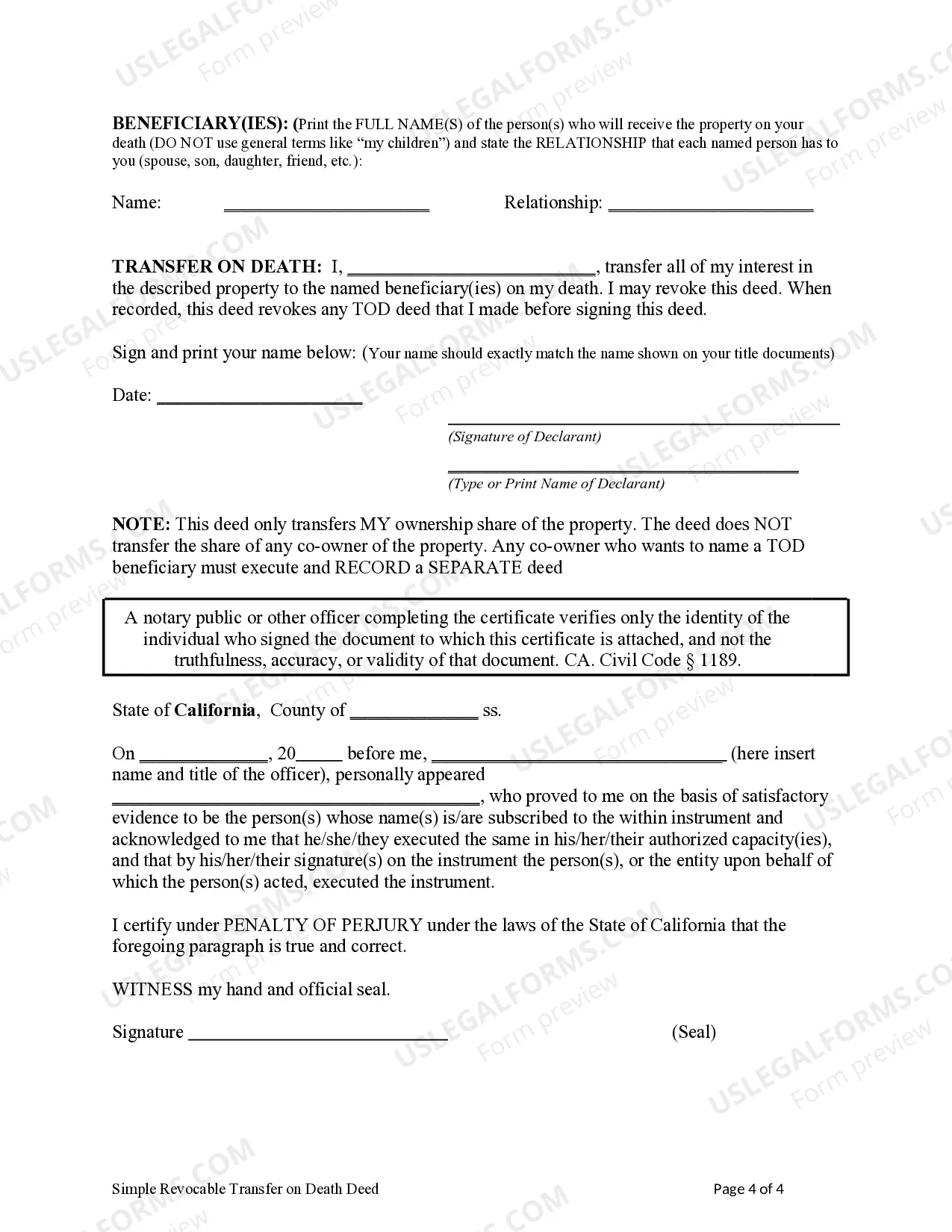

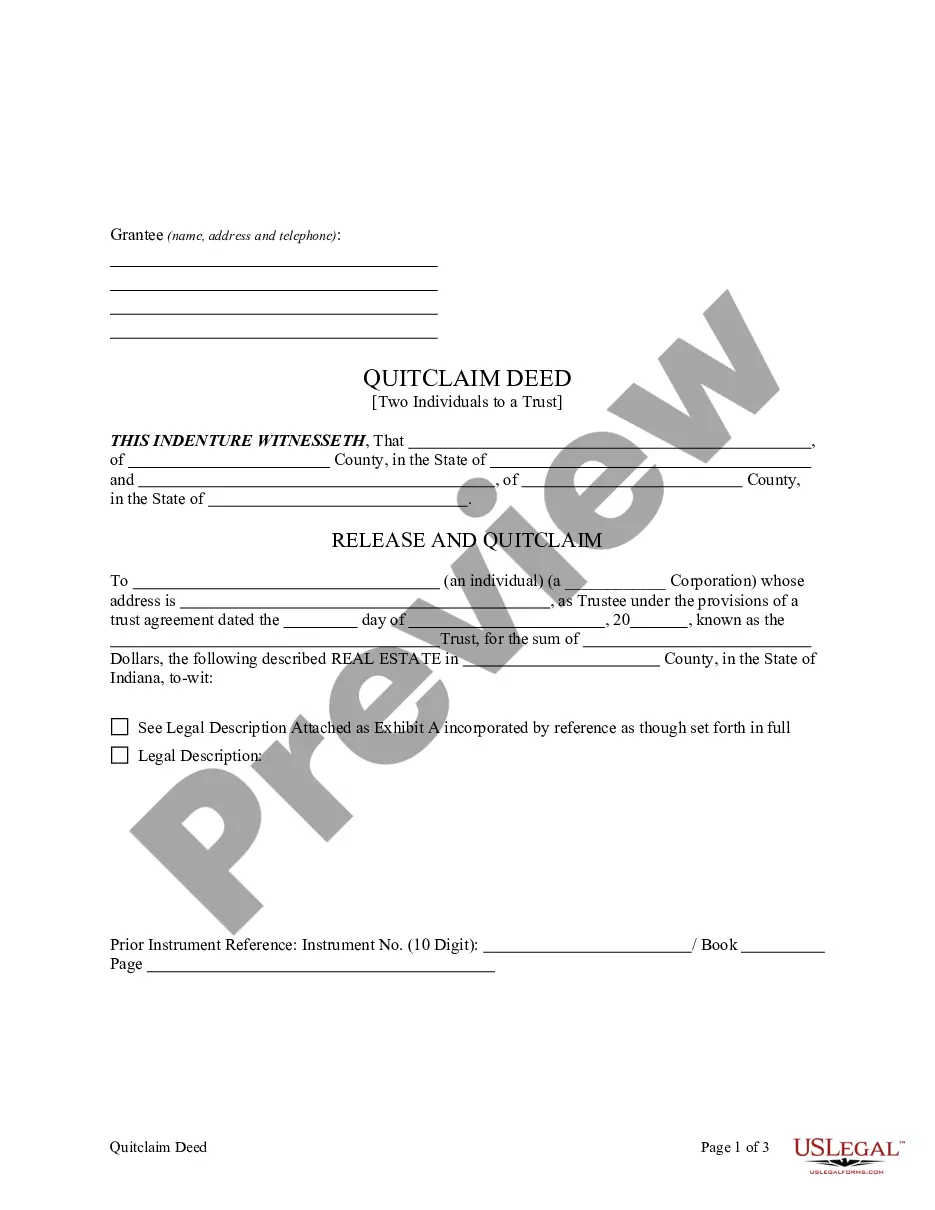

This form is a Revocable Transfer on Death Deed where the Grantor is an individual and the Grantee is an individual. The Grantor retains the right to revoke. The Deed must be recorded on or before 60 days after the date it is signed and notarized or it will not be effective. The Grantee must survive the Grantor or the conveyance is null and void. This deed complies with all state statutory laws.

Irvine California Revocable Transfer on Death Deed - Individual to Individual

Description

How to fill out Irvine California Revocable Transfer On Death Deed - Individual To Individual?

If you have previously utilized our service, sign in to your account and download the Irvine California Revocable Transfer on Death Deed - Individual to Individual onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have unlimited access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to access it again. Leverage the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

- Ensure you’ve found a suitable document. Review the description and use the Preview feature, if available, to verify it satisfies your needs. If it does not suit you, utilize the Search tab above to locate the right one.

- Buy the template. Click the Buy Now button and choose between a monthly or yearly subscription plan.

- Create an account and process your payment. Provide your credit card information or select the PayPal option to finalize the transaction.

- Obtain your Irvine California Revocable Transfer on Death Deed - Individual to Individual. Select the file format for your document and store it on your device.

- Finalize your sample. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

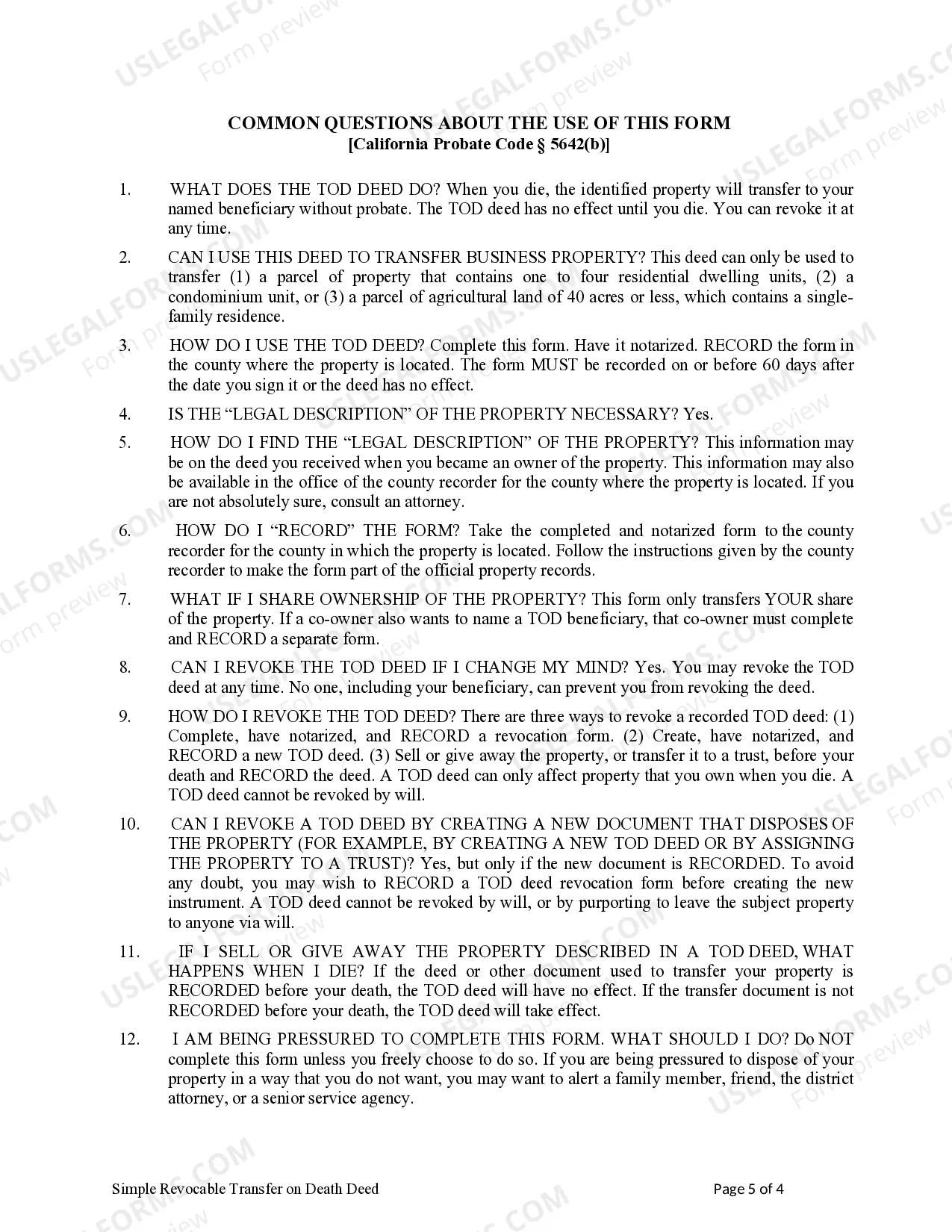

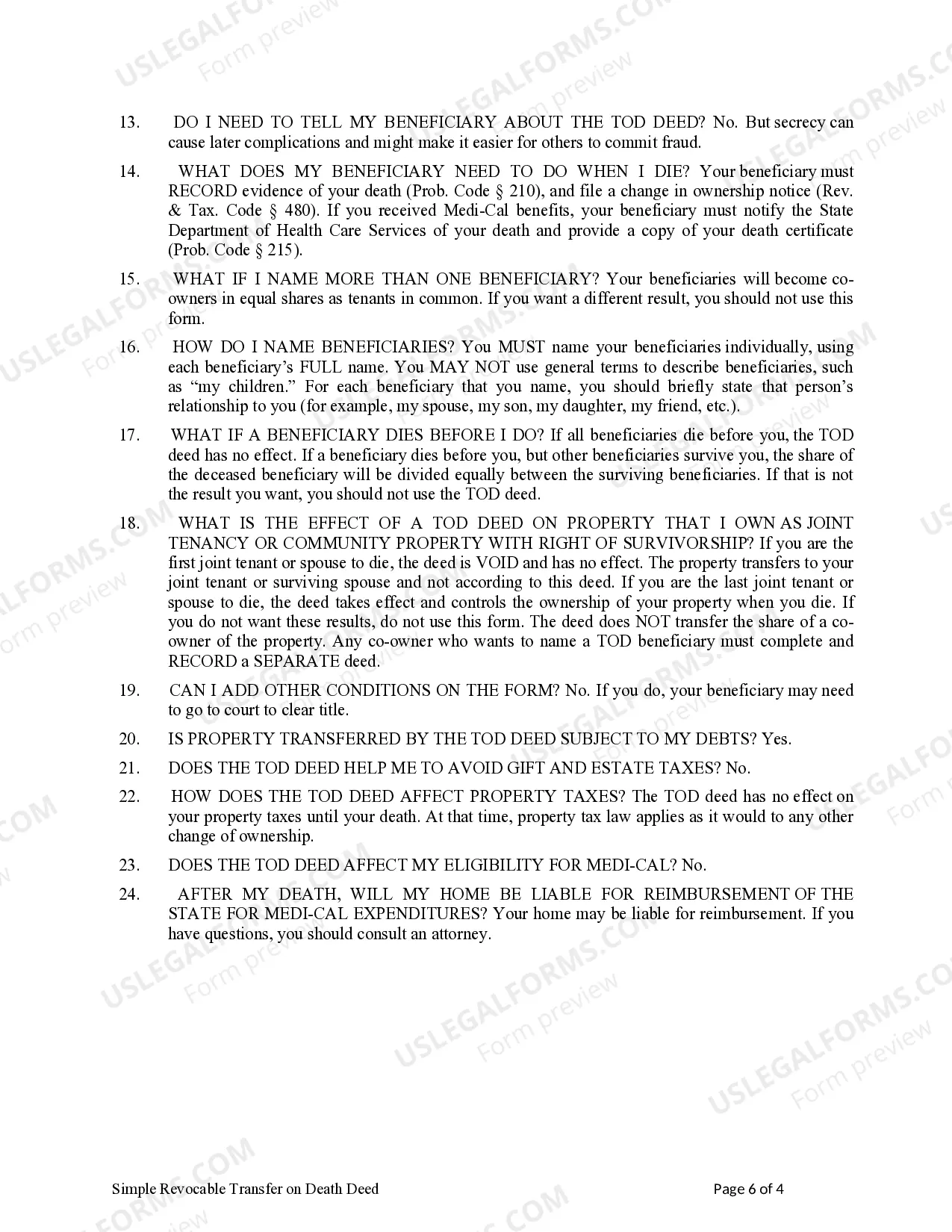

The California TOD deed form allows a person to avoid probate by using a deed to transfer property at his or her death. California first authorized TOD deeds on January 1, 2016, joining the growing list of states that allow probate to be avoided when property is transferred by a revocable deed.

Sunset Date. California's legislation that originally authorized TOD deeds in 2016 contained a sunset provision automatically repealing the TOD statute on January 1, 2022?unless extended before that date.

A California TOD deed must also be recorded with the county recorder of the county where the property is located. The amended statute requires recording within 60 days of a TOD deed's notarization date?a minor change from the prior version's recording deadline of 60 days after execution.

Step 1: Locate the Current Deed for the Property.Step 2: Read the ?Common Questions? Listed on Page 2 of the TOD Deed.Step 3: Fill Out the TOD Deed (Do Not Sign)Step 4: Sign in Front of a Notary; Have Two Witnesses Sign.Step 5: Record the Deed at the Recorder's Office within 60 Days of Signing It.

If the law expires, will your Transfer on Death deed still work? Yes, your Transfer on Death deed will remain valid as long as it is executed before January 1, 2022. However, with the uncertainty of the status of this law, there is no guarantee that future changes to the TOD deed law may not affect you.

In 2016 the California legislature created a Revocable Transfer on Death Deed (?TOD Deed?) as a way for California residents to transfer residential property to named beneficiaries, effective upon death. In 2021, the legislature passed SB-315 to update the law on TOD deeds and address some problems in the earlier law.

Including California, TOD deeds are now permitted in 26 states and the District of Columbia. The TOD deed allows a person to leave his or her real property to a designated person or persons such as a family member, friend, life-long partner or other loved one without having to set up a living trust.

If you register an account in TOD (also called beneficiary) form, the beneficiary you name will inherit the account automatically at your death. No probate court proceedings will be necessary; the beneficiary will deal directly with the brokerage company to transfer the account.