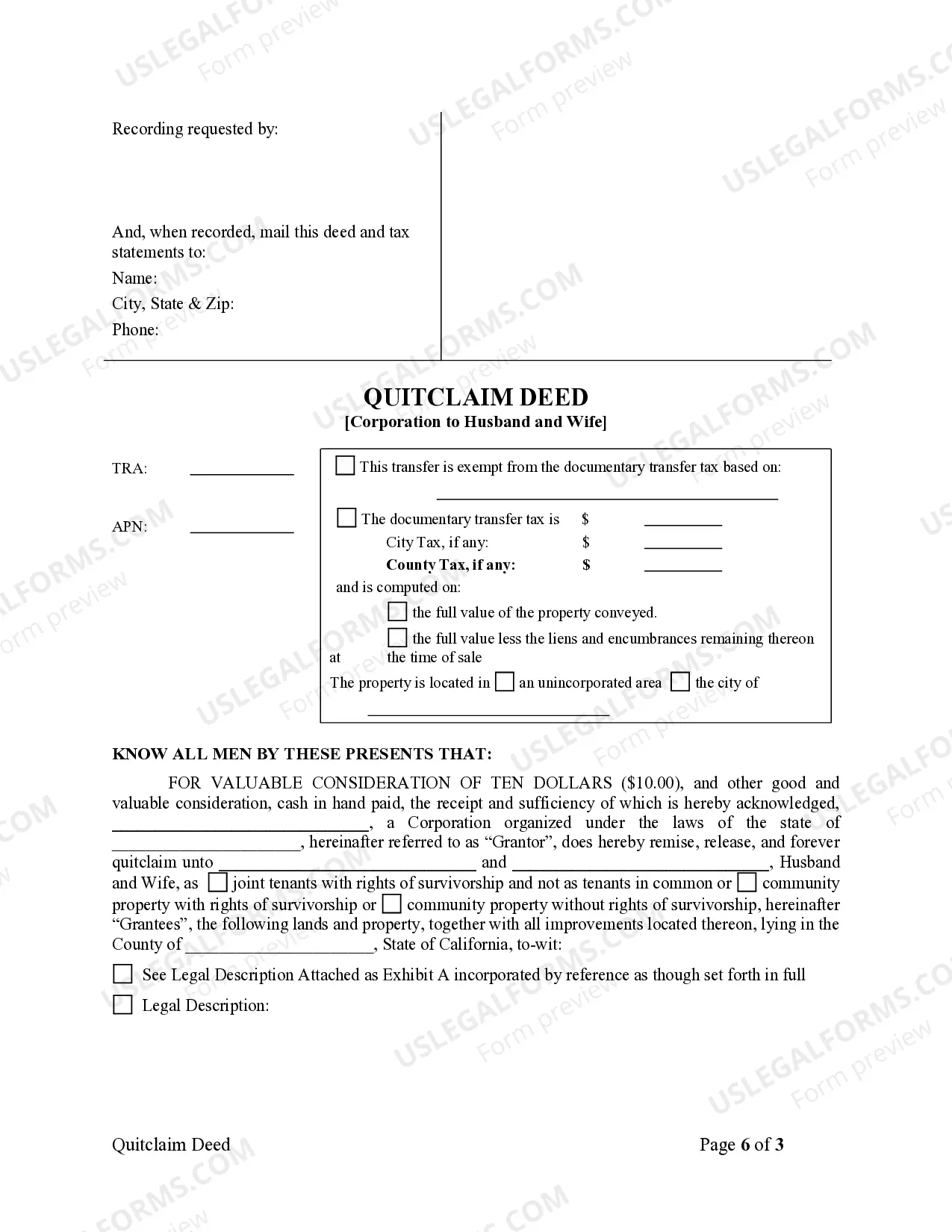

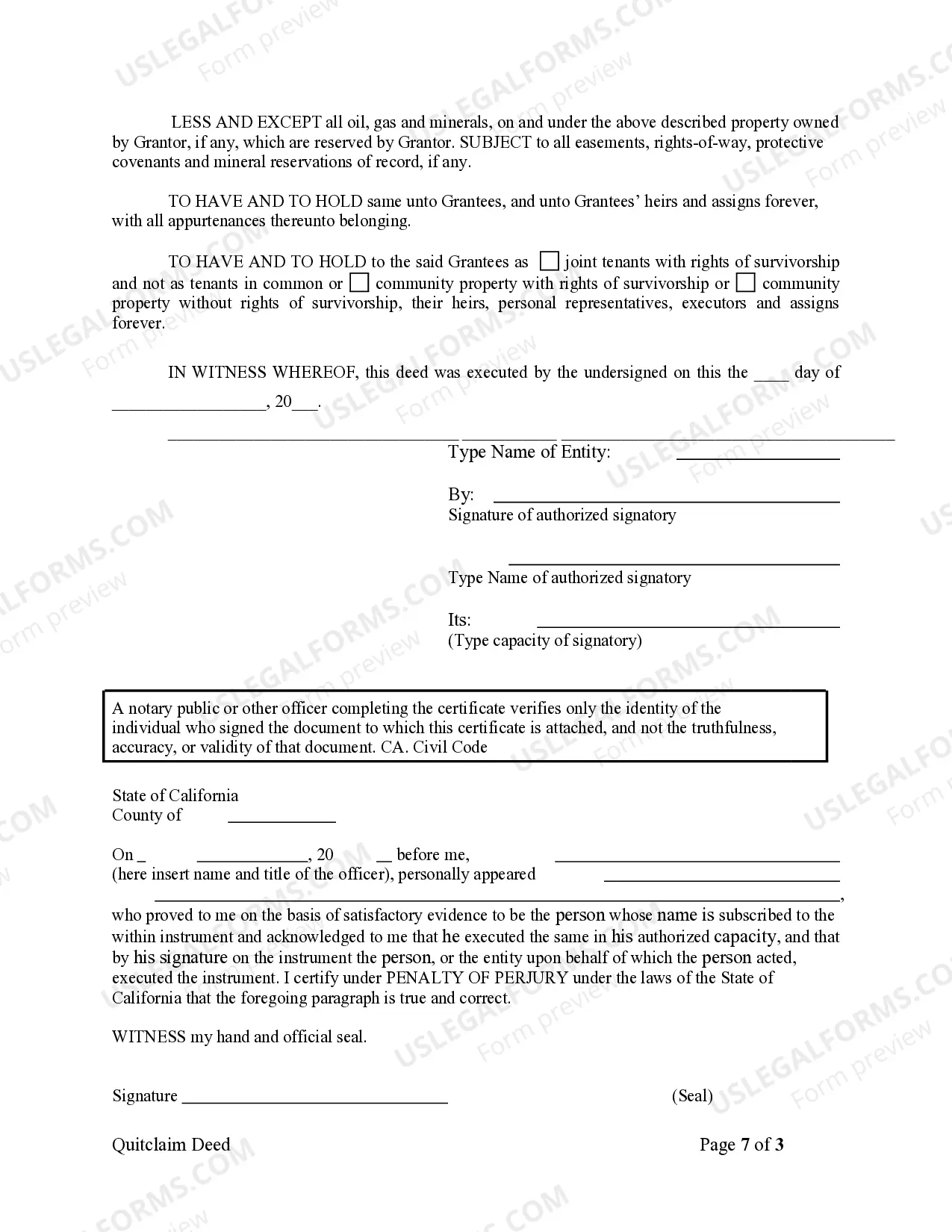

This Quitclaim Deed from Corporation to Husband and Wife form is a Quitclaim Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

A Bakersfield California Quitclaim Deed from Corporation to Husband and Wife is a legal document that transfers ownership of a property from a corporation to a married couple without any warranty or guarantee of title by the corporation. This type of deed is commonly used in real estate transactions when a corporation wants to transfer the property rights to a husband and wife without assuming any liability for the property. In Bakersfield, California, there are several types of Quitclaim Deeds from Corporation to Husband and Wife that may be encountered. These include: 1. Voluntary Quitclaim Deed: This is the most common type of quitclaim deed, where the corporation willingly transfers the property rights to the husband and wife. It is often used when the corporation no longer has any use for the property or wishes to divest itself of ownership. 2. Interfamily Quitclaim Deed: This type of quitclaim deed is used when the corporation and the husband and wife are related, such as when a family-owned corporation transfers property to family members. It is often employed for estate planning purposes or to facilitate transfers within a closely-knit family. 3. Court-Ordered Quitclaim Deed: Sometimes, a court may order a corporation to transfer property to a husband and wife as part of a legal proceeding, such as a divorce settlement or a judgment. In such cases, a court-ordered quitclaim deed is executed to effect the transfer as directed by the court. 4. Gifted Quitclaim Deed: A corporation may decide to gift a property to a husband and wife without any monetary exchange. This type of quitclaim deed is commonly used for tax and estate planning purposes, allowing the corporation to transfer ownership without the recipient couple needing to pay any consideration. It is important to consult with a qualified real estate attorney or title company when drafting or executing a Bakersfield California Quitclaim Deed from Corporation to Husband and Wife to ensure all legal requirements are met and to protect the interests of all parties involved.