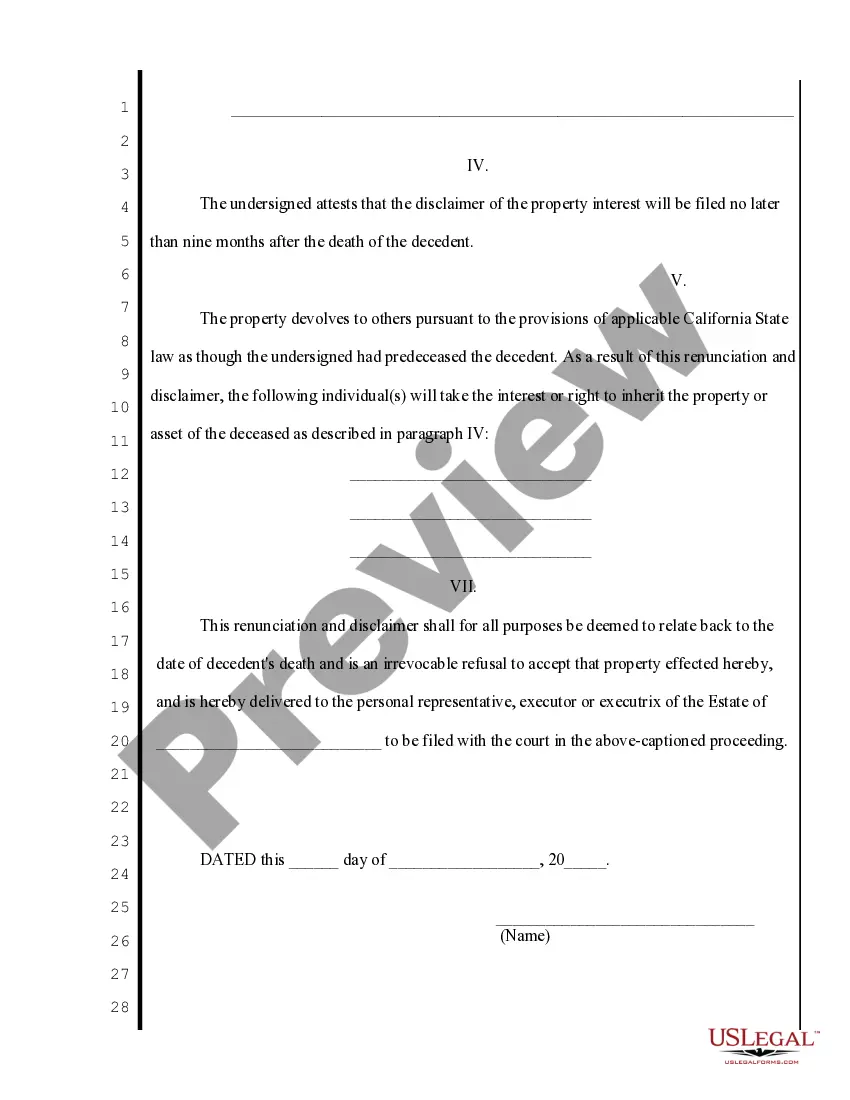

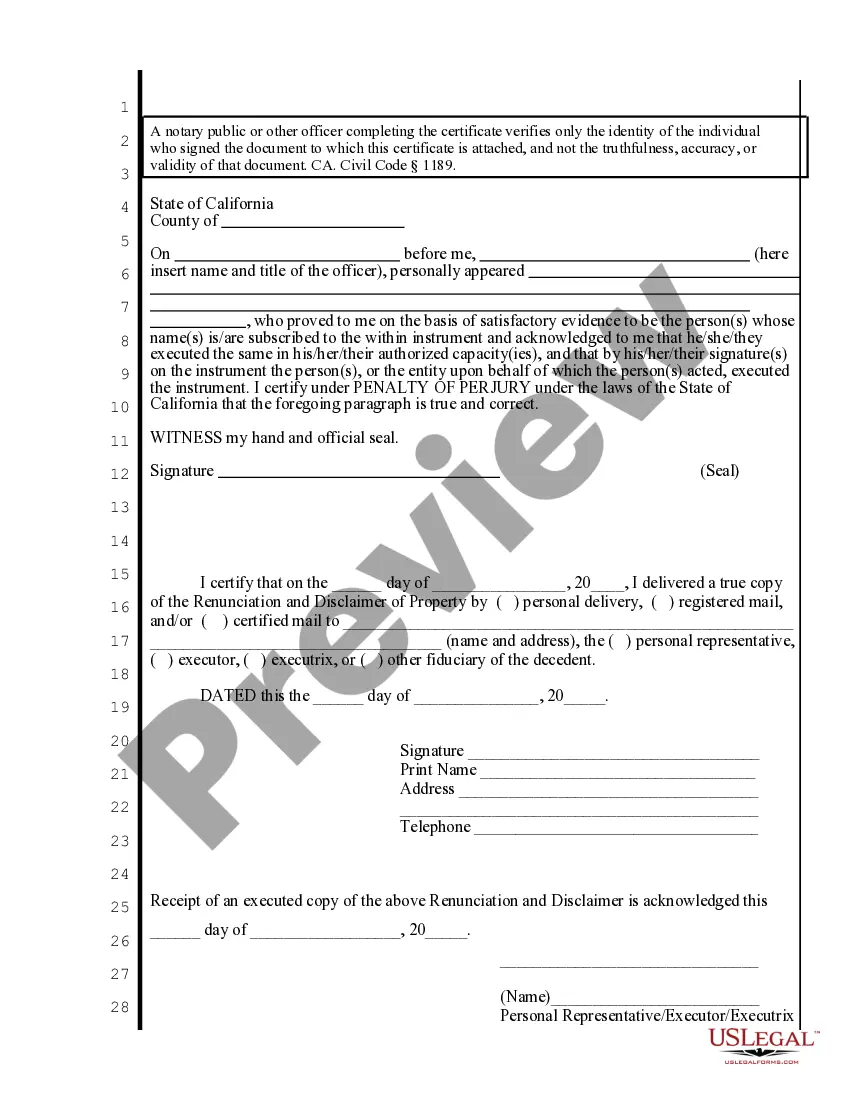

This form is a Renunciation and Disclaimer of Property received by the beneficiary. The beneficiary obtained an interest in the property of the decedent through a bequest in the decedent's last will and testament. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary wishes to disclaim a partial interest or the entire interest in the described property. California law requires that the disclaimer contain the names of the individual(s) who will take the interest or right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Orange California Renunciation And Disclaimer of Property from Will by Testate is a legal process that allows a named beneficiary of a will in Orange, California, to voluntarily relinquish their rights to inherit any property or assets as stated in the will. This renunciation and disclaimer can only be made by a beneficiary who is designated to receive property or assets from a deceased individual's will. The main purpose of this process is to disclaim any interest in the property or assets mentioned in the will, effectively passing them on to another beneficiary or allowing them to be distributed according to the provisions of California estate laws. This renunciation and disclaimer help to ensure a smooth and efficient transfer of assets upon the death of the testate. It is essential to note that there are different types of Orange California Renunciation And Disclaimer of Property from Will by Testate. These depend on the specific situation, intent, or reasons behind the renunciation and disclaimer: 1. Voluntary Renunciation and Disclaimer: This is the most common type where the named beneficiary willingly decides to renounce and disclaim their rights to receive any property or assets from the deceased's will. This could be due to various reasons such as the beneficiary having adequate personal wealth, not wanting the burden of managing the inherited assets, or wanting to pass on the inheritance to someone else. 2. Conditional Renunciation and Disclaimer: In some cases, a beneficiary may only renounce and disclaim their rights under specific conditions or requirements. These conditions could include the acceptance of certain conditions or instructions by the testator (the person who made the will) or the acceptance of an alternative arrangement for the distribution of the property or assets. 3. Partial Renunciation and Disclaimer: This type allows the beneficiary to renounce and disclaim only a portion of the property or assets they are entitled to receive. This might occur when the beneficiary is only interested in specific items, monetary amounts, or shares of the inheritance. 4. Administrative Renunciation and Disclaimer: Under certain circumstances, an executor or personal representative of the estate may request a beneficiary to renounce and disclaim their rights if it is deemed necessary to simplify the administration of the estate. This option may be exercised when it is in the best interest of the overall distribution of the assets or when it aligns with the testator's wishes. Completing an Orange California Renunciation And Disclaimer of Property from Will by Testate can be a complex legal process. It is crucial for beneficiaries considering this option to seek guidance from an experienced estate attorney who can provide the necessary knowledge and guidance to navigate the legal requirements and implications.

Orange California Renunciation And Disclaimer of Property from Will by Testate is a legal process that allows a named beneficiary of a will in Orange, California, to voluntarily relinquish their rights to inherit any property or assets as stated in the will. This renunciation and disclaimer can only be made by a beneficiary who is designated to receive property or assets from a deceased individual's will. The main purpose of this process is to disclaim any interest in the property or assets mentioned in the will, effectively passing them on to another beneficiary or allowing them to be distributed according to the provisions of California estate laws. This renunciation and disclaimer help to ensure a smooth and efficient transfer of assets upon the death of the testate. It is essential to note that there are different types of Orange California Renunciation And Disclaimer of Property from Will by Testate. These depend on the specific situation, intent, or reasons behind the renunciation and disclaimer: 1. Voluntary Renunciation and Disclaimer: This is the most common type where the named beneficiary willingly decides to renounce and disclaim their rights to receive any property or assets from the deceased's will. This could be due to various reasons such as the beneficiary having adequate personal wealth, not wanting the burden of managing the inherited assets, or wanting to pass on the inheritance to someone else. 2. Conditional Renunciation and Disclaimer: In some cases, a beneficiary may only renounce and disclaim their rights under specific conditions or requirements. These conditions could include the acceptance of certain conditions or instructions by the testator (the person who made the will) or the acceptance of an alternative arrangement for the distribution of the property or assets. 3. Partial Renunciation and Disclaimer: This type allows the beneficiary to renounce and disclaim only a portion of the property or assets they are entitled to receive. This might occur when the beneficiary is only interested in specific items, monetary amounts, or shares of the inheritance. 4. Administrative Renunciation and Disclaimer: Under certain circumstances, an executor or personal representative of the estate may request a beneficiary to renounce and disclaim their rights if it is deemed necessary to simplify the administration of the estate. This option may be exercised when it is in the best interest of the overall distribution of the assets or when it aligns with the testator's wishes. Completing an Orange California Renunciation And Disclaimer of Property from Will by Testate can be a complex legal process. It is crucial for beneficiaries considering this option to seek guidance from an experienced estate attorney who can provide the necessary knowledge and guidance to navigate the legal requirements and implications.