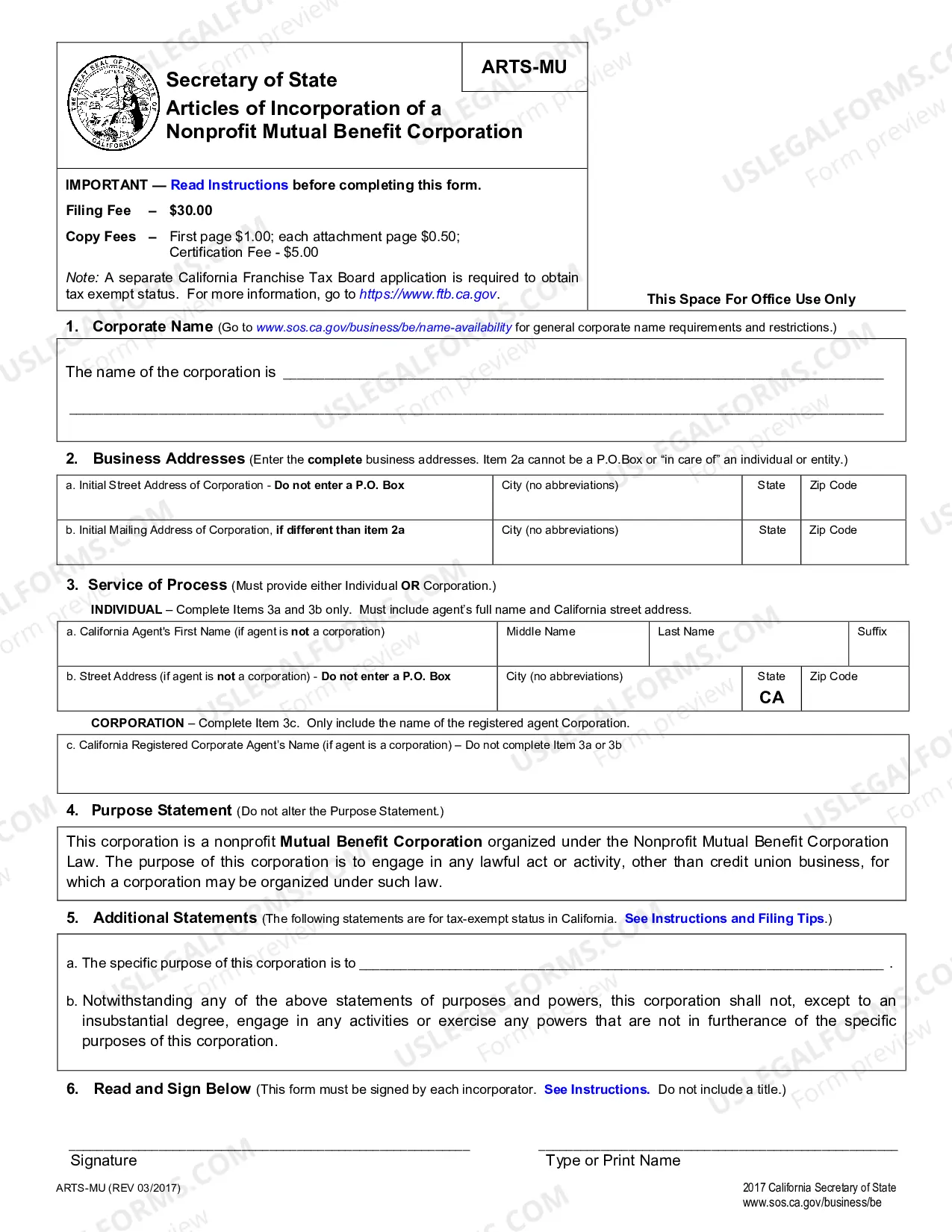

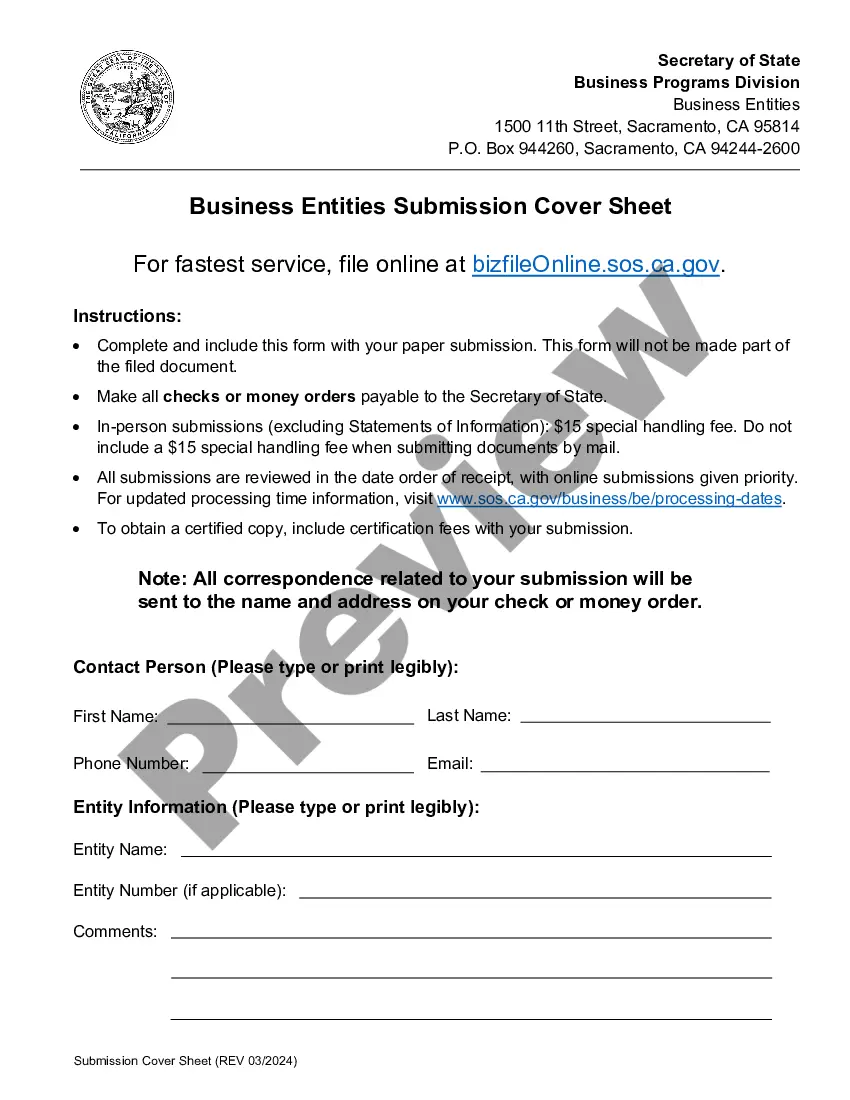

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

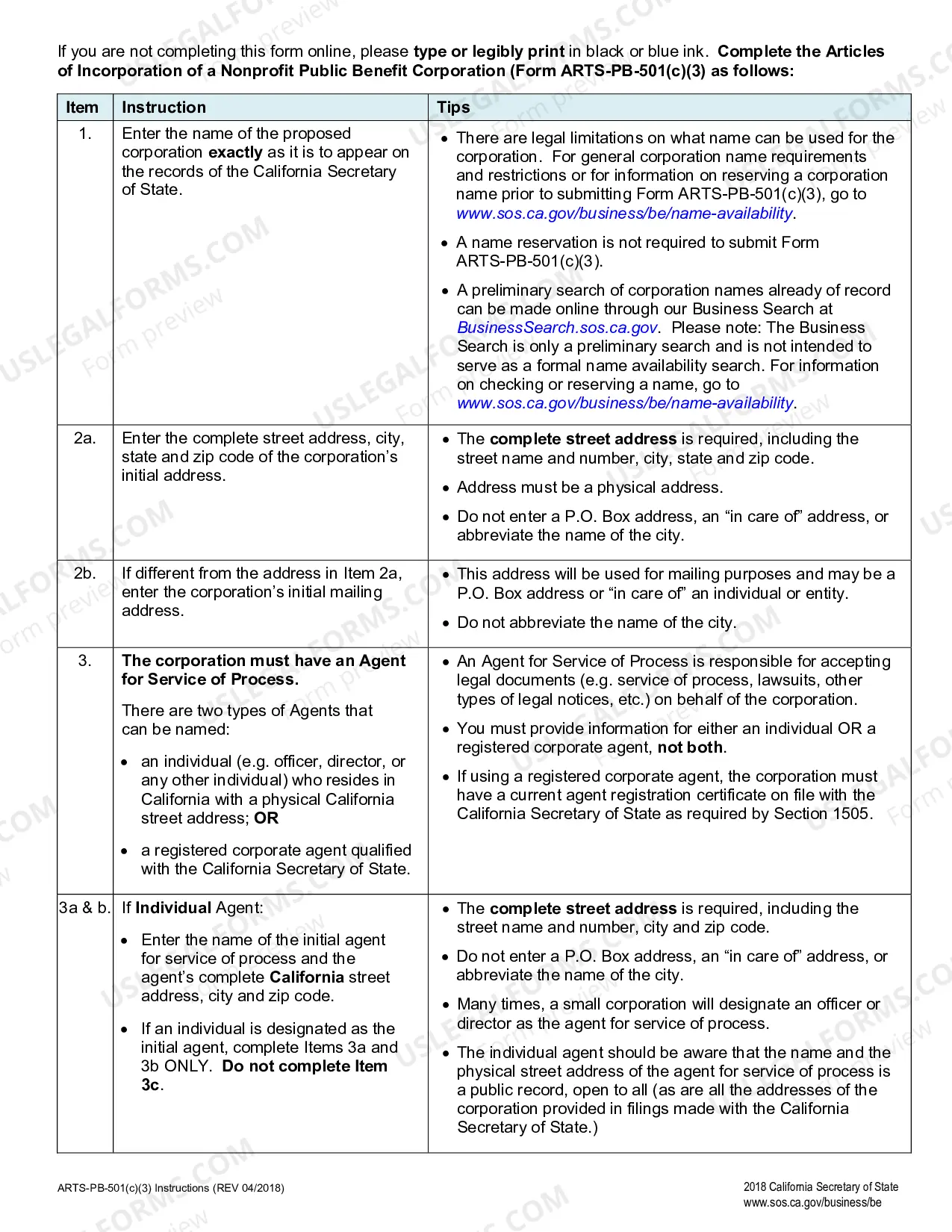

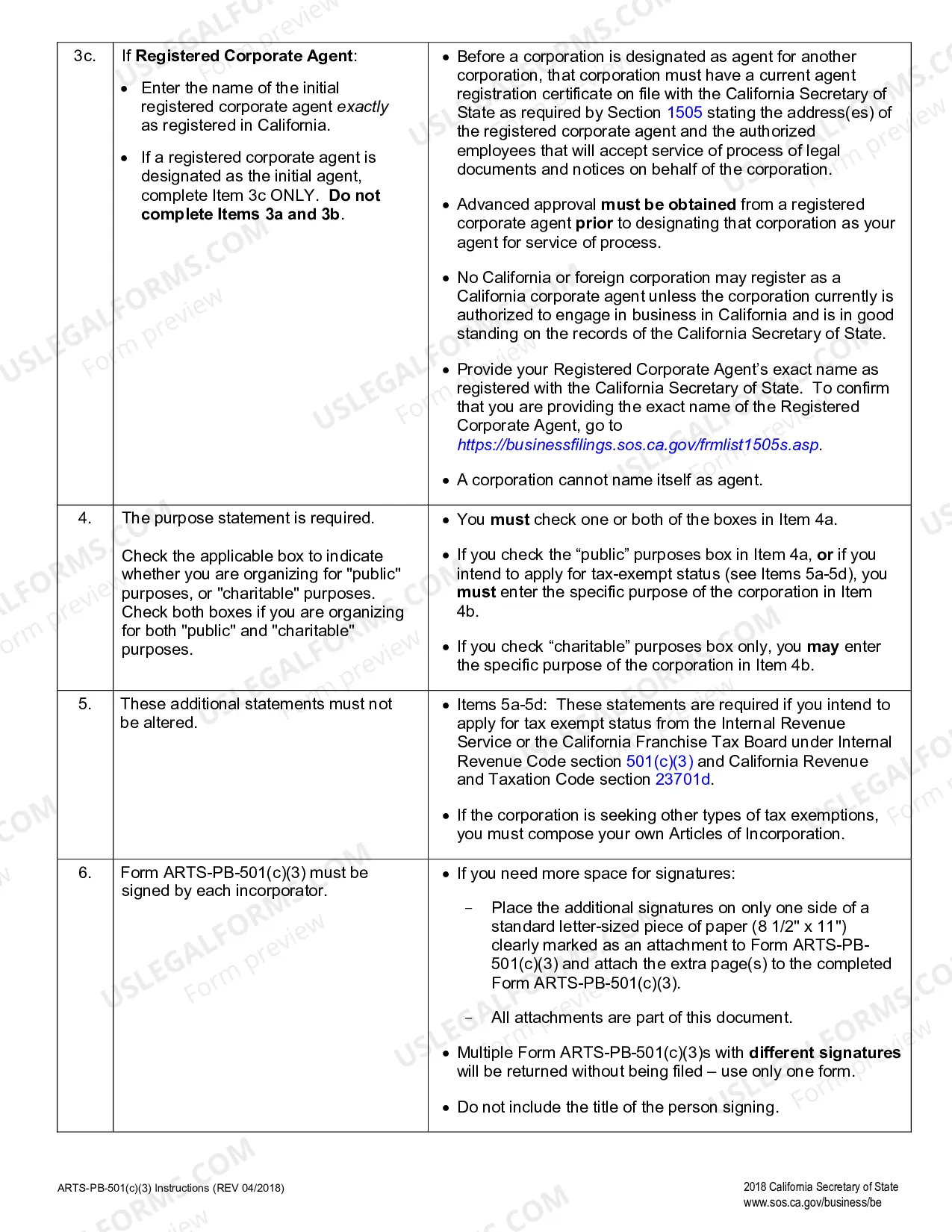

The Salinas California Articles of Incorporation for Domestic Nonprofit Nonstick Corporation is a legal document that must be filed with the California Secretary of State's office to establish a non-stock nonprofit corporation in Salinas, California. It outlines the essential details about the organization, its purpose, structure, and governance. This document is crucial as it formally establishes the existence of the nonprofit entity and grants it certain legal rights and privileges. The Articles of Incorporation for Domestic Nonprofit Nonstick Corporation in Salinas, California typically include the following information: 1. Name of the Corporation: This section specifies the chosen name of the nonprofit organization, which must comply with the regulations and requirements of the Secretary of State's office. 2. Corporate Purpose: The purpose section describes the nonprofit's objectives and activities that will be undertaken to fulfill its mission. It should clearly state that the organization operates on a nonprofit basis and that its activities will be exclusively directed towards charitable, educational, scientific, religious, or other specific purposes that qualify it as a nonprofit under California law. 3. Agent for Service of Process: This section identifies the name and address of an individual or a registered agent who will receive legal documents on behalf of the organization. This ensures that the organization can be properly served with legal notices and notifications. 4. Membership: If the nonprofit corporation will have members, it must define the qualification criteria, rights, and privileges of those members. 5. Duration: The duration section states whether the nonprofit corporation will exist perpetually or for a specific period of time. 6. Dissolution: This section outlines the procedures and conditions for dissolving the nonprofit corporation in the event that it ceases to operate or fulfill its intended purpose. It may include instructions regarding the distribution of remaining assets after debts are settled. 7. Initial Directors: The Articles of Incorporation require the names and addresses of the initial directors who will oversee the organization's activities and govern its affairs until the first official board meeting. 8. Incorporated: This section provides details about the individual or individuals incorporating the nonprofit corporation. It includes their names, addresses, and signatures. The Salinas California Articles of Incorporation for Domestic Nonprofit Nonstick Corporation are typically customized and tailored to the specific needs and goals of each organization. However, different types of nonprofits may require additional clauses or details. For example, public benefit corporations, mutual benefit corporations, and religious corporations may have specific requirements or provisions. It is crucial to consult with a qualified attorney or seek professional guidance to ensure compliance with all legal and regulatory obligations while preparing the Articles of Incorporation.