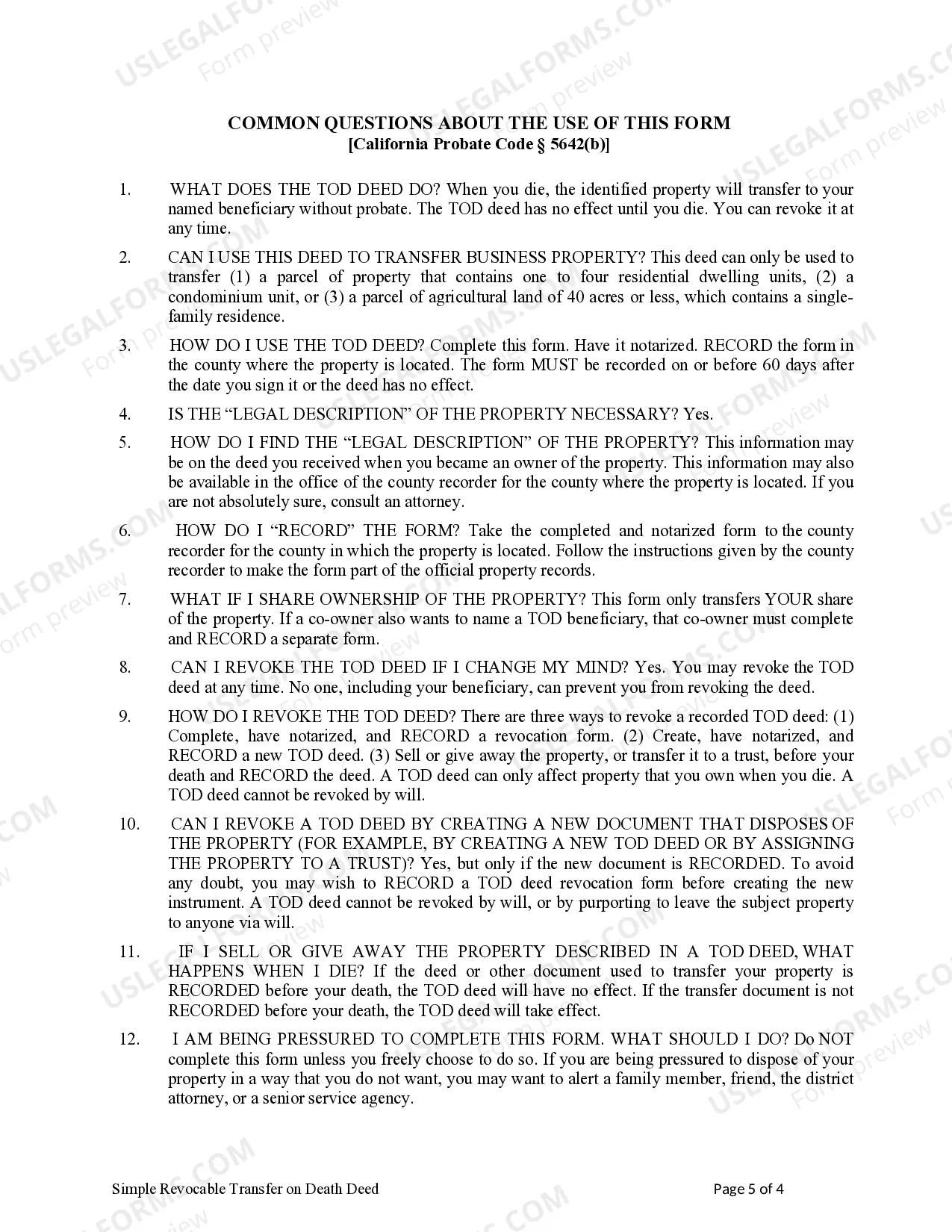

This form is a Revocable Transfer on Death Deed where the Grantor is an individual and the Grantee is an individual. The Grantor retains the right to revoke. The Deed must be recorded on or before 60 days after the date it is signed and notarized or it will not be effective. The Grantee must survive the Grantor or the conveyance is null and void. This deed complies with all state statutory laws.

Rialto California Revocable Transfer on Death Deed (TOD Deed) — Individual to Individual is a legal document that allows property owners in Rialto, California, to transfer their real estate assets to named beneficiaries upon their death without the need for probate. This type of deed provides individuals with an effective estate planning tool, ensuring a smooth transfer of property rights while avoiding the complexities, costs, and delays associated with the probate process. The Rialto California Revocable Transfer on Death Deed — Individual to Individual is specifically designed for property owners who want to retain control over their assets during their lifetime while designating a specific beneficiary to inherit the property upon their passing. The owner has the option to revoke or change the designated beneficiary at any time, providing them with flexibility and control over their estate plan. By creating a Revocable Transfer on Death Deed in Rialto, California, individuals can ensure a legally valid transfer of real estate properties to their desired beneficiary. This deed type guarantees that the property will automatically transfer upon the owner's death, without requiring beneficiary involvement during the owner's lifetime. It eliminates the need for the court-supervised probate process, saving time and money for both the beneficiaries and the estate. Different variations of the Rialto California Revocable Transfer on Death Deed — Individual to Individual may exist, tailored to specific circumstances or requirements. Some potential variations may include joint owners utilizing the deed, allowing them to simultaneously designate beneficiaries and control the transfer of their share of the property. Additionally, married couples may also choose the spousal transfer version, allowing for seamless transfer between spouses upon the first spouse's passing. In conclusion, the Rialto California Revocable Transfer on Death Deed — Individual to Individual is a crucial estate planning instrument for property owners in Rialto looking for an efficient and cost-effective way to pass on their real estate assets to designated beneficiaries. This legal document avoids probate, maintains individual control over the property during the owner's lifetime, and offers flexibility to make changes as needed. It is essential to consult with an attorney to discuss specific circumstances and ensure compliance with Rialto and California's legal requirements when considering this deed type.