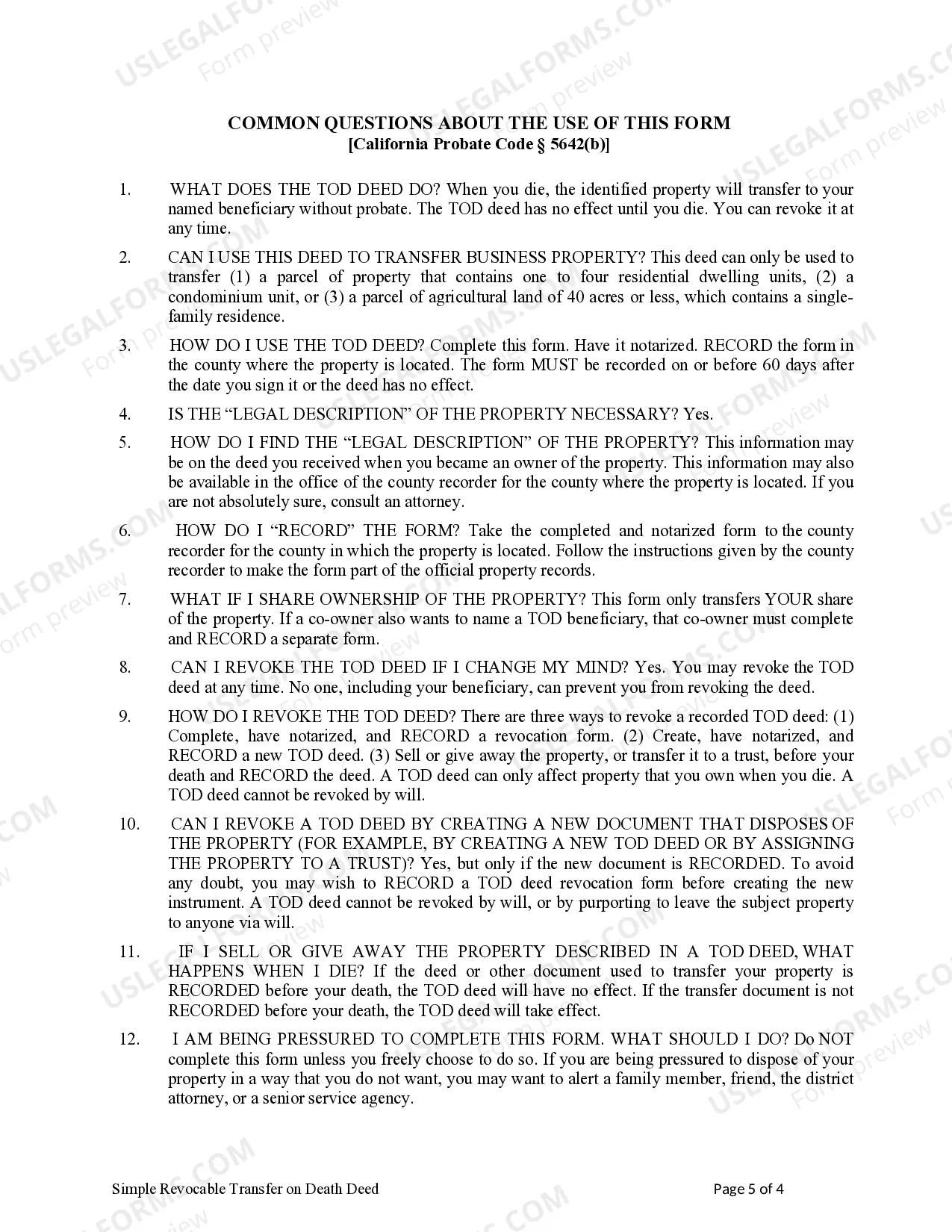

This form is a Revocable Transfer on Death Deed where the Grantor is an individual and the Grantee is an individual. The Grantor retains the right to revoke. The Deed must be recorded on or before 60 days after the date it is signed and notarized or it will not be effective. The Grantee must survive the Grantor or the conveyance is null and void. This deed complies with all state statutory laws.

Concord California Revocable Transfer on Death Deed — Individual to Individual is a legal instrument that allows an individual property owner in Concord, California to transfer their real property to another individual beneficiary upon their death, without the need for probate. This type of deed is often used by homeowners who want to ensure a smooth transfer of their property to a specific person or persons upon their passing, and to avoid the lengthy and costly probate process. It enables the property owner to have control and flexibility over who receives their property after their demise, while also providing certain safeguards and revocable options. There are various types of Concord California Revocable Transfer on Death Deeds — Individual to Individual, each serving a specific purpose: 1. Single Beneficiary Deed: This type of transfer on death deed designates a single individual as the beneficiary. It allows the property owner to name a specific person who will inherit the property upon their death. 2. Multiple Beneficiary Deed: This option allows the property owner to name multiple individuals as beneficiaries, specifying the percentage of the property each beneficiary will receive. It is commonly used when the property owner wants to divide the property equally among their children or heirs. 3. Successor Beneficiary Deed: This type of transfer on death deed designates both a primary beneficiary and a successor beneficiary. The primary beneficiary is typically the initial recipient of the property, while the successor beneficiary would inherit the property if the primary beneficiary predeceases the property owner. 4. Contingent Beneficiary Deed: A contingent beneficiary deed acts as a backup plan in case the primary beneficiary cannot inherit the property for any reason. It allows the property owner to name an alternative beneficiary, who would receive the property if the primary beneficiary is unable to do so. Revocable Transfer on Death Deeds — Individual to Individual provides flexibility to the property owner, as they can revoke or change the beneficiaries at any time during their lifetime. This type of deed can be an effective estate planning tool, as it provides a streamlined transfer process and avoids the need for court involvement. It's crucial to consult with an experienced attorney or legal professional in Concord, California, to ensure compliance with local laws and regulations and to properly execute the transfer on death deed.