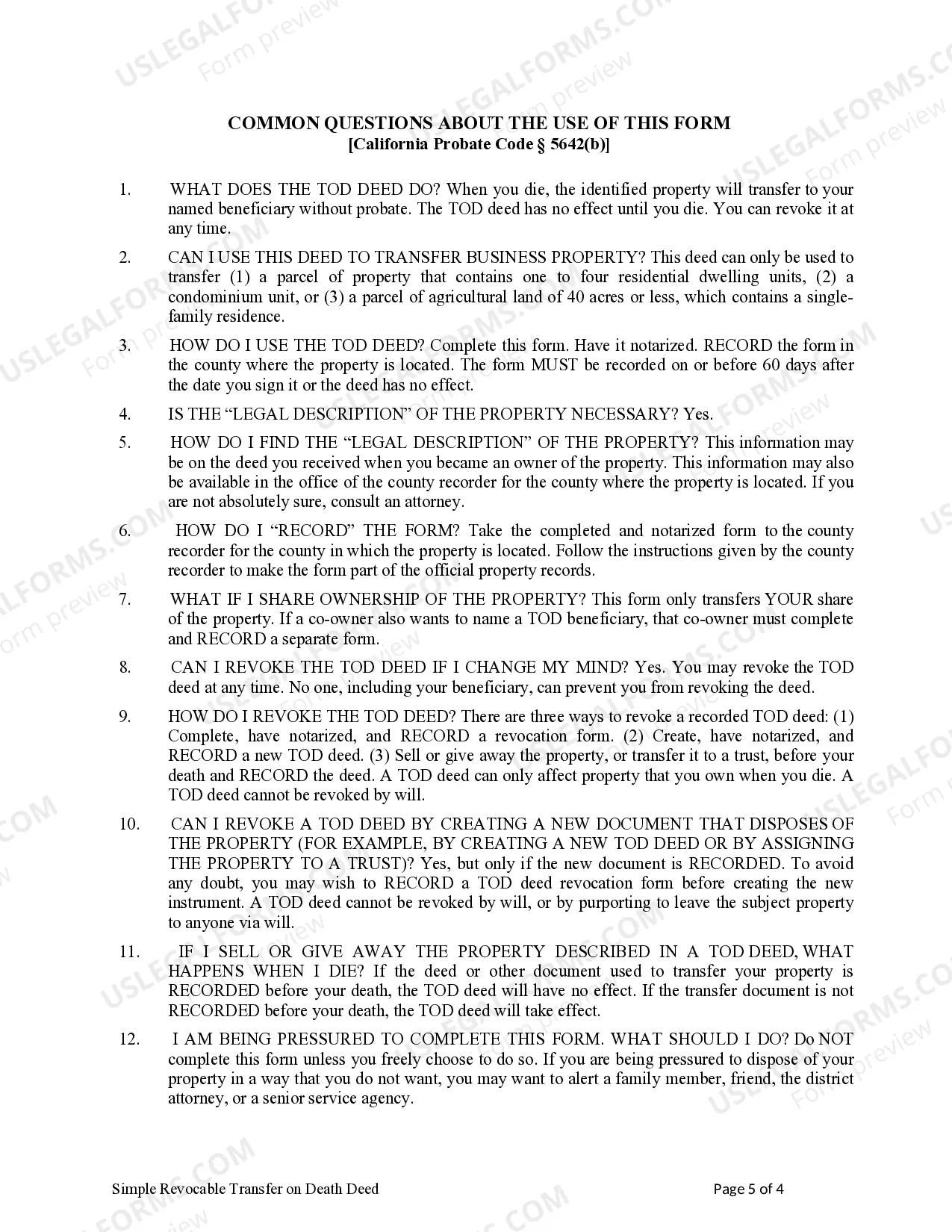

This form is a Revocable Transfer on Death Deed where the Grantor is an individual and the Grantee is an individual. The Grantor retains the right to revoke. The Deed must be recorded on or before 60 days after the date it is signed and notarized or it will not be effective. The Grantee must survive the Grantor or the conveyance is null and void. This deed complies with all state statutory laws.

The El Cajon California Revocable Transfer on Death Deed — Individual to Individual is a legal instrument that enables property owners in El Cajon, California, to transfer their property to a named individual upon their death, without the need for probate. This deed is commonly used as a method to streamline the transfer of real estate assets, allowing property owners to dictate their desired beneficiaries and avoid the time-consuming and costly probate process. The main purpose of the El Cajon California Revocable Transfer on Death Deed — Individual to Individual is to ensure a smooth transition of the property to the desired beneficiary upon the owner's demise. By utilizing this type of deed, property owners can maintain control over their property during their lifetime while also having the freedom to revoke or modify the transfer at any time before their death. It is important to note that there are various types of El Cajon California Revocable Transfer on Death Deeds available, allowing individuals to choose the one that best suits their specific needs: 1. Traditional Transfer on Death Deed: This type of deed is the standard version that allows property owners to name an individual beneficiary who will receive the property upon their death. 2. Contingent Transfer on Death Deed: In cases where the primary beneficiary is unable or unwilling to accept the property, a contingent beneficiary can be named, providing an alternative individual to inherit the property. 3. Multiple Beneficiary Transfer on Death Deed: This type of deed allows property owners to name multiple beneficiaries who will share the property equally upon the owner's death. This is particularly useful if the owner wants to distribute the property among several individuals or entities. 4. Modified Transfer on Death Deed: With this variation, property owners can include specific conditions or restrictions on the transfer of the property, ensuring that the beneficiary complies with certain requirements or obligations before fully receiving ownership. By utilizing the El Cajon California Revocable Transfer on Death Deed — Individual to Individual, property owners can efficiently transfer their real estate assets to their desired beneficiaries, ensuring a clear and documented transfer of ownership without the need for probate. It is essential to consult with a qualified estate planning attorney to properly execute the relevant deed and ensure compliance with all legal requirements.The El Cajon California Revocable Transfer on Death Deed — Individual to Individual is a legal instrument that enables property owners in El Cajon, California, to transfer their property to a named individual upon their death, without the need for probate. This deed is commonly used as a method to streamline the transfer of real estate assets, allowing property owners to dictate their desired beneficiaries and avoid the time-consuming and costly probate process. The main purpose of the El Cajon California Revocable Transfer on Death Deed — Individual to Individual is to ensure a smooth transition of the property to the desired beneficiary upon the owner's demise. By utilizing this type of deed, property owners can maintain control over their property during their lifetime while also having the freedom to revoke or modify the transfer at any time before their death. It is important to note that there are various types of El Cajon California Revocable Transfer on Death Deeds available, allowing individuals to choose the one that best suits their specific needs: 1. Traditional Transfer on Death Deed: This type of deed is the standard version that allows property owners to name an individual beneficiary who will receive the property upon their death. 2. Contingent Transfer on Death Deed: In cases where the primary beneficiary is unable or unwilling to accept the property, a contingent beneficiary can be named, providing an alternative individual to inherit the property. 3. Multiple Beneficiary Transfer on Death Deed: This type of deed allows property owners to name multiple beneficiaries who will share the property equally upon the owner's death. This is particularly useful if the owner wants to distribute the property among several individuals or entities. 4. Modified Transfer on Death Deed: With this variation, property owners can include specific conditions or restrictions on the transfer of the property, ensuring that the beneficiary complies with certain requirements or obligations before fully receiving ownership. By utilizing the El Cajon California Revocable Transfer on Death Deed — Individual to Individual, property owners can efficiently transfer their real estate assets to their desired beneficiaries, ensuring a clear and documented transfer of ownership without the need for probate. It is essential to consult with a qualified estate planning attorney to properly execute the relevant deed and ensure compliance with all legal requirements.