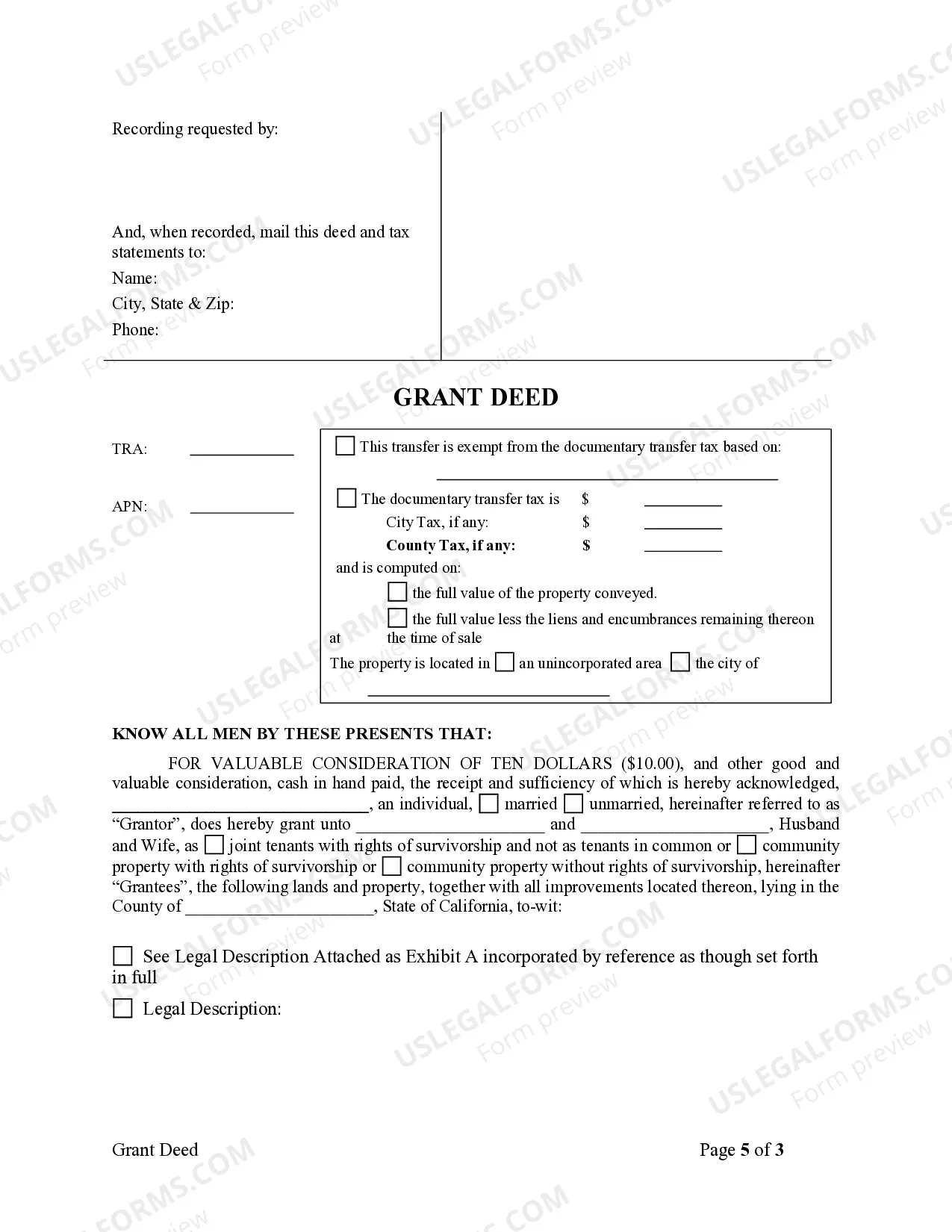

This Grant Deed is needed when an individual wishes to grant certain property to a Husband and Wife. Upon signing this form, the Husband and Wife will be the sole owners of the property granted to them by the individual.

San Diego California Grant Deed from Individual to Husband and Wife

Description

How to fill out California Grant Deed From Individual To Husband And Wife?

If you have previously utilized our service, sign in to your account and acquire the San Diego California Grant Deed from Individual to Husband and Wife on your device by selecting the Download button. Make certain your subscription is active. Otherwise, extend it based on your payment arrangement.

If this is your initial interaction with our service, follow these straightforward steps to obtain your document.

You have ongoing access to every document you have acquired: you can find it in your profile under the My documents section whenever you need to access it again. Utilize the US Legal Forms service to swiftly find and store any template for your personal or business requirements!

- Verify you’ve found a suitable document. Review the description and use the Preview feature, if available, to determine if it fulfills your requirements. If it doesn’t fit your criteria, utilize the Search option above to find the suitable one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and finalize the payment. Use your credit card information or the PayPal option to complete the purchase.

- Receive your San Diego California Grant Deed from Individual to Husband and Wife. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it or use professional online editors to complete it and sign it electronically.

Form popularity

FAQ

To get a copy of your grant deed in California, visit your local county recorder's office or check their website. You can typically search for your property and request copies online. For your convenience, consider using US Legal Forms, which provides templates and resources related to the San Diego California Grant Deed from Individual to Husband and Wife.

If you lost your grant deed in California, you can easily request a replacement through the county recorder's office. They will provide you with a certified copy of your San Diego California Grant Deed from Individual to Husband and Wife. Alternatively, you can use US Legal Forms to streamline the process and access the necessary documents conveniently.

Yes, grant deeds are public records in California. Anyone can access these documents at the county recorder's office, which includes the San Diego County Recorder's Office. This means you can view and obtain copies of the San Diego California Grant Deed from Individual to Husband and Wife if needed.

To add a spouse to your grant deed in California, you will need to fill out a grant deed form, indicating the change. Both spouses must sign the document before a notary public. Afterward, submit the amended San Diego California Grant Deed from Individual to Husband and Wife to the county recorder's office to complete the process.

To remove someone from a grant deed in California, you may need to complete a grant deed form and have it notarized. You must also ensure that the person being removed agrees to the change. Once everything is ready, file the revised San Diego California Grant Deed from Individual to Husband and Wife with the local recorder's office.

Yes, you can obtain a copy of your grant deed online in California. Many counties offer online access to property records, including the San Diego County Recorder's Office. Simply visit their website, search for your property, and you can download your San Diego California Grant Deed from Individual to Husband and Wife.

While you do not need a lawyer to add someone to your deed, consulting one is often beneficial. A legal expert can guide you through the process of completing a San Diego California Grant Deed from Individual to Husband and Wife and ensure all necessary steps are followed. This can help you avoid mistakes that might complicate future property matters.

To add your spouse to your deed in California, you should complete a San Diego California Grant Deed from Individual to Husband and Wife. Fill out the deed with both names, sign it, and ensure it's notarized. Afterward, record the deed with the appropriate county office to make the ownership official.

Yes, you can add someone to a deed without a lawyer by using a San Diego California Grant Deed from Individual to Husband and Wife. Many online resources provide the necessary forms and guidance. However, even though it is possible, seeking legal advice can help you navigate the complexities of property law and prevent potential issues.

While adding someone to a deed can simplify ownership, there are potential disadvantages. For example, it may expose the property to the new owner's creditors or affect your eligibility for certain government benefits. Additionally, making someone a co-owner can complicate future property decisions or sales. Hence, it's wise to weigh these factors carefully.