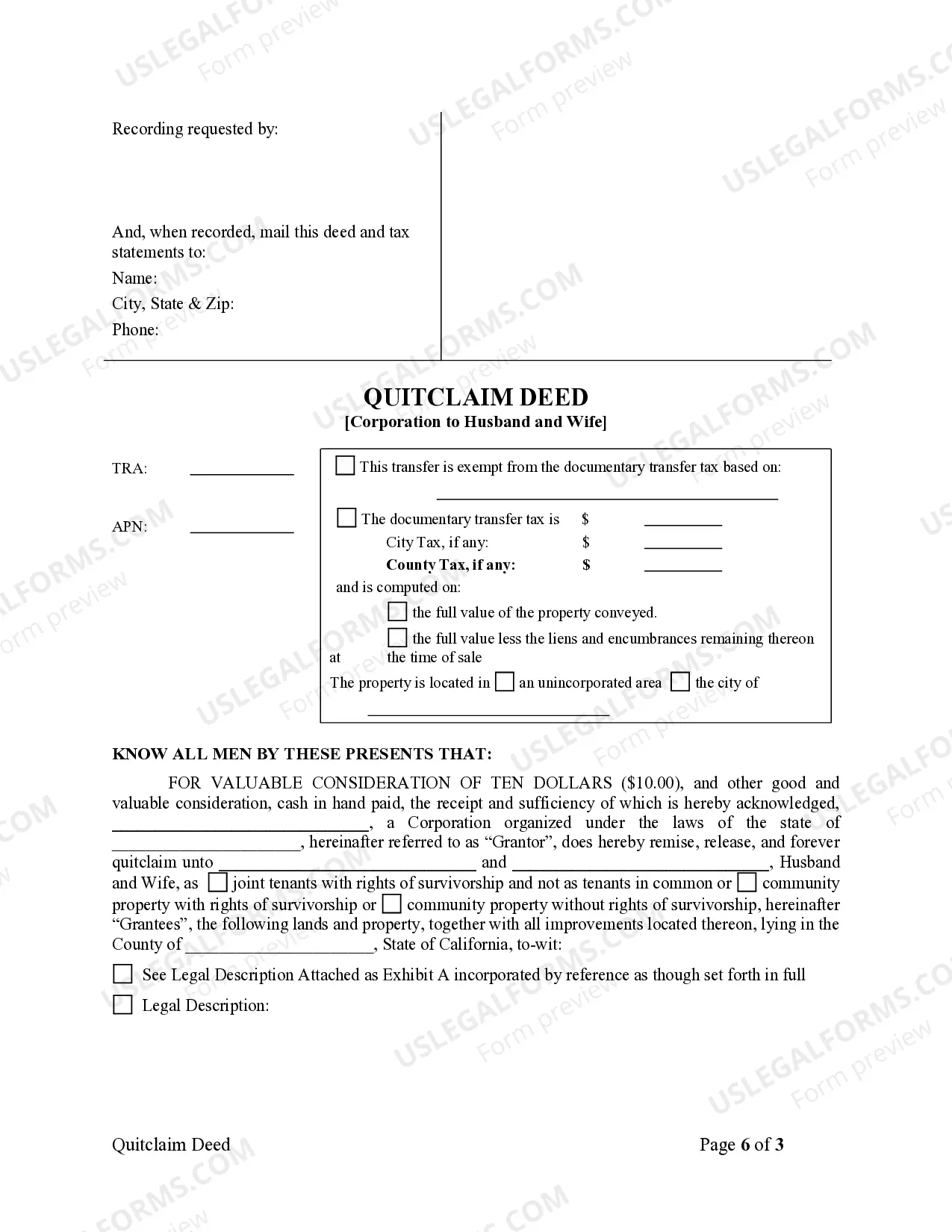

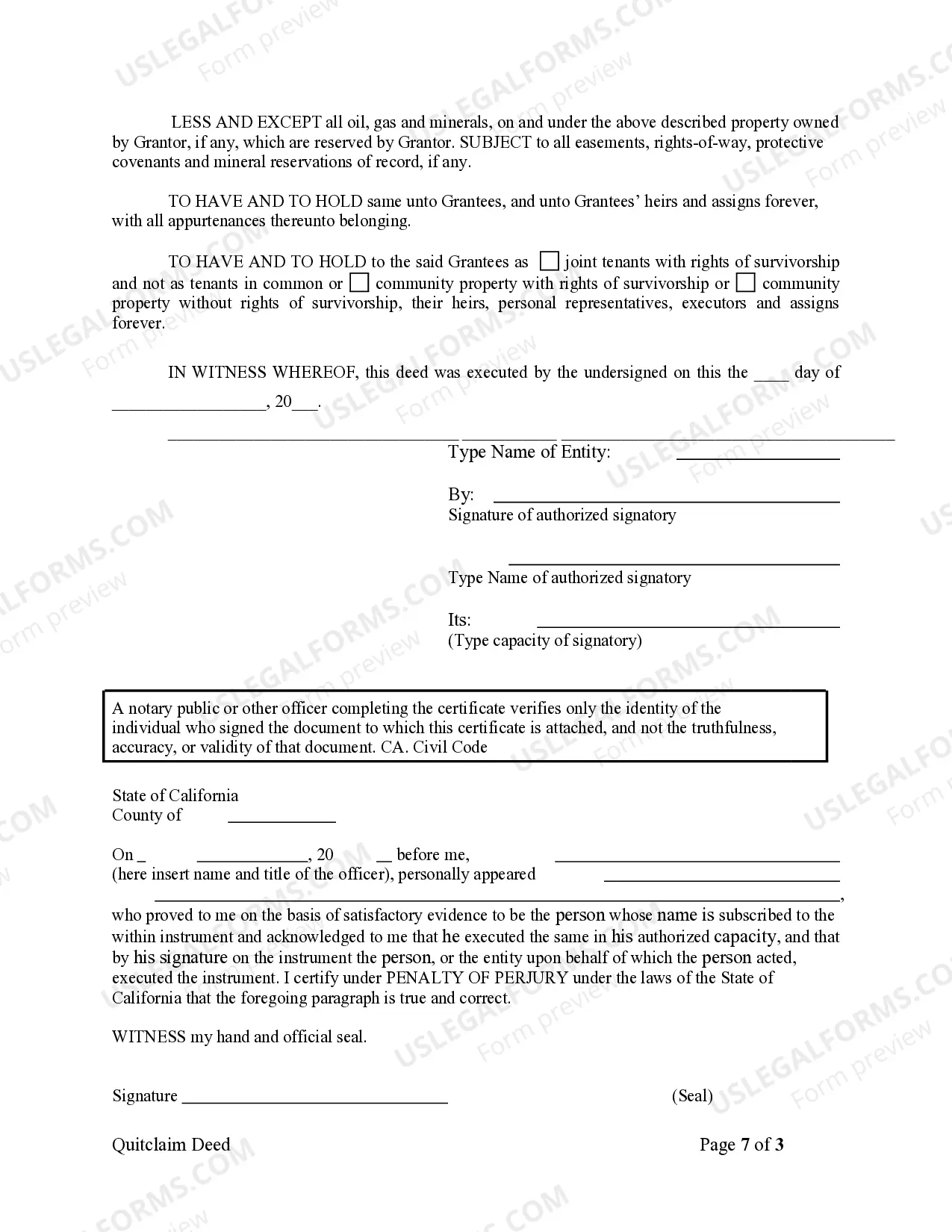

This Quitclaim Deed from Corporation to Husband and Wife form is a Quitclaim Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

A Simi Valley California Quitclaim Deed from Corporation to Husband and Wife is a crucial legal document used to transfer property ownership rights from a corporation to a married couple within Simi Valley, California. This type of deed ensures the smooth and lawful transfer of property rights without any warranty or guarantee on the part of the corporation, implying that they do not claim any disputes, liens, or outstanding legal issues associated with the property being transferred. Keywords: 1. Simi Valley California: Specifies the geographical location of the deed and helps in identifying the local legal regulations that apply to the property transfer. 2. Quitclaim Deed: Provides the specific type of legal instrument used for transferring property ownership rights. 3. Corporation: Refers to the legal entity that currently holds the title to the property and grants the transfer to the husband and wife. 4. Husband and Wife: Identifies the specific recipients of the property rights, emphasizing that both spouses will jointly hold ownership after the transfer. Different types of Simi Valley California Quitclaim Deeds from Corporation to Husband and Wife: 1. Individual Ownership: In this scenario, the corporation transfers the property exclusively to one individual within the married couple, designating them as the sole owner. 2. Joint Tenancy: The joint tenancy variation grants equal ownership rights to both spouses. In case of the death of one spouse, the surviving spouse automatically inherits the deceased spouse's share. 3. Tenancy in Common: This type of deed grants each spouse a specific percentage of ownership, which can be unequal. In the absence of survivorship rights, the share of a deceased spouse can be inherited according to their will or the state's laws of intestate succession. 4. Community Property: Relevant for states with community property laws, this variation ensures that the property ownership is held equally by both spouses, entitling each to a 50% share. In the event of divorce or death, the property division follows community property rules. In summary, a Simi Valley California Quitclaim Deed from Corporation to Husband and Wife is a legally binding document that transfers property ownership rights from a corporation to a married couple within Simi Valley, California. Different variations of this deed exist, including individual ownership, joint tenancy, tenancy in common, and community property, catering to the specific ownership requirements and legal structures of the couple.