This Warranty Deed from Corporation to Individual form is a Warranty Deed where the Grantor is a corporation and the Grantee is an individual. Grantor conveys and warrants the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

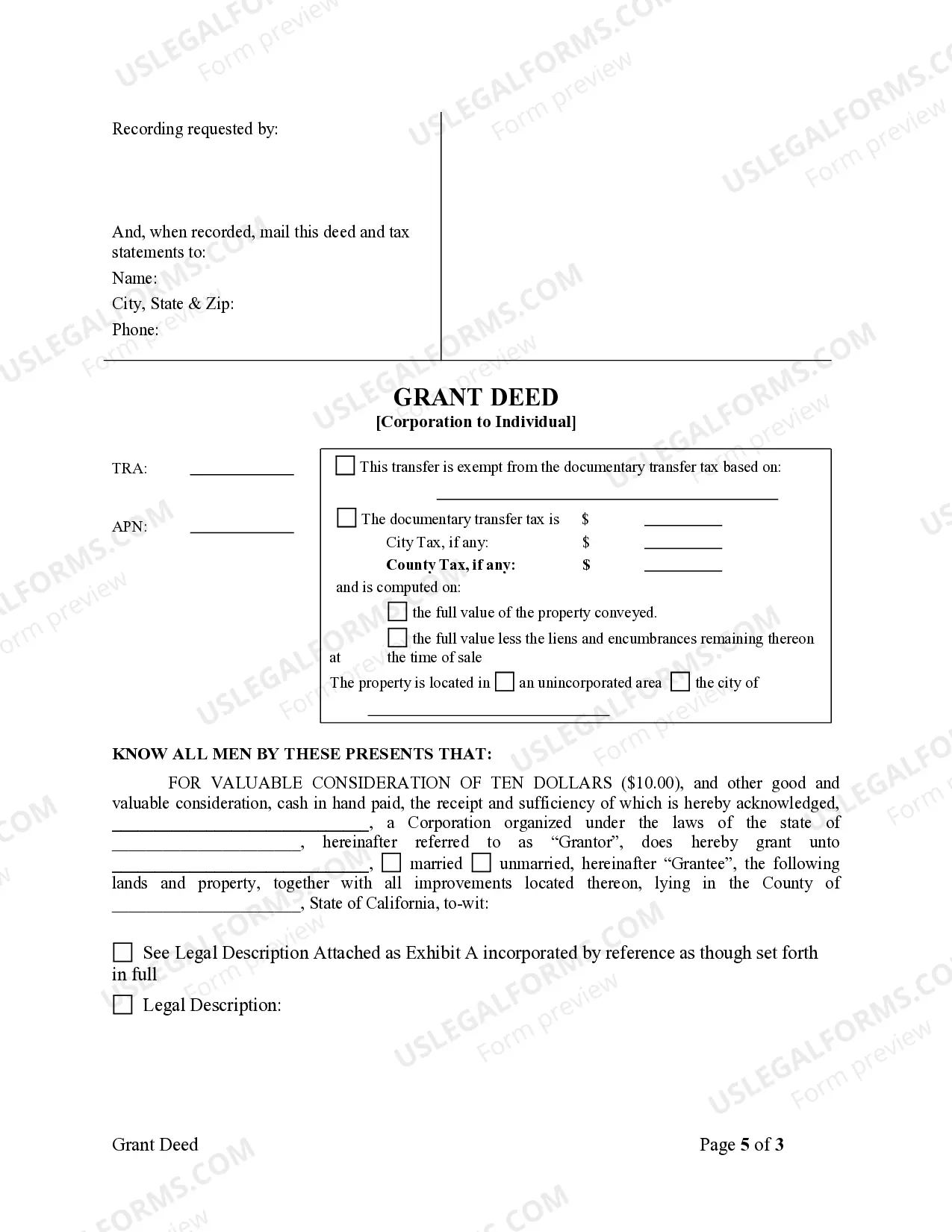

Inglewood California Grant Deed from Corporation to Individual A grant deed is a legal document used in real estate transactions to transfer property ownership from one party to another. In the context of Inglewood, California, a grant deed specifically refers to the transfer of property from a corporation to an individual. This type of transfer is common when a corporation wishes to convey ownership of a property to an individual employee, stakeholder, or shareholder. The Inglewood California Grant Deed from Corporation to Individual encompasses several important details. Firstly, it identifies the precise location and description of the property being transferred, including its address, boundaries, and legal description. This information is crucial for clearly establishing the scope of the deed. Additionally, the grant deed includes the full legal names and addresses of the corporation, as the granter (the party transferring ownership), and the individual, as the grantee (the recipient of ownership rights). These identification details ensure accurate record-keeping and establish the parties involved in the transaction. Furthermore, the Inglewood California Grant Deed from Corporation to Individual outlines the consideration provided for the transfer. Consideration refers to the value exchanged for the property and could take the form of money, services, or other assets. The inclusion of this information is essential for recording the financial aspects of the transaction. It is important to note that in the context of Inglewood, California, grant deeds from corporations to individuals may encompass various types or circumstances. Some possible variations include: 1. Employee Stock Ownership Plan (ESOP) Transfer: In this scenario, a corporation transfers ownership of a property to an individual as part of an employee benefit plan, such as an ESOP. The deed would outline the ESOP terms and conditions and the specific property being transferred. 2. Stockholder Dividend Distribution: Corporations may occasionally distribute property assets to individual stockholders as dividends. These grant deeds would detail the dividend distribution and the specific property given to each stockholder. 3. Incentive or Bonus Grant: In some cases, corporations award properties to individuals as incentives or bonuses for exceptional performance or as part of an employment agreement. These grant deeds would explicitly state the purpose and terms of the incentive or bonus grant. In conclusion, an Inglewood California Grant Deed from Corporation to Individual is a legal document facilitating the transfer of property ownership from a corporation to an individual in Inglewood, California. Its contents include information regarding the property, details of the granter and grantee, consideration exchanged, and possibly specific circumstances such as ESOP transfers, stockholder dividends, or incentive grants. These details ensure that the transfer process is accurately documented, establishing clear ownership rights for the individual receiving the property.Inglewood California Grant Deed from Corporation to Individual A grant deed is a legal document used in real estate transactions to transfer property ownership from one party to another. In the context of Inglewood, California, a grant deed specifically refers to the transfer of property from a corporation to an individual. This type of transfer is common when a corporation wishes to convey ownership of a property to an individual employee, stakeholder, or shareholder. The Inglewood California Grant Deed from Corporation to Individual encompasses several important details. Firstly, it identifies the precise location and description of the property being transferred, including its address, boundaries, and legal description. This information is crucial for clearly establishing the scope of the deed. Additionally, the grant deed includes the full legal names and addresses of the corporation, as the granter (the party transferring ownership), and the individual, as the grantee (the recipient of ownership rights). These identification details ensure accurate record-keeping and establish the parties involved in the transaction. Furthermore, the Inglewood California Grant Deed from Corporation to Individual outlines the consideration provided for the transfer. Consideration refers to the value exchanged for the property and could take the form of money, services, or other assets. The inclusion of this information is essential for recording the financial aspects of the transaction. It is important to note that in the context of Inglewood, California, grant deeds from corporations to individuals may encompass various types or circumstances. Some possible variations include: 1. Employee Stock Ownership Plan (ESOP) Transfer: In this scenario, a corporation transfers ownership of a property to an individual as part of an employee benefit plan, such as an ESOP. The deed would outline the ESOP terms and conditions and the specific property being transferred. 2. Stockholder Dividend Distribution: Corporations may occasionally distribute property assets to individual stockholders as dividends. These grant deeds would detail the dividend distribution and the specific property given to each stockholder. 3. Incentive or Bonus Grant: In some cases, corporations award properties to individuals as incentives or bonuses for exceptional performance or as part of an employment agreement. These grant deeds would explicitly state the purpose and terms of the incentive or bonus grant. In conclusion, an Inglewood California Grant Deed from Corporation to Individual is a legal document facilitating the transfer of property ownership from a corporation to an individual in Inglewood, California. Its contents include information regarding the property, details of the granter and grantee, consideration exchanged, and possibly specific circumstances such as ESOP transfers, stockholder dividends, or incentive grants. These details ensure that the transfer process is accurately documented, establishing clear ownership rights for the individual receiving the property.