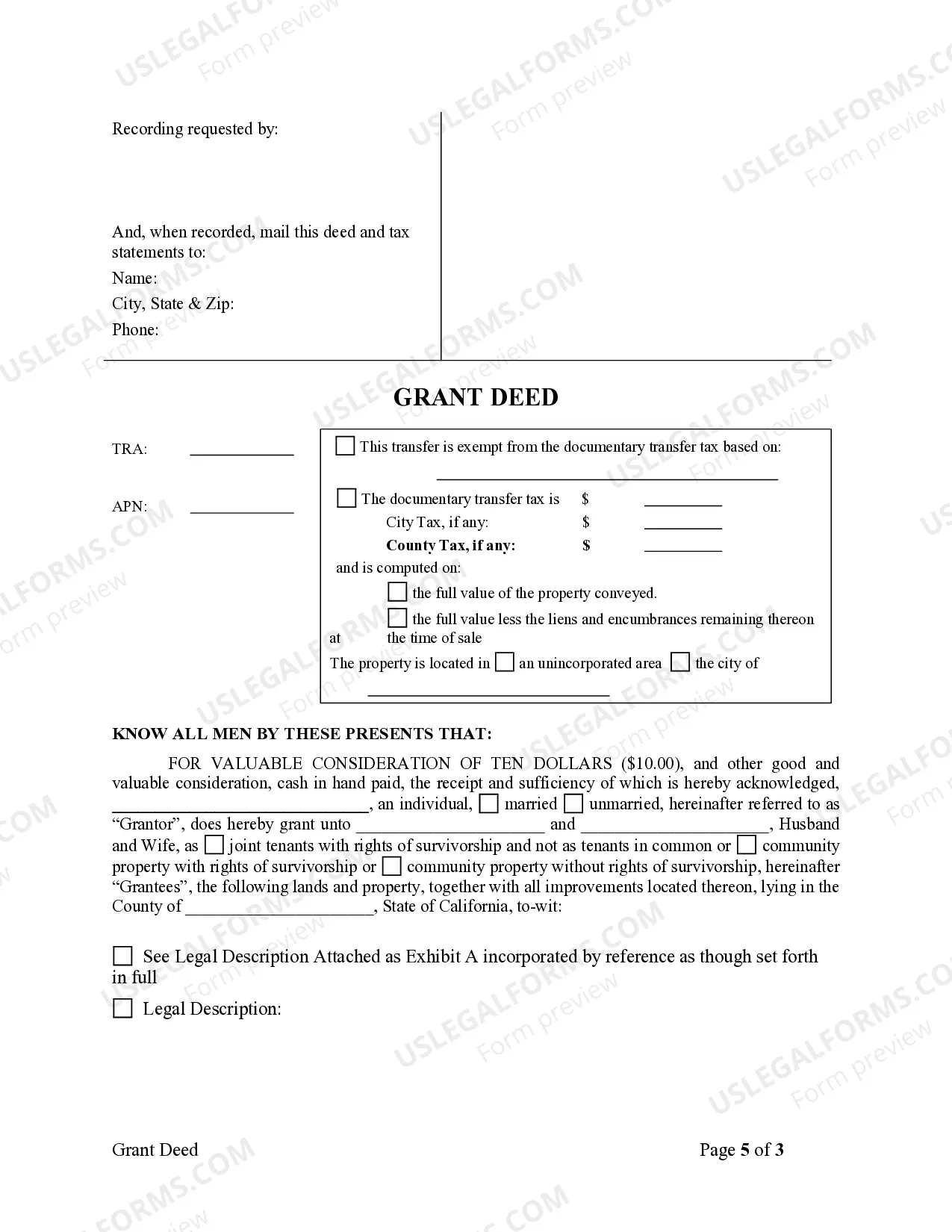

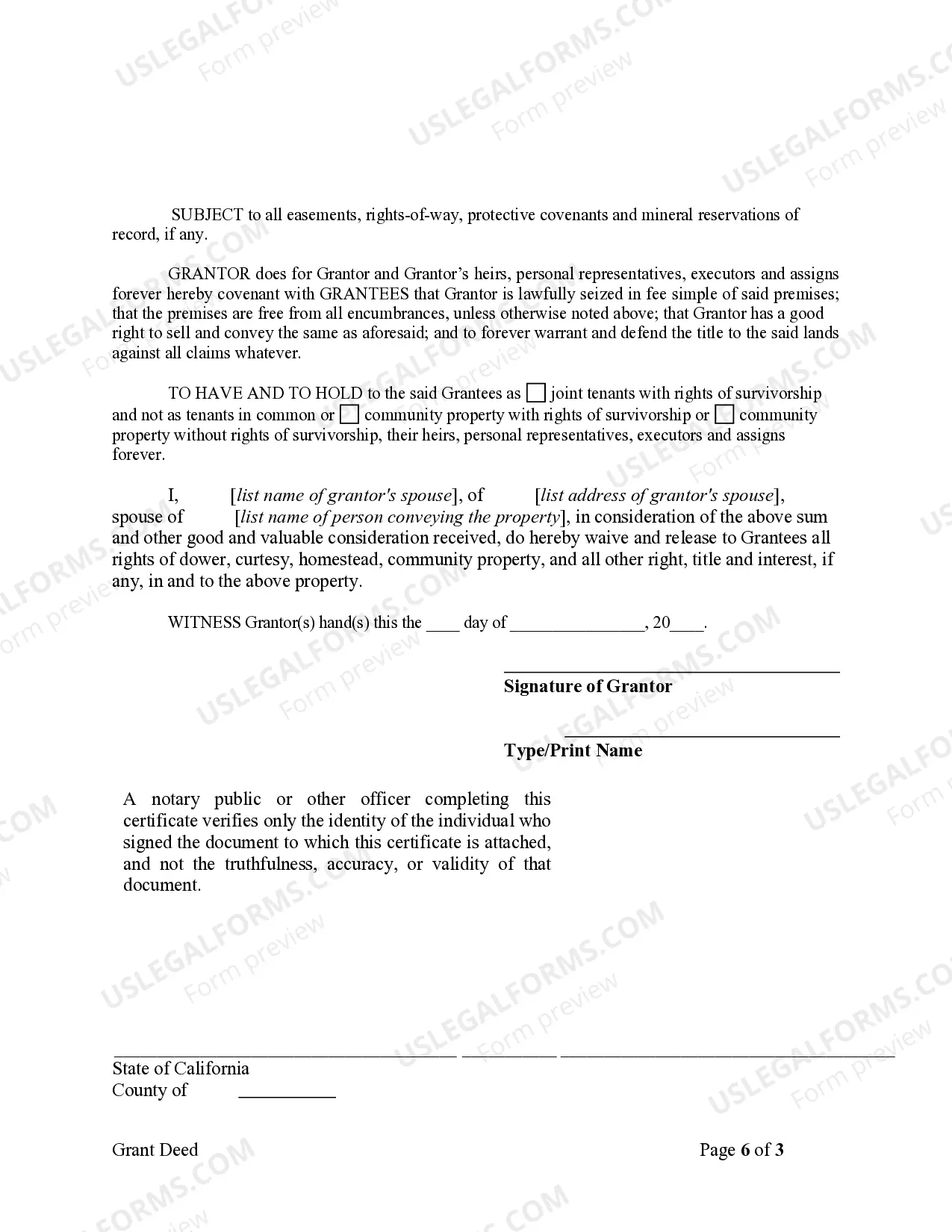

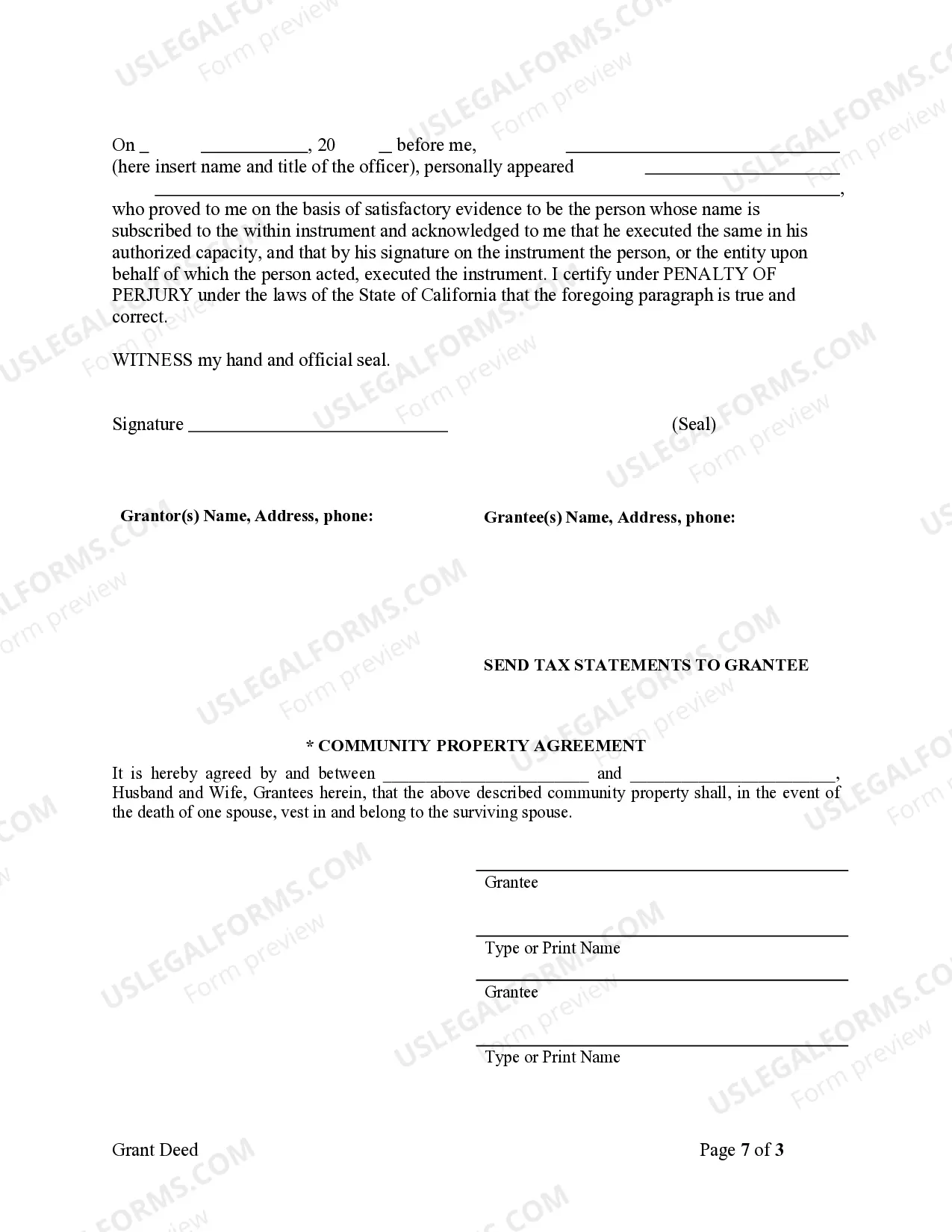

This Grant Deed is needed when an individual wishes to grant certain property to a Husband and Wife. Upon signing this form, the Husband and Wife will be the sole owners of the property granted to them by the individual.

A Corona California Grant Deed from Individual to Husband and Wife is a legal document that transfers the ownership of a property from an individual or granter to a married couple as grantees. This type of deed is commonly used when the granter wishes to convey their interest in real estate to both spouses equally. The Grant Deed serves as proof of transfer, providing details about the property and the conditions of the transfer. It includes essential information such as the names of the granter and grantees, the legal description of the property being conveyed, and any encumbrances or restrictions that may affect the property's title. It's important to note that though the use of the term "Husband and Wife" indicates that the property is being transferred jointly to a married couple, it doesn't necessarily imply any specific tenancy type or co-ownership arrangement. Depending on the couple's preferences and circumstances, they can choose different forms of co-ownership. Some common types of Corona California Grant Deeds from Individual to Husband and Wife include: 1. Joint Tenancy: In this form of co-ownership, both spouses hold an equal undivided interest in the property, with the right of survivorship. This means that if one spouse passes away, their share automatically transfers to the surviving spouse, bypassing probate. 2. Tenancy in Common: With this type of co-ownership, each spouse holds a separate and distinct share of the property, which can be equal or unequal. Unlike joint tenancy, there is no right of survivorship. If one spouse passes away, their share is typically transferred according to their will, or if there is no will, it follows the laws of intestate succession. 3. Community Property: California is a community property state, so any property acquired during the marriage is presumed to be community property, owned equally by both spouses. In this form of co-ownership, each spouse has a 50% undivided interest in the property. If one spouse passes away, their share will typically transfer to the surviving spouse as per community property laws. When drafting a Corona California Grant Deed from Individual to Husband and Wife, it is essential to consult with a qualified attorney or a real estate professional to ensure all legal requirements are met. This deed is typically recorded at the Riverside County Recorder's Office to provide notice to potential buyers or creditors about the change in ownership and protect the grantees' interests.A Corona California Grant Deed from Individual to Husband and Wife is a legal document that transfers the ownership of a property from an individual or granter to a married couple as grantees. This type of deed is commonly used when the granter wishes to convey their interest in real estate to both spouses equally. The Grant Deed serves as proof of transfer, providing details about the property and the conditions of the transfer. It includes essential information such as the names of the granter and grantees, the legal description of the property being conveyed, and any encumbrances or restrictions that may affect the property's title. It's important to note that though the use of the term "Husband and Wife" indicates that the property is being transferred jointly to a married couple, it doesn't necessarily imply any specific tenancy type or co-ownership arrangement. Depending on the couple's preferences and circumstances, they can choose different forms of co-ownership. Some common types of Corona California Grant Deeds from Individual to Husband and Wife include: 1. Joint Tenancy: In this form of co-ownership, both spouses hold an equal undivided interest in the property, with the right of survivorship. This means that if one spouse passes away, their share automatically transfers to the surviving spouse, bypassing probate. 2. Tenancy in Common: With this type of co-ownership, each spouse holds a separate and distinct share of the property, which can be equal or unequal. Unlike joint tenancy, there is no right of survivorship. If one spouse passes away, their share is typically transferred according to their will, or if there is no will, it follows the laws of intestate succession. 3. Community Property: California is a community property state, so any property acquired during the marriage is presumed to be community property, owned equally by both spouses. In this form of co-ownership, each spouse has a 50% undivided interest in the property. If one spouse passes away, their share will typically transfer to the surviving spouse as per community property laws. When drafting a Corona California Grant Deed from Individual to Husband and Wife, it is essential to consult with a qualified attorney or a real estate professional to ensure all legal requirements are met. This deed is typically recorded at the Riverside County Recorder's Office to provide notice to potential buyers or creditors about the change in ownership and protect the grantees' interests.