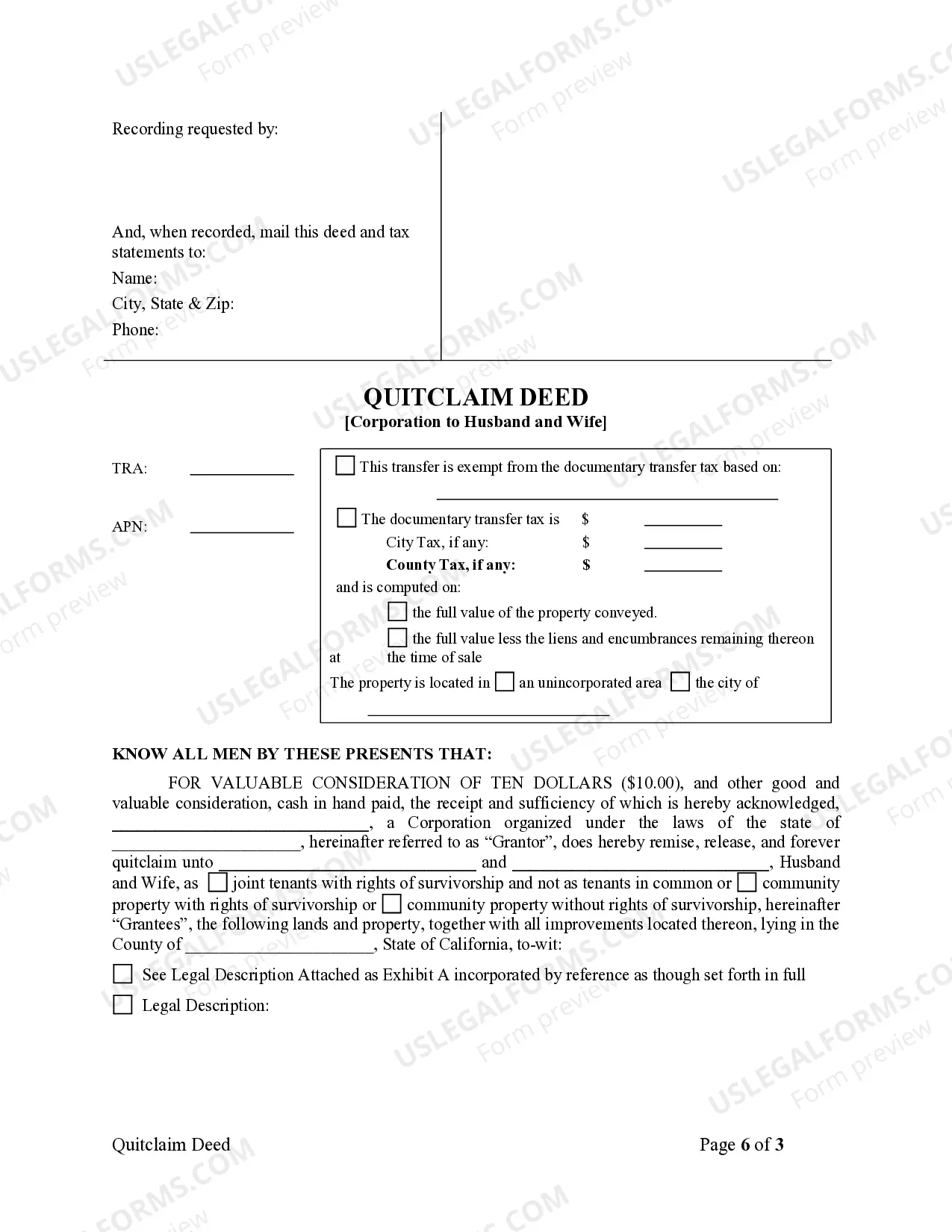

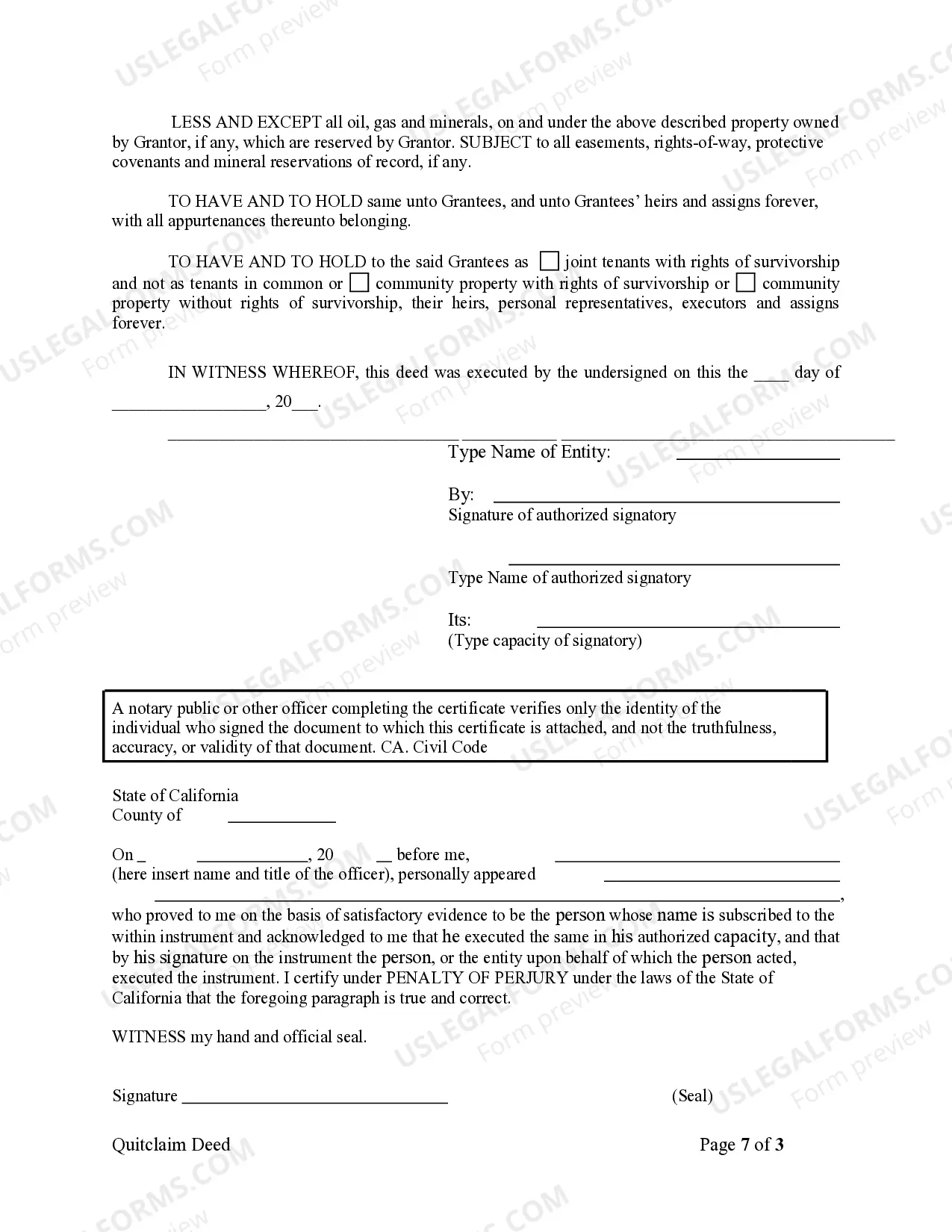

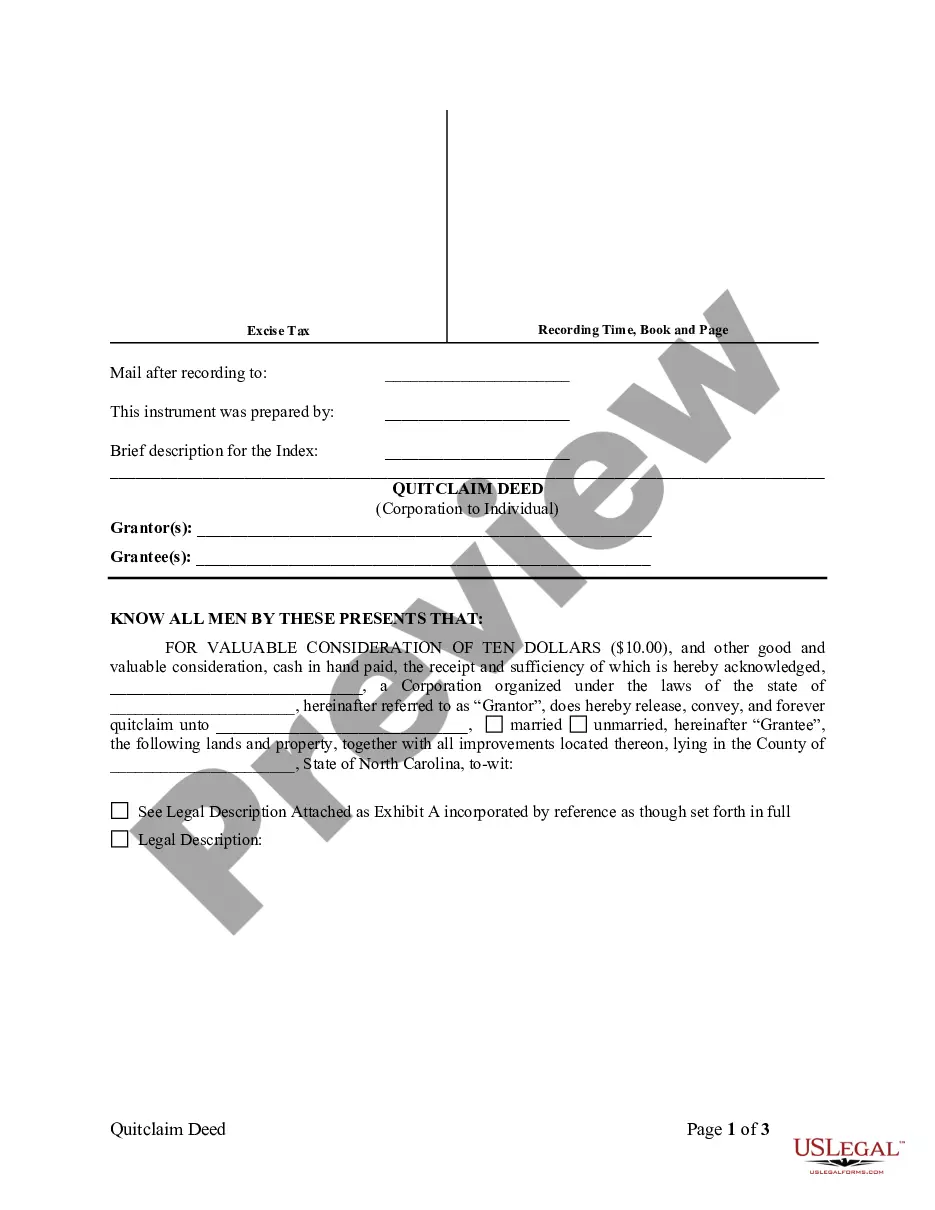

This Quitclaim Deed from Corporation to Husband and Wife form is a Quitclaim Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

A Riverside California Quitclaim Deed from Corporation to Husband and Wife is a legal document that transfers ownership of a property from a corporation to a married couple using a quitclaim deed. In this type of transaction, the corporation relinquishes any claim or interest it may have in the property, allowing the husband and wife to become the new owners. This type of deed is commonly used when a corporation wishes to transfer ownership of a property to a married couple without making any warranties or guarantees regarding the property's title. It should be noted that a quitclaim deed does not provide any assurance of clear title or protect against potential liens or encumbrances on the property. It simply transfers whatever interest the corporation may have, if any, to the husband and wife. There are various types or variations of the Riverside California Quitclaim Deed from Corporation to Husband and Wife, including: 1. General Quitclaim Deed: This is the most basic form of quitclaim deed, transferring the corporation's interest in the property to the husband and wife. 2. Special Warranty Quitclaim Deed: This type of deed offers a limited warranty, where the corporation guarantees that it has not done anything to impair the title during its ownership. 3. Affidavit of Title: In some cases, an affidavit of title may accompany the quitclaim deed. This affidavit provides additional assurances about the property's title status and may be required by the buyer or lender. It is important for the husband and wife receiving the quitclaim deed to fully understand the implications and limitations of this type of transfer. Consulting with a real estate attorney or legal professional is recommended to ensure all necessary steps and precautions are taken during this process. Additionally, conducting a thorough title search and obtaining title insurance can help protect against any undiscovered issues with the property's title. In conclusion, a Riverside California Quitclaim Deed from Corporation to Husband and Wife is a legal document used to transfer ownership of a property from a corporation to a married couple. Understanding the different types and ensuring necessary precautions are taken will help facilitate a smooth and secure transfer of property rights.

A Riverside California Quitclaim Deed from Corporation to Husband and Wife is a legal document that transfers ownership of a property from a corporation to a married couple using a quitclaim deed. In this type of transaction, the corporation relinquishes any claim or interest it may have in the property, allowing the husband and wife to become the new owners. This type of deed is commonly used when a corporation wishes to transfer ownership of a property to a married couple without making any warranties or guarantees regarding the property's title. It should be noted that a quitclaim deed does not provide any assurance of clear title or protect against potential liens or encumbrances on the property. It simply transfers whatever interest the corporation may have, if any, to the husband and wife. There are various types or variations of the Riverside California Quitclaim Deed from Corporation to Husband and Wife, including: 1. General Quitclaim Deed: This is the most basic form of quitclaim deed, transferring the corporation's interest in the property to the husband and wife. 2. Special Warranty Quitclaim Deed: This type of deed offers a limited warranty, where the corporation guarantees that it has not done anything to impair the title during its ownership. 3. Affidavit of Title: In some cases, an affidavit of title may accompany the quitclaim deed. This affidavit provides additional assurances about the property's title status and may be required by the buyer or lender. It is important for the husband and wife receiving the quitclaim deed to fully understand the implications and limitations of this type of transfer. Consulting with a real estate attorney or legal professional is recommended to ensure all necessary steps and precautions are taken during this process. Additionally, conducting a thorough title search and obtaining title insurance can help protect against any undiscovered issues with the property's title. In conclusion, a Riverside California Quitclaim Deed from Corporation to Husband and Wife is a legal document used to transfer ownership of a property from a corporation to a married couple. Understanding the different types and ensuring necessary precautions are taken will help facilitate a smooth and secure transfer of property rights.