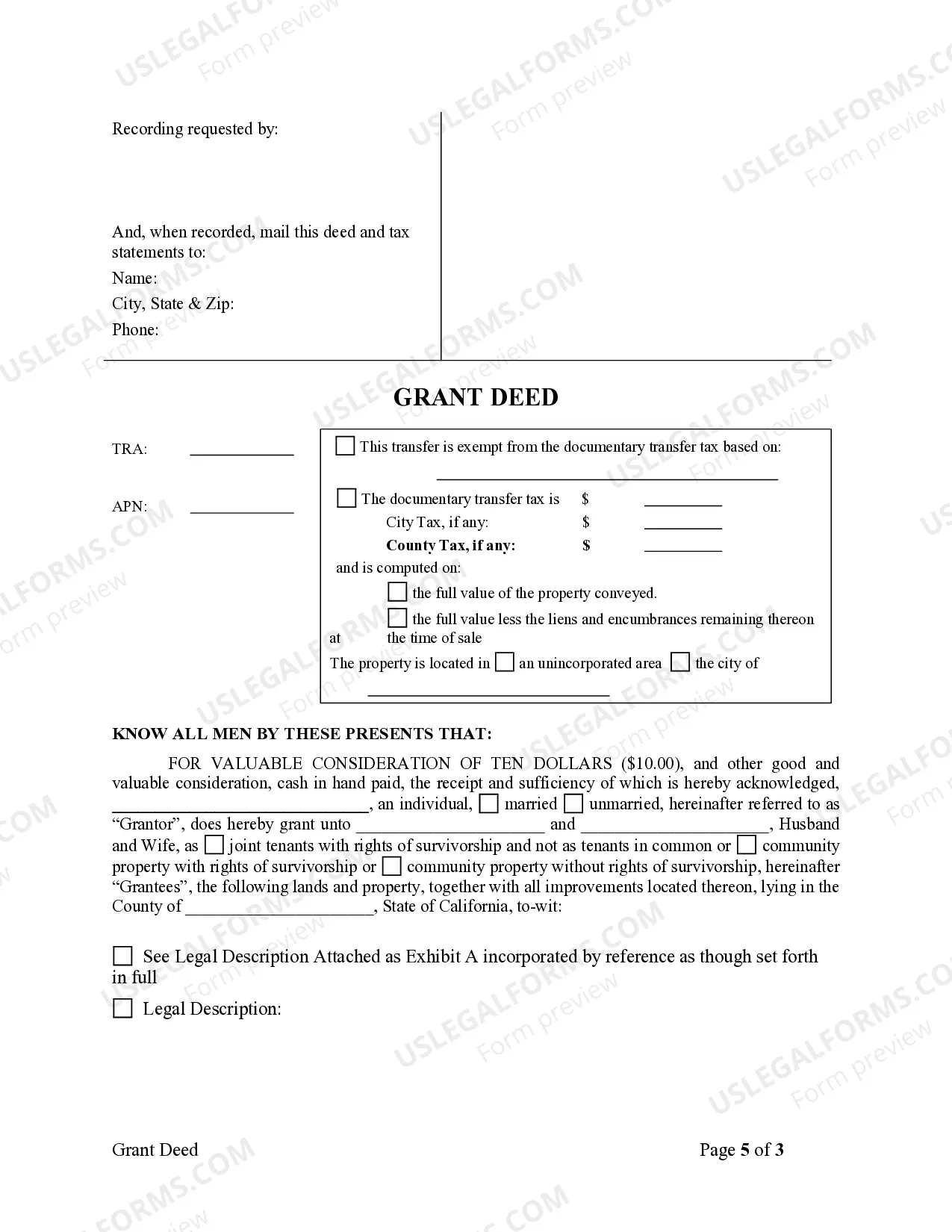

This Grant Deed is needed when an individual wishes to grant certain property to a Husband and Wife. Upon signing this form, the Husband and Wife will be the sole owners of the property granted to them by the individual.

Downey California Grant Deed from Individual to Husband and Wife

Description

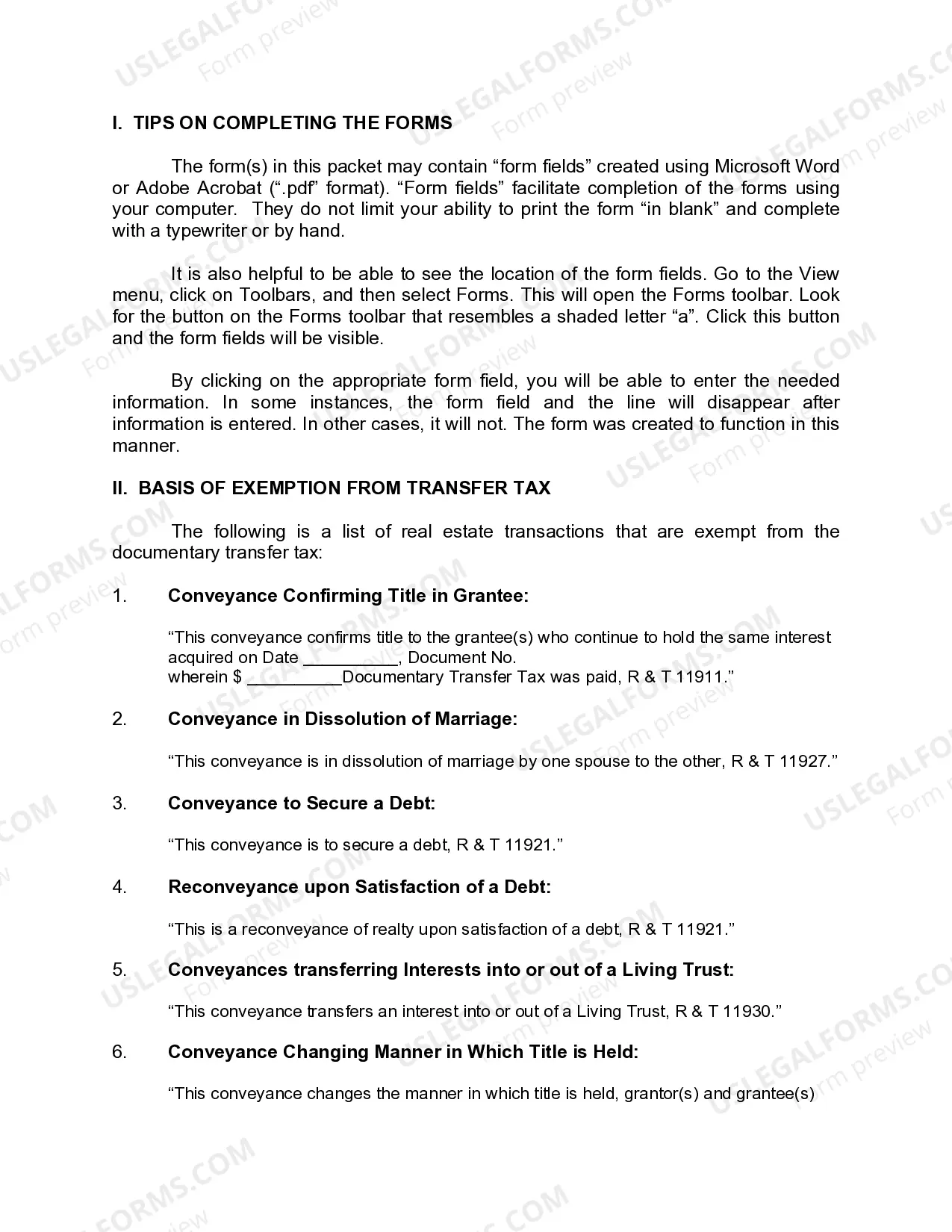

How to fill out California Grant Deed From Individual To Husband And Wife?

We consistently seek to minimize or avert legal complications when navigating intricate legal or financial issues.

To achieve this, we enroll in legal services that, as a general rule, come with substantial costs. However, not every legal issue is that intricate.

A majority of them can be handled independently.

US Legal Forms is a virtual repository of current DIY legal paperwork encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

Simply Log In to your account and click the Get button beside it. If you happen to misplace the form, you can always download it again from the My documents tab. The process remains just as straightforward even if you’re new to the platform! You can set up your account in minutes. Ensure to verify if the Downey California Grant Deed from Individual to Husband and Wife aligns with the laws and regulations of your state and area. Additionally, it’s crucial to review the form’s description (if available), and should you detect any inconsistencies with your original request, look for an alternative form. Once you’re certain that the Downey California Grant Deed from Individual to Husband and Wife meets your requirements, you can select a subscription plan and proceed with payment. You can then download the form in any preferred file format. For over 24 years, we have served millions by providing ready-to-customize and current legal documents. Take full advantage of US Legal Forms today to conserve time and resources!

- Our repository enables you to manage your affairs autonomously without relying on the assistance of a lawyer.

- We provide access to legal document templates that are not always readily available.

- Our templates are tailored to specific states and regions, which greatly eases the search process.

- Benefit from US Legal Forms when you need to quickly and securely locate and acquire the Downey California Grant Deed from Individual to Husband and Wife or any other document.

Form popularity

FAQ

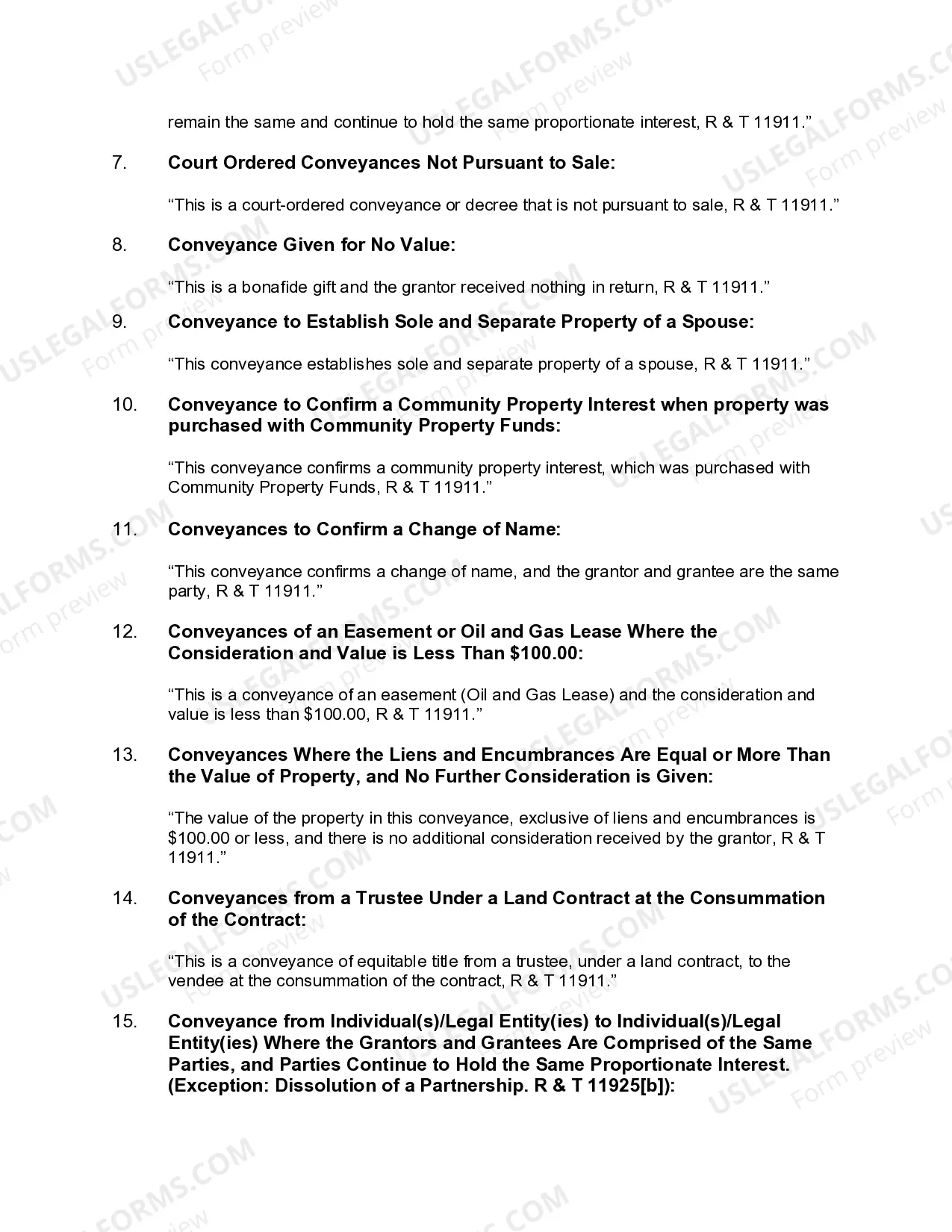

To remove someone from a grant deed, begin by drafting a new deed that leaves out the individual in question. The process requires the consent and signature of the person being removed. After you ensure that the new deed complies with California regulations, submit it to your county recorder's office, updating your Downey California Grant Deed from Individual to Husband and Wife as necessary.

To add your spouse to the deed in California, you must prepare a new grant deed that includes both your names. This new deed typically requires you to explain the relationship and intention behind the addition. It's necessary to sign the document, notarize it, and then file it with the county recorder's office to formalize your Downey California Grant Deed from Individual to Husband and Wife.

To remove someone from a grant deed in California, you will need to create a new deed that specifies the change. It’s important to have the person being removed sign this new deed, as their consent is necessary. Once signed, you will file the new deed with your local county recorder's office to authenticate the changes to your Downey California Grant Deed from Individual to Husband and Wife.

Removing someone from a deed without refinancing typically involves preparing a new grant deed that excludes the individual you want to remove. This deed must also be signed by the person leaving the title, confirming their consent to the removal. You should then record the new deed with the county recorder's office, ensuring that your Downey California Grant Deed from Individual to Husband and Wife stays current.

Yes, it is generally advisable for both spouses to be on the house title in California. This protects each spouse's interests in the property and can ease the transfer process in case of future changes, such as selling or passing the property down. Including both names helps establish a joint ownership and reinforces your Downey California Grant Deed from Individual to Husband and Wife.

Filling out a California grant deed involves entering key information such as the names of the granter and grantee, the property's legal description, and any relevant information about the transaction. You should ensure that the form adheres to state guidelines and includes necessary signatures. After completing the document, it's essential to file it with the county recorder's office to make your Downey California Grant Deed from Individual to Husband and Wife official.

To amend a grant deed in California, you need to prepare a new deed that illustrates the changes you wish to make. This should include specific details of the property and the names of the individuals involved. Once completed, the amended deed must be signed and notarized before recording it with your local county recorder's office. The process ensures that your Downey California Grant Deed from Individual to Husband and Wife accurately reflects your current intentions.

An interspousal transfer grant deed allows spouses to transfer property between each other without incurring transfer taxes. This type of deed can be useful when one spouse wants to add the other to the title or in cases of asset planning. When creating a Downey California Grant Deed from Individual to Husband and Wife, this deed simplifies the process and preserves the benefits of joint ownership, ensuring clarity and security in marital property interests.

To add a spouse to a deed in California, start by creating a Downey California Grant Deed from Individual to Husband and Wife. Make sure you have all required information and signatures, then notarize the document. Finally, file the deed with your county’s recorder office for official recognition and to update ownership records.

Adding someone to a deed in California may trigger tax implications, such as reassessment of property taxes. However, transferring a property to a spouse generally qualifies for an exclusion from property tax reassessment. Always consult a tax professional to understand how your specific situation, including the Downey California Grant Deed from Individual to Husband and Wife, will affect your taxes.