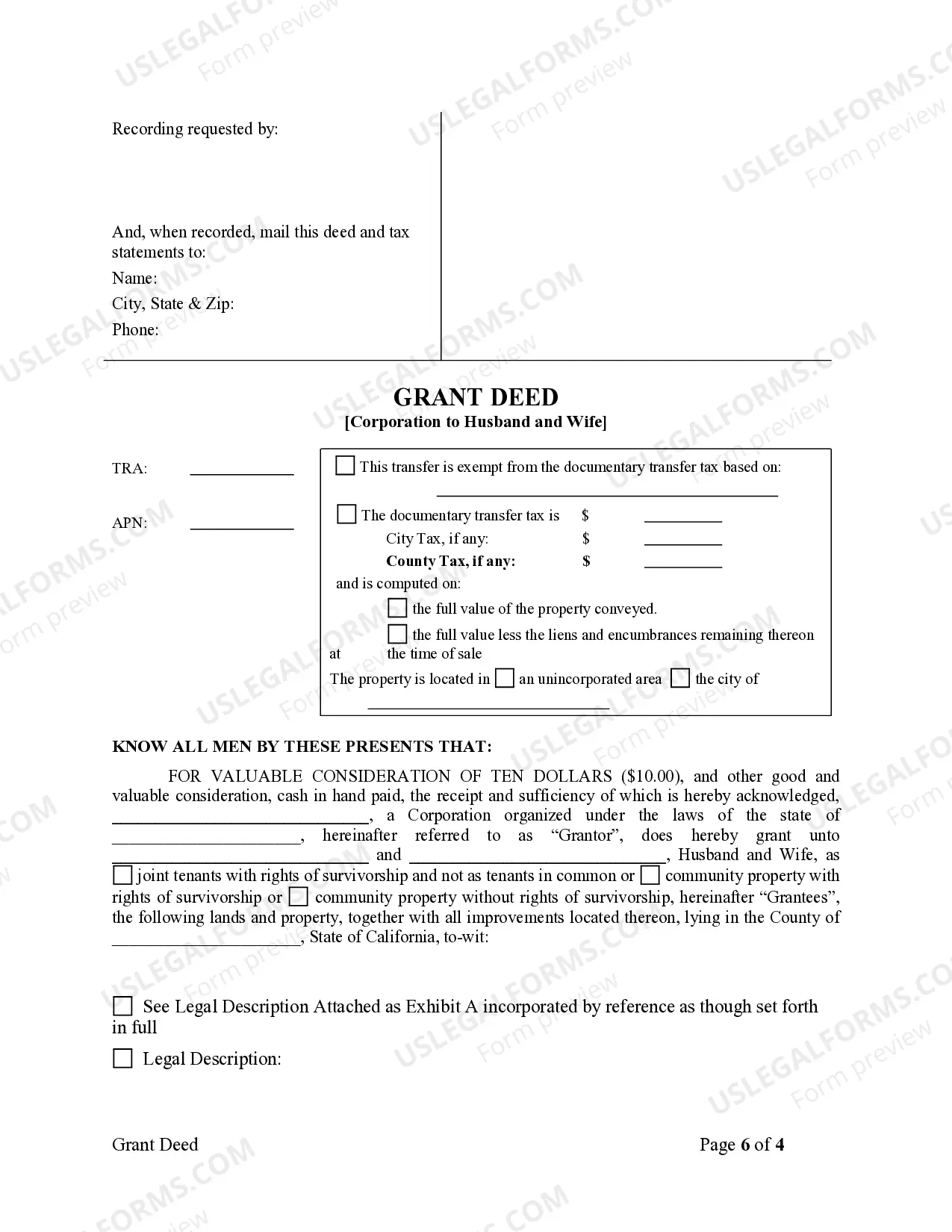

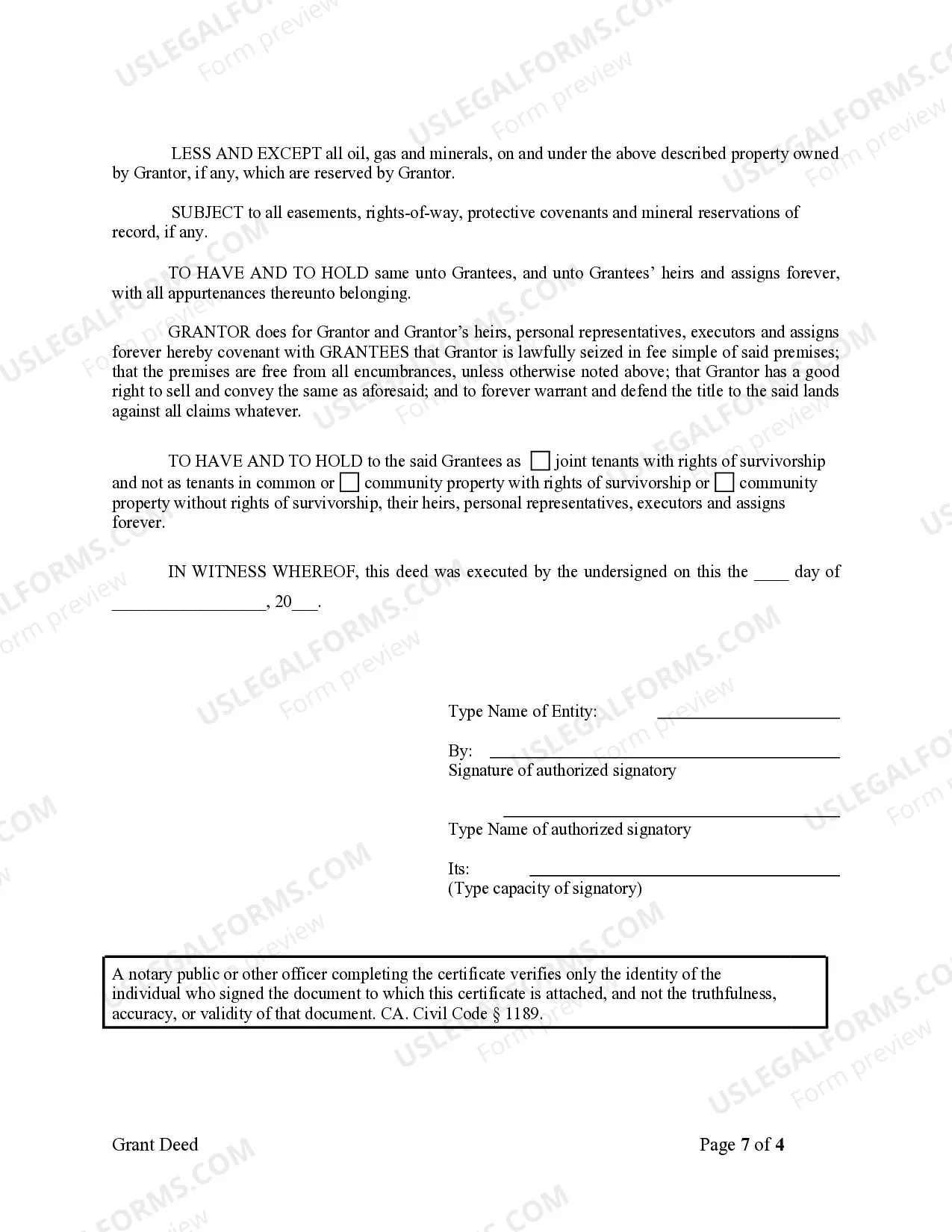

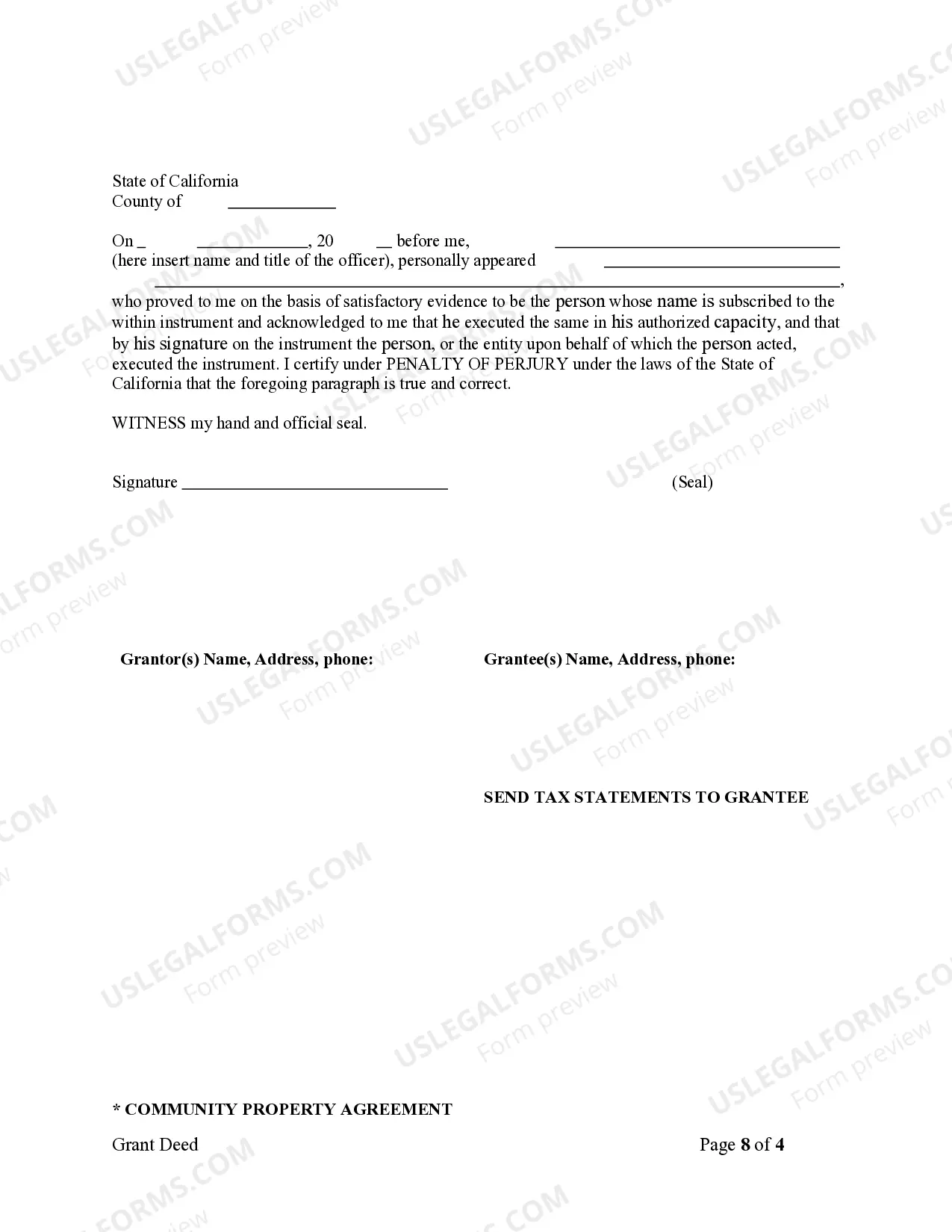

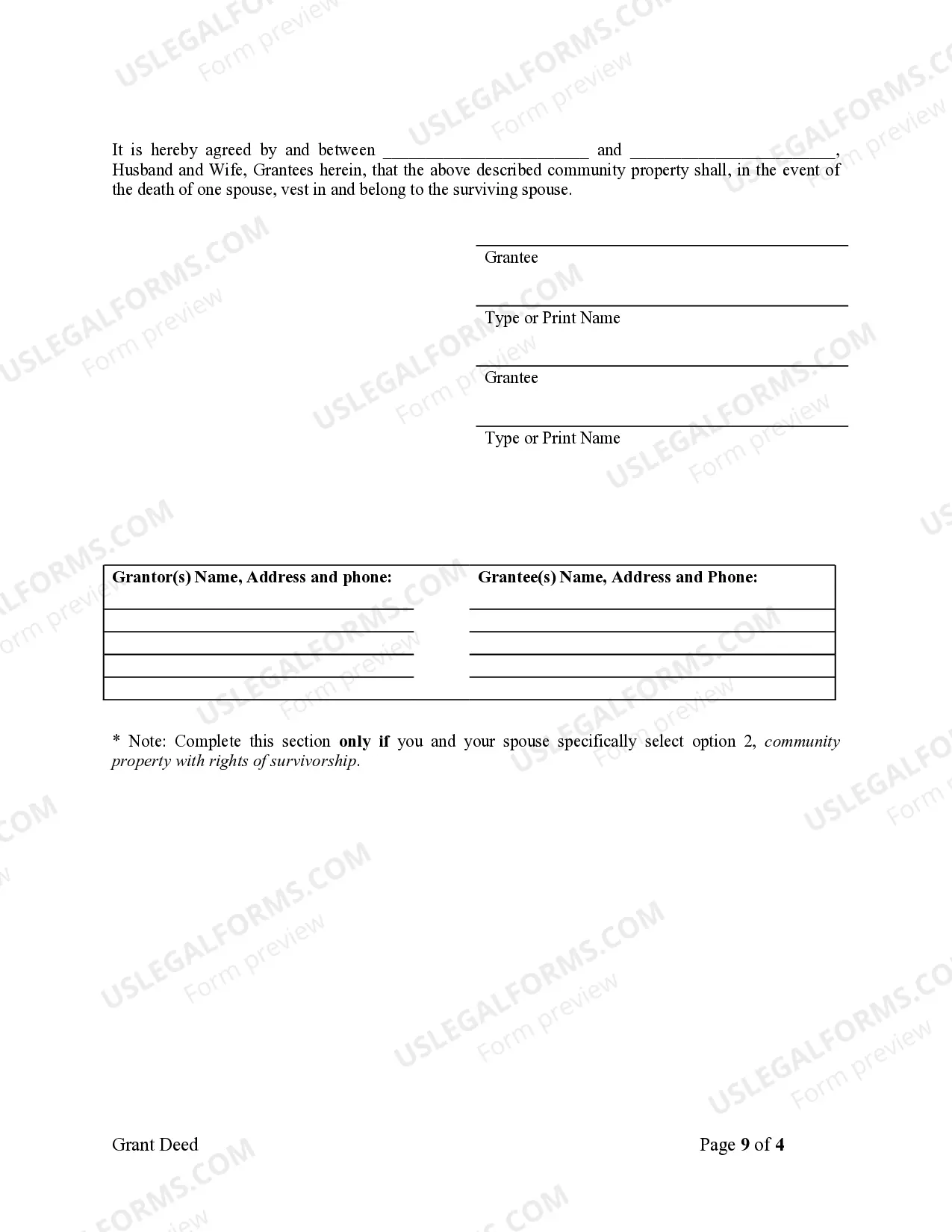

This Warranty Deed from Corporation to Husband and Wife form is a Warranty Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and warrants the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

Title: Orange California Grant Deed from Corporation to Husband and Wife — A Comprehensive Overview Description: An Orange California Grant Deed is a legally binding document that facilitates the transfer of property from a corporation to a husband and wife. This write-up provides a detailed description of what these grant deeds entail, outlining key information and incorporating relevant keywords such as "Orange California Grant Deed," "corporation," "husband and wife," and variations thereof. Keywords: — Orange California Grant Dee— - Corporation — Husband and Wife - Grant Deed from Corporation — California properttransferfe— - Legal document — Real estate transactio— - Orange County deed transfer Types of Orange California Grant Deeds from Corporation to Husband and Wife: 1. General/Standard Grant Deed: This type of grant deed transfers real property ownership from a corporation to a husband and wife without any expressed warranties. It guarantees that the corporation holds the property title but does not provide assurances regarding potential encumbrances. 2. Special Warranty Grant Deed: The Special Warranty Grant Deed also transfers property ownership, but the corporation provides limited warranties. It assures that the property owned by the corporation during its ownership has not incurred any encumbrances, except those specifically mentioned in the deed. 3. Bargain and Sale Deed: Similar to the standard grant deed, this type of deed transfers ownership without warranties. However, it implies that the corporation holds the title and possesses the legal authority to transfer the property to the husband and wife, without necessarily disclosing any encumbrances. 4. Grant Deed with Encumbrances: This specific type of grant deed discloses any known encumbrances on the property being transferred. It ensures that the husband and wife are aware of any existing liens, mortgages, or other legal claims associated with the property. 5. Quitclaim Deed: Though not necessarily a grant deed, the Quitclaim Deed is also commonly used for property transfers. It offers the least protection to the buyer, as it merely transfers the ownership interest held by the corporation to the husband and wife, without providing any warranties or guaranteeing the corporation's ownership rights. Conclusion: In summary, an Orange California Grant Deed from Corporation to Husband and Wife is a vital legal document facilitating the transfer of property ownership from a corporation to a married couple. Variations of this grant deed include the General/Standard Grant Deed, Special Warranty Grant Deed, Bargain and Sale Deed, Grant Deed with Encumbrances, and the Quitclaim Deed. Engaging legal assistance during this process is highly recommended ensuring a smooth and legally compliant property transfer transaction.