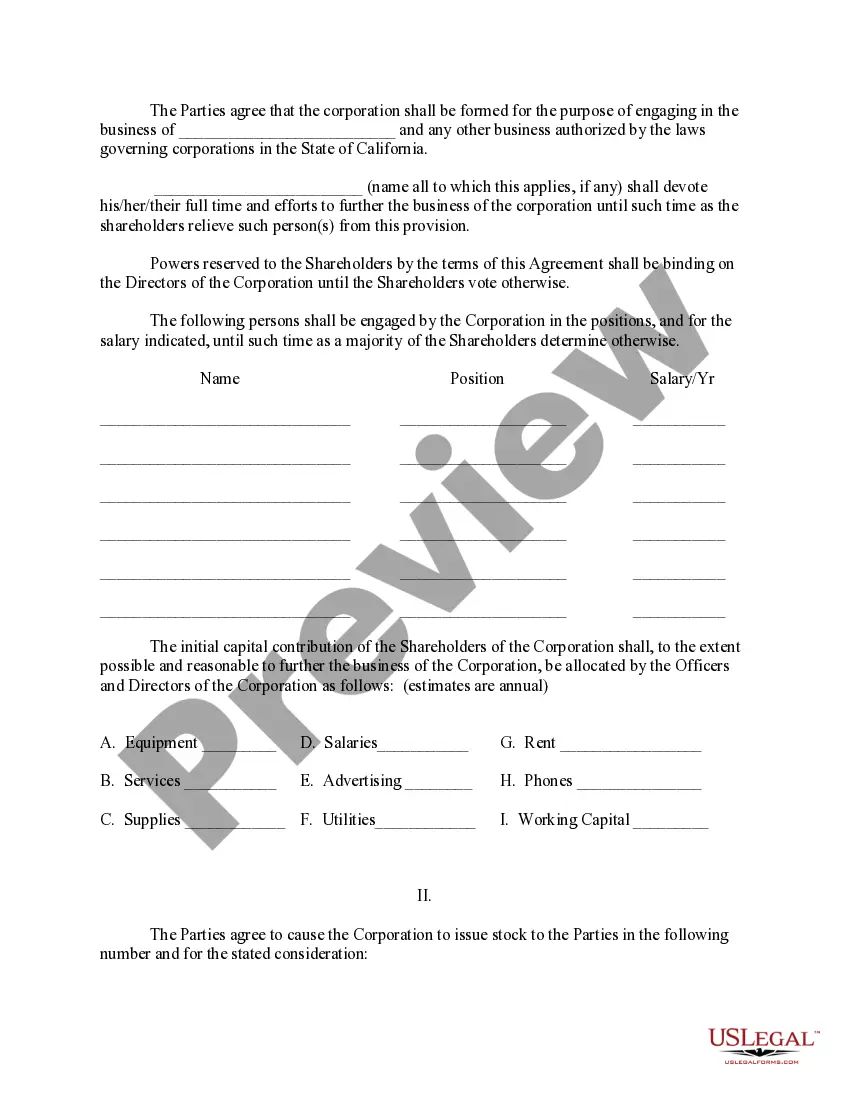

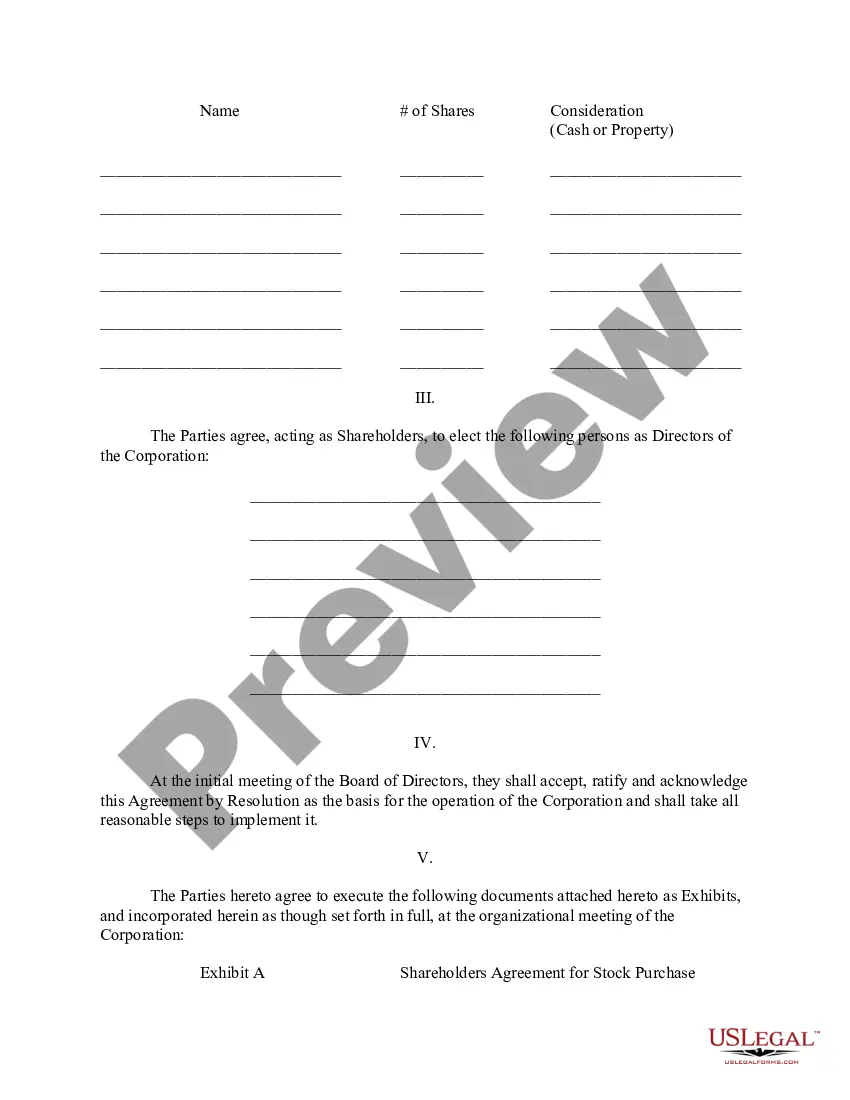

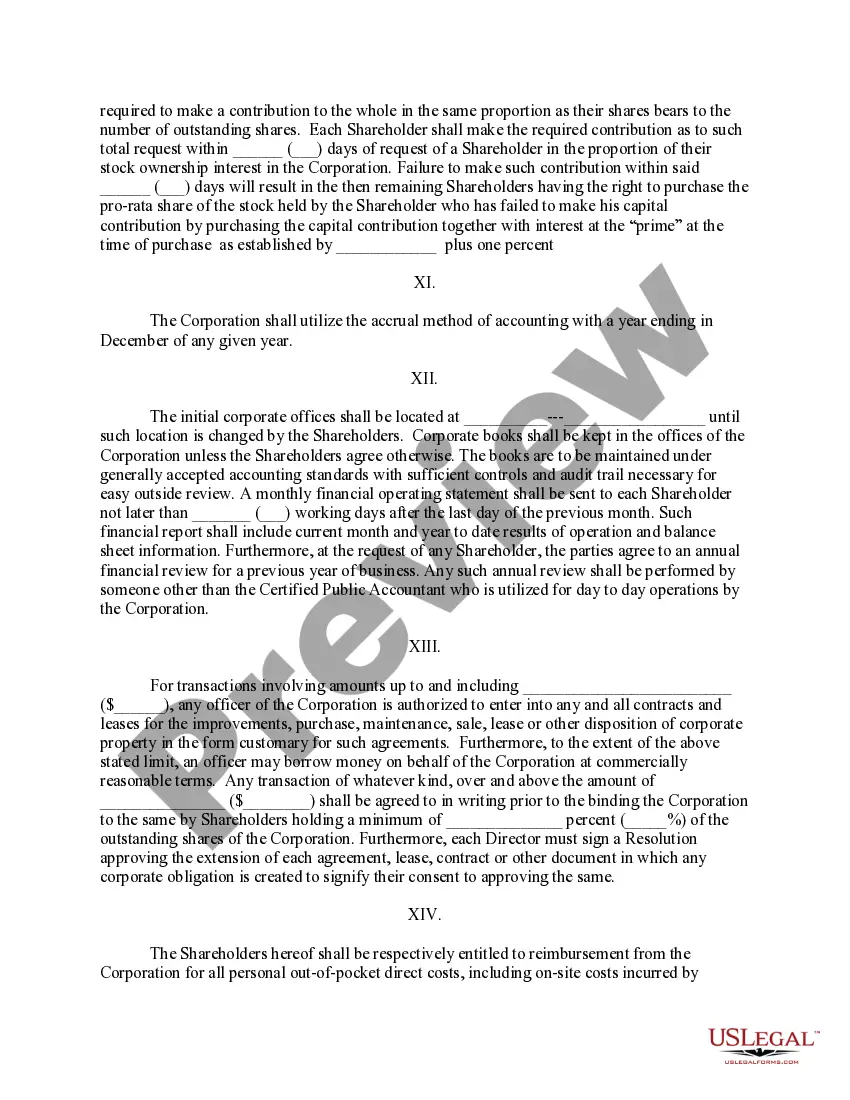

This package of forms contains a pre-incorporation agreement for the formers of a corporation to sign agreeing on how the corporate will be operated, who will be elected as officers and directors, salaries and many other corporate matters.

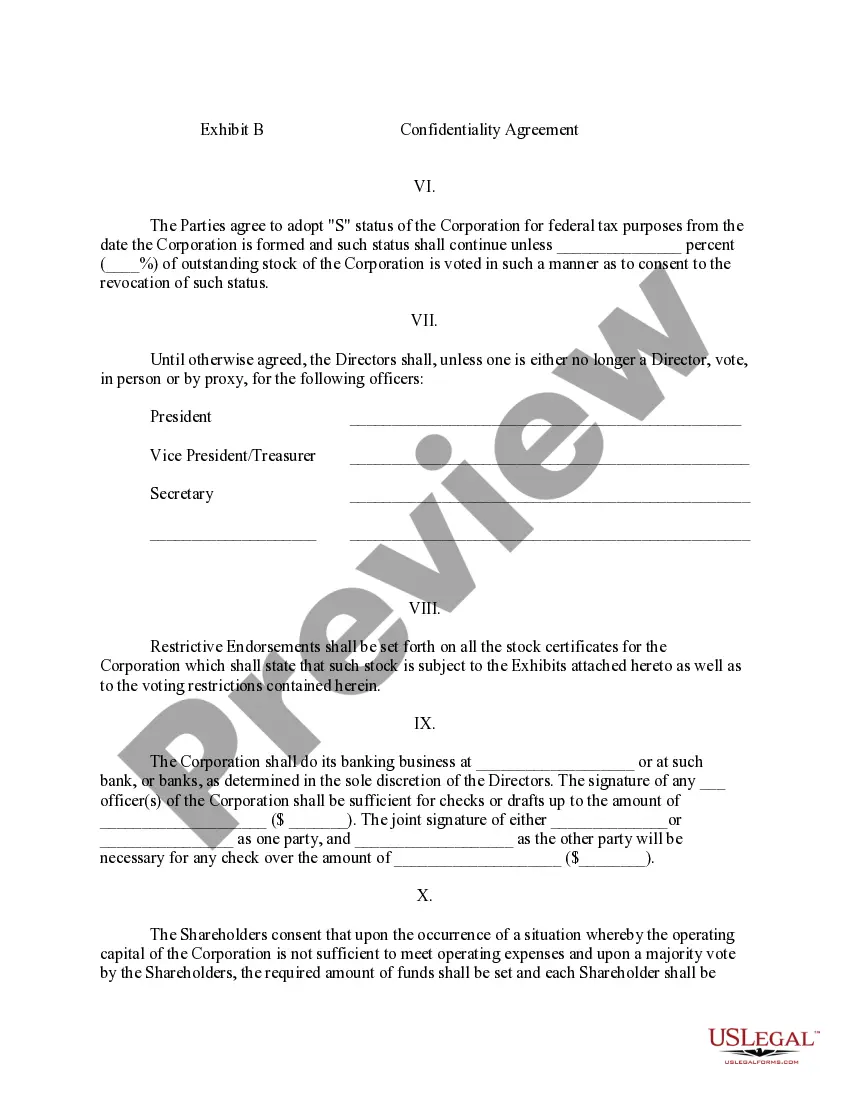

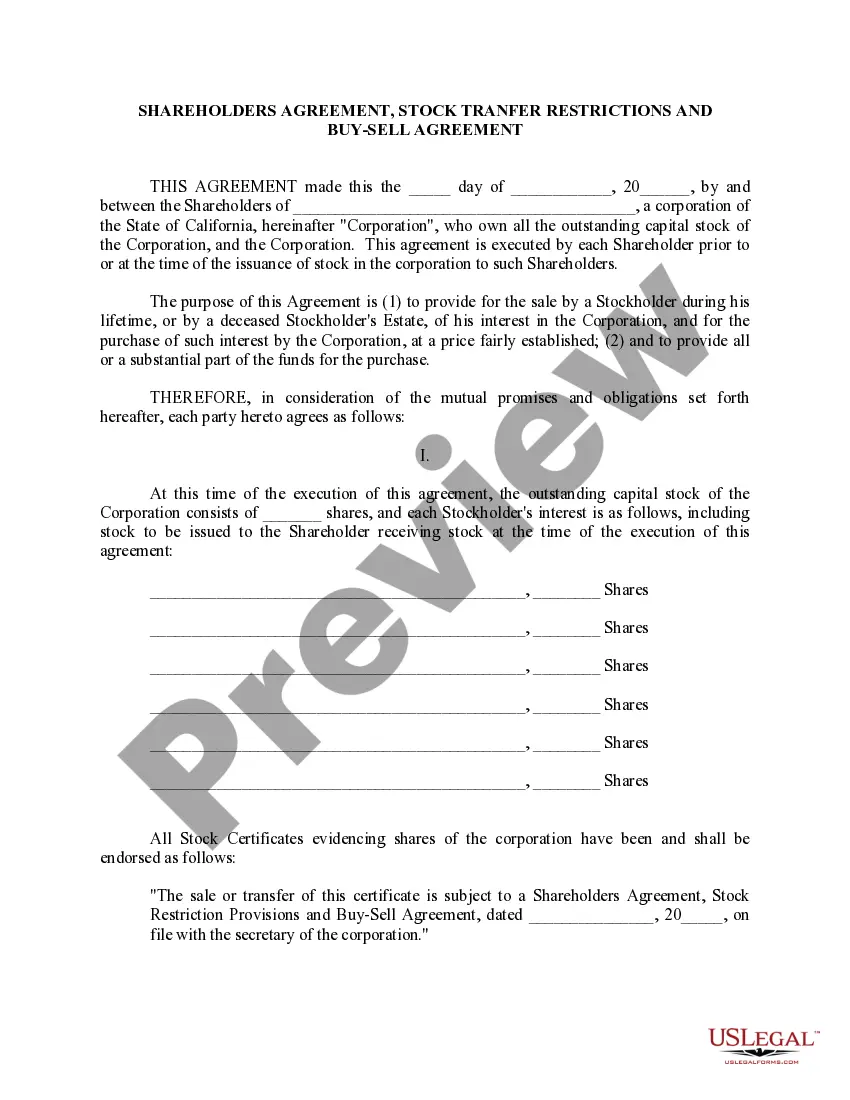

The Shareholders Agreement is signed by the shareholders to agree on how the shares of a deceased shareholder may be purchased and how shares of a person who desires to sell their stock may be obtained by the other shareholders or the corporation. Restrictions on the Sale of stock are included to accomplish the goals of the shareholders to keep the corporation under the control of the existing shareholders.

The Confidentiality Agreement is made between the shareholders wherein they agree to keep confidential certain corporate matters.

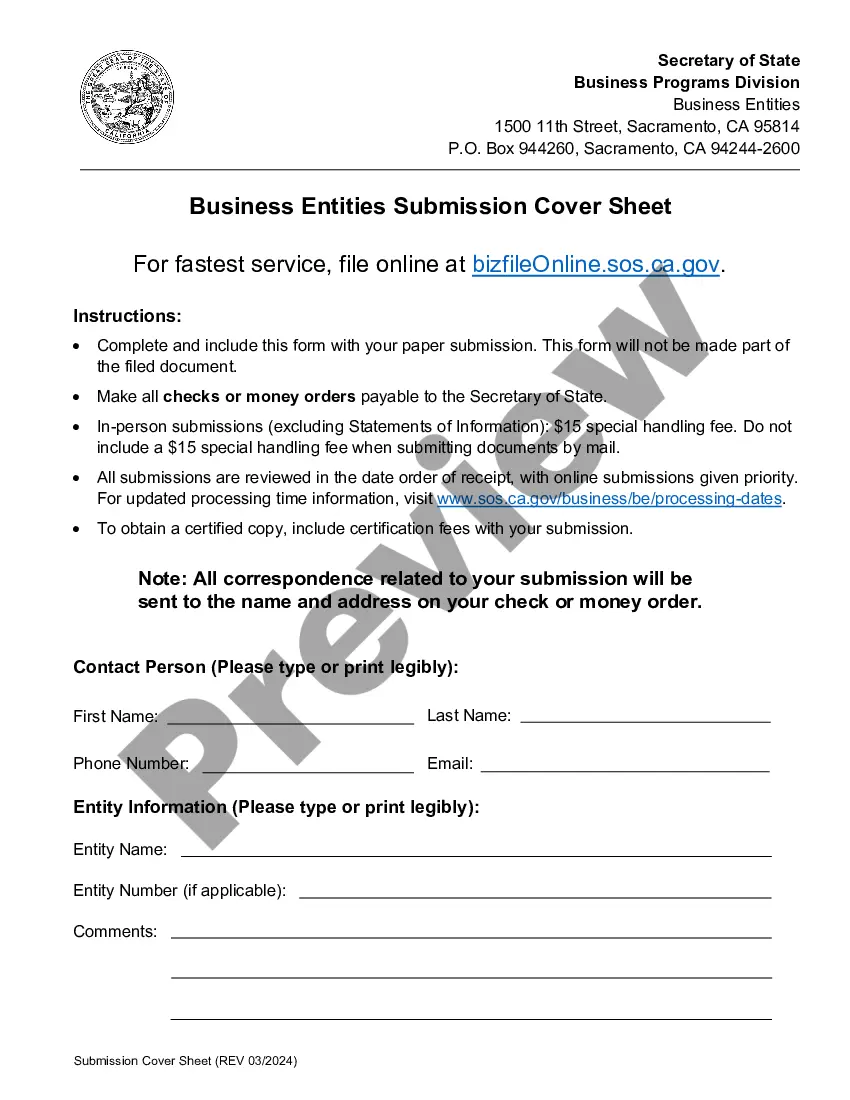

El Cajon California Pre-Incorporation Agreement, Shareholders Agreement, and Confidentiality Agreement are essential legal documents that play a vital role in governing the formation, functioning, and protection of businesses in El Cajon, California. These agreements ensure clarity, security, and ethical conduct within business operations. Let's delve into each agreement in detail: 1. El Cajon California Pre-Incorporation Agreement: The El Cajon California Pre-Incorporation Agreement is a legally binding document signed by prospective founders or stakeholders before incorporating a business entity. It outlines their commitments, roles, and responsibilities during the pre-incorporation stage. This agreement may encompass essential aspects such as the initial capital contributions by each party, division of shares, decision-making processes, intellectual property rights, and the overall expectations among the founding members. The aim is to create a solid foundation for the future incorporation process. 2. Shareholders Agreement: The Shareholders Agreement is a comprehensive legal document that outlines the rights, duties, and obligations of shareholders in a company incorporated in El Cajon, California. It serves as a contractual arrangement among the company's shareholders, ensuring a fair and efficient management structure. This agreement covers topics like share allocation, dividend distribution, voting rights, board composition, restrictions on share transfer, dispute resolution, and exit strategies. Different types of Shareholders Agreements include: — Voting Trust Agreement: Establishes a voting trust, where shareholders transfer their voting rights to selected trustees temporarily. — Buy-Sell Agreement: Outlines the procedure to be followed if a shareholder wants to sell their shares, including preemptive rights for existing shareholders. — Drag-Along and Tag-Along Agreement: Defines the rights of majority and minority shareholders in case of a sale of the company, allowing minority shareholders to "tag-along" and sell their shares along with the majority shareholders. — Founder's Agreement: Specifically designed for startup companies, this agreement covers topics like vesting of shares, roles of founders, intellectual property rights, and dispute resolution mechanisms. 3. Confidentiality Agreement: The Confidentiality Agreement, also known as a Non-Disclosure Agreement (NDA), is a legally binding contract that protects sensitive information shared between parties involved in a business relationship. This agreement ensures that all parties involved maintain the confidentiality of proprietary information, trade secrets, customer lists, financial data, and any other details deemed confidential. Different variations of Confidentiality Agreements include: — Unilateral NDA: Involves one party disclosing confidential information to another party. — Mutual NDA: Occurs when both parties exchange confidential information with each other. — Multilateral NDA: Involves multiple parties who exchange confidential information with each other, often seen in complex business collaborations. In El Cajon, California, these agreements are crucial to establish clear ground rules, protect the interests of all parties involved, and foster transparency and trust within business relationships. It is advisable to consult legal professionals to draft and customize these agreements to suit the specific needs of the business and comply with California state laws.El Cajon California Pre-Incorporation Agreement, Shareholders Agreement, and Confidentiality Agreement are essential legal documents that play a vital role in governing the formation, functioning, and protection of businesses in El Cajon, California. These agreements ensure clarity, security, and ethical conduct within business operations. Let's delve into each agreement in detail: 1. El Cajon California Pre-Incorporation Agreement: The El Cajon California Pre-Incorporation Agreement is a legally binding document signed by prospective founders or stakeholders before incorporating a business entity. It outlines their commitments, roles, and responsibilities during the pre-incorporation stage. This agreement may encompass essential aspects such as the initial capital contributions by each party, division of shares, decision-making processes, intellectual property rights, and the overall expectations among the founding members. The aim is to create a solid foundation for the future incorporation process. 2. Shareholders Agreement: The Shareholders Agreement is a comprehensive legal document that outlines the rights, duties, and obligations of shareholders in a company incorporated in El Cajon, California. It serves as a contractual arrangement among the company's shareholders, ensuring a fair and efficient management structure. This agreement covers topics like share allocation, dividend distribution, voting rights, board composition, restrictions on share transfer, dispute resolution, and exit strategies. Different types of Shareholders Agreements include: — Voting Trust Agreement: Establishes a voting trust, where shareholders transfer their voting rights to selected trustees temporarily. — Buy-Sell Agreement: Outlines the procedure to be followed if a shareholder wants to sell their shares, including preemptive rights for existing shareholders. — Drag-Along and Tag-Along Agreement: Defines the rights of majority and minority shareholders in case of a sale of the company, allowing minority shareholders to "tag-along" and sell their shares along with the majority shareholders. — Founder's Agreement: Specifically designed for startup companies, this agreement covers topics like vesting of shares, roles of founders, intellectual property rights, and dispute resolution mechanisms. 3. Confidentiality Agreement: The Confidentiality Agreement, also known as a Non-Disclosure Agreement (NDA), is a legally binding contract that protects sensitive information shared between parties involved in a business relationship. This agreement ensures that all parties involved maintain the confidentiality of proprietary information, trade secrets, customer lists, financial data, and any other details deemed confidential. Different variations of Confidentiality Agreements include: — Unilateral NDA: Involves one party disclosing confidential information to another party. — Mutual NDA: Occurs when both parties exchange confidential information with each other. — Multilateral NDA: Involves multiple parties who exchange confidential information with each other, often seen in complex business collaborations. In El Cajon, California, these agreements are crucial to establish clear ground rules, protect the interests of all parties involved, and foster transparency and trust within business relationships. It is advisable to consult legal professionals to draft and customize these agreements to suit the specific needs of the business and comply with California state laws.