards the down payment. At the end of the lease term, the tenant secures financing to complete the purchase. Both types of San Diego California Option to Purchase Addendum to Residential Lease — Lease or Rent to Own have specific terms and conditions that should be clearly outlined in the agreement. These terms typically include the purchase price, option fee, rent credits, maintenance responsibilities, and any other relevant details. It is important for both parties to consult legal professionals to ensure that the San Diego California Option to Purchase Addendum to Residential Lease — Lease or Rent to Own adheres to local regulations and protects the rights and interests of both the landlord and tenant. Overall, the San Diego California Option to Purchase Addendum to Residential Lease — Lease or Rent to Own provides a convenient pathway for individuals in San Diego to transition from renting to owning a property, allowing them to secure their dream home while minimizing the risks associated with traditional home buying.