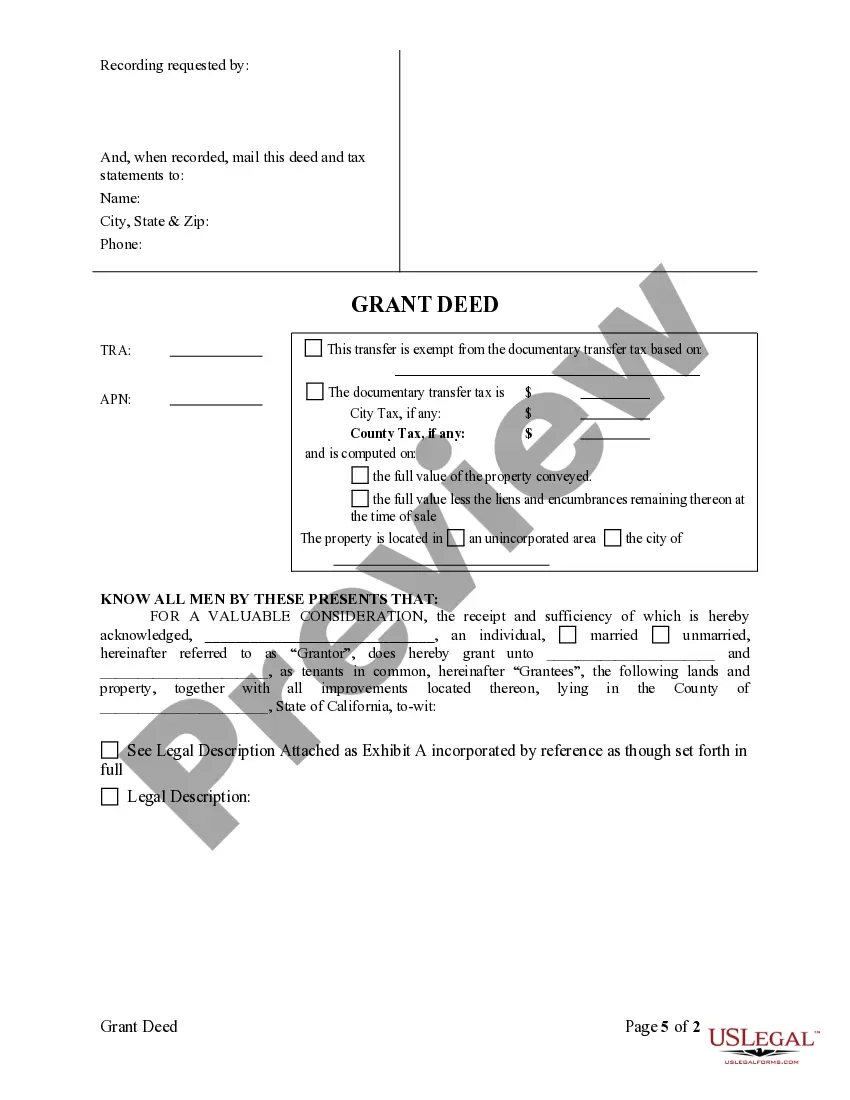

This form is a Warranty Deed where the grantors is an individual and the grantees are two individuals. Grantor conveys and warrants the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A San Diego California Grant Deed From Individual to Two Individuals as Tenants in Common is a legal document that transfers ownership of real property from one individual to two other individuals as co-owners. This type of grant deed establishes a joint tenancy, where both parties hold an undivided interest in the property. It is a common way for individuals to own property together while ensuring equal rights and responsibilities for all parties involved. This grant deed ensures that the ownership rights are shared equally between the two individuals while allowing them to retain their independence. The granter, the individual transferring the property, agrees to convey their interest in the property to the grantees, the two individuals receiving the property. The grantees then become co-owners with equal rights to the property. By obtaining a San Diego California Grant Deed From Individual to Two Individuals as Tenants in Common, the co-owners acquire an undivided interest in the property. This means that both parties have the right to use and enjoy the entire property, and they are not limited to specific portions. In case of a sale, each co-owner is entitled to a proportionate share of the proceeds. It is important to note that there are different types of grant deeds depending on the specific circumstances or preferences of the parties involved. For instance, a San Diego California Grant Deed From Individual to Two Individuals as Tenants in Common with Rights of Survivorship can be used if the co-owners wish to ensure that upon the death of one, the surviving owner will automatically inherit the deceased owner's share. Furthermore, individuals may also opt for a San Diego California Joint Tenancy Grant Deed, where co-owners have equal rights to the property, but with the right of survivorship. This means that if one owner passes away, their share automatically transfers to the surviving owner. Overall, a San Diego California Grant Deed From Individual to Two Individuals as Tenants in Common provides a legal framework for individuals to share ownership of a property in a fair and equitable manner. It ensures that both parties have equal rights and responsibilities while allowing for flexibility in terms of future transactions or changes in ownership.