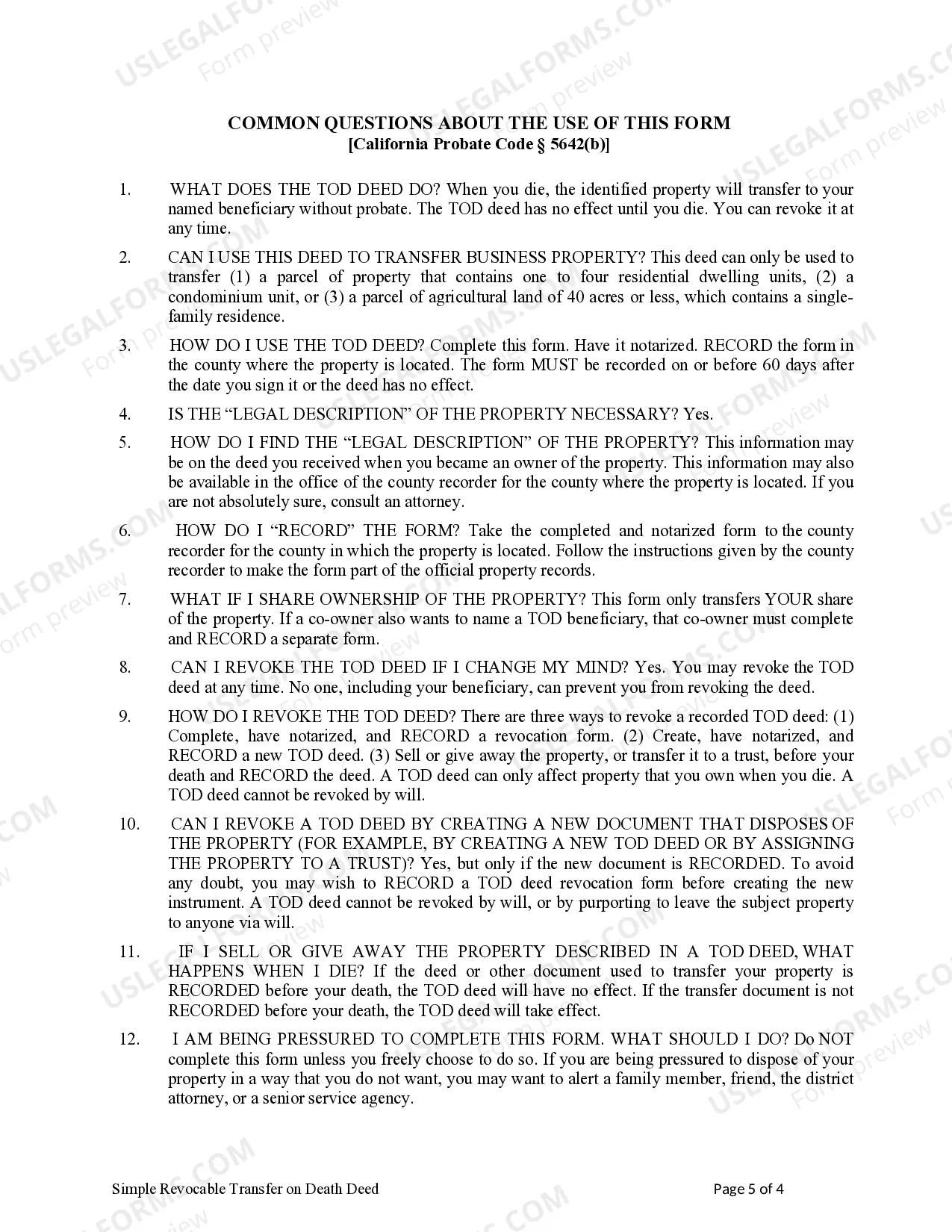

This form is a Revocable Transfer on Death Deed where the Grantor is an individual and the Grantee is an individual. The Grantor retains the right to revoke. The Deed must be recorded on or before 60 days after the date it is signed and notarized or it will not be effective. The Grantee must survive the Grantor or the conveyance is null and void. This deed complies with all state statutory laws.

A San Diego California Revocable Transfer on Death Deed — Individual to Individual is a legal document that allows an individual property owner in San Diego, California, to transfer their property to another individual upon their death, without the need for probate. This type of deed is commonly used to ensure a smooth transfer of real estate assets while minimizing legal complications and costs. The San Diego California Revocable Transfer on Death Deed — Individual to Individual comes in two main types, namely: 1. Basic Revocable Transfer on Death Deed: This type of deed simply transfers the property from the individual owner to the designated beneficiary upon the owner's death. The deed can be revoked or changed by the owner at any time during their lifetime. 2. Joint Revocable Transfer on Death Deed: In this type of deed, two individuals — usually spouses or partner— - are named as co-owners of the property. In the event of the death of one owner, the surviving owner automatically becomes the sole owner of the property without the need for probate. This type of deed provides added protection and convenience for couples or co-owners. It is important to note that the San Diego California Revocable Transfer on Death Deed — Individual to Individual is a legal document that must be executed properly and in compliance with state laws. Consulting with a qualified attorney or estate planning professional is highly recommended ensuring that all legal requirements are met and the intentions of the property owner are properly reflected in the deed. Some keywords relevant to this topic include: San Diego, California, Revocable Transfer on Death Deed, Individual to Individual, property transfer, probate, legal document, real estate assets, estate planning, beneficiary, joint ownership, spouses, partners.