Includes instructions and forms required to register a non-California corporation in California.

San Diego California Registration of Foreign Corporation

Description

How to fill out California Registration Of Foreign Corporation?

If you are in search of a legitimate document, it’s exceedingly challenging to discover a superior service than the US Legal Forms website – perhaps the most comprehensive collections online.

With this collection, you can locate an immense number of templates for commercial and personal uses categorized by types and states, or specific phrases.

With the top-notch search function, finding the latest San Diego California Registration of Foreign Corporation is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the format and download it to your device. Edit the document. Fill it out, amend it, print it, and sign the acquired San Diego California Registration of Foreign Corporation.

- Additionally, the validity of each document is verified by a team of skilled attorneys who regularly evaluate the templates on our platform and update them in line with the latest state and county laws.

- If you are already familiar with our platform and possess a registered account, all you need to obtain the San Diego California Registration of Foreign Corporation is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have opened the sample you need. Review its description and use the Preview feature (if available) to examine its contents. If it doesn’t fulfill your requirements, utilize the Search bar at the top of the page to find the desired document.

- Verify your selection. Click the Buy now button. After that, choose the desired subscription plan and provide information to register an account.

Form popularity

FAQ

To initiate the San Diego California Registration of Foreign Corporation, you must first obtain a certified copy of your corporation's formation documents from your home state. Next, you will complete the Application to Register a Foreign Corporation, which can be submitted online or by mail. Additionally, you will need to designate a registered agent in California for official communications. Finally, you should file the application, along with the required fees, to successfully register your foreign corporation in California.

Yes, you can register your S Corporation in another state. However, if your business operates in multiple states, including California, you will need to comply with the regulations for each state, including the San Diego California Registration of Foreign Corporation. This process allows your corporation to legally conduct business in California while maintaining your primary registration in another state. Using platforms like UsLegalForms can simplify this process by providing the necessary forms and guidance tailored for your needs.

Yes, a foreign corporation must register in California if it intends to conduct business within the state. This registration process ensures compliance with state laws and regulations. The registration is crucial for protecting your business interests and facilitating legal operations. For a smooth San Diego California Registration of Foreign Corporation, consider using platforms like uslegalforms to simplify the process.

Tax Requirements for Foreign LLCs All LLCs in California?both domestic and foreign?are required to remit the $800 Franchise Tax each year as legislated by the California Revenue and Taxation Code Section 17941.

You can register a foreign (out-of-state) corporation in California by filing a Statement and Designation by Foreign Corporation (Form S&DC-S/N), along with a Certificate of Good Standing, to the Secretary of State's office. Through June 2023, there is no filing fee, so now is the time to register.

The filing fee to register a foreign corporation in California is $100. For $149 plus state fees (and your state's Certificate of Good Standing fee), we'll register your foreign corporation in California on your behalf.

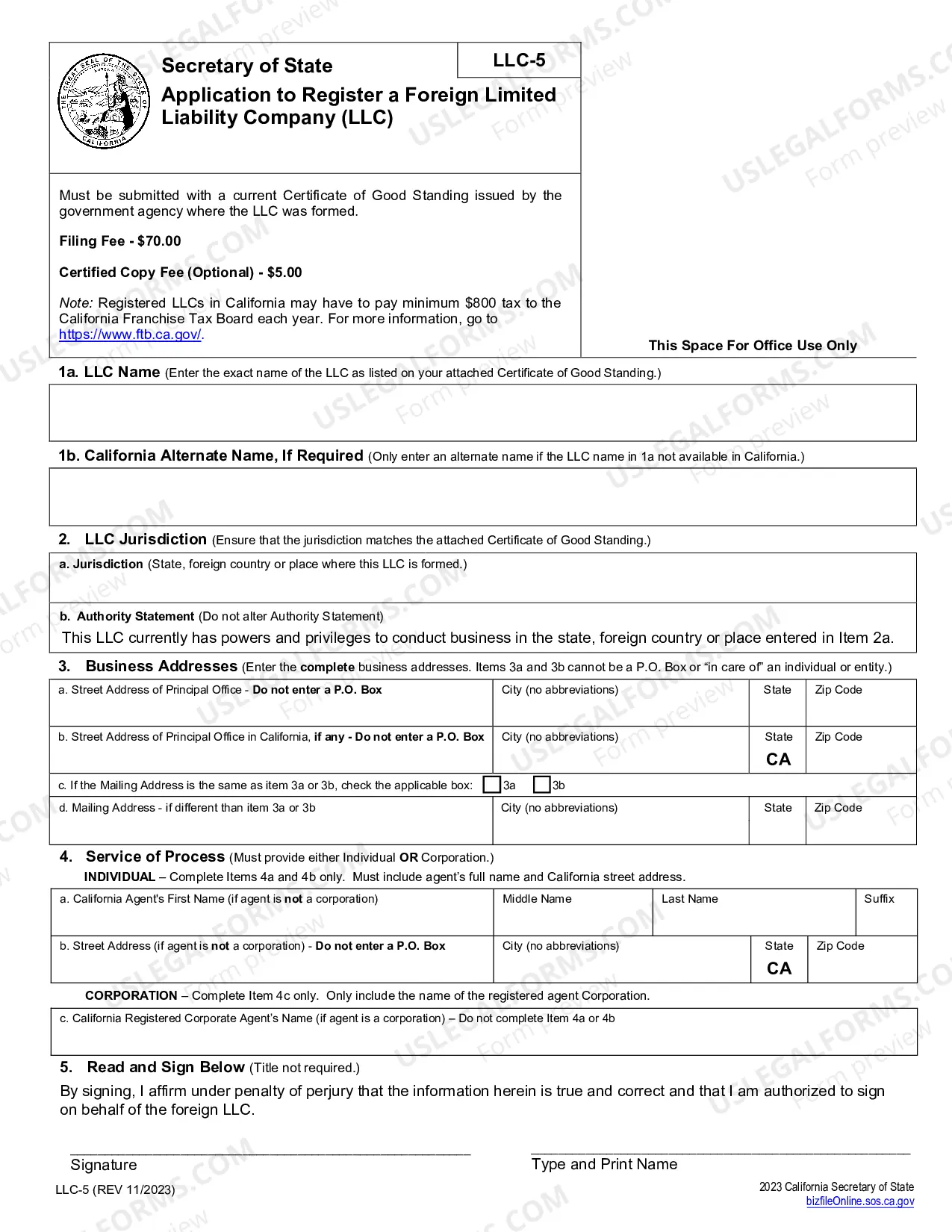

A foreign LLC is simply an LLC that was formed in another state. To register a foreign LLC in California, you'll need to appoint a California registered agent and file the Application to Register a Foreign LLC (Form LLC-5) with the Secretary of State.

California's LLC Act requires foreign LLCs to register with the state of California if they are transacting business within the state.

All LLCs organized outside of California must register with the California Secretary of State to do business in California. To register, you must file Form LLC-5, Application to Register a Foreign Limited Liability Company and pay a $70 fee.