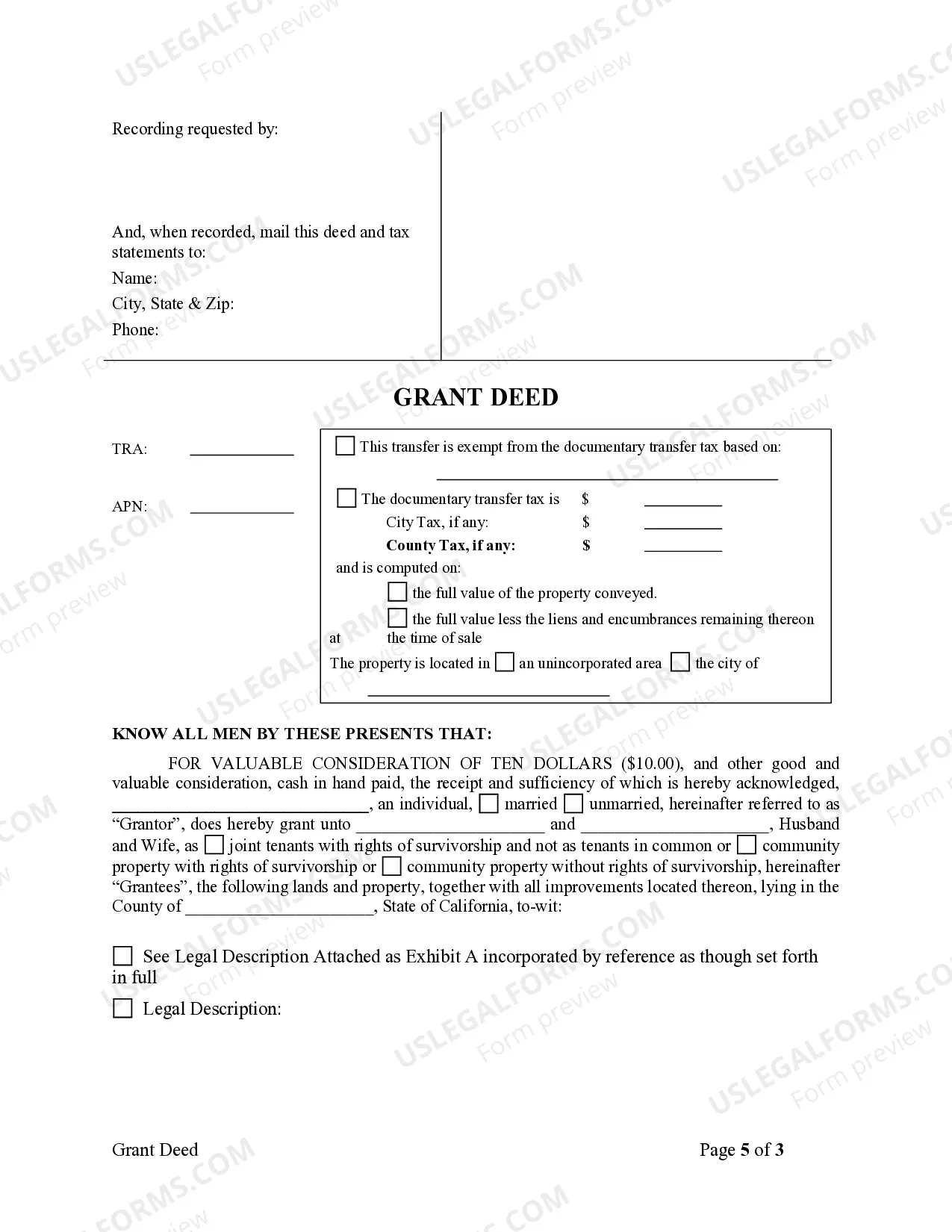

This Grant Deed is needed when an individual wishes to grant certain property to a Husband and Wife. Upon signing this form, the Husband and Wife will be the sole owners of the property granted to them by the individual.

Santa Clara California Grant Deed from Individual to Husband and Wife

Description

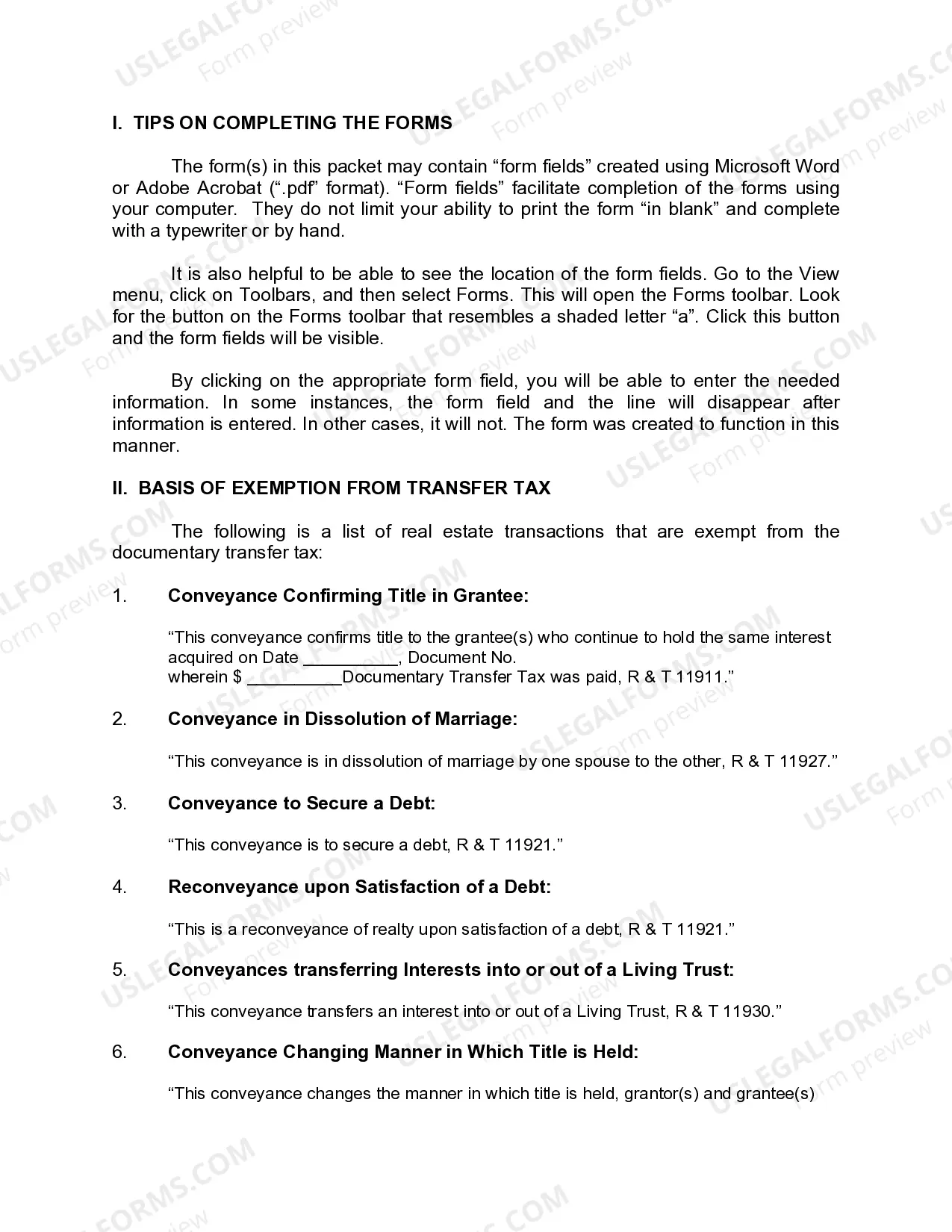

How to fill out California Grant Deed From Individual To Husband And Wife?

Locating authenticated templates that align with your local statutes can be challenging unless you utilize the US Legal Forms vault.

It is an online repository of over 85,000 legal documents for both personal and business needs as well as various real-world scenarios.

All the files are systematically arranged by purpose and jurisdiction, making the search for the Santa Clara California Grant Deed from Individual to Husband and Wife quick and simple.

Keeping documents organized and compliant with legal standards is of utmost importance. Utilize the US Legal Forms library to always have crucial document templates readily available for your needs!

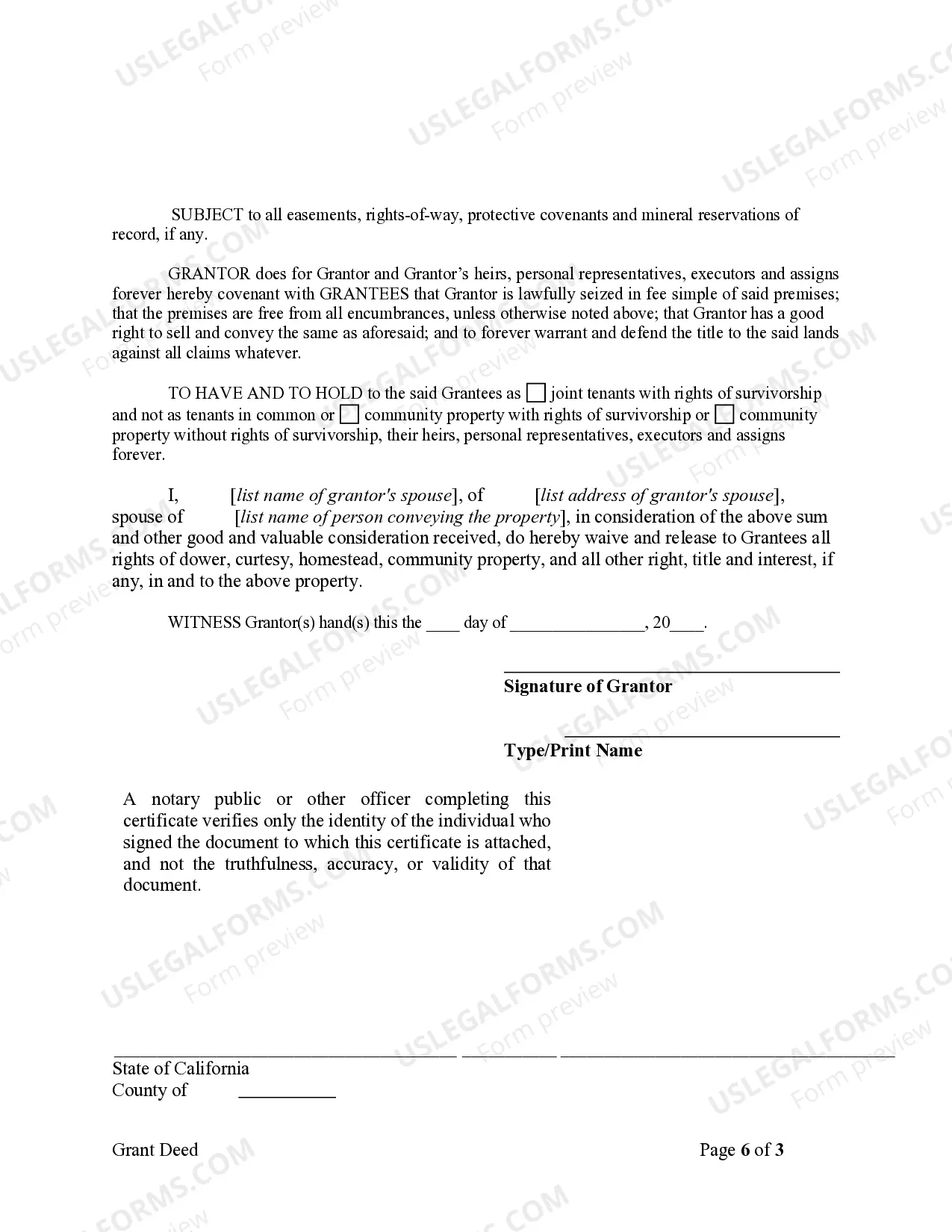

- Ensure to review the Preview mode and document description.

- Verify that you have selected the correct template that fulfills your requirements and aligns perfectly with your local legal standards.

- Look for an alternative template, if necessary.

- If you detect any discrepancies, utilize the Search tab at the top to find the appropriate one.

- If it meets your needs, proceed to the next phase.

Form popularity

FAQ

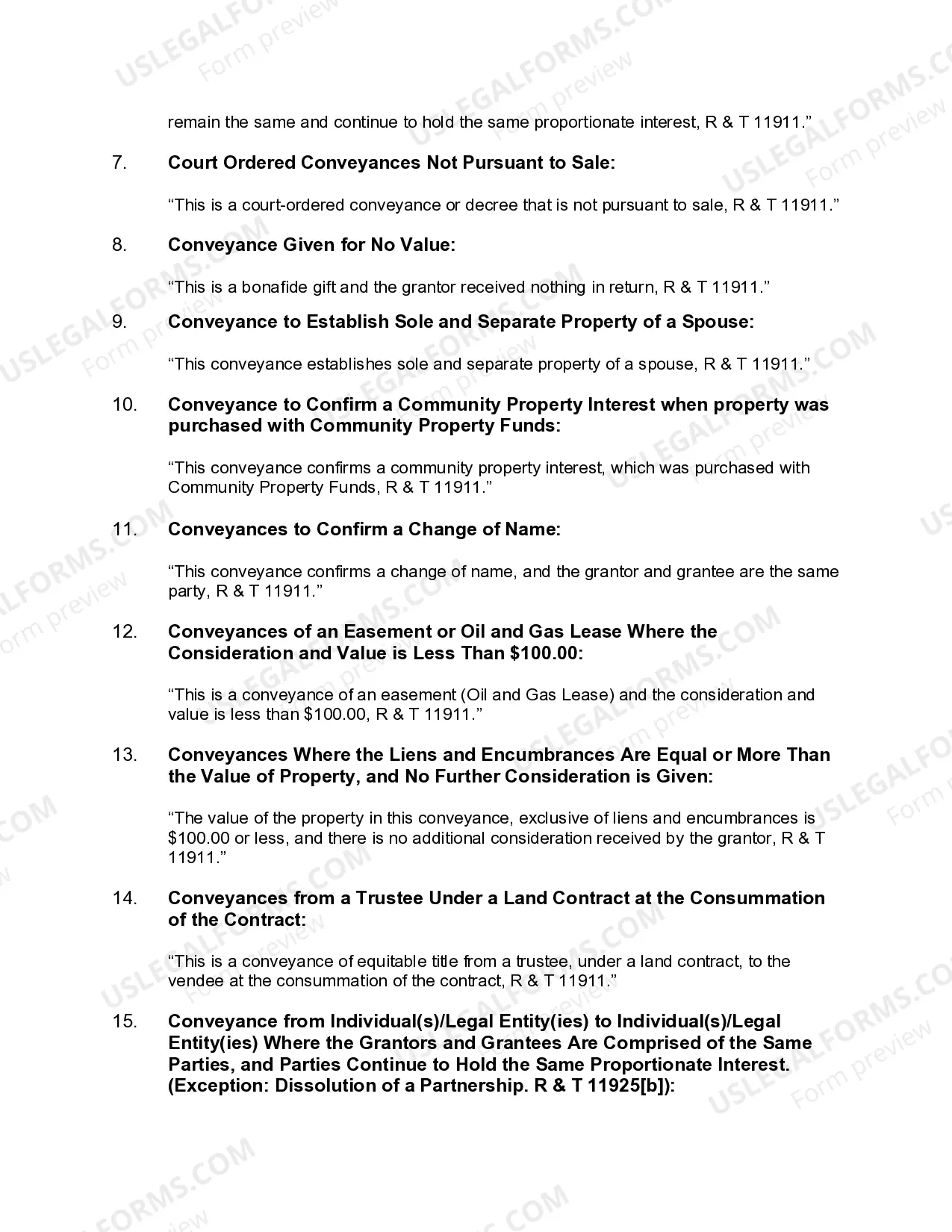

To obtain a copy of your house deed in Santa Clara County, visit the Santa Clara County Recorder's Office or access their website. You can search for your property using the address or parcel number. If you need assistance, platforms like USLegalForms can guide you through the process to acquire essential documents, including the Santa Clara California Grant Deed from Individual to Husband and Wife.

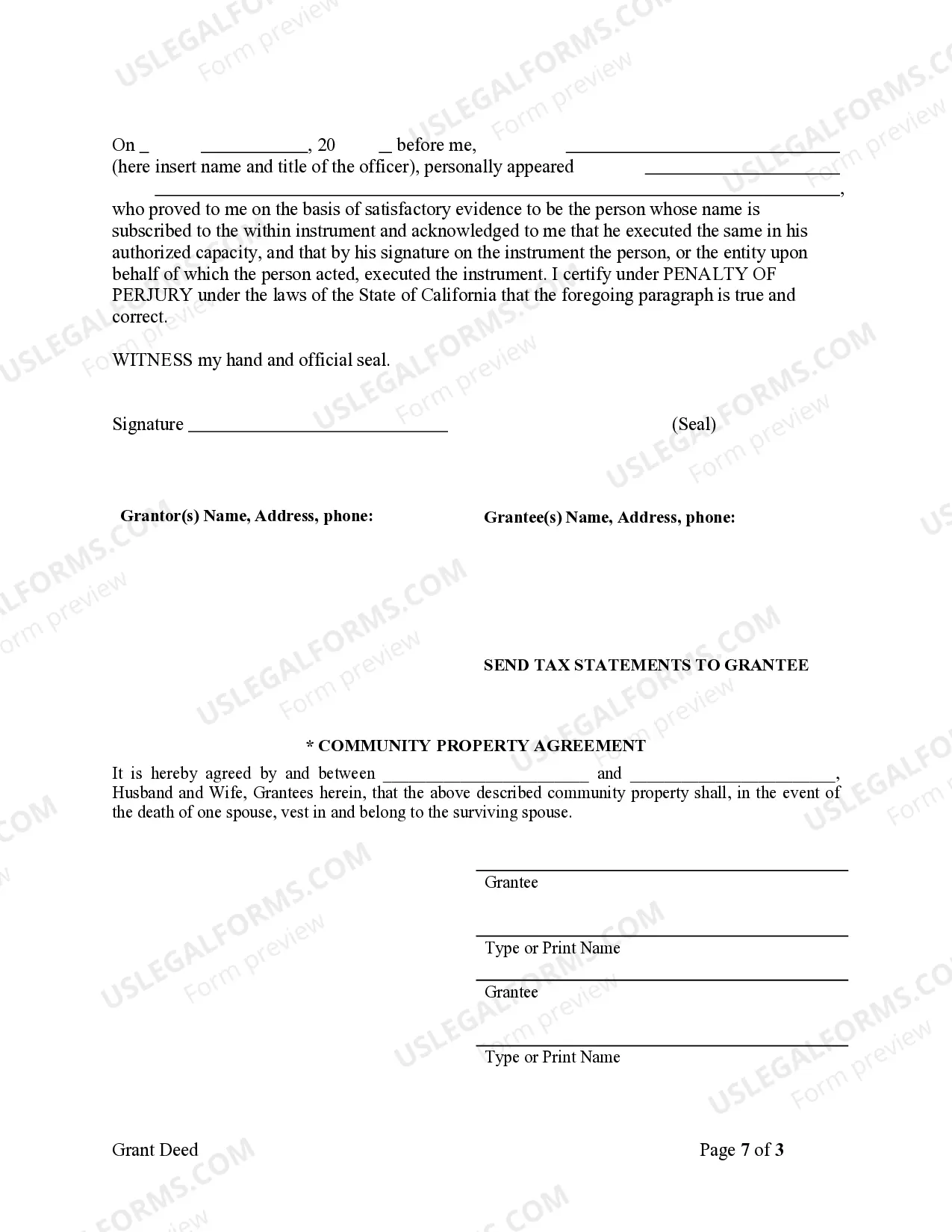

To add your spouse to the house deed in California, you typically need to prepare a new Santa Clara California Grant Deed from Individual to Husband and Wife. This deed will list both spouses as owners. After completing the document, you must sign it in front of a notary public and file it with the Santa Clara County Recorder's Office. This process helps ensure both partners are recognized as co-owners of the property.

Adding someone to a deed in California may trigger property tax reassessment, depending on the ownership structure and relationship between the parties. Generally, California allows for certain exemptions, especially when making transfers between spouses or adding a spouse to a deed. It's essential to consult a tax professional or real estate attorney to understand the implications fully. At US Legal Forms, you can find resources to help navigate the Santa Clara California Grant Deed from Individual to Husband and Wife transfer with clarity on potential tax impacts.

The best way to transfer property title between family members is often through a grant deed or a quitclaim deed, depending on the circumstances. These documents allow you to clearly outline the transfer while maintaining family relationships and avoiding unnecessary complications. In particular, when transferring from an individual to a married couple, it is crucial to follow the regulations set by California law. US Legal Forms offers templates specifically designed for the Santa Clara California Grant Deed from Individual to Husband and Wife, making this process easier.

To add someone to a grant deed in California, you will need to prepare and file a new deed that includes both parties’ names. Typically, a quitclaim deed is used to transfer ownership and rights to property. For a successful transaction, you must ensure the new deed complies with California laws, which may include notarization and a proper filing with your county recorder. Using platforms like US Legal Forms can simplify this process by providing templates tailored for Santa Clara California Grant Deed from Individual to Husband and Wife.

To remove someone from a deed without refinancing, you can create a quitclaim deed or grant deed that transfers ownership from both parties to the remaining owner. This process allows you to bypass refinancing while ensuring legal documentation of the ownership change. You must record the new deed with your local county recorder's office to finalize the removal. US Legal Forms can help simplify this task with easy-to-follow templates.

Removing someone from a grant deed involves creating a new deed that specifies the change in ownership. This new document must indicate the intent to change the title from both parties to just one. Once completed and notarized, the new deed should be filed with the county recorder's office to ensure proper legal documentation. Consider using US Legal Forms for expert guidance on this process.

To remove someone from a grant deed in California, you typically need to draft a new grant deed that transfers the interest to the remaining owner. The deed must clearly specify the names involved and reflect the intent to remove the previous owner. After execution, submit it to your local county recorder's office for it to take effect. Alternatively, US Legal Forms offers resources that can assist you in this process.

In California, it is often advisable for both spouses to be on the house title. Doing so provides legal rights and claims to the property for both parties. Additionally, including both names can help with inheritance matters, should one spouse pass away. Using a Santa Clara California grant deed from individual to husband and wife can facilitate including both names on the title.

Filling out a California grant deed involves providing specific information like the property's legal description, grantor's name, and grantee's name. You must clearly indicate if the transfer is from an individual to a husband and wife. It's also necessary to include the date of the transfer and to sign the document before a notary public. Explore resources like US Legal Forms for templates that guide you through this process.