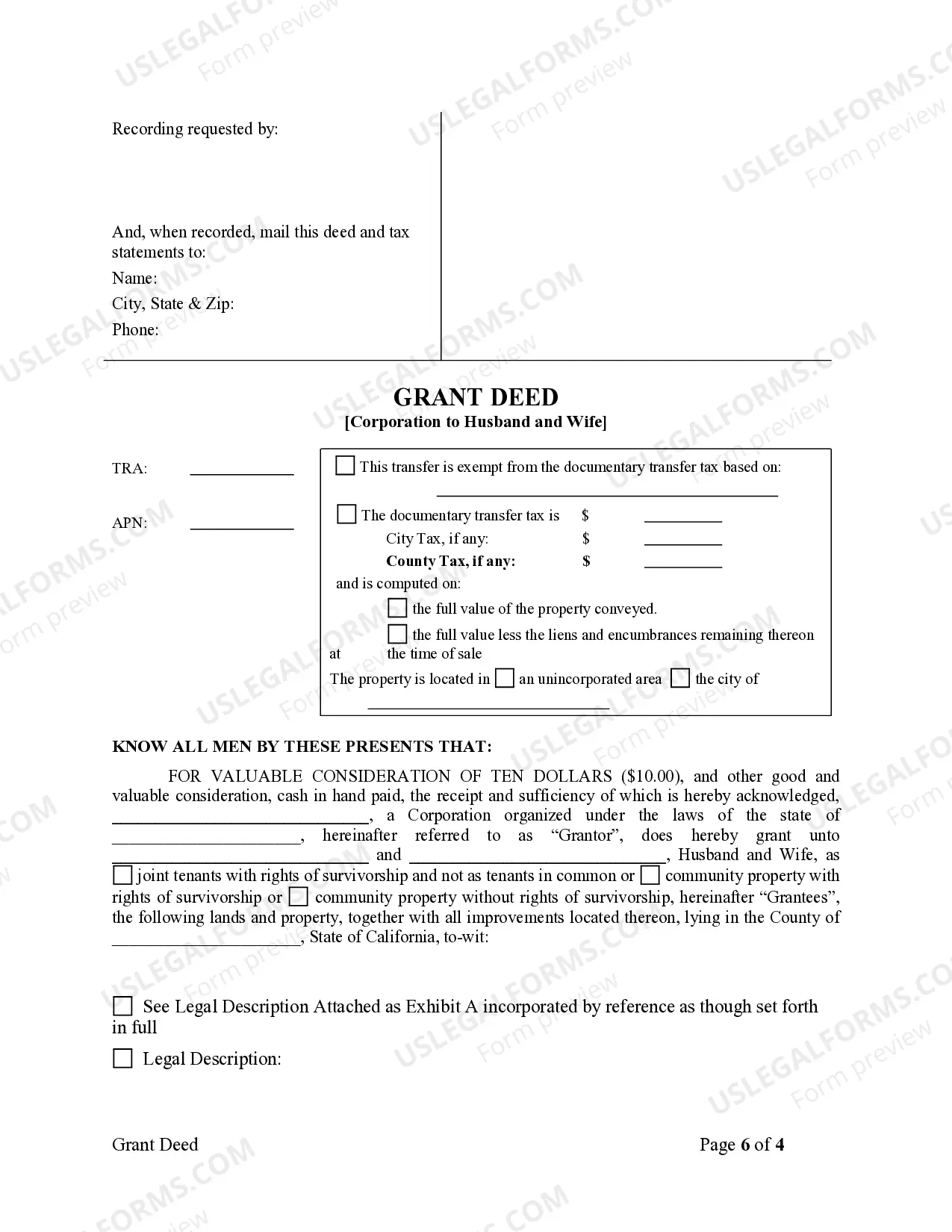

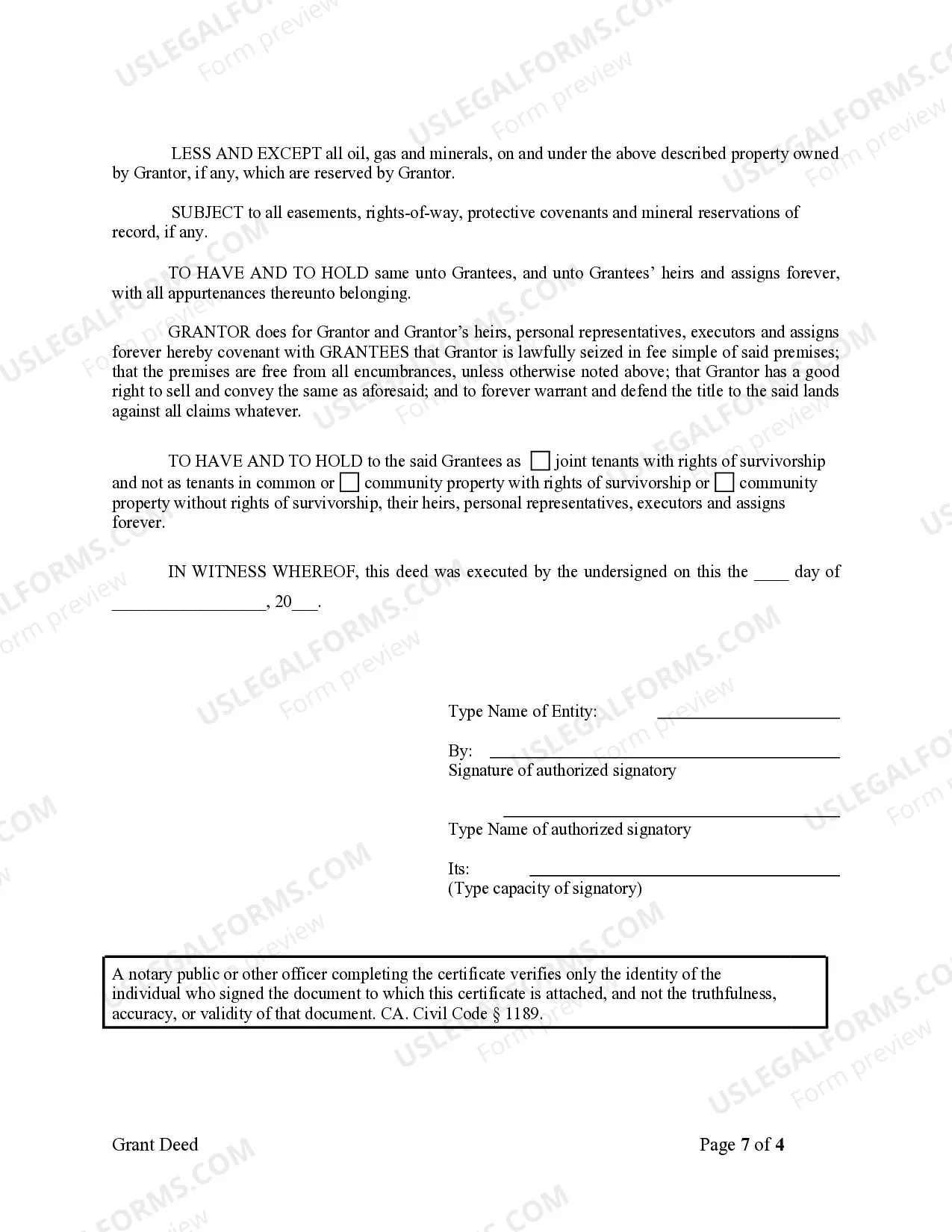

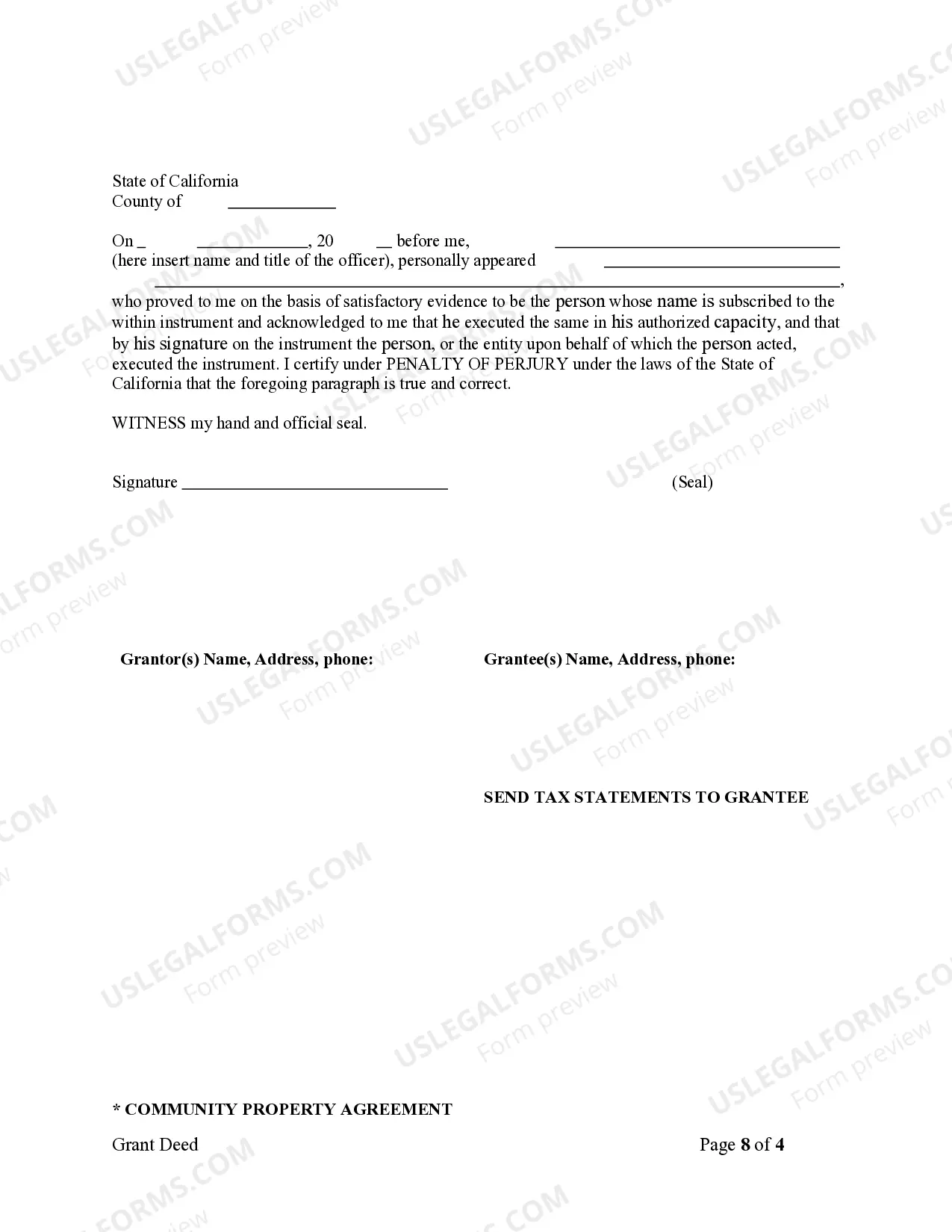

This Warranty Deed from Corporation to Husband and Wife form is a Warranty Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and warrants the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

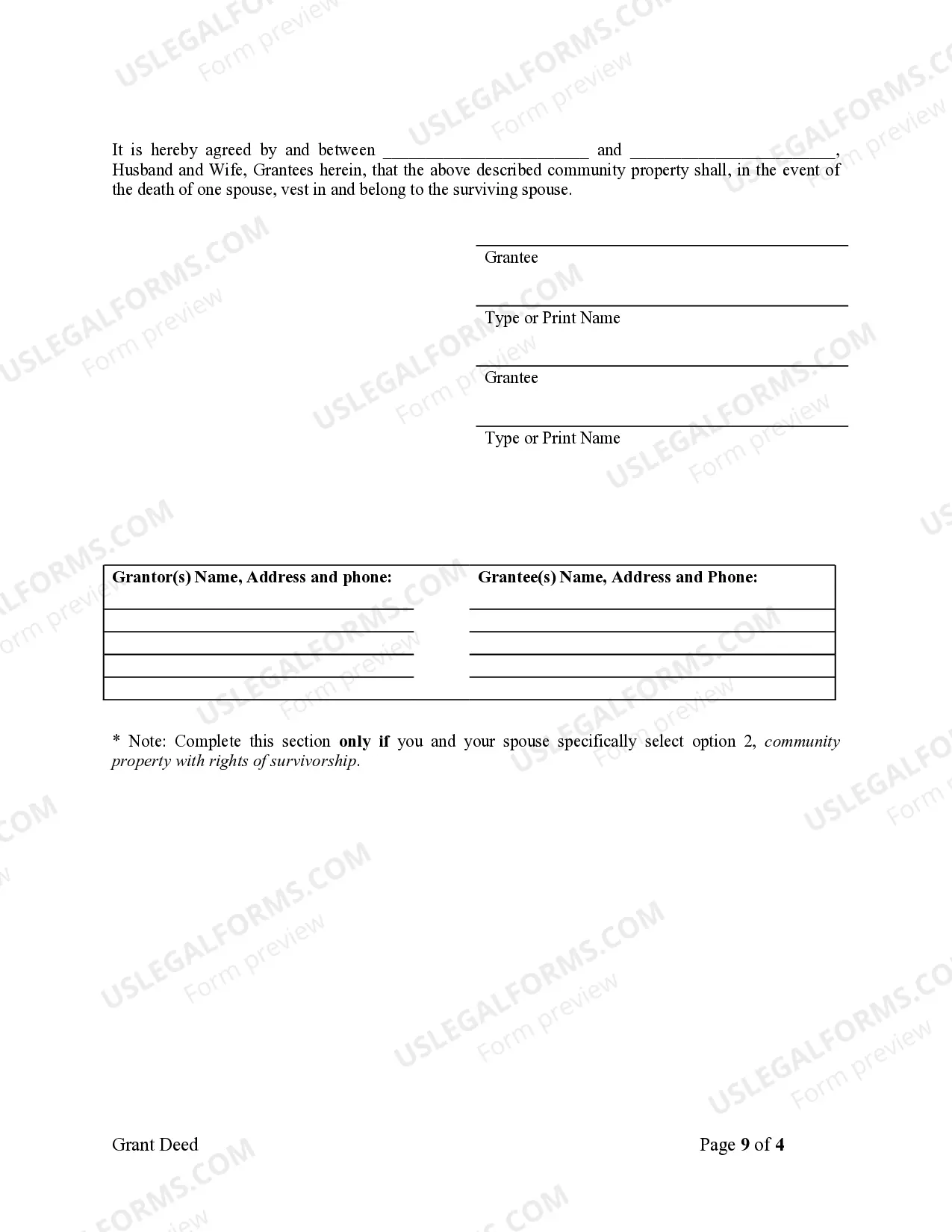

A Corona California Grant Deed from a corporation to a husband and wife is a legal document that transfers ownership of real property from a corporation to a married couple. This particular type of grant deed ensures that the property is jointly owned by both spouses, which provides certain legal protections and rights. The Corona California Grant Deed from Corporation to Husband and Wife is often used when a corporation wishes to transfer property to a married couple for various reasons, such as estate planning, business succession, or personal reasons. This type of deed offers several benefits, including the ability for the husband and wife to share ownership of the property, enjoy equal rights to use and manage the property, and have a joint interest in the property's appreciation. It is important to note that there are different variations of the Corona California Grant Deed from Corporation to Husband and Wife. Some common types may include: 1. Joint Tenancy Grant Deed: This type of grant deed ensures that the property ownership is held as "joint tenants with rights of survivorship." In this scenario, if one spouse passes away, the surviving spouse automatically becomes the sole owner of the property, without the need for probate. 2. Community Property Grant Deed: This grant deed establishes that the property will be owned as "community property" by the husband and wife. This means that both spouses have equal ownership interests and share in any appreciation of the property during the marriage. 3. Tenancy in Common Grant Deed: With this type of grant deed, the property ownership is held as "tenants in common." In this case, each spouse owns a separate undivided interest in the property, which they can freely dispose of or will to their heirs. Unlike joint tenancy, there is no automatic transfer of ownership to the surviving spouse upon death. The Corona California Grant Deed from Corporation to Husband and Wife is an essential legal document that facilitates the transfer of property from a corporation to a married couple. It is crucial to consult with a qualified real estate attorney to ensure that the deed is prepared correctly, and all legal requirements are met. Using a reliable title company can also help streamline the process and ensure a seamless transfer of property ownership.A Corona California Grant Deed from a corporation to a husband and wife is a legal document that transfers ownership of real property from a corporation to a married couple. This particular type of grant deed ensures that the property is jointly owned by both spouses, which provides certain legal protections and rights. The Corona California Grant Deed from Corporation to Husband and Wife is often used when a corporation wishes to transfer property to a married couple for various reasons, such as estate planning, business succession, or personal reasons. This type of deed offers several benefits, including the ability for the husband and wife to share ownership of the property, enjoy equal rights to use and manage the property, and have a joint interest in the property's appreciation. It is important to note that there are different variations of the Corona California Grant Deed from Corporation to Husband and Wife. Some common types may include: 1. Joint Tenancy Grant Deed: This type of grant deed ensures that the property ownership is held as "joint tenants with rights of survivorship." In this scenario, if one spouse passes away, the surviving spouse automatically becomes the sole owner of the property, without the need for probate. 2. Community Property Grant Deed: This grant deed establishes that the property will be owned as "community property" by the husband and wife. This means that both spouses have equal ownership interests and share in any appreciation of the property during the marriage. 3. Tenancy in Common Grant Deed: With this type of grant deed, the property ownership is held as "tenants in common." In this case, each spouse owns a separate undivided interest in the property, which they can freely dispose of or will to their heirs. Unlike joint tenancy, there is no automatic transfer of ownership to the surviving spouse upon death. The Corona California Grant Deed from Corporation to Husband and Wife is an essential legal document that facilitates the transfer of property from a corporation to a married couple. It is crucial to consult with a qualified real estate attorney to ensure that the deed is prepared correctly, and all legal requirements are met. Using a reliable title company can also help streamline the process and ensure a seamless transfer of property ownership.