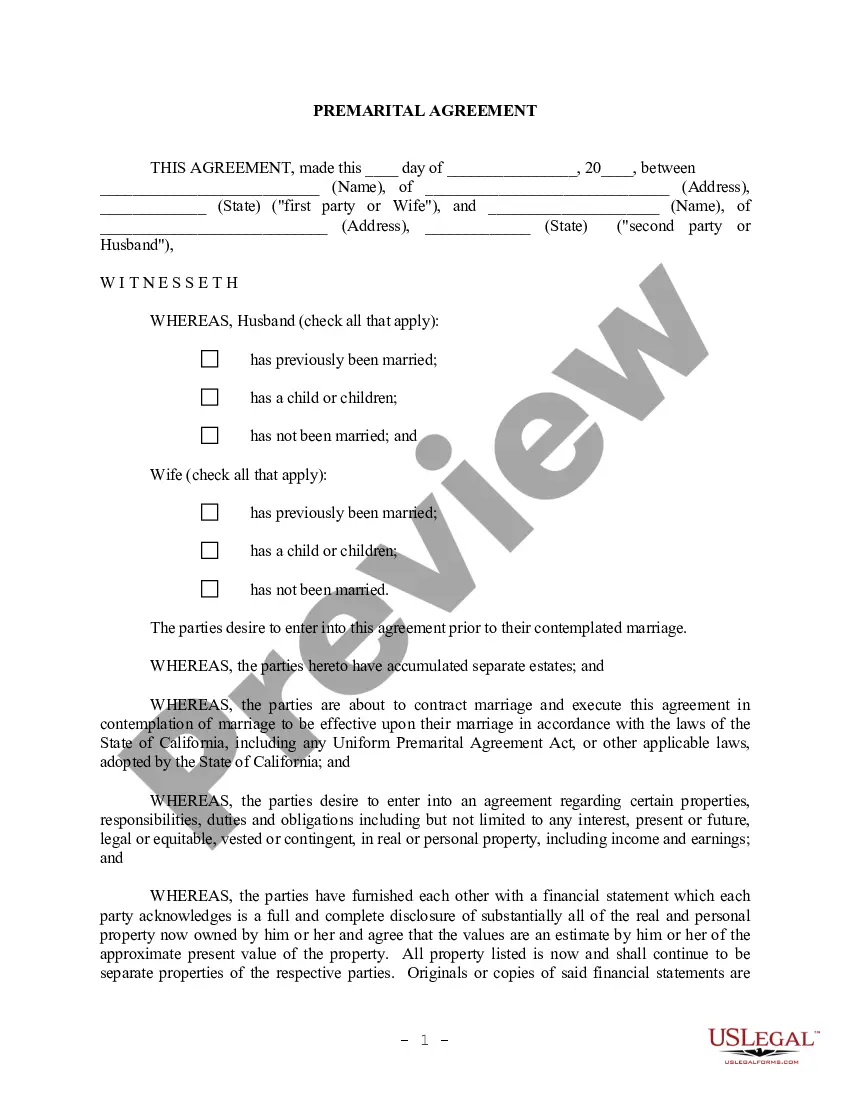

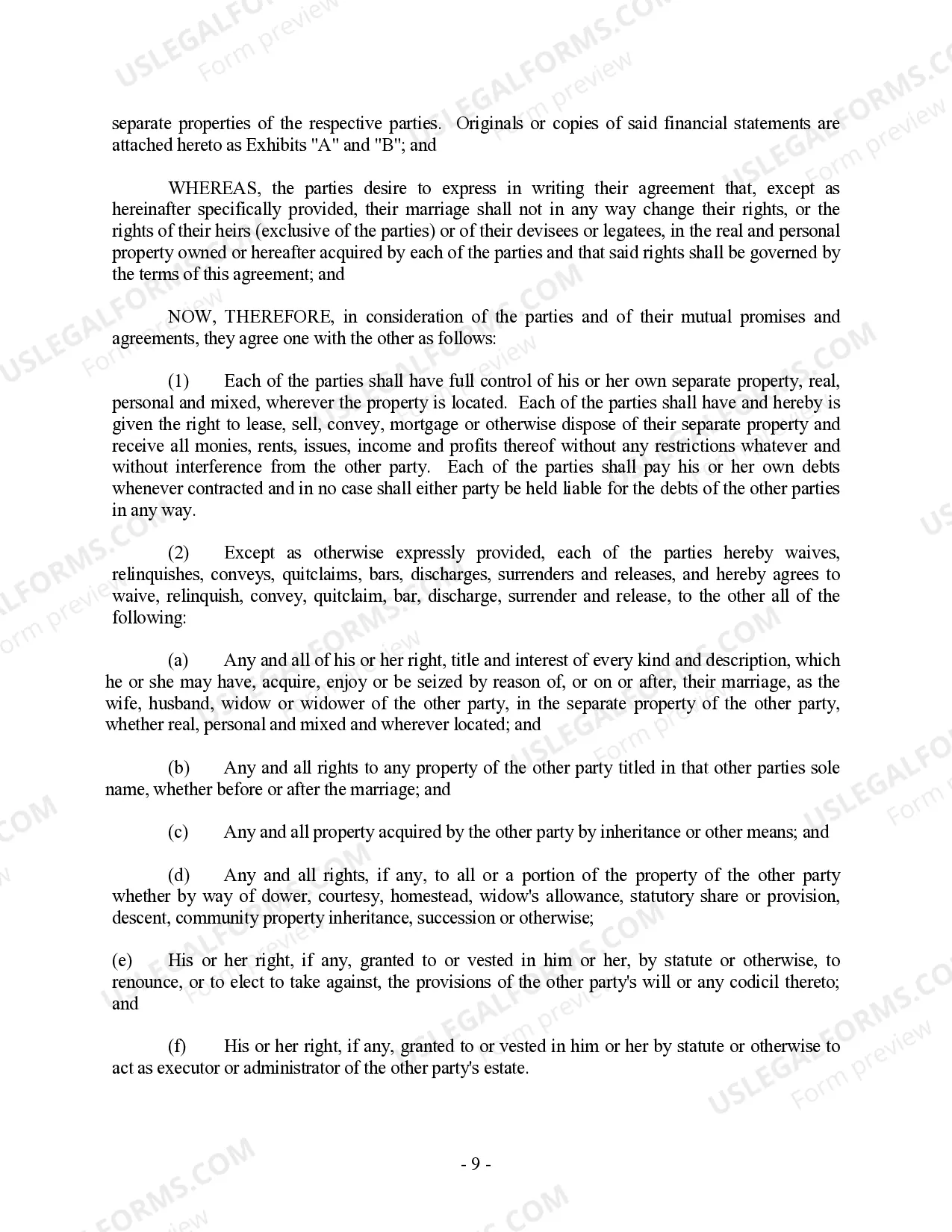

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

A Temecula California Prenuptial Premarital Agreement with Financial Statements is a legal contract entered into by couples planning to get married in Temecula, California. This agreement outlines the financial rights and responsibilities of each party before and during the marriage, providing clarity and protection for both individuals involved. With the inclusion of financial statements, this agreement ensures that the assets, debts, and properties of each party are disclosed and agreed upon beforehand. The main purpose of a Temecula California Prenuptial Premarital Agreement with Financial Statements is to establish a framework for how the couple's assets, income, and property will be divided in the event of a divorce or legal separation. It can also address matters such as spousal support, inheritance rights, and the division of debts. By addressing these issues prior to marriage, couples can avoid potential conflicts and uncertainty in the future. There are different types of Temecula California Prenuptial Premarital Agreements with Financial Statements to cater to various circumstances and preferences. Here are a few notable types: 1. Traditional Prenuptial Agreement: This type of agreement focuses on the division of assets and property owned by each party before the marriage. It typically involves disclosing financial statements and outlining how these assets will be distributed in the event of divorce. 2. Business-Specific Prenuptial Agreement: This type of agreement is suitable for couples who own businesses or have significant business interests. It addresses the protection and division of business assets, profit sharing, and potential business-related debts. 3. Customized Prenuptial Agreement: Couples with specific requirements or unique financial situations may opt for a customized agreement. This type of agreement allows for personalized clauses and provisions tailored to the couple's specific needs, ensuring comprehensive asset protection and financial arrangements. 4. Prenuptial Agreement with Estate Planning: This agreement combines the aspects of a prenuptial agreement with estate planning considerations. It addresses the succession, division, and management of assets in the event of death or incapacitation, in addition to covering the division of assets in case of divorce. A Temecula California Prenuptial Premarital Agreement with Financial Statements is a crucial legal document that can help couples safeguard their assets and establish clear financial expectations in their marriage. It is advisable for couples to consult with a qualified attorney experienced in family law to draft and review the agreement, ensuring that it adheres to California laws and accurately reflects their wishes and interests.A Temecula California Prenuptial Premarital Agreement with Financial Statements is a legal contract entered into by couples planning to get married in Temecula, California. This agreement outlines the financial rights and responsibilities of each party before and during the marriage, providing clarity and protection for both individuals involved. With the inclusion of financial statements, this agreement ensures that the assets, debts, and properties of each party are disclosed and agreed upon beforehand. The main purpose of a Temecula California Prenuptial Premarital Agreement with Financial Statements is to establish a framework for how the couple's assets, income, and property will be divided in the event of a divorce or legal separation. It can also address matters such as spousal support, inheritance rights, and the division of debts. By addressing these issues prior to marriage, couples can avoid potential conflicts and uncertainty in the future. There are different types of Temecula California Prenuptial Premarital Agreements with Financial Statements to cater to various circumstances and preferences. Here are a few notable types: 1. Traditional Prenuptial Agreement: This type of agreement focuses on the division of assets and property owned by each party before the marriage. It typically involves disclosing financial statements and outlining how these assets will be distributed in the event of divorce. 2. Business-Specific Prenuptial Agreement: This type of agreement is suitable for couples who own businesses or have significant business interests. It addresses the protection and division of business assets, profit sharing, and potential business-related debts. 3. Customized Prenuptial Agreement: Couples with specific requirements or unique financial situations may opt for a customized agreement. This type of agreement allows for personalized clauses and provisions tailored to the couple's specific needs, ensuring comprehensive asset protection and financial arrangements. 4. Prenuptial Agreement with Estate Planning: This agreement combines the aspects of a prenuptial agreement with estate planning considerations. It addresses the succession, division, and management of assets in the event of death or incapacitation, in addition to covering the division of assets in case of divorce. A Temecula California Prenuptial Premarital Agreement with Financial Statements is a crucial legal document that can help couples safeguard their assets and establish clear financial expectations in their marriage. It is advisable for couples to consult with a qualified attorney experienced in family law to draft and review the agreement, ensuring that it adheres to California laws and accurately reflects their wishes and interests.