This Warranty Deed from Individual to Husband and Wife form is a Warranty Deed where the Grantor is an individual and the Grantees are husband and wife. Grantor conveys and warrants the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

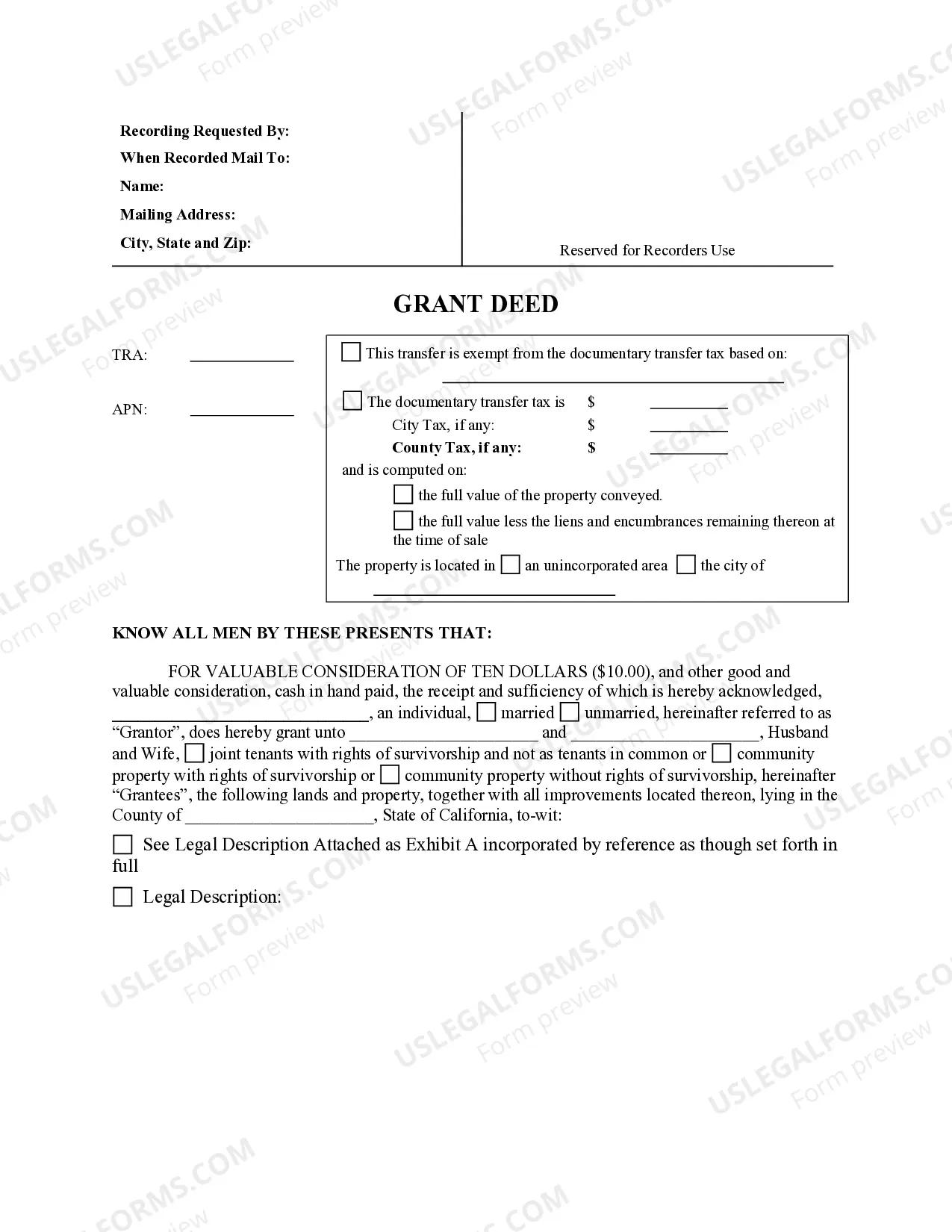

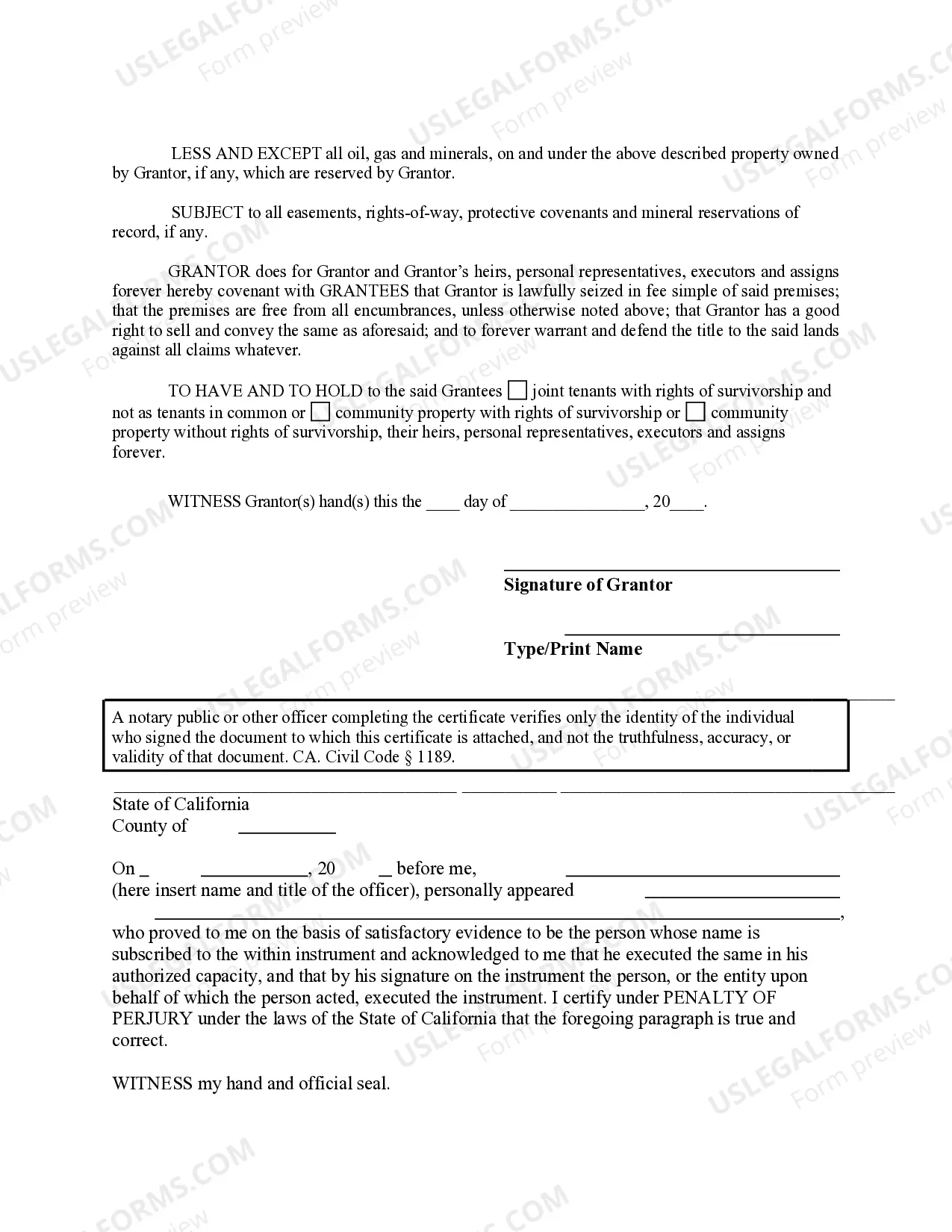

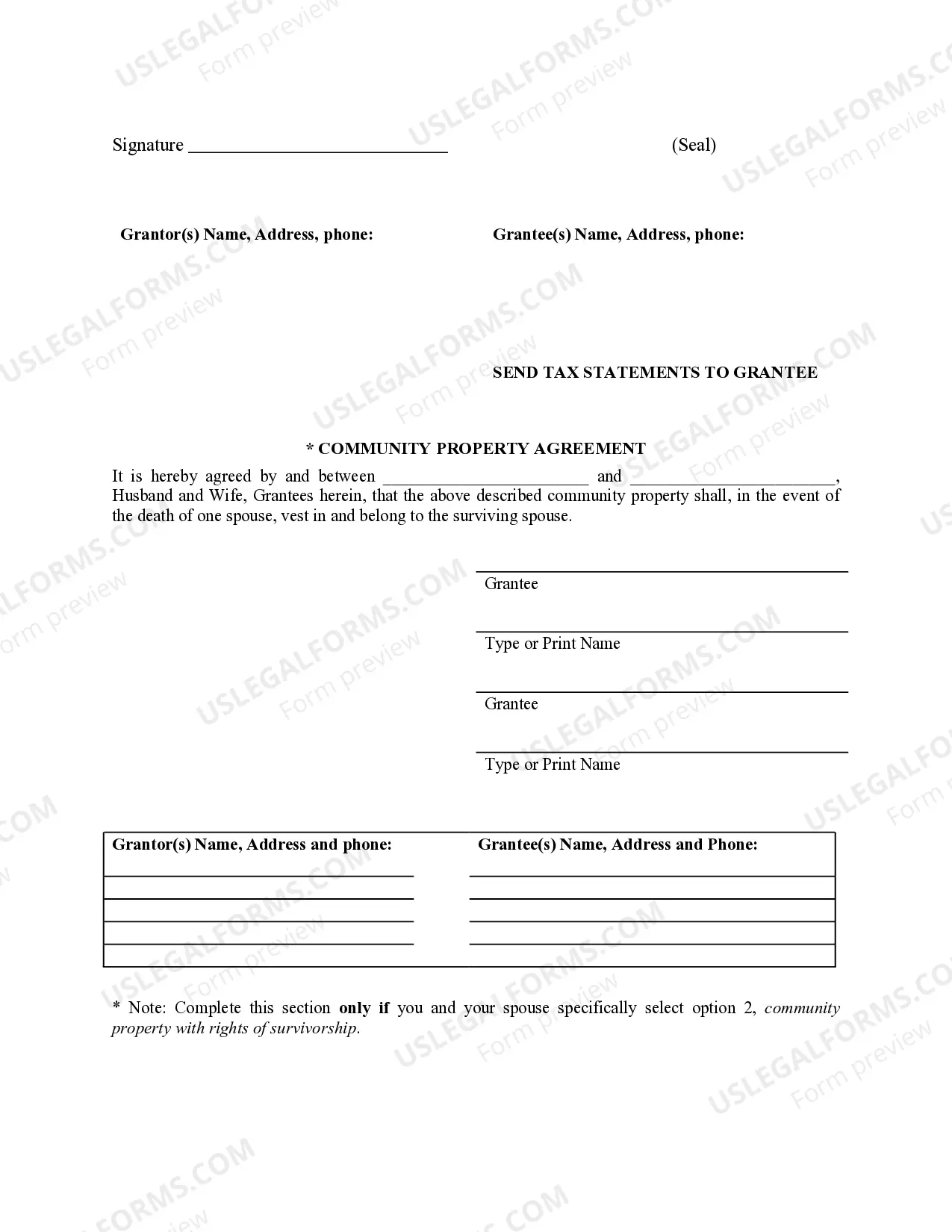

A Santa Clara California Grant Deed from Individual to Husband and Wife with Reservation of Mineral Rights — Transfer is a legal document that enables an individual to transfer ownership of real estate to a husband and wife while reserving mineral rights. This type of deed serves to convey ownership while ensuring that the granter retains the rights to any minerals found or extracted from the property. The Santa Clara California Grant Deed from Individual to Husband and Wife with Reservation of Mineral Rights — Transfer is an essential legal instrument in real estate transactions, providing a clear and comprehensive record of ownership transfer and mineral rights reservation. It safeguards the interests of both the granter and the grantee, ensuring a smooth and legally valid transfer of property. There are various types of Santa Clara California Grant Deeds from Individual to Husband and Wife with Reservation of Mineral Rights — Transfers, each designed to cater to specific situations. Some notable variations include: 1. Traditional Grant Deed: In this type of transfer, the granter legally conveys their real estate ownership to the husband and wife while reserving mineral rights. This is the most common and straightforward version of the deed. 2. Joint Tenancy Grant Deed: A joint tenancy grant deed allows the granter to transfer ownership to the husband and wife as joint tenants, with equal shares of the property. In this case, the mineral rights are also reserved. 3. Tenancy in Common Grant Deed: A tenancy in common grant deed enables the granter to transfer the property to the husband and wife as tenants in common, with distinct ownership percentages. Here also, the mineral rights can be reserved. 4. Enhanced Life Estate Grant Deed: Also known as a "Lady Bird Deed," this type of grant deed allows the granter (usually an individual) to transfer the property to the husband and wife while retaining a life estate. The life estate grants the granter the right to use and occupy the property during their lifetime, with ownership automatically transferring to the beneficiaries (the husband and wife) upon the granter's death. Mineral rights can be reserved in this variation of the deed as well. In summary, a Santa Clara California Grant Deed from Individual to Husband and Wife with Reservation of Mineral Rights — Transfer is a legal instrument that facilitates the smooth transfer of property ownership while reserving the granter's mineral rights. With various types of deeds catering to different ownership structures, it is essential to choose the appropriate variation that aligns with the specific requirements of the transaction.