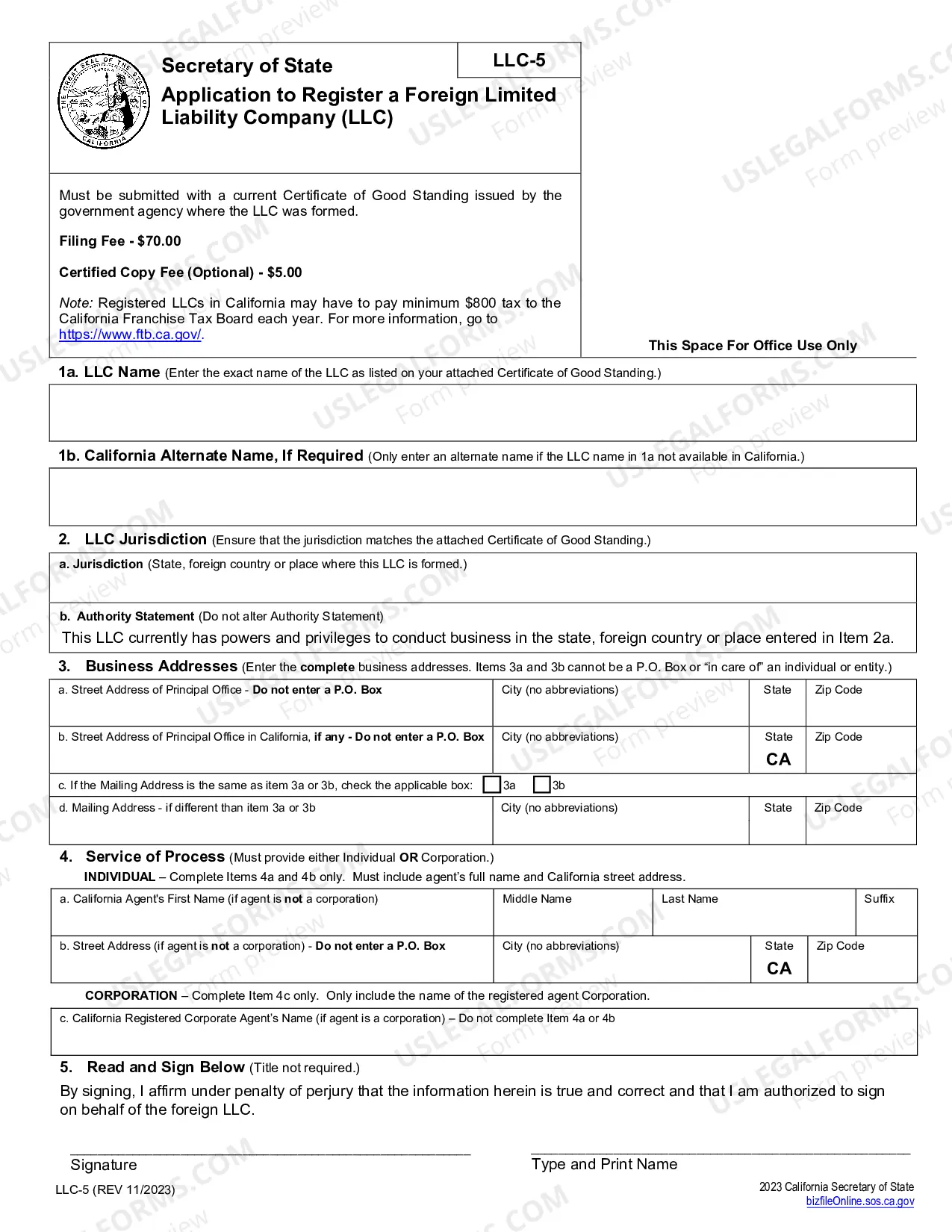

Includes instructions and forms required to register a non-California corporation in California.

Thousand Oaks California Registration of Foreign Corporation is a legal process that allows corporations incorporated outside of California to operate and conduct business within the city of Thousand Oaks. This registration ensures that foreign corporations comply with local laws and regulations, while also safeguarding the interests of the city and its residents. To initiate the Thousand Oaks California Registration of Foreign Corporation, foreign corporations must complete and submit the necessary application forms to the appropriate government agency. The application typically requires detailed information about the corporation, including its legal name, principal address, registered agent's contact details, and a copy of the corporation's articles of incorporation. Foreign corporations looking to expand their operations in Thousand Oaks can benefit from registering for the Thousand Oaks California Registration of Foreign Corporation. Obtaining this registration allows corporations to establish a presence in the city, effectively engage in commercial activities, and protect their legal rights. There are several types of Thousand Oaks California Registration of Foreign Corporation, each catering to different corporate structures and needs: 1. Regular Foreign Corporation Registration: This is the standard registration for foreign corporations seeking to operate in Thousand Oaks. It is applicable to general corporations that operate for profit, including both C corporations and S corporations. 2. Nonprofit Foreign Corporation Registration: Designed for foreign corporations that operate as nonprofit entities, this registration type allows nonprofit organizations to carry out charitable, educational, religious, or scientific activities within Thousand Oaks. 3. Professional Corporation Registration: This registration pertains to foreign corporations practicing professional services, such as legal, medical, engineering, or architectural services. This ensures compliance with specific regulations and requirements governing these professional practices. Upon successful registration, foreign corporations are granted a Certificate of Qualification, validating their authority to conduct business in Thousand Oaks. It is crucial to note that the registration requirements and processes may vary between different jurisdictions, so foreign corporations must adhere to the specific guidelines laid out by the Thousand Oaks government. In essence, the Thousand Oaks California Registration of Foreign Corporation enables corporations from outside California to establish a legal presence within the city. This process ensures compliance with local regulations and provides corporations with the necessary authorization to pursue business opportunities effectively. By completing the registration, foreign corporations can engage in commerce in Thousand Oaks while enjoying the benefits and protection offered by the local legal framework.