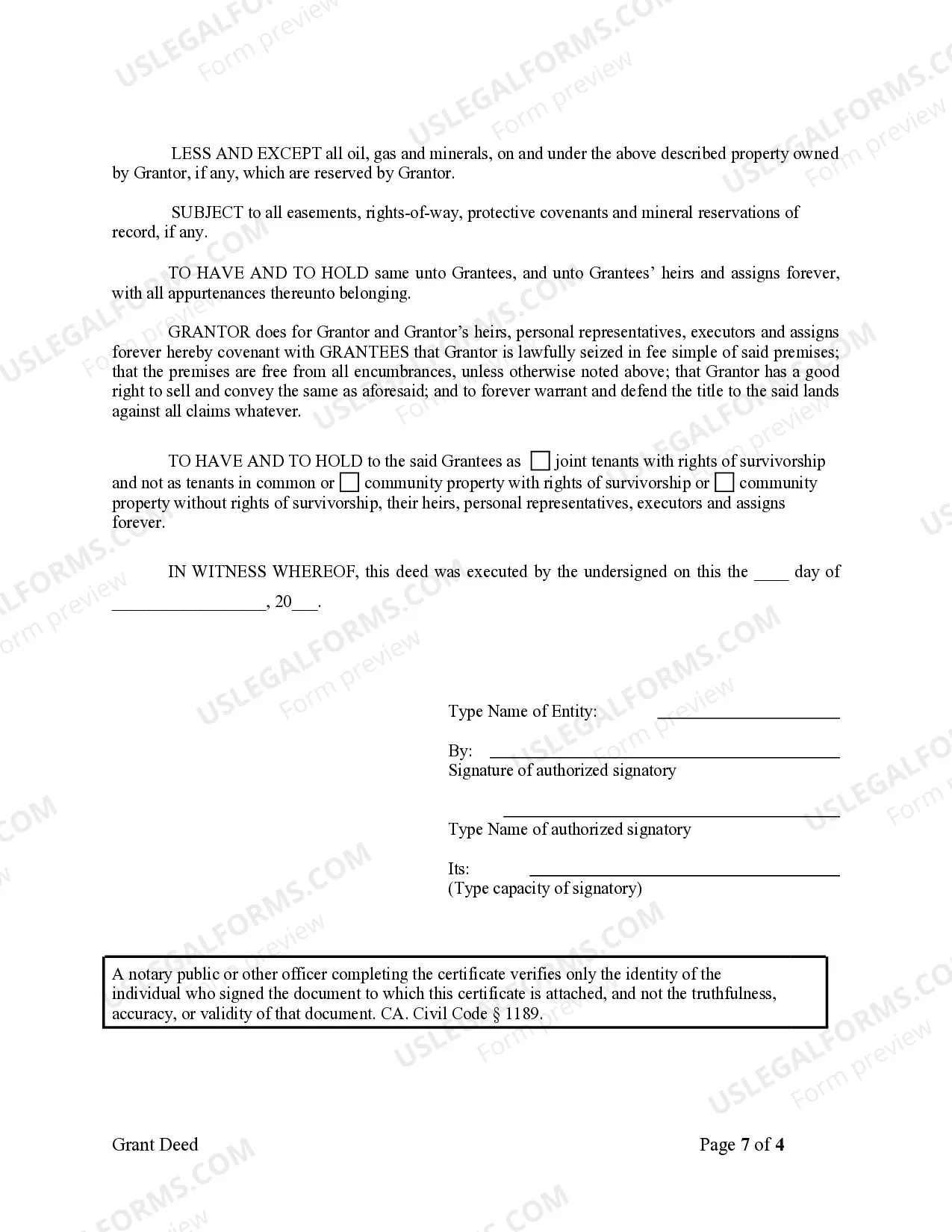

This Warranty Deed from Corporation to Husband and Wife form is a Warranty Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and warrants the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

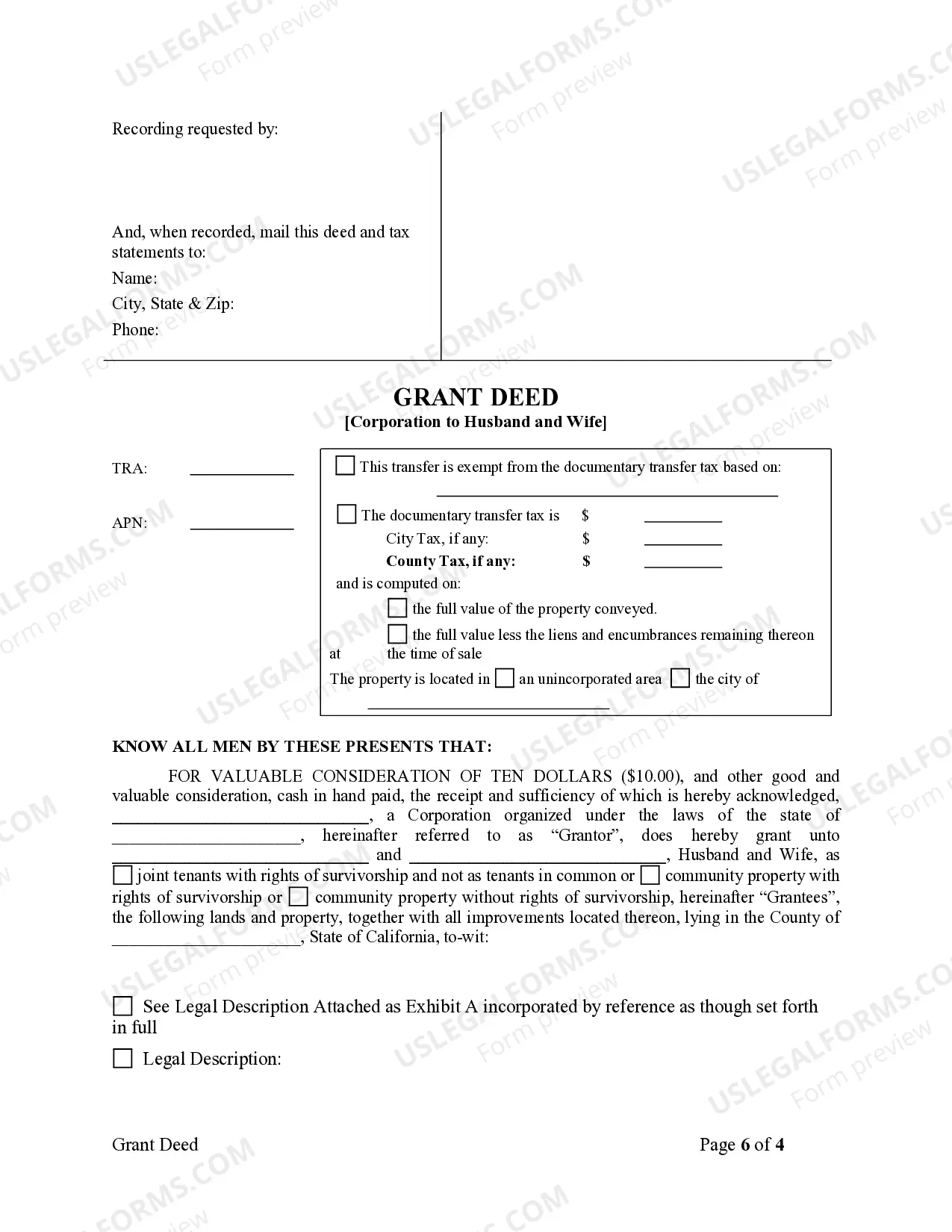

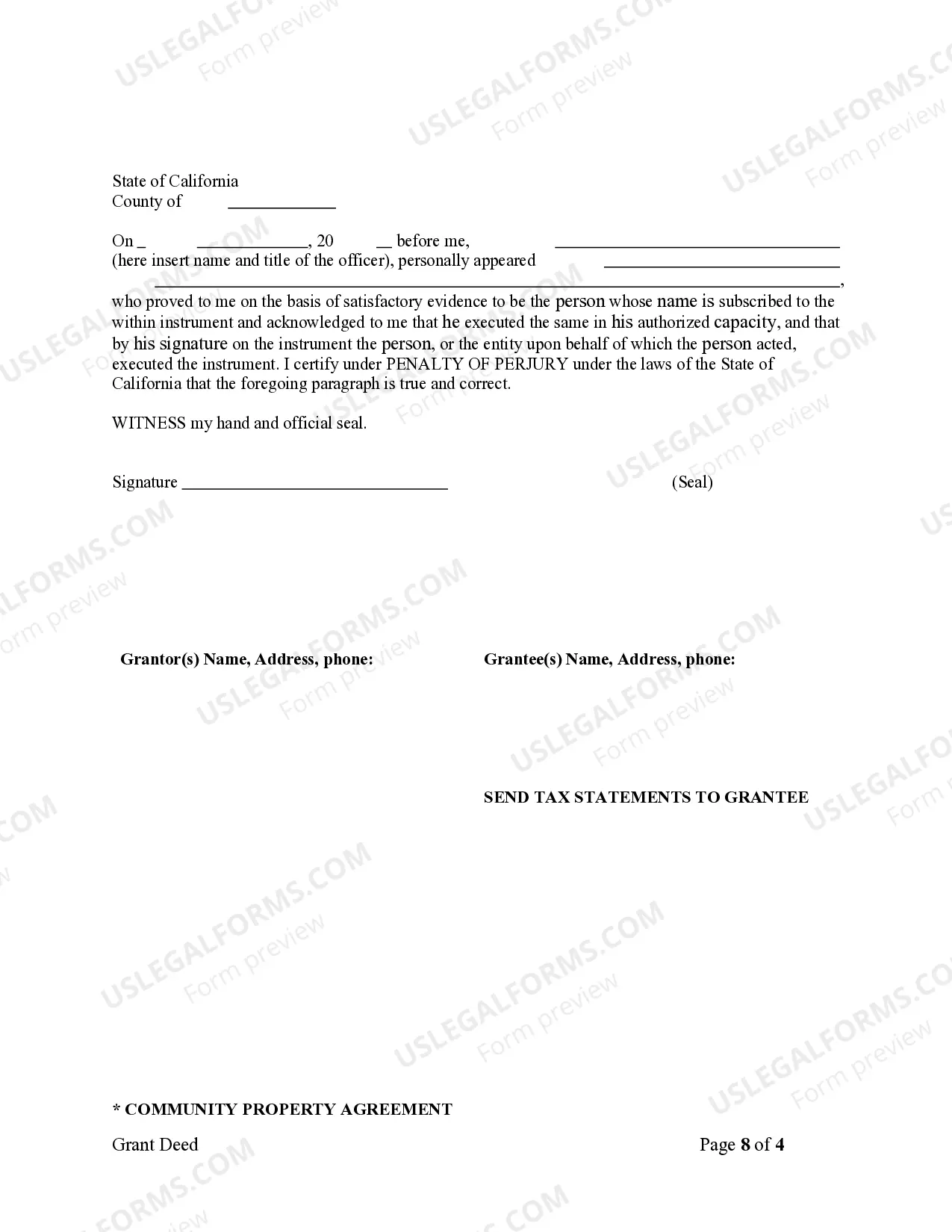

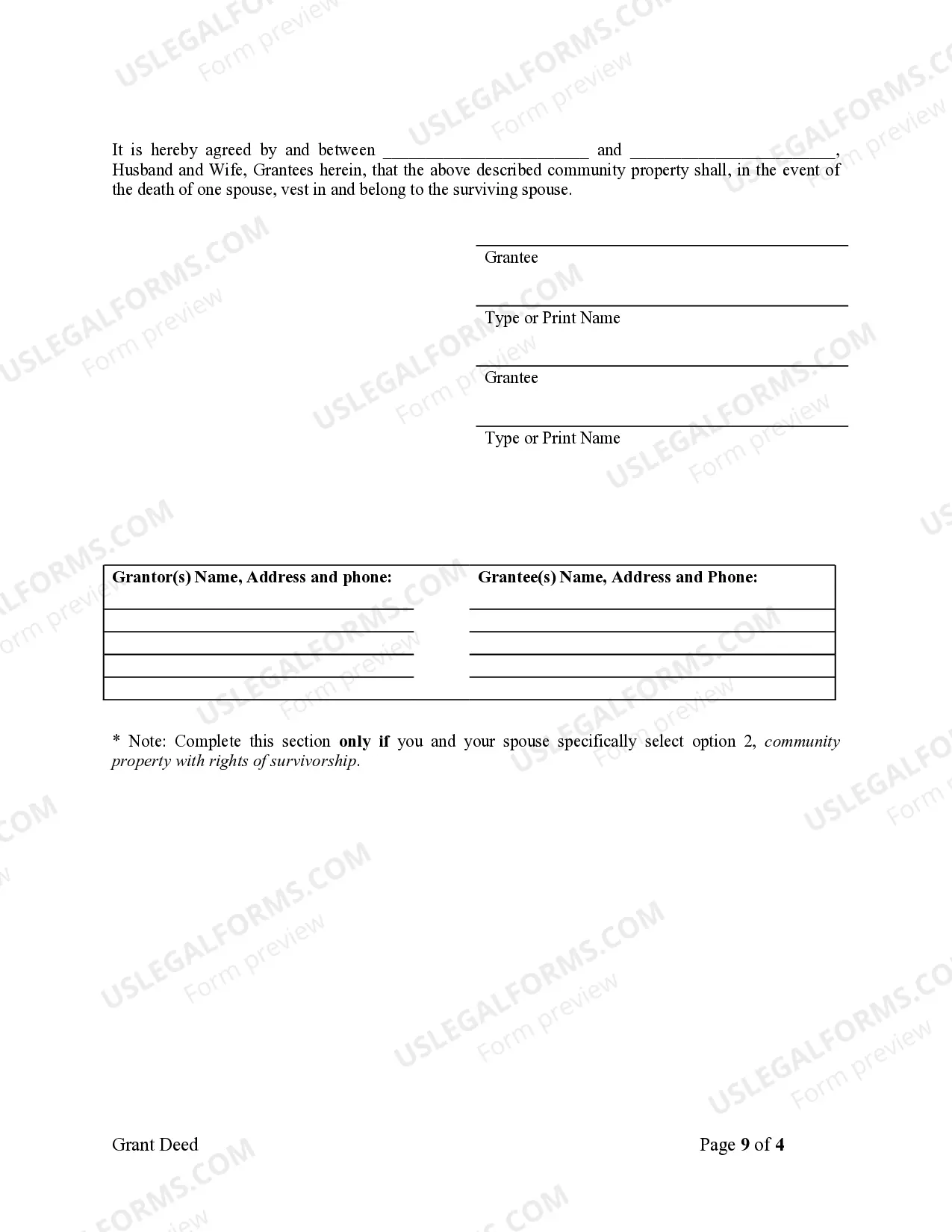

In San Diego, California, a Grant Deed from Corporation to Husband and Wife is a legally binding document that facilitates the transfer of real estate ownership from a corporation to a married couple. This type of deed ensures that the property is transferred to both spouses jointly, providing them with equal rights and ownership interests. A San Diego California Grant Deed from Corporation to Husband and Wife is typically used when a corporation, either for business purposes or as an investment vehicle, decides to transfer the ownership of a property to a married couple. This can occur in various scenarios, such as when a corporation wants to distribute property assets among shareholders or when a company-owned property is sold to a married couple for personal use or investment purposes. The Grant Deed serves as the legal instrument for transferring the title from the corporation to the husband and wife, guaranteeing that the property's ownership rights are transferred lawfully. Different types of San Diego California Grant Deeds from Corporation to Husband and Wife include: 1. General Grant Deed: This is the most common type of Grant Deed and transfers the property's ownership from the corporation to the husband and wife without any warranties. It essentially conveys the property "as-is," without any guarantees regarding title or condition. It is crucial for the buyers to conduct their due diligence and obtain title insurance to protect their interests. 2. Special Warranty Deed: This type of Grant Deed offers limited warranties to the husband and wife. The corporation guarantees that it has not incurred any undisclosed liabilities, debts, or encumbrances during its period of ownership. However, it does not provide protection against any issues that may have arisen prior to the corporation's ownership. 3. Quitclaim Deed: In some cases, a Grant Deed from Corporation to Husband and Wife may be in the form of a Quitclaim Deed. This type of deed transfers the property's ownership rights without any warranties or guarantees. The corporation essentially relinquishes any claims it may have had on the property, if any, to the husband and wife. It is crucial for both the corporation and the husband and wife to ensure that the Grant Deed is properly drafted, executed, and recorded in the San Diego County Recorder's Office. Consulting with real estate attorneys, title companies, or experienced professionals is highly advisable to ensure compliance with local laws and a smooth transfer of property ownership.