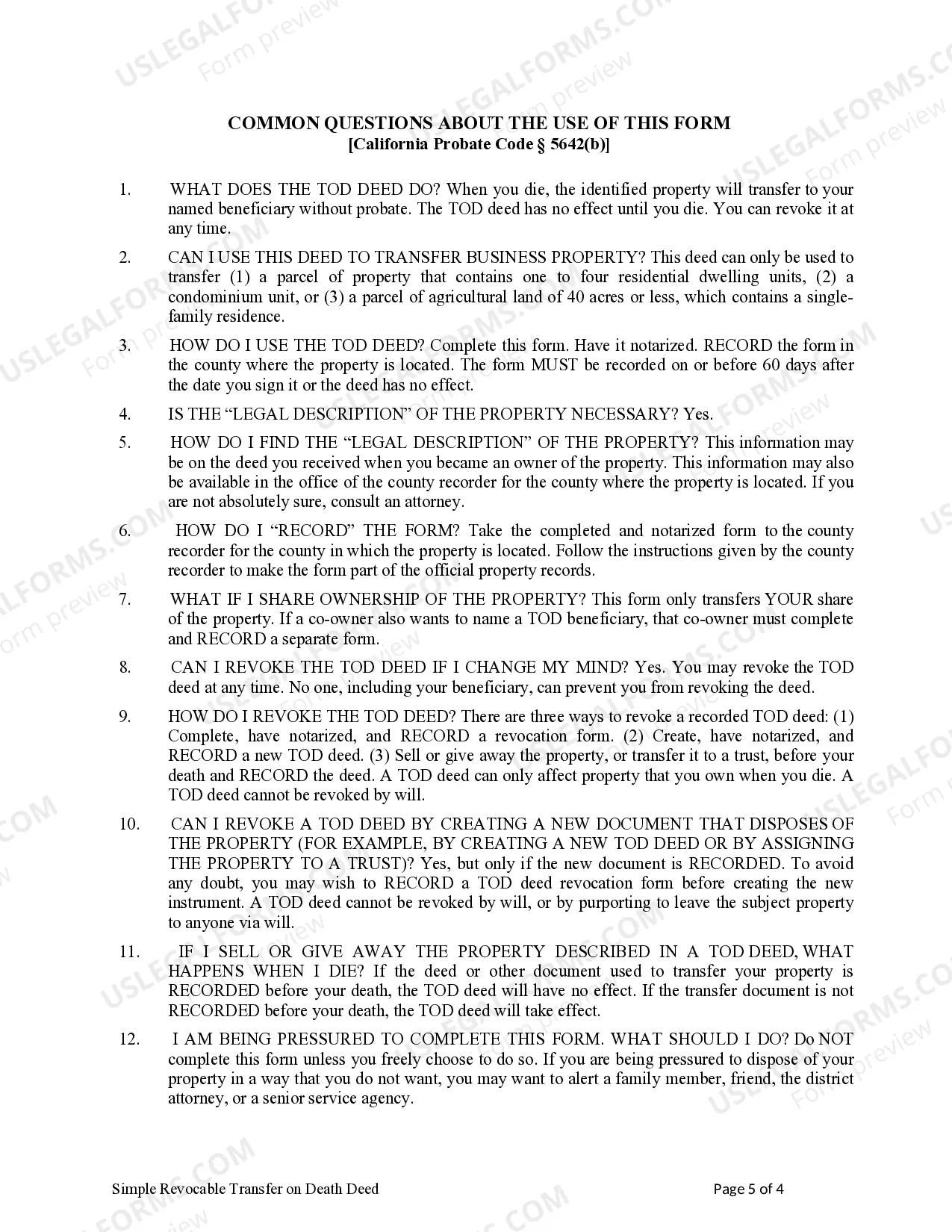

This form is a Revocable Transfer on Death Deed where the Grantor is an individual and the Grantee is an individual. The Grantor retains the right to revoke. The Deed must be recorded on or before 60 days after the date it is signed and notarized or it will not be effective. The Grantee must survive the Grantor or the conveyance is null and void. This deed complies with all state statutory laws.

Los Angeles California Revocable Transfer on Death Deed — Individual to Individual is a legal mechanism that allows property owners in Los Angeles, California, to transfer their real estate assets to beneficiaries upon their death without the need for probate. This type of deed provides a simple and cost-effective way to pass on property outside the traditional probate process. Keywords: Los Angeles California, Revocable Transfer on Death Deed, Individual to Individual, property owners, beneficiaries, probate, real estate assets, legal mechanism, transfer, death, cost-effective, probate process. There are various types or variations of Los Angeles California Revocable Transfer on Death Deed — Individual to Individual, including: 1. Single-party to Single-party Transfer: This type of transfer involves a single property owner designating a single beneficiary to receive the property upon their death. It is commonly used when there is only one primary beneficiary. 2. Joint-party to Joint-party Transfer: In this case, multiple property owners jointly designate one or more beneficiaries to inherit the property upon the death of all parties. It is often utilized by spouses or domestic partners who wish to pass their property collectively to chosen beneficiaries. 3. Single-party to Multiple-party Transfer: This particular type of transfer involves a single property owner designating multiple beneficiaries to share ownership of the property upon their death. It allows for distribution among multiple beneficiaries according to the owner's wishes. 4. Joint-party with Survivorship to Joint-party Transfer: This type of transfer is commonly used by married couples or partners who wish to ensure that the surviving party automatically inherits the property upon the death of one partner. It provides for an immediate transfer of ownership to the surviving party without the need for probate. 5. Joint-party with Right of Sepulcher to Joint-party Transfer: This specific type of transfer is designed for individuals who want to ensure that their chosen beneficiary has control over their remains after their death. In addition to transferring ownership of the property, it grants the beneficiary the right to make decisions regarding the burial or final disposition of the deceased. When considering a Los Angeles California Revocable Transfer on Death Deed — Individual to Individual, it is crucial to consult with an experienced attorney to ensure all legal requirements and specific intentions are properly addressed and documented. This mechanism can help facilitate the seamless transfer of property outside of probate, saving time, money, and the hassle of court proceedings.