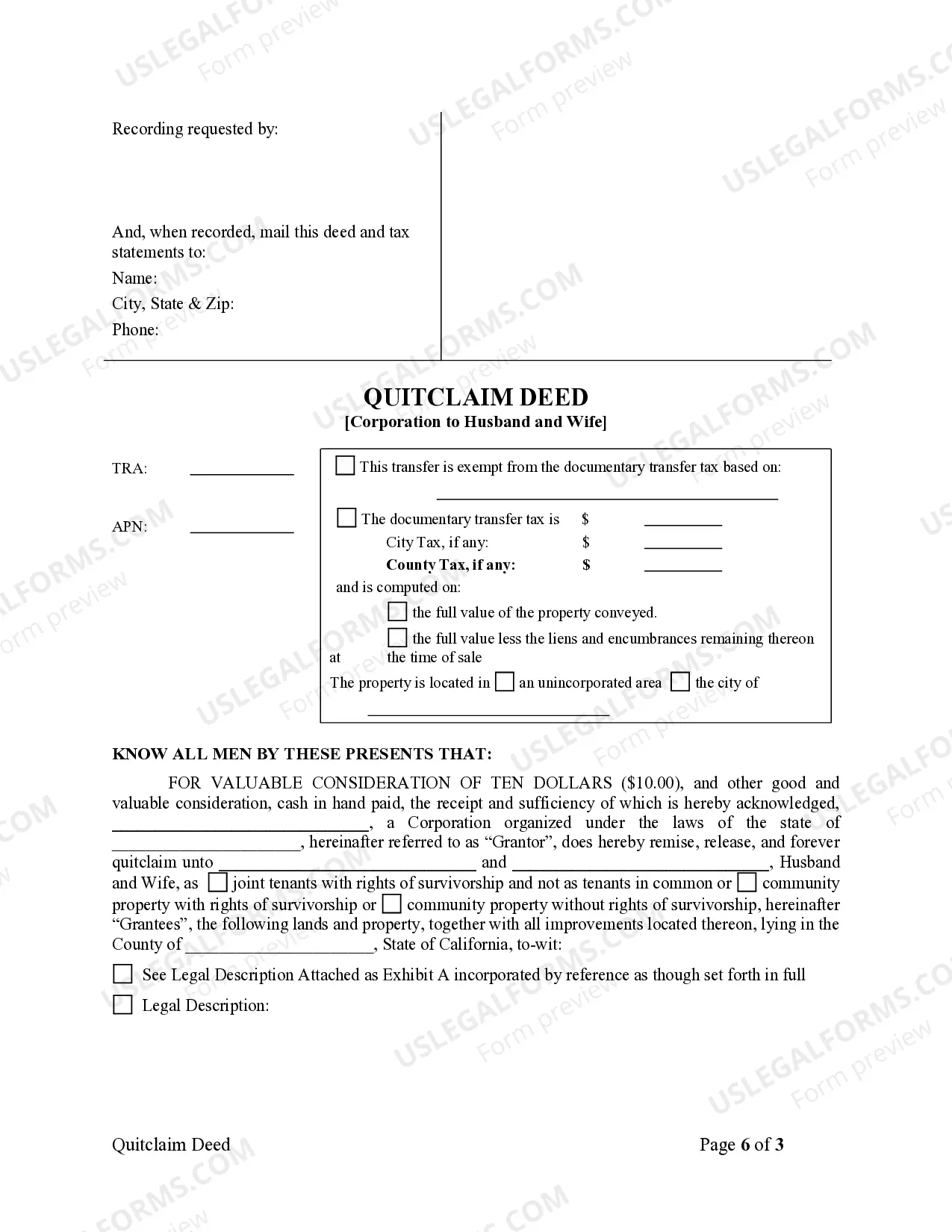

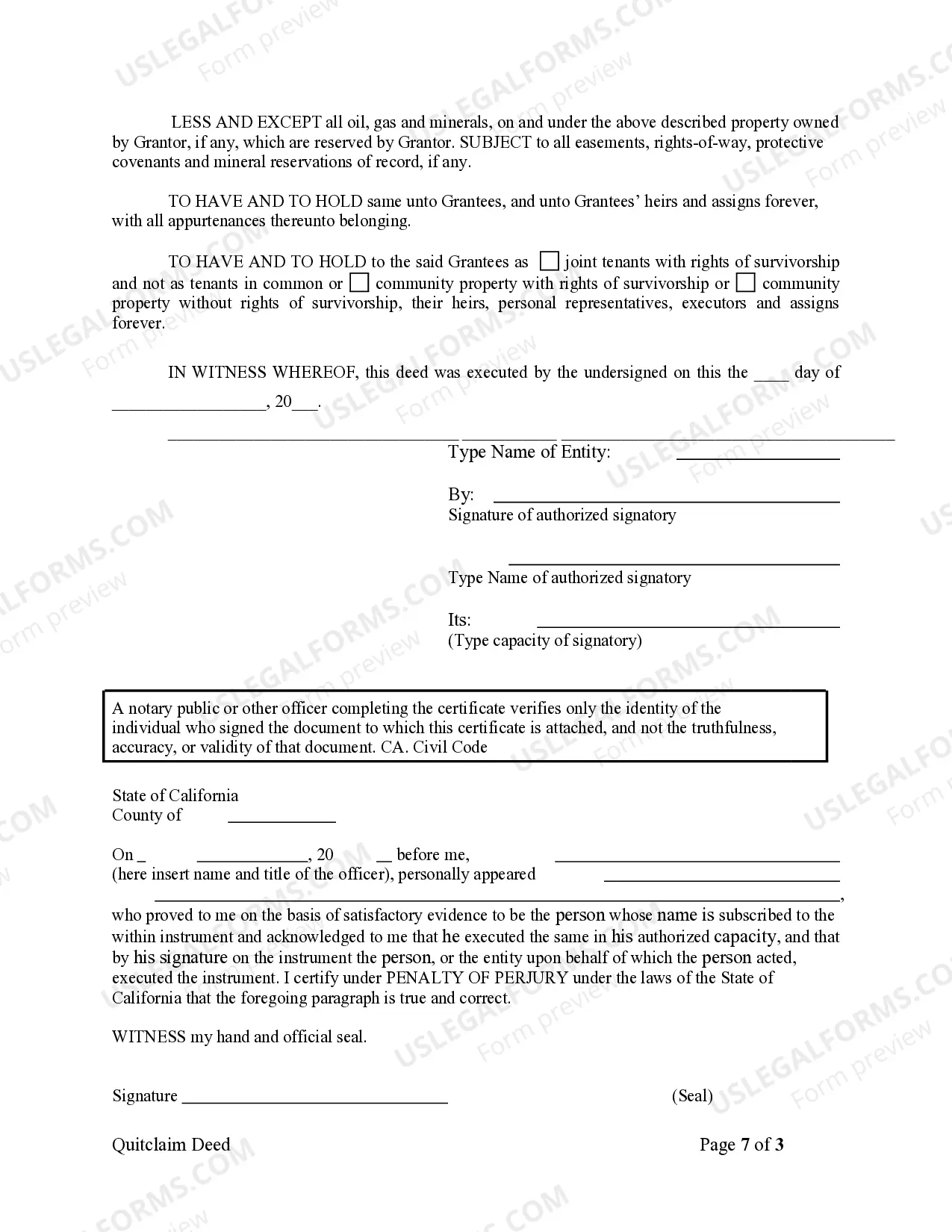

This Quitclaim Deed from Corporation to Husband and Wife form is a Quitclaim Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

A Quitclaim Deed in Anaheim, California is a legal document that transfers ownership of a property from a corporation to a husband and wife. This type of deed is commonly used when a corporation wishes to transfer its interest in a property to a married couple without making any warranties regarding the property's title or condition. The Anaheim California Quitclaim Deed from Corporation to Husband and Wife is a legally binding document that effectively releases the corporation's rights and interests in the property and transfers them to the husband and wife as joint owners. This transfer of ownership is done without any guarantees or promises about the property's history, encumbrances, or legal status. Essentially, the corporation is "quitting" or terminating its claim to the property and passing it on to the couple. The Anaheim Quitclaim Deed allows the corporation to convey its interest to the husband and wife without assuming any liability or responsibility for any potential issues or defects associated with the property. It is important for the husband and wife to thoroughly inspect the property and conduct necessary due diligence before accepting the transfer to ensure they are aware of any possible issues. Different types of Anaheim California Quitclaim Deeds from Corporation to Husband and Wife may include variations in the specific terms or conditions of the transfer, such as: 1. Conditional Quitclaim Deed: This type of deed includes certain conditions or stipulations that must be met for the transfer to be valid. It may outline specific requirements or obligations to be fulfilled by the husband and wife, as well as the consequences of non-compliance. 2. Partial Quitclaim Deed: In this scenario, the corporation only transfers a portion of its ownership interest in the property to the husband and wife while retaining the remaining share. This variation is commonly used when there are multiple owners or shareholders involved. 3. Joint Tenancy Quitclaim Deed: This type of deed creates a joint tenancy between the husband and wife, meaning they both have an equal and undivided interest in the property. In the event of one spouse's death, the surviving spouse automatically inherits the deceased spouse's share. 4. Tenancy in Common Quitclaim Deed: Unlike joint tenancy, a tenancy in common allows the husband and wife to own different proportions of the property. Each party has a distinct and separate ownership interest, which can be freely transferred or inherited outside the rules governing joint tenancy. When executing an Anaheim California Quitclaim Deed from a corporation to a husband and wife, it is recommended to consult with a qualified real estate attorney or a title company familiar with the local laws and requirements to ensure a smooth and legally compliant transfer of ownership.