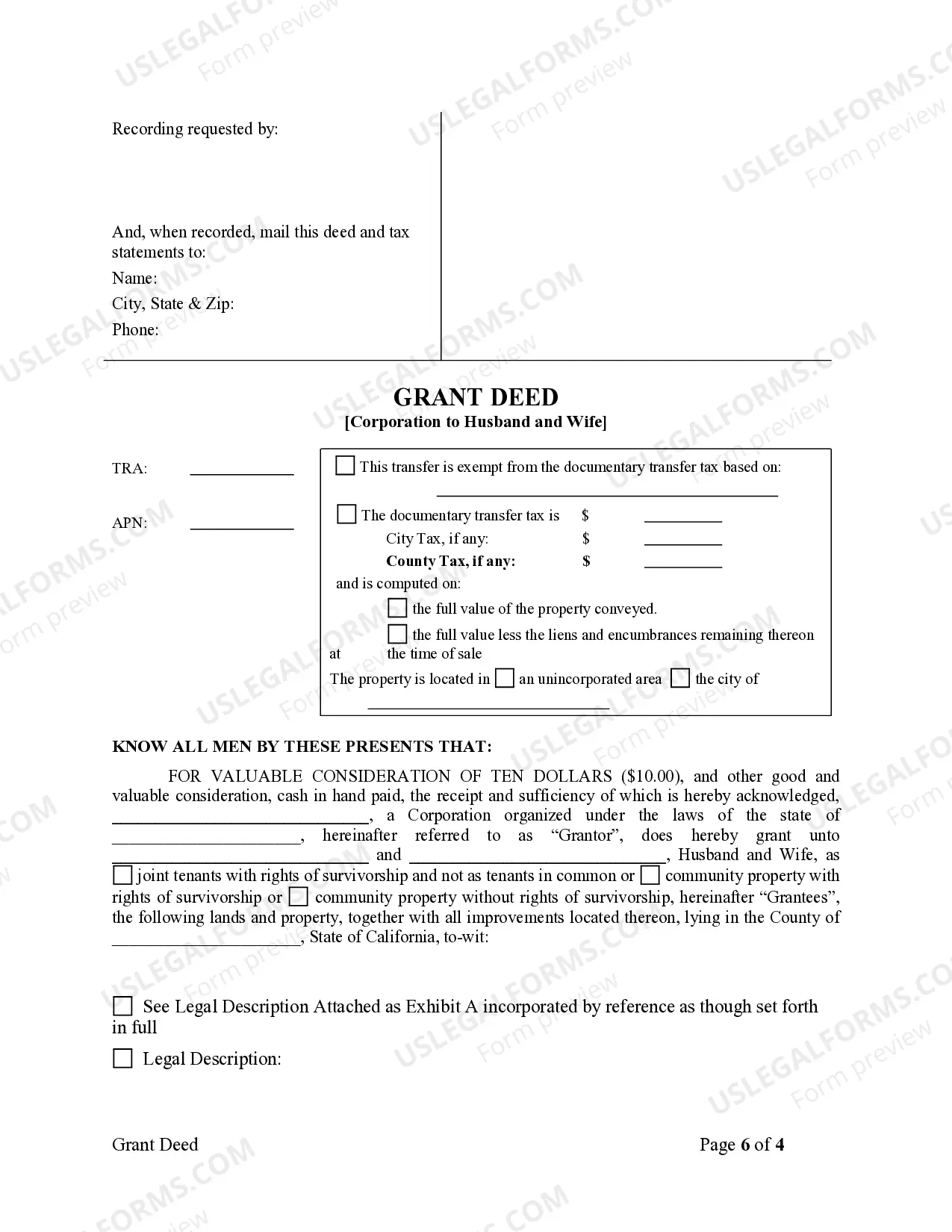

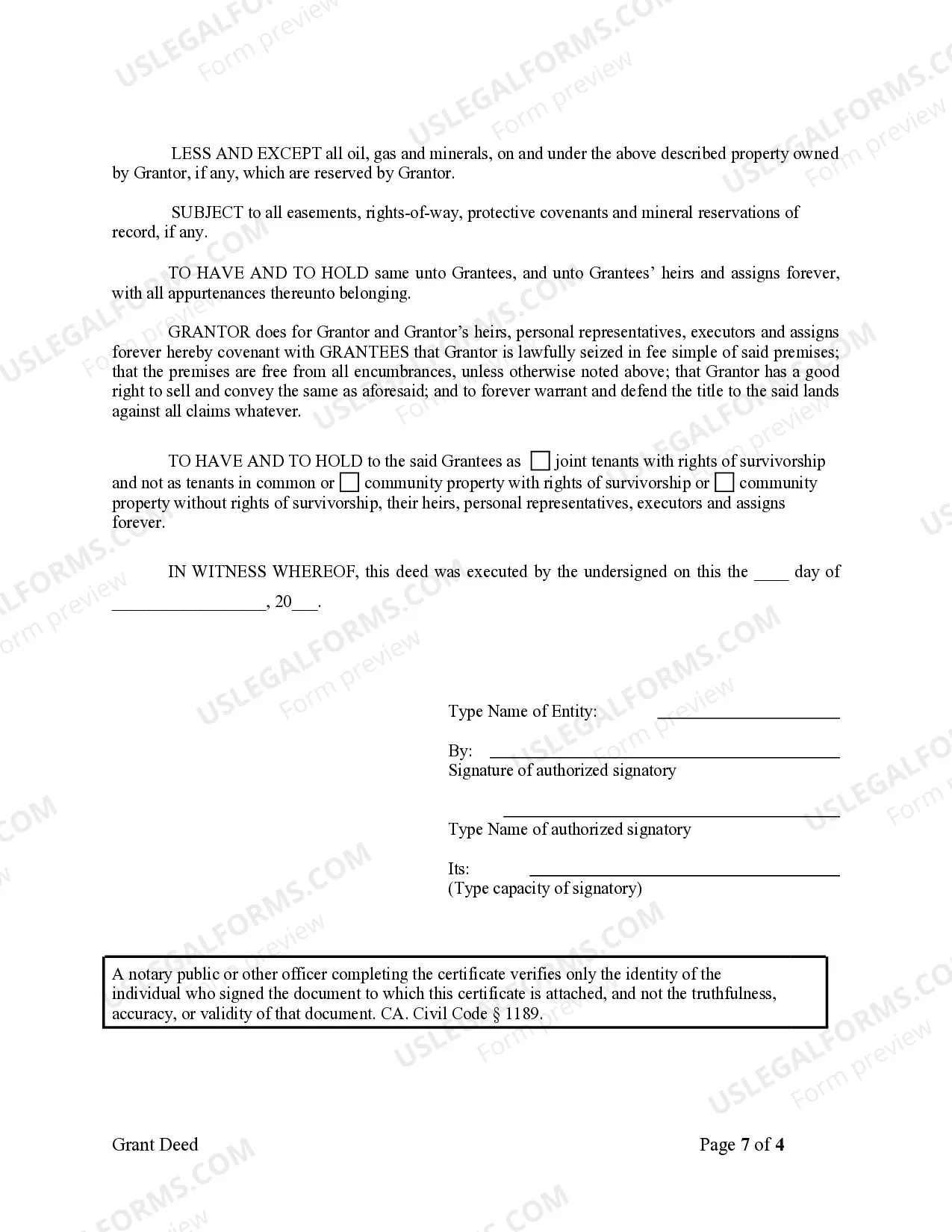

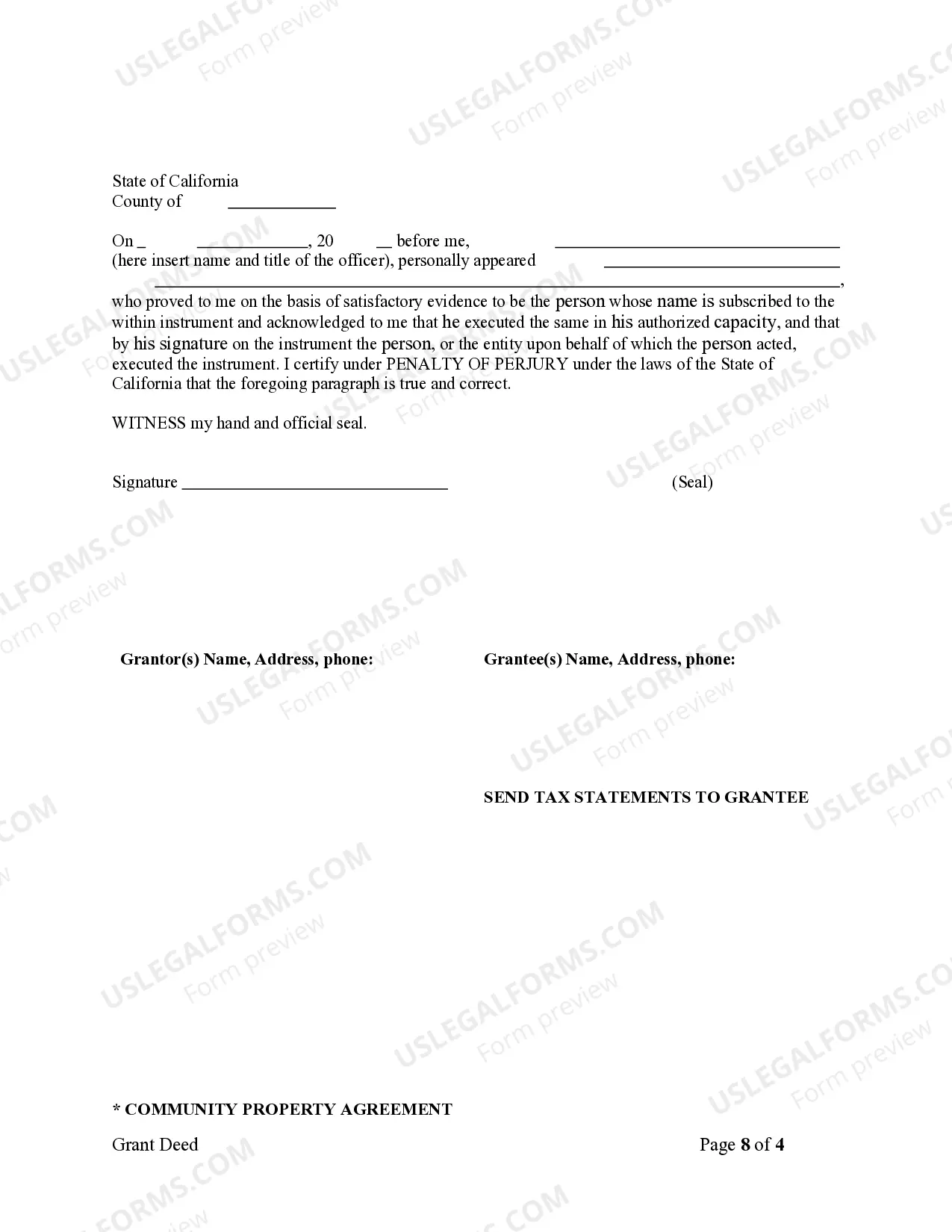

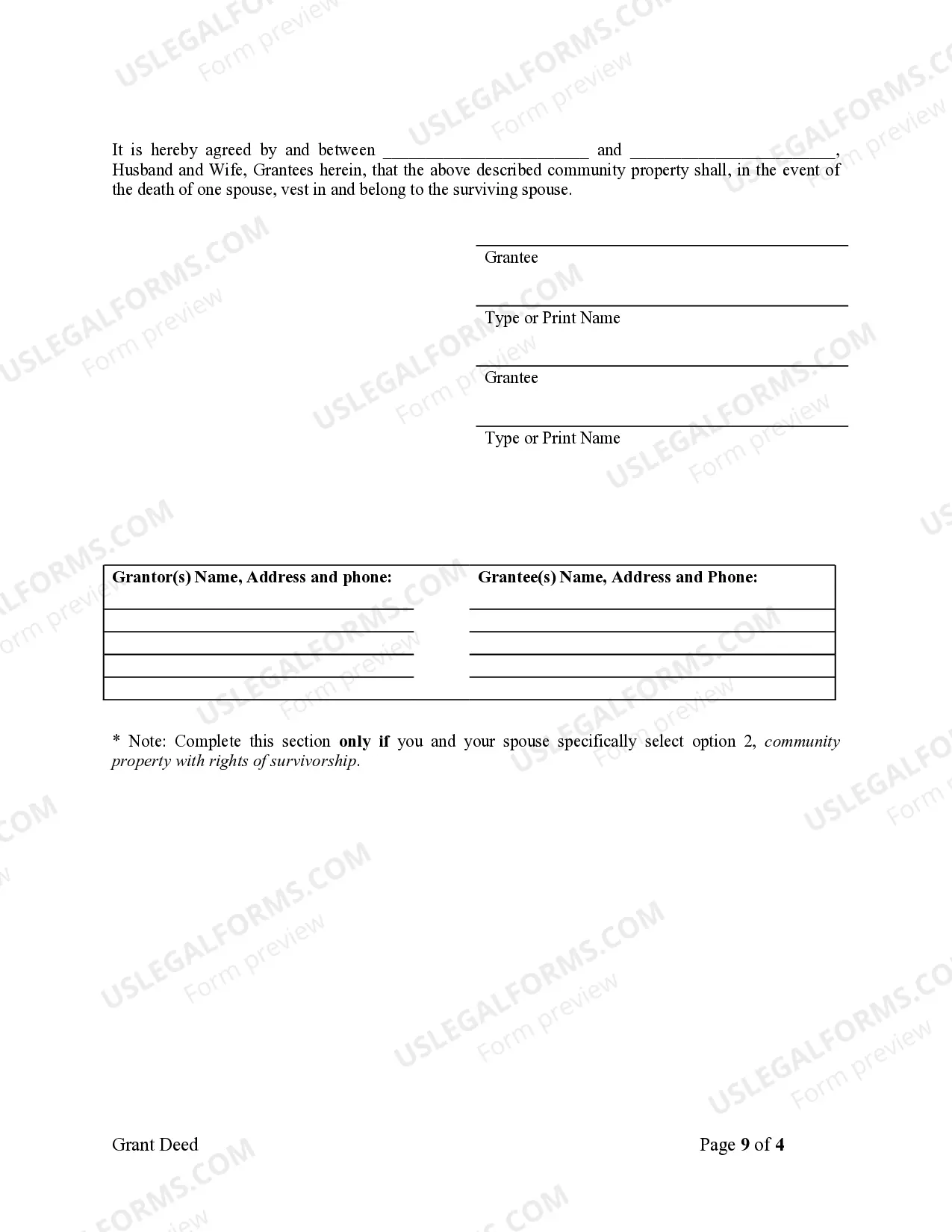

This Warranty Deed from Corporation to Husband and Wife form is a Warranty Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and warrants the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

A Jurupa Valley California Grant Deed from Corporation to Husband and Wife refers to a legal document that effectively transfers ownership of property from a corporation to a married couple (husband and wife) in Jurupa Valley, California. This type of grant deed ensures a smooth and lawful transfer of real estate and ensures that the husband and wife become the rightful owners of the property. Keywords: Jurupa Valley California, grant deed, corporation, husband and wife, property transfer, ownership, real estate, transfer of ownership. In the context of Jurupa Valley California, there are different types of grant deeds that can be used to transfer property ownership from a corporation to a husband and wife. Some notable examples include: 1. General Warranty Deed: This type of grant deed offers the highest level of protection to the buyer, as the corporation guarantees that they hold clear title to the property and will defend the buyer against any claims that may arise in the future. 2. Special Warranty Deed: Unlike the general warranty deed, this type of grant deed only guarantees that the corporation holds clear title to the property during the period they owned it. It protects the husband and wife from any defects or claims that arose only during the corporation's ownership. 3. Quitclaim Deed: This is a relatively simple type of grant deed that transfers the corporation's interest in the property to the husband and wife. However, unlike the other types of grant deeds, a quitclaim deed does not provide any warranties or guarantees regarding the title's validity. Regardless of the specific type of Jurupa Valley California Grant Deed from Corporation to Husband and Wife, it is essential to consult with a qualified real estate attorney to ensure all legal requirements are met and to safeguard the interests of the parties involved in the property transfer.