This Operating Agreement is for a Limited Liability Company with only one Member. This form may be perfect for an LLC started by one person. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

Garden Grove California Single Member Limited Liability Company LLC Operating Agreement

Description

How to fill out California Single Member Limited Liability Company LLC Operating Agreement?

If you have previously utilized our service, Log In to your account and download the Garden Grove California Single Member Limited Liability Company LLC Operating Agreement to your device by clicking the Download button. Ensure that your subscription is current. If it is not, renew it as per your payment arrangement.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continuous access to all documents you have purchased: you can find them in your profile under the My documents section whenever you wish to use them again. Make the most of the US Legal Forms service to effortlessly locate and save any template for your personal or business requirements!

- Confirm that you’ve located an appropriate document. Review the details and use the Preview feature, if available, to verify if it fulfills your needs. If it is not fitting, utilize the Search tab above to discover the correct one.

- Purchase the template. Click the Buy Now button and select either a monthly or yearly subscription plan.

- Create an account and complete your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Garden Grove California Single Member Limited Liability Company LLC Operating Agreement. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or leverage professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Structuring a single-member LLC involves defining ownership, specifying management roles, and outlining operational procedures. Start by establishing your LLC in accordance with California state law and drafting a Garden Grove California Single Member Limited Liability Company LLC Operating Agreement that details these elements. This agreement acts as a guide for running your business and ensures clarity in operations.

member LLC does not always require an Employer Identification Number (EIN) if it does not have employees and you choose to report taxes as a sole proprietor. However, having an EIN can simplify banking and tax filing processes, making it easier to separate personal and business finances. If needed, obtaining an EIN is a straightforward process, made easier with resources like uslegalforms.

The best management structure for an LLC often depends on the specific needs of the business. For a single-member LLC, a member-managed structure is typically the simplest option, allowing you full control over business operations. This makes decision-making more straightforward and efficient, and a well-crafted Garden Grove California Single Member Limited Liability Company LLC Operating Agreement can enhance this process.

The most notable disadvantage of an LLC is the potential for self-employment taxes. As the owner, you're responsible for paying these taxes on your business profits, which can be higher than corporate tax rates. Additionally, in some cases, administrating an LLC can be more complex than operating as a sole proprietorship. However, using a Garden Grove California Single Member Limited Liability Company LLC Operating Agreement can help simplify your management tasks.

While California law does not require an operating agreement for single-member LLCs, it is highly advisable to have one. An operating agreement helps define your business's management and operational guidelines, which protects your limited liability status. The Garden Grove California Single Member Limited Liability Company LLC Operating Agreement not only clarifies your business structure but also helps in case of disputes or audits.

Yes, a single-member LLC in California typically requires a business license, which varies based on the city and type of business activity. It's essential to check with your local government for specific licensing requirements. Following these regulations helps ensure your business operates legally and avoids potential fines. Obtaining the proper licensing information can be easily managed with tools provided by platforms like uslegalforms.

A single member LLC is a business entity that combines the benefits of a corporation and a sole proprietorship. It allows one individual to own and operate a business while enjoying limited liability protection. This means that your personal assets remain separate from business liabilities, providing you peace of mind. The Garden Grove California Single Member Limited Liability Company LLC Operating Agreement outlines the structure and operations of your LLC.

In California, a single member LLC is generally treated as a disregarded entity for tax purposes. This means the income is reported on the owner's personal tax return, typically subjecting it to the individual tax rate. However, California imposes a minimum annual franchise tax of $800 on LLCs, regardless of income. To navigate these tax implications effectively, consider utilizing a well-drafted Garden Grove California Single Member Limited Liability Company LLC Operating Agreement to ensure clarity in financial responsibilities.

Yes, you can indeed have a single member LLC in California. This type of business structure offers you full control while still providing personal liability protection. It's a popular choice for solo entrepreneurs and businesses. When you create a Garden Grove California Single Member Limited Liability Company LLC Operating Agreement, you set clear guidelines for managing your business, which can be beneficial in avoiding disputes.

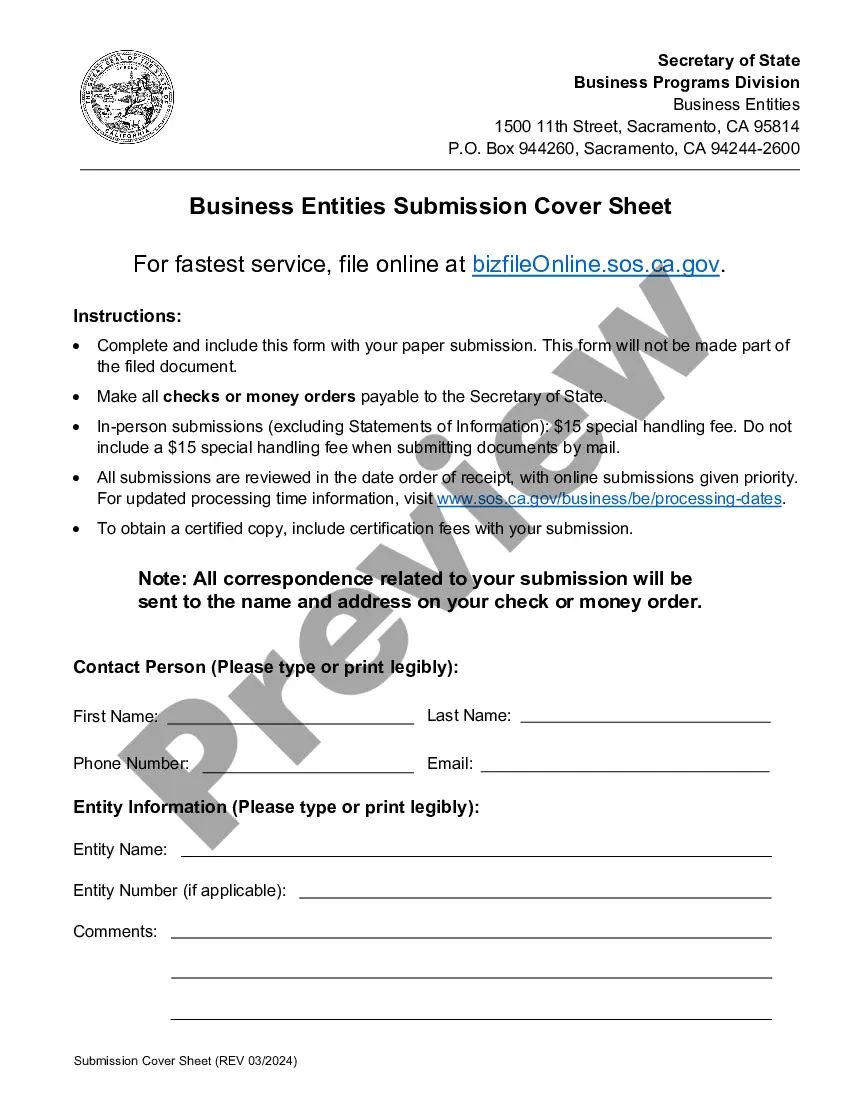

To open a single member LLC in California, you need to file the Articles of Organization with the California Secretary of State. After that, create an operating agreement, which outlines the management structure and operational guidelines for your Garden Grove California Single Member Limited Liability Company LLC. This agreement is crucial for clarifying your business’s rules and responsibilities. Lastly, ensure you obtain any necessary permits and licenses to operate legally.