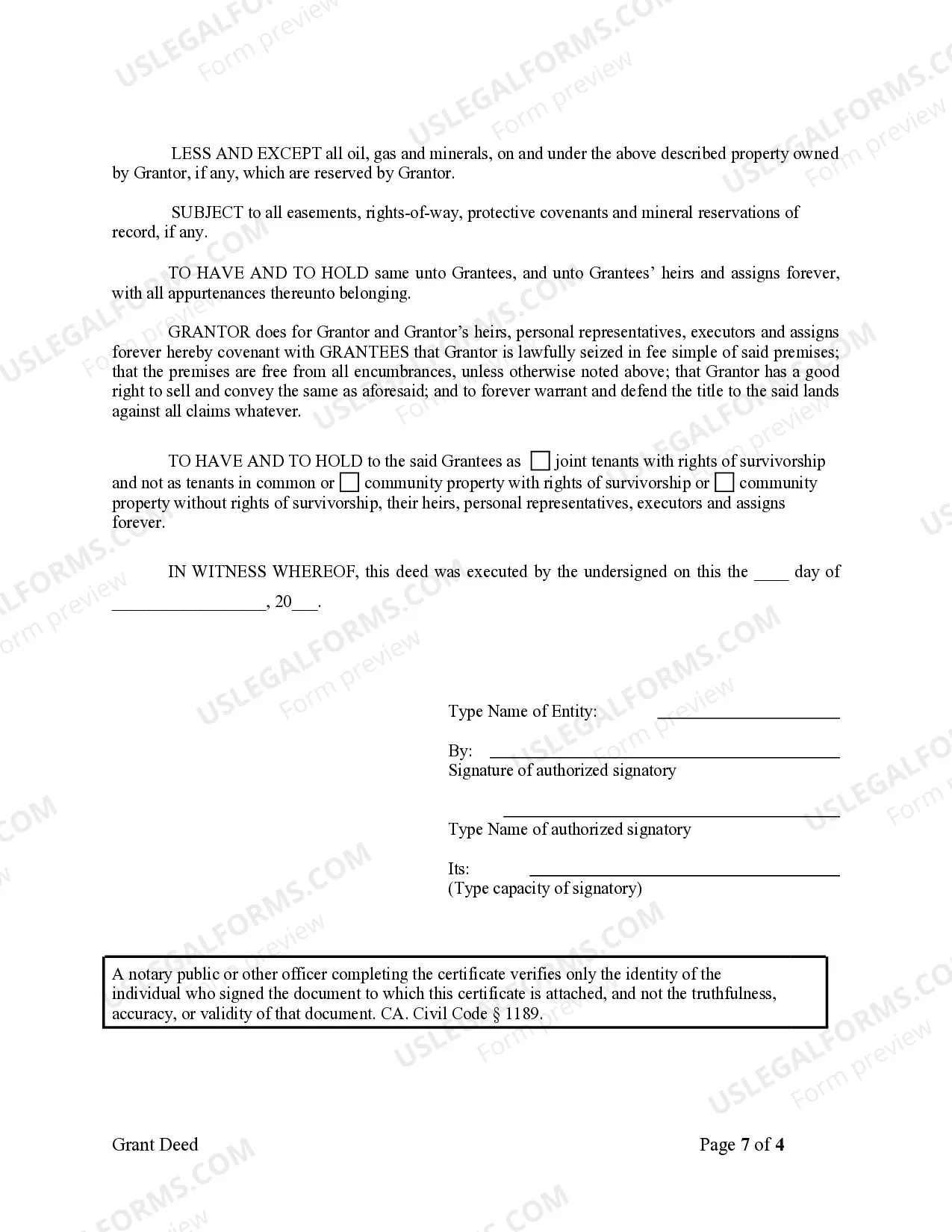

This Warranty Deed from Corporation to Husband and Wife form is a Warranty Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and warrants the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

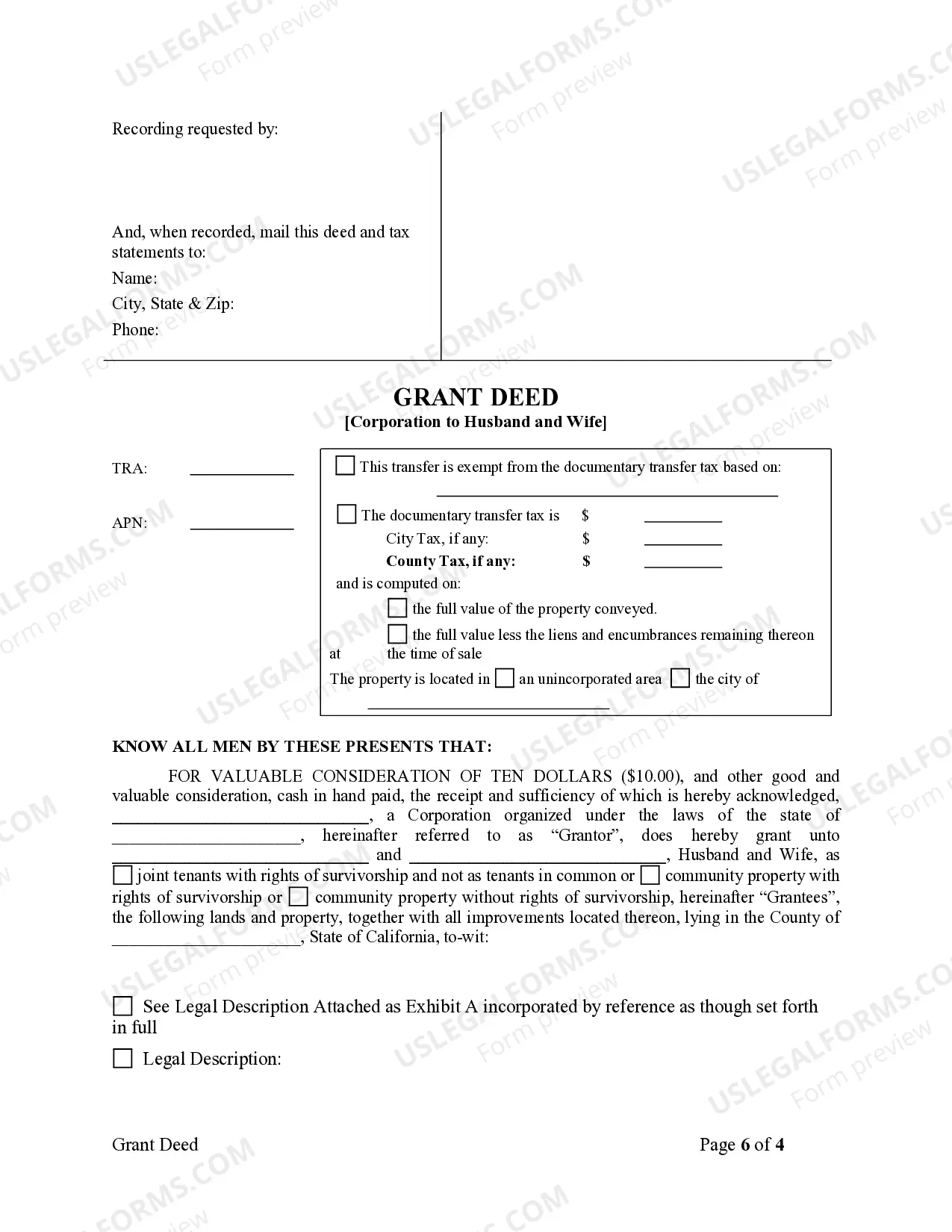

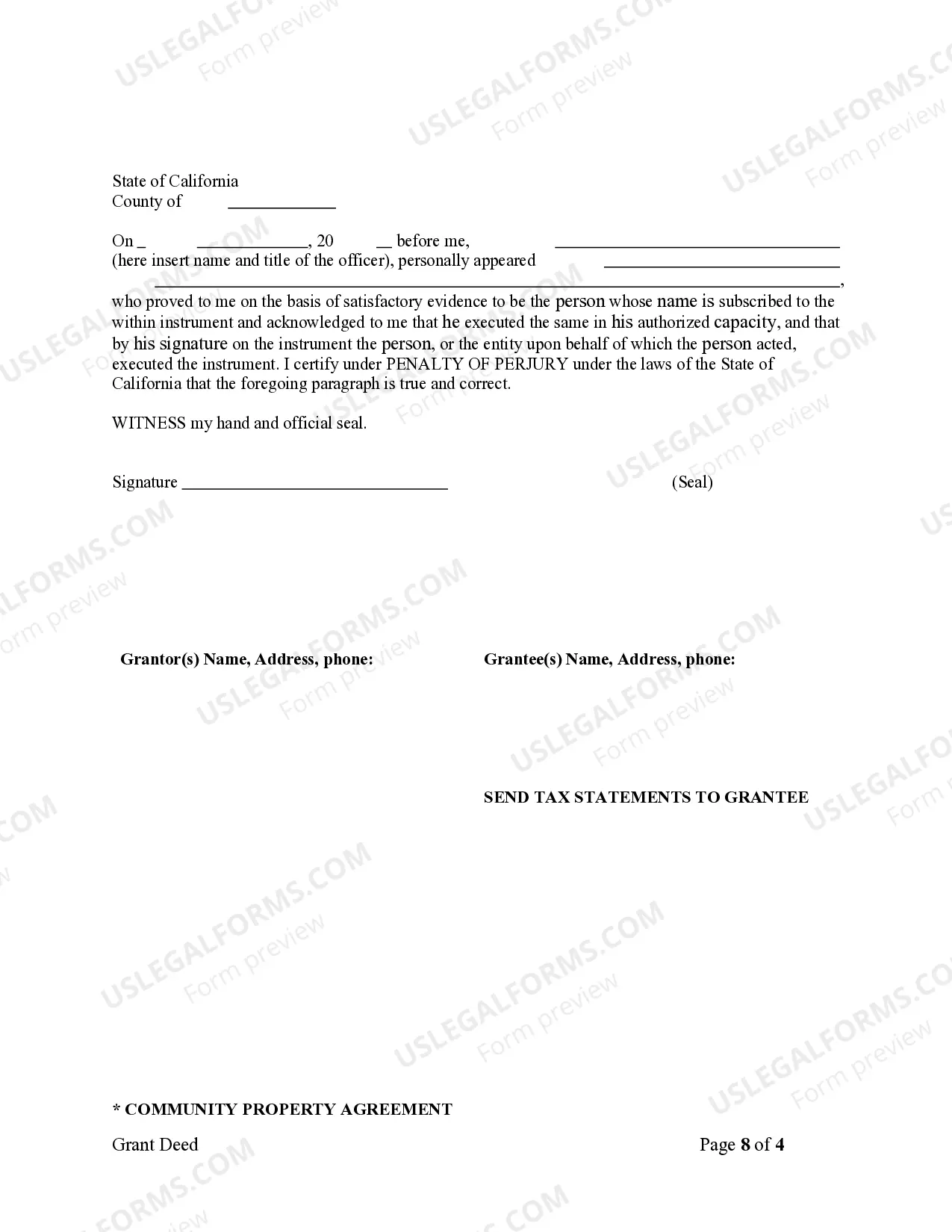

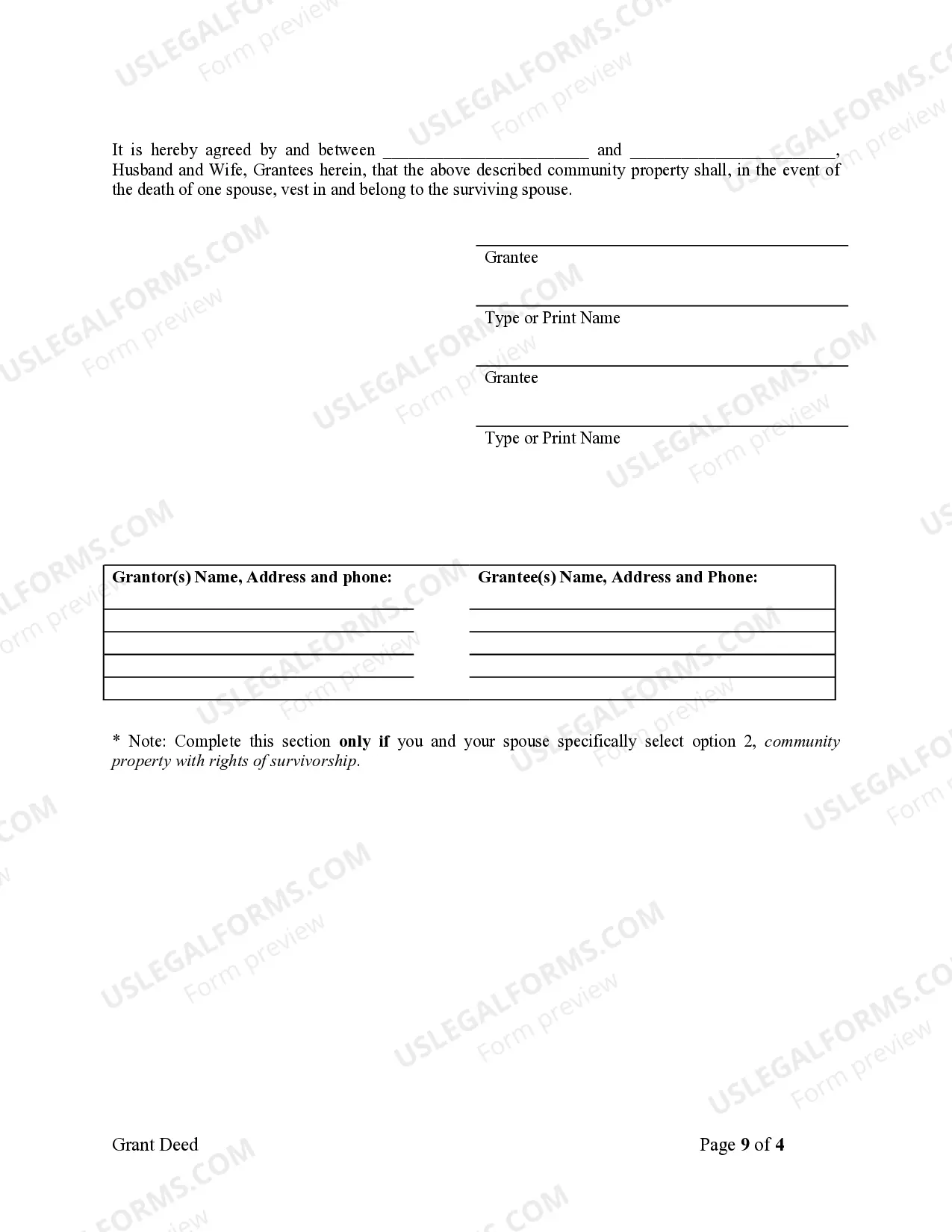

A Los Angeles California Grant Deed from Corporation to Husband and Wife is a legally binding document that transfers ownership of property from a corporation to a married couple. This deed serves as proof of the transfer, ensuring that the couple becomes the lawful owners of the property. Here are some important details and keywords related to this type of deed: 1. Definition: A Los Angeles California Grant Deed from Corporation to Husband and Wife is a legal instrument that conveys ownership of real estate from a corporation to a couple in Los Angeles, California. 2. Purpose: The purpose of this deed is to establish the transfer of property ownership rights from a corporation to a married couple, ensuring that both individuals are recorded as the legal owners. 3. Property Transfer: This type of deed facilitates the transfer of real property, which can include land, buildings, or any improvements on the property. 4. Granter and Grantee: The granter refers to the corporation that is transferring the property, while the grantees are the husband and wife who will become the new owners. 5. Consideration: Consideration refers to the value exchanged for the property. In a Los Angeles California Grant Deed from Corporation to Husband and Wife, consideration may involve monetary compensation or any other mutually agreed-upon form of exchange. 6. Legal Requirements: To be valid, this type of deed must meet specific legal requirements, including being in writing, correctly identifying the property, and complying with relevant California laws and regulations. 7. Different Types: While there may not be different types of Los Angeles California Grant Deeds from Corporation to Husband and Wife, variations may exist based on unique circumstances or specific legal requirements related to the property transfer. 8. Notarization and Decoration: Most grant deeds require notarization to ensure their validity. Upon execution, the deed must be recorded with the County Recorder's Office in Los Angeles County to provide public notice of the change in ownership. 9. Legal Assistance: Given the complex nature of property transfers and legal requirements surrounding grant deeds, seeking legal assistance from real estate attorneys or professionals experienced in Los Angeles property law is highly recommended. 10. Importance: A Los Angeles California Grant Deed from Corporation to Husband and Wife is crucial as it ensures clear ownership rights, protects the interests of all involved parties, and provides a valuable legal record of the property transfer. In summary, a Los Angeles California Grant Deed from Corporation to Husband and Wife is a legally binding document that facilitates the transfer of property ownership from a corporation to a married couple in Los Angeles, California. It is imperative to understand the legal requirements and seek professional guidance to ensure a smooth and valid property transfer.