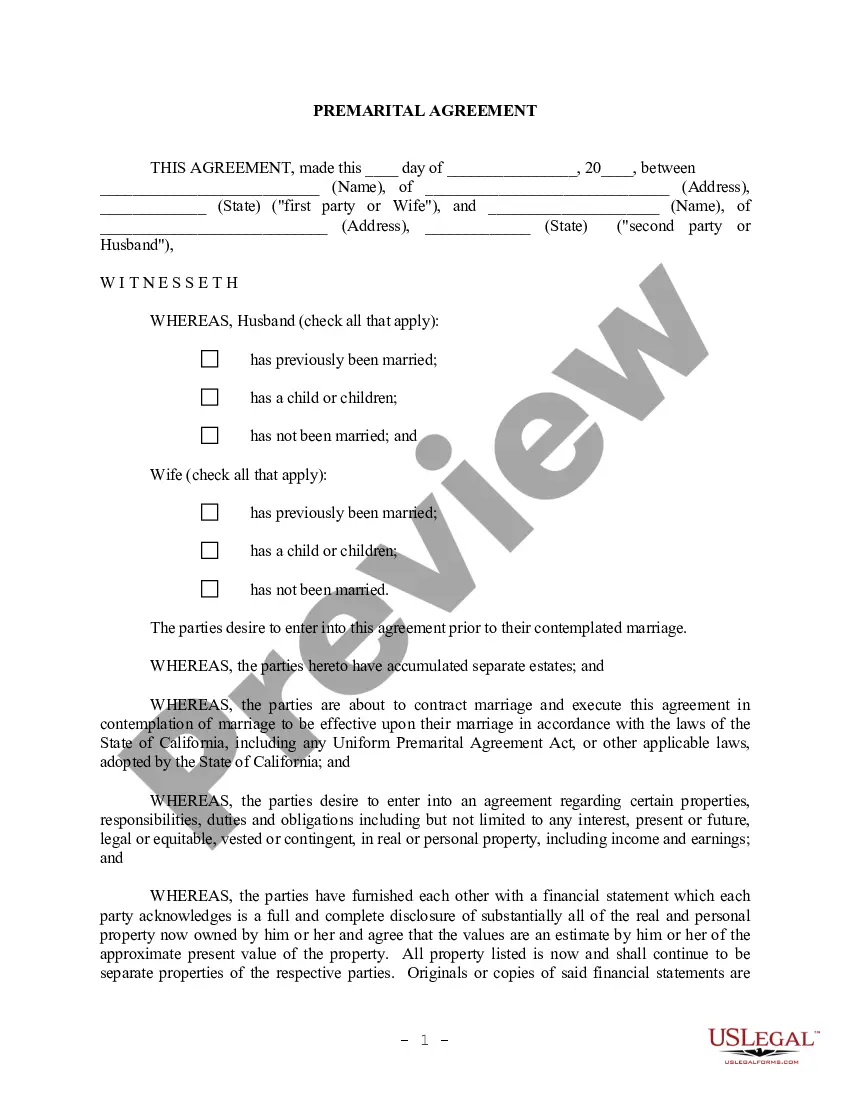

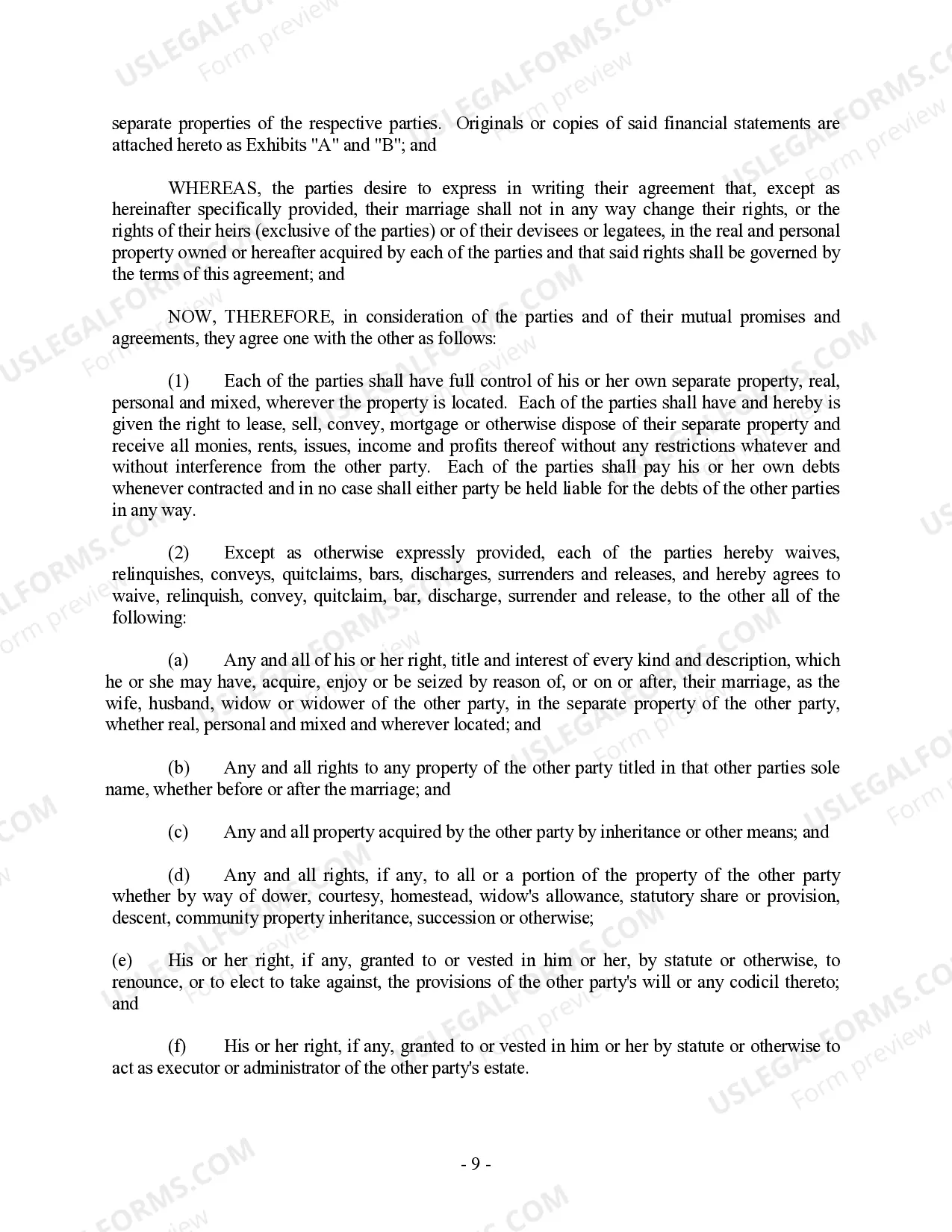

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

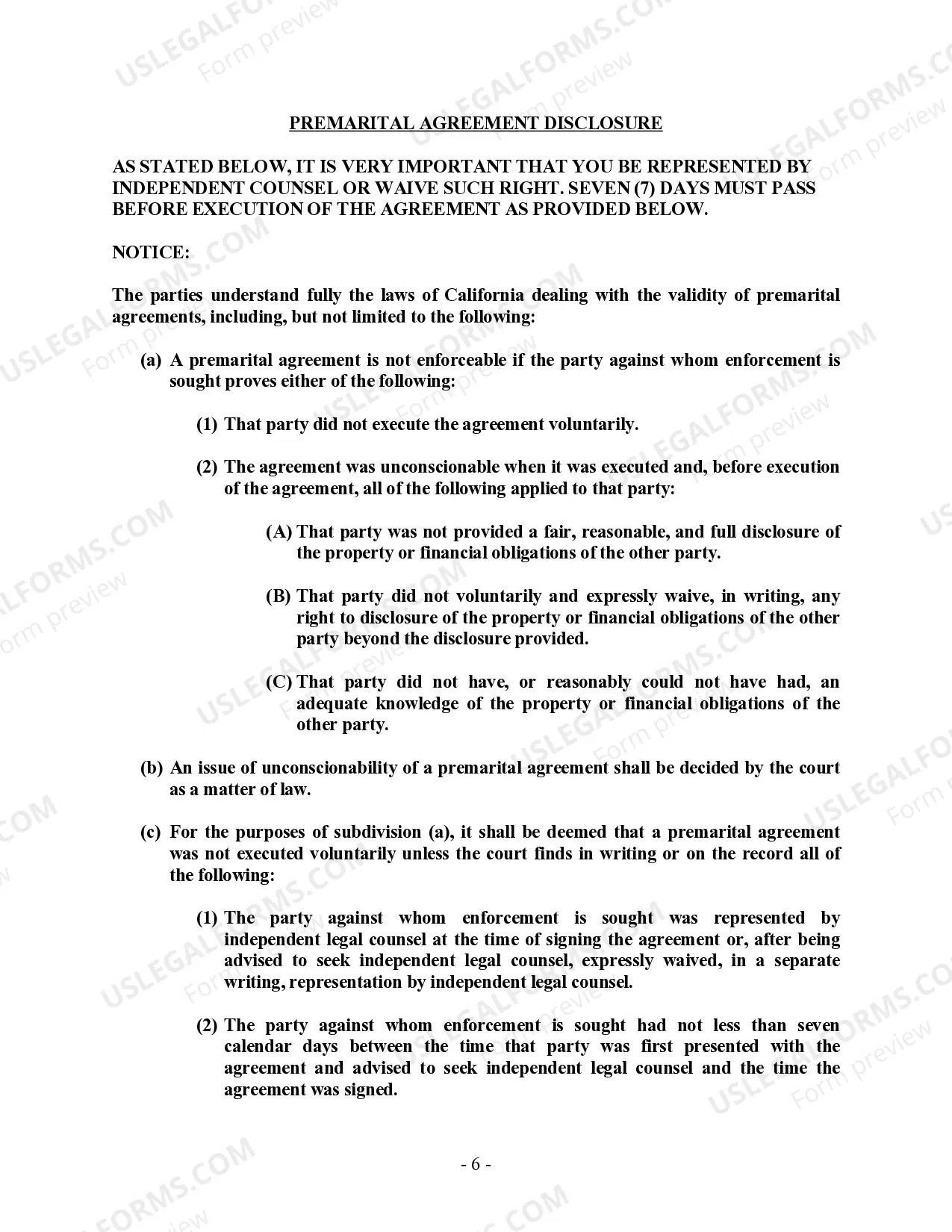

A Huntington Beach California Prenuptial Premarital Agreement with Financial Statements is a legally binding document that establishes the division of assets, debts, and financial responsibilities between two individuals entering into a marital partnership in Huntington Beach, California. This agreement serves to protect the rights and assets of both parties in case of a divorce or legal separation. It ensures a fair and equitable distribution of marital assets and liabilities based on predetermined terms agreed upon by both parties. By including financial statements within the agreement, individuals can provide a comprehensive overview of their financial situation at the time of entering the marriage. This may include details such as existing debts, income, assets, and investments. These statements play a crucial role in determining the distribution of assets, spousal support, and potential financial settlements during divorce proceedings. Different types of Huntington Beach California Prenuptial Premarital Agreement with Financial Statements may include: 1. Traditional Prenuptial Agreement: This type of agreement outlines the financial expectations and division of assets between the individuals before they tie the knot. It focuses on protecting separate property, defining how assets acquired individually or jointly during the marriage will be divided, and addressing potential spousal support issues. 2. Huntington Beach California Postnuptial Agreement: While similar to a prenuptial agreement, a postnuptial agreement is entered into after the individuals have already married. It serves a similar purpose of defining the division of assets, debts, and financial responsibilities if the couple chooses to separate or divorce. 3. Separate Property Agreement: This agreement focuses on protecting the individual's separate property acquired before the marriage or received during the marriage through gifts, inheritances, or personal ventures. It ensures that these assets remain separate and are not subject to division in case of a divorce. 4. Comprehensive Financial Agreement: This type of agreement goes beyond addressing property division and spousal support. It includes detailed provisions related to financial responsibilities such as bill payment, tax obligations, joint account management, and investment decisions. It aims to provide a comprehensive framework for handling finances during the marriage. When drafting a Huntington Beach California Prenuptial Premarital Agreement with Financial Statements, it is vital to consult with a qualified attorney specializing in family law matters in order to ensure that all legal requirements are met and both parties' interests are protected.A Huntington Beach California Prenuptial Premarital Agreement with Financial Statements is a legally binding document that establishes the division of assets, debts, and financial responsibilities between two individuals entering into a marital partnership in Huntington Beach, California. This agreement serves to protect the rights and assets of both parties in case of a divorce or legal separation. It ensures a fair and equitable distribution of marital assets and liabilities based on predetermined terms agreed upon by both parties. By including financial statements within the agreement, individuals can provide a comprehensive overview of their financial situation at the time of entering the marriage. This may include details such as existing debts, income, assets, and investments. These statements play a crucial role in determining the distribution of assets, spousal support, and potential financial settlements during divorce proceedings. Different types of Huntington Beach California Prenuptial Premarital Agreement with Financial Statements may include: 1. Traditional Prenuptial Agreement: This type of agreement outlines the financial expectations and division of assets between the individuals before they tie the knot. It focuses on protecting separate property, defining how assets acquired individually or jointly during the marriage will be divided, and addressing potential spousal support issues. 2. Huntington Beach California Postnuptial Agreement: While similar to a prenuptial agreement, a postnuptial agreement is entered into after the individuals have already married. It serves a similar purpose of defining the division of assets, debts, and financial responsibilities if the couple chooses to separate or divorce. 3. Separate Property Agreement: This agreement focuses on protecting the individual's separate property acquired before the marriage or received during the marriage through gifts, inheritances, or personal ventures. It ensures that these assets remain separate and are not subject to division in case of a divorce. 4. Comprehensive Financial Agreement: This type of agreement goes beyond addressing property division and spousal support. It includes detailed provisions related to financial responsibilities such as bill payment, tax obligations, joint account management, and investment decisions. It aims to provide a comprehensive framework for handling finances during the marriage. When drafting a Huntington Beach California Prenuptial Premarital Agreement with Financial Statements, it is vital to consult with a qualified attorney specializing in family law matters in order to ensure that all legal requirements are met and both parties' interests are protected.