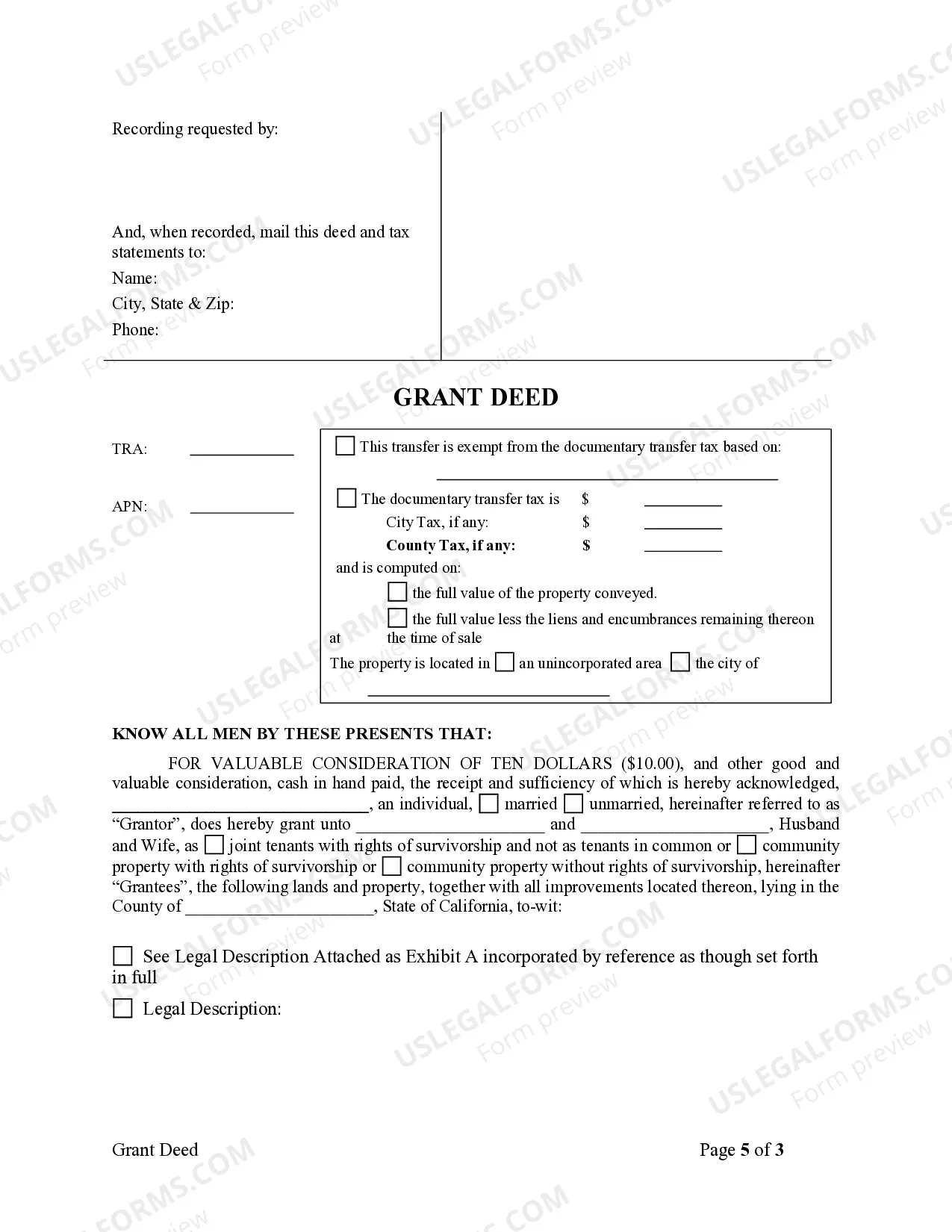

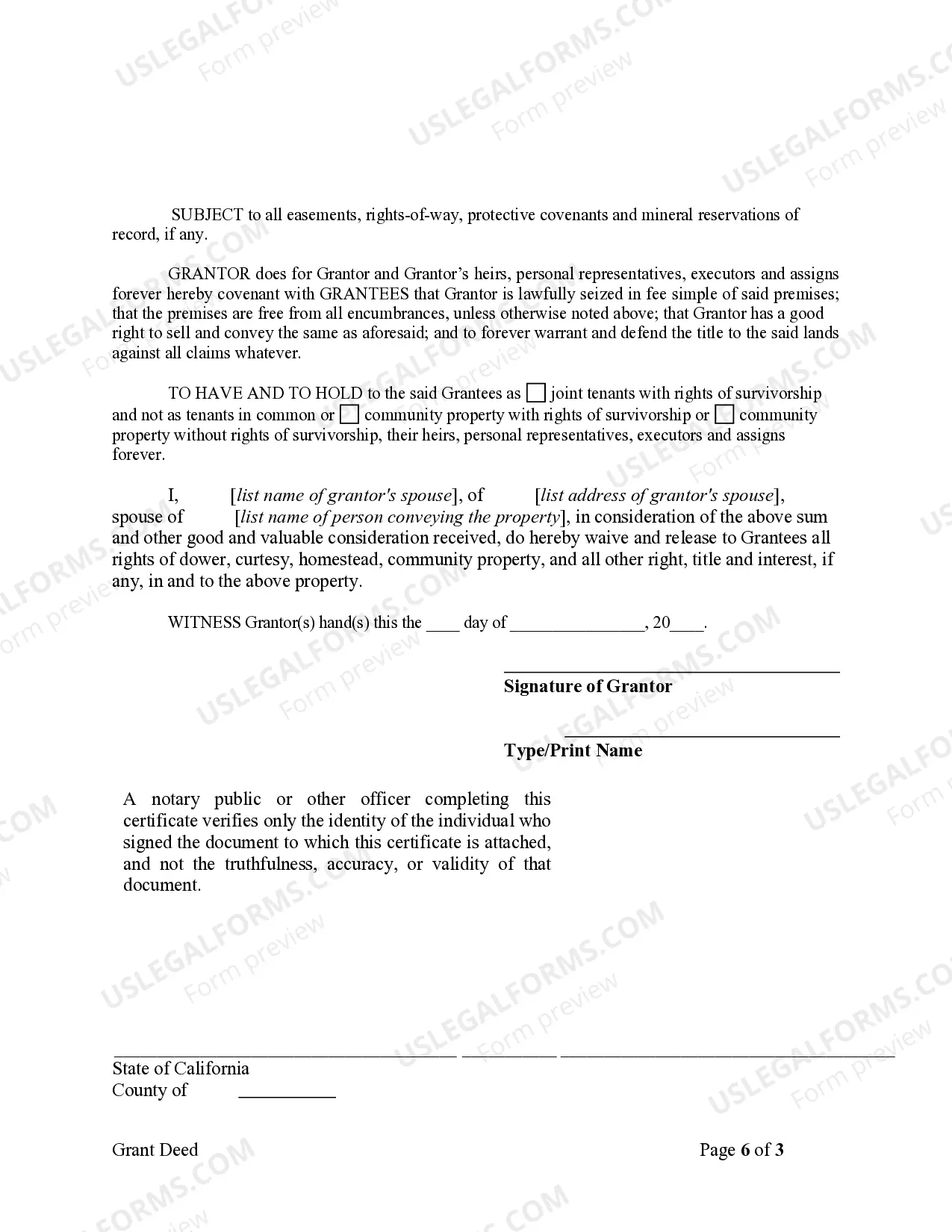

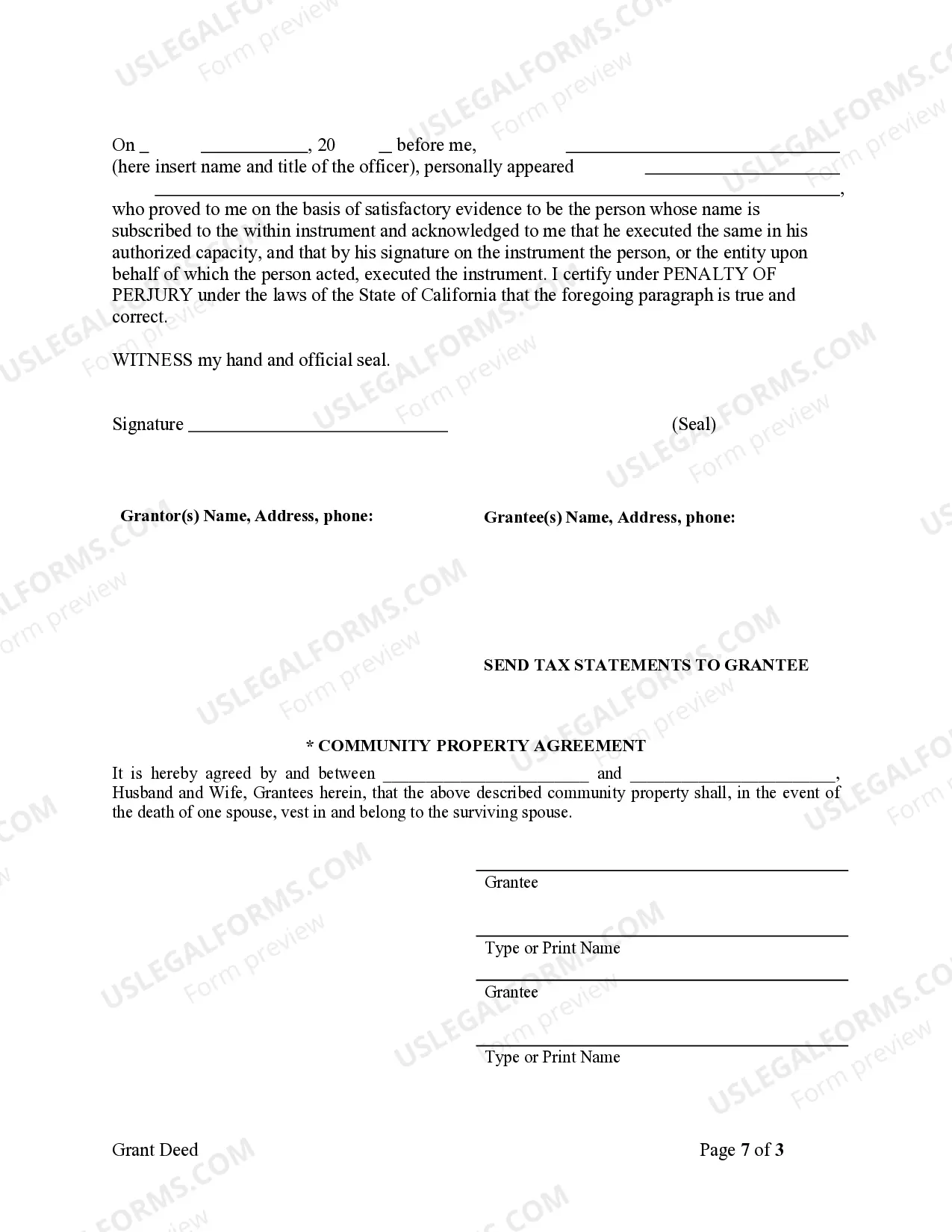

This Grant Deed is needed when an individual wishes to grant certain property to a Husband and Wife. Upon signing this form, the Husband and Wife will be the sole owners of the property granted to them by the individual.

Irvine California Grant Deed from Individual to Husband and Wife

Description

How to fill out Irvine California Grant Deed From Individual To Husband And Wife?

If you are in search of an appropriate form template, it’s impossible to find a more user-friendly service than the US Legal Forms site – one of the most comprehensive repositories on the internet.

With this repository, you can locate thousands of document examples for business and personal use categorized by types and states, or keywords.

With our sophisticated search feature, obtaining the latest Irvine California Grant Deed from Individual to Husband and Wife is as straightforward as 1-2-3.

Execute the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Select the file format and download it to your device.

- Furthermore, the accuracy of each entry is confirmed by a team of qualified attorneys who consistently review the templates on our platform and refresh them in accordance with the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to do to acquire the Irvine California Grant Deed from Individual to Husband and Wife is to Log In to your account and select the Download option.

- If you are utilizing US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have located the sample you desire. Review its description and utilize the Preview option (if available) to inspect its content. If it does not meet your requirements, employ the Search feature located at the top of the page to find the required document.

- Validate your choice. Click the Buy now button. After that, choose your preferred pricing plan and provide the necessary information to create an account.

Form popularity

FAQ

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

An interspousal transfer deed, more technically called an interspousal transfer grant deed, is a legal document used to give sole ownership of shared property, such as a house, to one person in a marriage. They are commonly employed in divorce cases to transfer community property to one spouse.

Calculating real property transfer tax is straightforward. Currently, most counties charge $1.10 per $1000 value of transferred real property in California. For example, on real property valued at $20,000, the county documentary tax would be $22.00.

As a homeowner, you are permitted to give your property to your children at any time, even if you live in it.

Today, Californians most often transfer title to real property by a simple written instrument, the grant deed. The word ?grant? is expressly designated by statute as a word of conveyance. (Civil Code Section 1092) A second form of deed is the quitclaim deed.

California mainly uses two types of deeds: the ?grant deed? and the ?quitclaim deed.? Most other deeds you will see, such as the common ?interspousal transfer deed,? are versions of grant or quitclaim deeds customized for specific circumstances.

In California, quitclaim deeds are commonly used between spouses, relatives, or if a property owner is transferring his or her property into his or her trust. A grant deed is commonly used in most arms-length real estate transactions not involving family members or spouses.

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

To do this in California, you will need a copy of the current deed ? for San Francisco property, visit the assessor-recorder's office in city hall ? as well as a preliminary change of ownership report form and a new grant deed form. You can find the forms online at a court or county law library website.