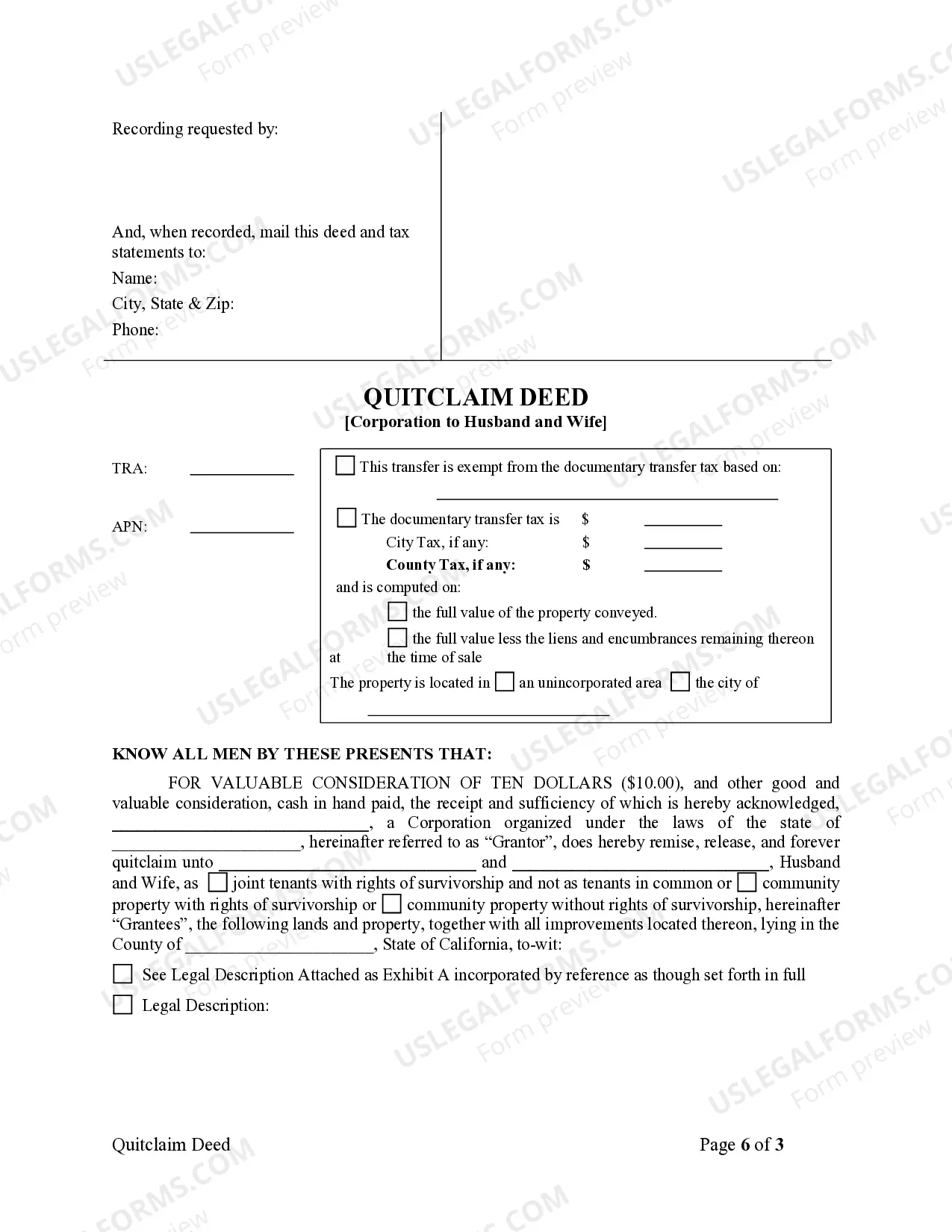

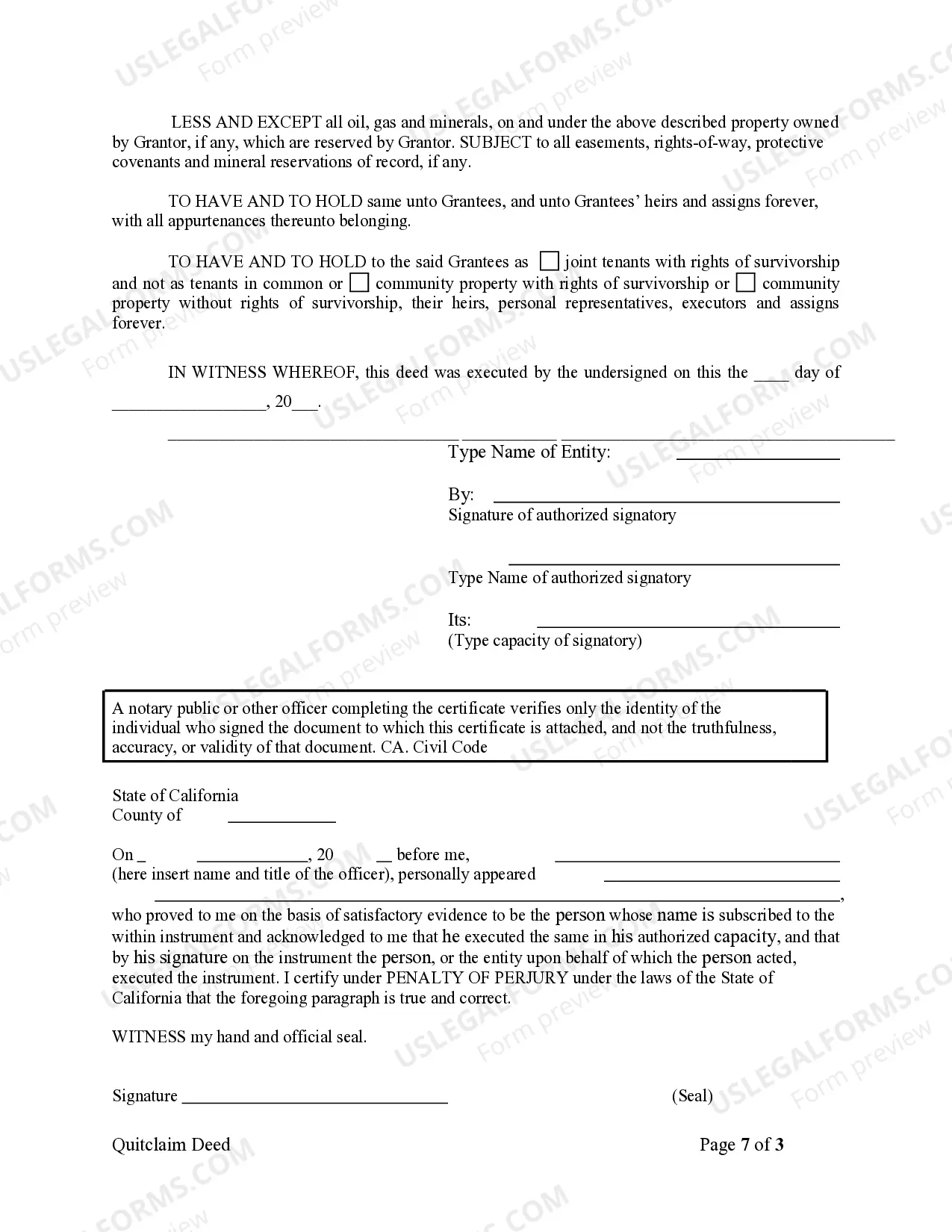

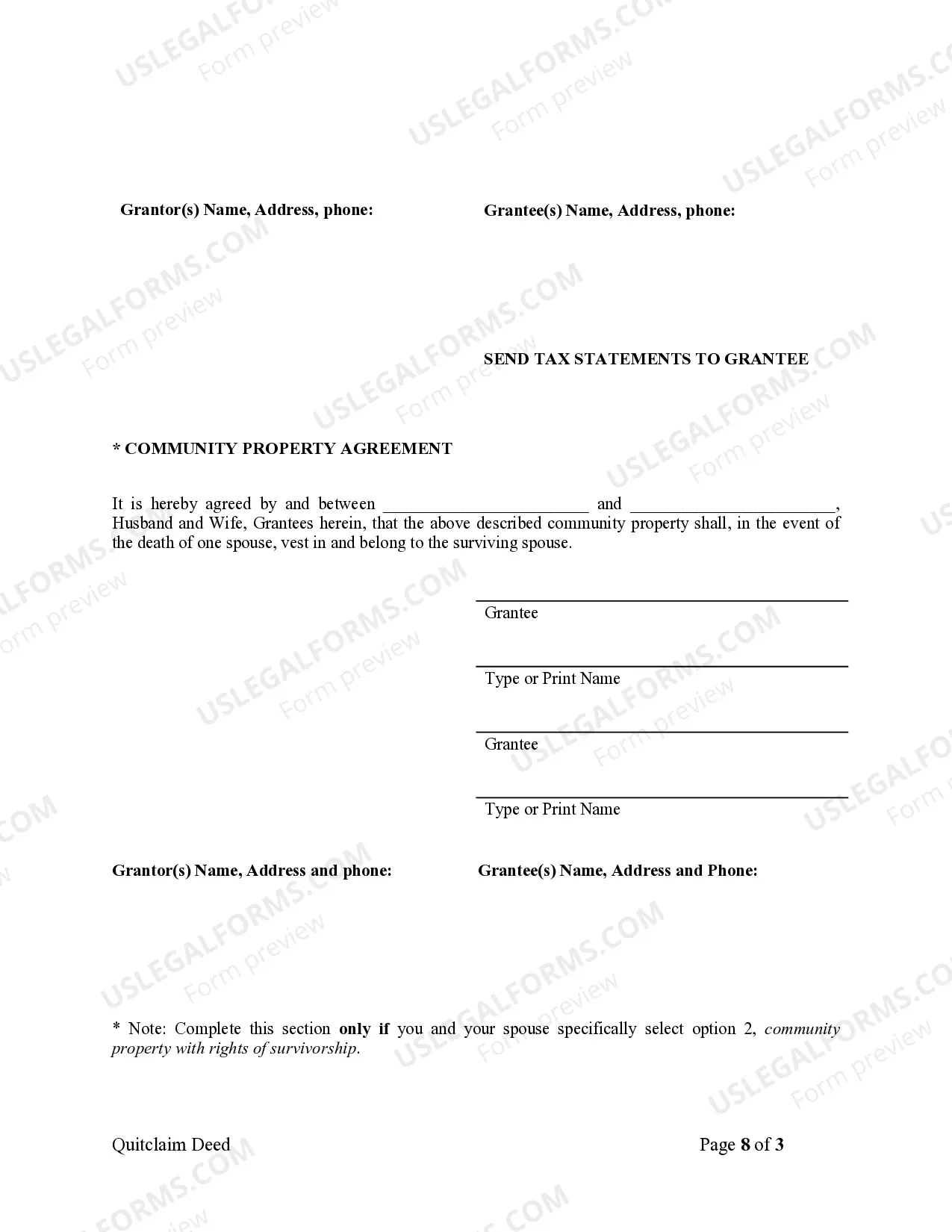

This Quitclaim Deed from Corporation to Husband and Wife form is a Quitclaim Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

Stockton California Quitclaim Deed from Corporation to Husband and Wife

Description

How to fill out California Quitclaim Deed From Corporation To Husband And Wife?

Do you require a trustworthy and economical provider of legal documents to obtain the Stockton California Quitclaim Deed from Corporation to Husband and Wife? US Legal Forms is your reliable resource.

Whether you need a straightforward agreement to establish rules for living together with your partner or a collection of documents to facilitate your separation or divorce proceedings in court, we have you covered.

Our platform offers over 85,000 current legal document templates for personal and business use. All the templates we provide are not generic and are tailored following the regulations of individual states and counties.

To download the document, you must Log In to your account, locate the required form, and click the Download button adjacent to it. Please note that you can redownload your previously acquired form templates anytime from the My documents tab.

Now you can establish your account. Then select the subscription plan and continue to payment.

After the payment is completed, download the Stockton California Quitclaim Deed from Corporation to Husband and Wife in any available file format. You can return to the website whenever needed and redownload the document at no additional cost.

- Are you new to our site? No problem.

- You can create an account within minutes, but before doing so, make sure to follow these steps.

- Verify if the Stockton California Quitclaim Deed from Corporation to Husband and Wife aligns with the laws of your state and locality.

- Review the form's details (if available) to determine who it is intended for and what it is suitable for.

- Restart your search if the form does not fit your legal situation.

Form popularity

FAQ

To add your spouse to a deed in California, you would typically need to file a quitclaim deed with the appropriate county office. For a Stockton California Quitclaim Deed from Corporation to Husband and Wife, ensure all parties sign the document in accordance with state law. Using US Legal Forms can provide you with the necessary documents and guidance on the process. This will help to ensure a straightforward addition to your property.

Certainly, you can execute a quitclaim deed on your own. While it is legally permissible, the process can be complex, especially for a Stockton California Quitclaim Deed from Corporation to Husband and Wife. Using resources from US Legal Forms can simplify the task and provide you with correct templates. It's essential to familiarize yourself with all requirements to ensure everything goes smoothly.

A quitclaim deed may become void if it does not meet legal requirements or if it is signed under duress. In the case of a Stockton California Quitclaim Deed from Corporation to Husband and Wife, issues such as lack of proper signatures or failure to meet state-specific regulations can lead to voiding the deed. It is crucial to follow all guidelines and carefully complete the deed to avoid such pitfalls. Utilizing US Legal Forms can help ensure your deed is compliant.

Yes, you can transfer a deed without hiring an attorney, especially if you are comfortable with the legal procedures. For a Stockton California Quitclaim Deed from Corporation to Husband and Wife, you may use templates available through US Legal Forms to facilitate the transfer. This can make the process smoother and ensure that all necessary information is included. However, consulting with a legal professional can help clarify any complex aspects.

Adding someone to a deed can complicate property rights and ownership agreements. It creates potential challenges in deciding how to manage the property in the future. When dealing with a Stockton California Quitclaim Deed from Corporation to Husband and Wife, consult with legal experts or use platforms like uslegalforms to ensure you understand the potential risks and rights involved.

In most cases, if a spouse signs a quitclaim deed, they relinquish their ownership rights to the property. However, the receiving spouse retains ownership and legal rights under California law. When using a Stockton California Quitclaim Deed from Corporation to Husband and Wife, it is crucial to understand the implications fully to ensure both parties are aware of their rights.

A quitclaim deed primarily benefits individuals seeking to clarify or transfer property ownership. For married couples, it can simplify the transfer process when one spouse is transferring their interest to the other. In the case of a Stockton California Quitclaim Deed from Corporation to Husband and Wife, both parties gain clear rights to the property, reducing disputes and fostering transparency.

You can add your spouse to your deed through a quitclaim deed, which allows for a straightforward transfer of property rights. This method does not require refinancing and can often be completed with minimal paperwork. Using a Stockton California Quitclaim Deed from Corporation to Husband and Wife streamlines this process, making it easy to include your partner.

Yes, having both names on the deed is beneficial for married couples. It ensures that both spouses have legal rights to the property. This is particularly important in situations involving a Stockton California Quitclaim Deed from Corporation to Husband and Wife, as it offers clarity and security in ownership.

One major disadvantage of a quit claim deed is that it does not guarantee that the transferring party has clear ownership of the property. This can be problematic in a Stockton California Quitclaim Deed from Corporation to Husband and Wife scenario, where you want to ensure clear title. Additionally, quit claim deeds usually provide no warranties or protections against any claims. For comprehensive guidance on this, consider seeking support from platforms like US Legal Forms to ensure you're informed about potential drawbacks.