Includes instructions and forms required to register a non-California corporation in California.

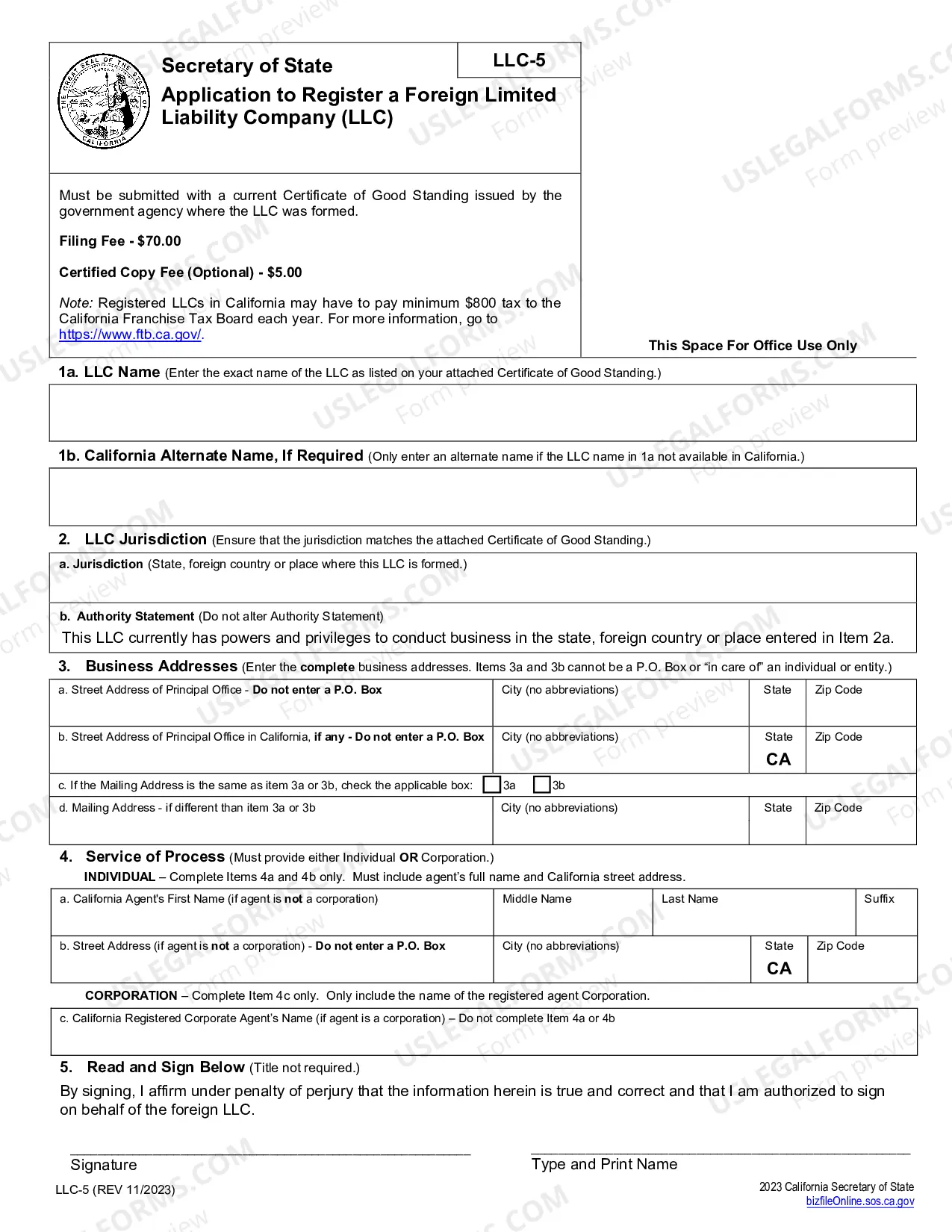

Antioch California Registration of Foreign Corporation is a necessary process that allows a corporation established in a different state or country to conduct business within the city of Antioch, California. This registration ensures that the corporation complies with the local legal requirements, maintains transparency, and contributes to the local economy. To initiate the Antioch California Registration of Foreign Corporation, companies need to file an application with the California Secretary of State, providing pertinent information about their business, such as the corporation's name, principal location, the state of incorporation, and a designated agent for service of process within the state of California. Once the application is received, the California Secretary of State reviews the documents and verifies the corporation's compliance with all necessary laws and regulations. The foreign corporation may also need to submit a Certificate of Good Standing, which confirms that it is up to date with taxes, fees, and other legal obligations in its home state or country. Upon successful registration, the corporation is granted the legal right to operate its business in Antioch, California. However, it is crucial to note that this registration does not exempt the foreign corporation from any local, state, or federal taxation requirements. Therefore, after obtaining the registration, corporations must comply with all applicable tax laws and reporting obligations to operate lawfully. While the process of Antioch California Registration of Foreign Corporation remains generally the same, it is important to recognize that there might be different types of foreign corporations. For example: 1. For-profit foreign corporations: These are foreign corporations established with the primary objective of making profits. They must comply with the relevant business laws and regulations of Antioch, California. 2. Non-profit foreign corporations: These are foreign corporations that do not operate for the purpose of generating profits. These corporations must meet specific requirements and adhere to the regulations outlined by the California Nonprofit Corporation Law. 3. Professional foreign corporations: These are foreign corporations owned and operated by professionals who provide services such as legal, medical, architectural, or engineering services. Similar to other foreign corporations, professional foreign corporations must meet the registration requirements specific to their profession. In conclusion, the Antioch California Registration of Foreign Corporation is a crucial step for corporations outside the state or country who wish to conduct business in Antioch, California. By identifying the corporation's type and complying with the necessary requirements, foreign corporations can ensure their legal legitimacy and establish a strong foundation for successful business operations in the city.Antioch California Registration of Foreign Corporation is a necessary process that allows a corporation established in a different state or country to conduct business within the city of Antioch, California. This registration ensures that the corporation complies with the local legal requirements, maintains transparency, and contributes to the local economy. To initiate the Antioch California Registration of Foreign Corporation, companies need to file an application with the California Secretary of State, providing pertinent information about their business, such as the corporation's name, principal location, the state of incorporation, and a designated agent for service of process within the state of California. Once the application is received, the California Secretary of State reviews the documents and verifies the corporation's compliance with all necessary laws and regulations. The foreign corporation may also need to submit a Certificate of Good Standing, which confirms that it is up to date with taxes, fees, and other legal obligations in its home state or country. Upon successful registration, the corporation is granted the legal right to operate its business in Antioch, California. However, it is crucial to note that this registration does not exempt the foreign corporation from any local, state, or federal taxation requirements. Therefore, after obtaining the registration, corporations must comply with all applicable tax laws and reporting obligations to operate lawfully. While the process of Antioch California Registration of Foreign Corporation remains generally the same, it is important to recognize that there might be different types of foreign corporations. For example: 1. For-profit foreign corporations: These are foreign corporations established with the primary objective of making profits. They must comply with the relevant business laws and regulations of Antioch, California. 2. Non-profit foreign corporations: These are foreign corporations that do not operate for the purpose of generating profits. These corporations must meet specific requirements and adhere to the regulations outlined by the California Nonprofit Corporation Law. 3. Professional foreign corporations: These are foreign corporations owned and operated by professionals who provide services such as legal, medical, architectural, or engineering services. Similar to other foreign corporations, professional foreign corporations must meet the registration requirements specific to their profession. In conclusion, the Antioch California Registration of Foreign Corporation is a crucial step for corporations outside the state or country who wish to conduct business in Antioch, California. By identifying the corporation's type and complying with the necessary requirements, foreign corporations can ensure their legal legitimacy and establish a strong foundation for successful business operations in the city.