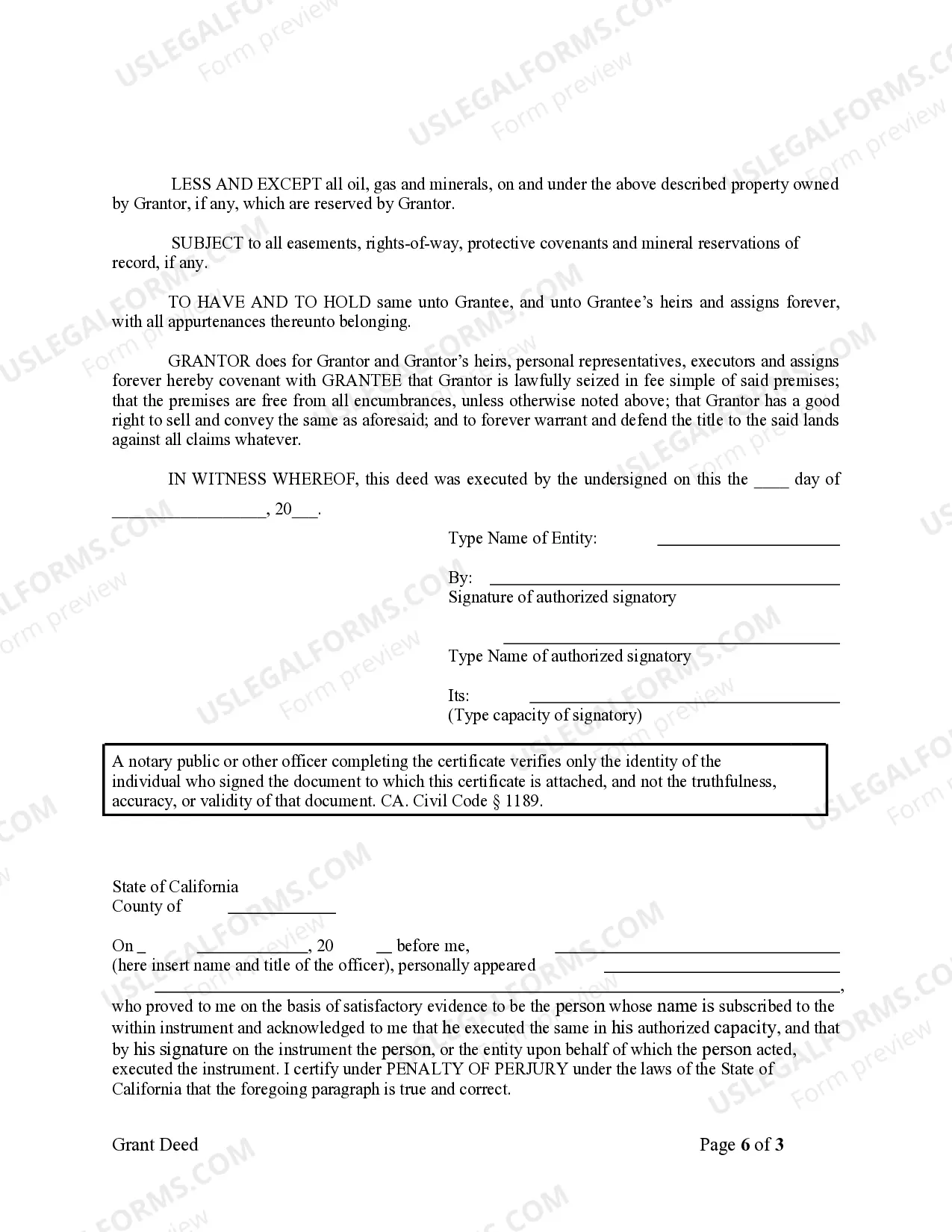

This Warranty Deed from Corporation to Individual form is a Warranty Deed where the Grantor is a corporation and the Grantee is an individual. Grantor conveys and warrants the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

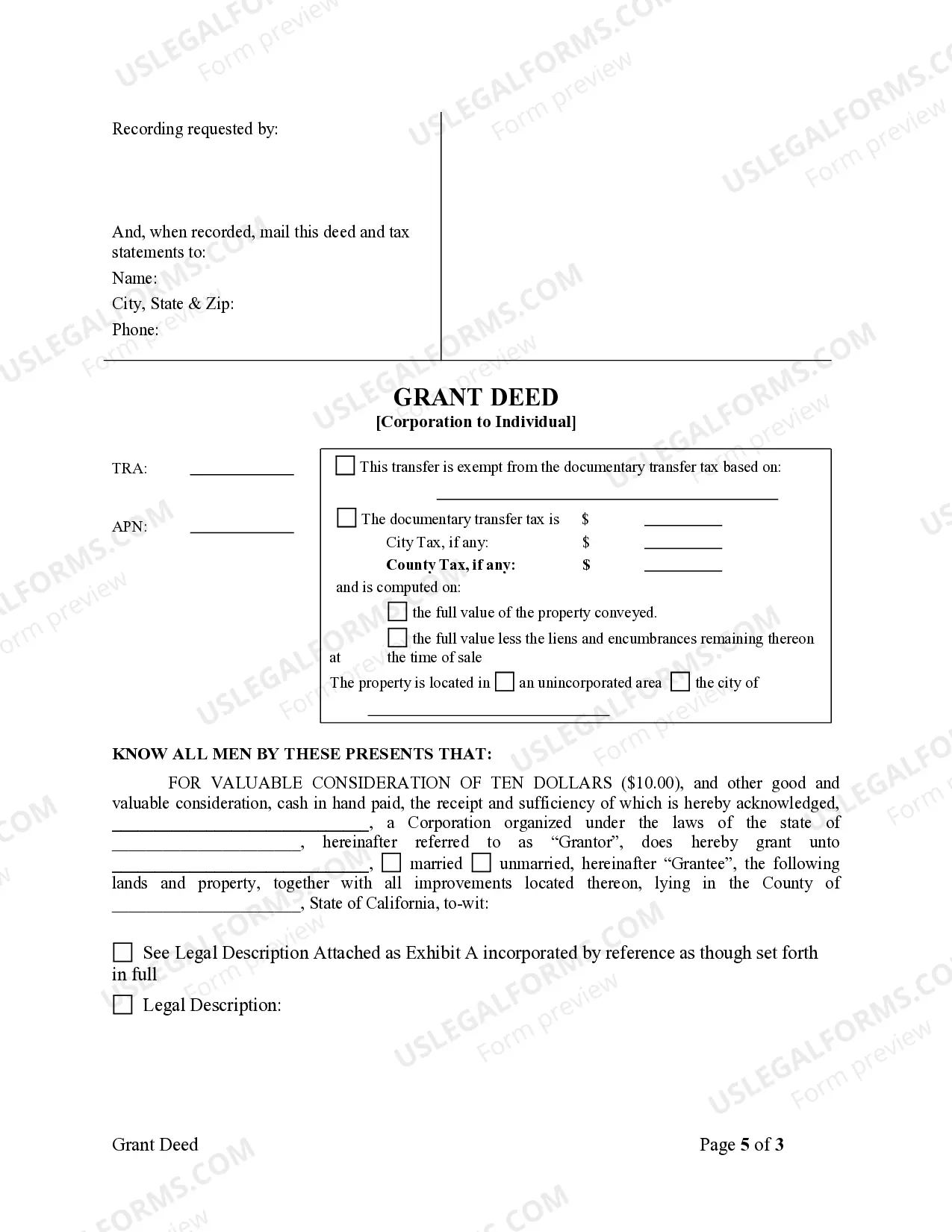

A Santa Maria California Grant Deed from Corporation to an Individual is a legally binding document that transfers ownership of real estate from a corporation to an individual in the city of Santa Maria, California. This type of deed is commonly used during the sale or transfer of property from a corporation to an individual. The Santa Maria California Grant Deed ensures that the individual receiving the property obtains the legal right of ownership. The document contains relevant details such as the names of the parties involved, the property description, and specific terms and conditions of the transfer. The primary purpose of a Grant Deed is to guarantee that the corporation grants full ownership rights to the individual, which then becomes responsible for all legal and financial obligations associated with the property. There are no specific types of Santa Maria California Grant Deed from Corporation to Individual. However, different variations may be based on the specific circumstances of the transfer, such as whether it is a residential or commercial property transaction. Other variations may occur if there are multiple individuals receiving the property or if the corporation retains partial ownership rights, as in the case of joint tenancy or tenancy in common. The Santa Maria California Grant Deed from Corporation to Individual is a pivotal legal document providing protection and clarity to both parties involved in the property transfer. It ensures a smooth transition of ownership and is often required for filing or recording purposes with the appropriate county recorder's office. Keywords: Santa Maria California, Grant Deed, Corporation, Individual, property transfer, ownership rights, legal document, real estate, residential property, commercial property, joint tenancy, tenancy in common, county recorder's office.